Family Servicemembers Group Life Insurance (FSGLI) is a valuable benefit designed to provide financial security to the families of active duty members of the U.S. Armed Forces. This insurance policy offers coverage to the beneficiary in the event of the insured's death while on active duty. The primary purpose of FSGLI is to ensure that the family of a servicemember has financial support during challenging times, helping to cover expenses such as funeral costs, outstanding debts, and daily living expenses. It is a crucial component of the comprehensive benefits package provided by the military, offering peace of mind and financial protection to those who serve their country.

| Characteristics | Values |

|---|---|

| Purpose | To provide financial protection to the family of a servicemember in the event of death while on active duty or due to a service-related injury. |

| Eligibility | Open to active duty members of the U.S. Armed Forces, including the Army, Navy, Air Force, Marines, and Coast Guard. |

| Coverage | Offers a death benefit to the designated beneficiary(ies) upon the servicemember's death. |

| Benefits | Provides financial support to cover expenses such as funeral costs, outstanding debts, and daily living expenses for the family. |

| Group Plan | Administered through the U.S. Department of Defense, making it a group insurance plan. |

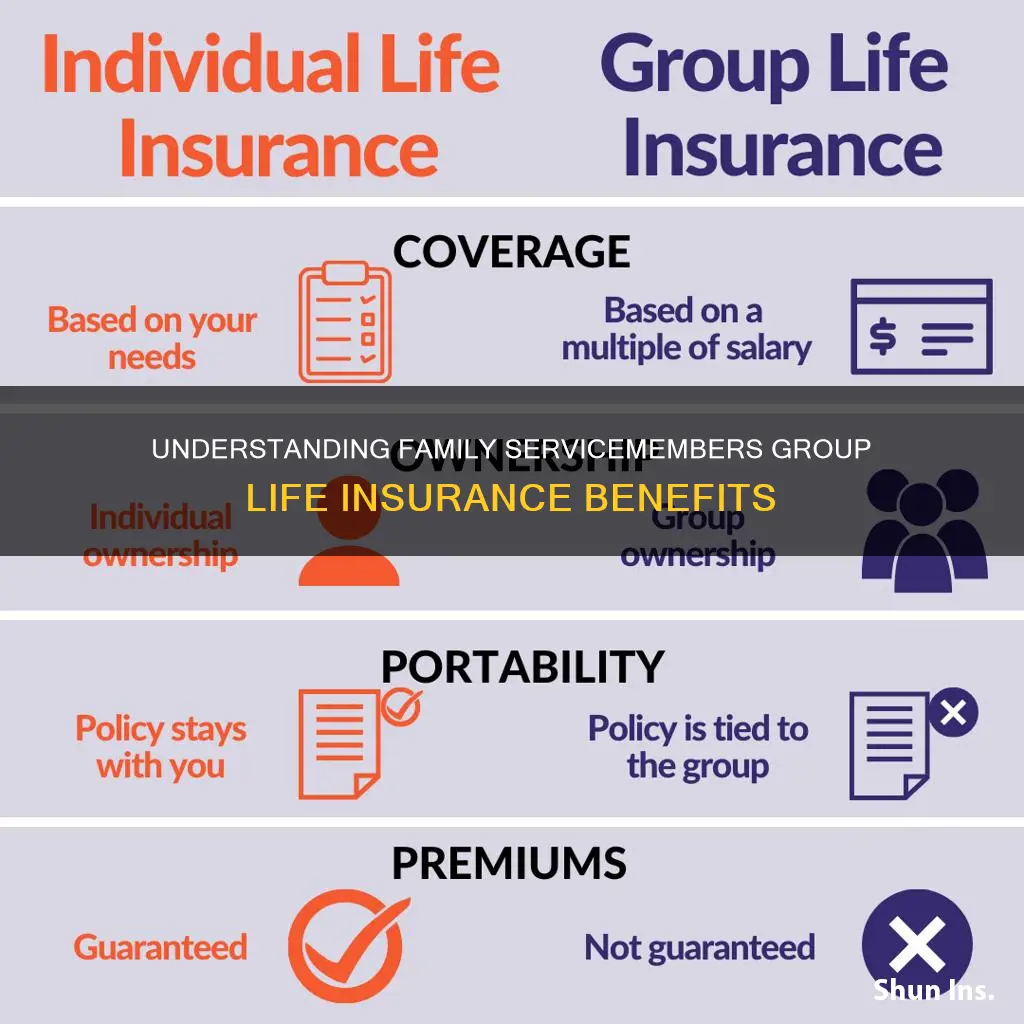

| Premiums | Premiums are typically deducted from the servicemember's pay, making it convenient and affordable. |

| Portability | The policy can be converted to an individual plan if the servicemember leaves active duty. |

| Conversion Option | Allows the policyholder to convert the group policy to an individual permanent life insurance policy. |

| Term Life | Initially, it is a term life insurance, which can be converted to a permanent policy. |

| Tax-Free Benefits | Death benefits are generally tax-free and paid directly to the beneficiary(ies). |

| Enrollment | Servicemembers can enroll in the plan during specific enrollment periods, usually at the beginning of their service. |

| Administration | Managed by the Servicemembers' Group Life Insurance (SGLI) office within the U.S. Department of Defense. |

| Recent Changes | The SGLI program has undergone updates, including increased coverage limits and the option for additional coverage. |

| Beneficiary Designations | Policyholders can choose one or more primary and contingent beneficiaries to receive the death benefit. |

| Customer Support | Offers customer service and assistance for policyholders and beneficiaries. |

What You'll Learn

- Eligibility: Active-duty military personnel and their dependents qualify for this insurance

- Benefits: It provides financial protection for surviving family members

- Coverage: The policy offers death benefits and optional additional coverage

- Cost: Premiums are typically lower than commercial life insurance

- Portability: Servicemembers can transfer their policy to different locations

Eligibility: Active-duty military personnel and their dependents qualify for this insurance

Family Servicemembers Group Life Insurance (FSGLI) is a valuable benefit designed to provide financial security to the families of active-duty military personnel. This insurance is a group policy, meaning it is offered to a specific group of individuals, in this case, active-duty military members and their eligible dependents. The primary purpose of FSGLI is to offer a cost-effective way to secure life insurance coverage for those who serve in the armed forces, ensuring that their families are protected in the event of their passing.

Eligibility for this insurance is straightforward and primarily focused on active-duty military personnel and their families. Active-duty military members are those who are currently serving in the U.S. Armed Forces, including the Army, Navy, Air Force, Marines, and Coast Guard. This insurance is specifically tailored to support the unique needs of those who dedicate their lives to protecting the nation.

For active-duty military personnel, the insurance provides coverage for the duration of their service. This means that as long as they remain on active duty, their families are protected. The coverage amount is typically based on the member's rank and pay grade, ensuring that the insurance keeps pace with their military career progression. This is a significant advantage, as it provides long-term financial security for the family.

Dependents of active-duty military personnel are also eligible for FSGLI. Dependents include spouses and children who are financially dependent on the servicemember. The insurance coverage for dependents can be tailored to their specific needs, ensuring that their financial well-being is protected. This aspect of the insurance is particularly crucial, as it provides a safety net for the family's financial stability, even in the absence of the primary breadwinner.

In summary, Family Servicemembers Group Life Insurance is a critical benefit for active-duty military personnel and their dependents. It offers a convenient and affordable way to secure life insurance coverage, providing financial protection for families during the servicemember's active duty. Understanding the eligibility criteria and the coverage options available is essential for military families to make informed decisions about their financial security.

Understanding Voluntary Life Insurance: Employee Payment Options

You may want to see also

Benefits: It provides financial protection for surviving family members

Family Servicemembers Group Life Insurance (FSGLI) is a valuable benefit designed to offer financial security to the families of active-duty servicemembers in the U.S. military. This insurance program is a group policy, meaning it covers multiple individuals simultaneously, in this case, the active-duty military personnel and their families. The primary purpose of FSGLI is to provide a safety net for the financial well-being of the family in the event of the servicemember's death while on active duty.

The insurance policy typically offers a death benefit, which is a lump sum payment paid to the designated beneficiary(ies) upon the insured's passing. This financial protection is crucial as it ensures that the family can maintain their standard of living and cover essential expenses, even in the absence of the primary income earner. The death benefit can be used to cover various costs, including mortgage payments, education expenses for children, medical bills, and other daily living expenses. By providing this financial cushion, FSGLI offers peace of mind to servicemembers, knowing that their families will be taken care of should they not return.

One of the key advantages of FSGLI is its simplicity and ease of access. Since it is a group policy, the application process is often streamlined, and the coverage can be activated quickly. This is particularly important for servicemembers who may be deployed or in remote locations, ensuring that their families are protected even when they are not present. The policy is designed to be flexible, allowing servicemembers to choose the level of coverage that best suits their needs and budget.

Furthermore, FSGLI often includes additional benefits that enhance its value. These may include waiver of premium provisions, which allow the policy to remain in force even if the insured is unable to pay the premiums due to illness or injury. Some policies also offer accidental death and dismemberment (AD&D) coverage, providing an additional layer of protection. These extra features ensure that the insurance remains a comprehensive and reliable source of financial security.

In summary, Family Servicemembers Group Life Insurance is a critical benefit for active-duty military personnel and their families. It provides a financial safety net, ensuring that the surviving family members can maintain their financial stability and cover essential expenses in the event of the servicemember's death. With its group policy structure, simplicity, and additional benefits, FSGLI offers a valuable layer of protection for those who serve our country.

Understanding the Duration of Servicemen's Group Life Insurance

You may want to see also

Coverage: The policy offers death benefits and optional additional coverage

Family Servicemembers Group Life Insurance (FSGLI) is a valuable benefit designed to provide financial security to the families of active-duty military personnel. This insurance policy is specifically tailored to offer coverage to the beneficiaries of servicemembers, ensuring that their loved ones are protected during challenging times. The primary purpose of this insurance is to provide a financial safety net, offering death benefits to the designated beneficiaries when the insured servicemember passes away.

The death benefit provided by FSGLI is a crucial aspect of the policy. It ensures that the family receives a lump sum payment, which can be used to cover various expenses, such as funeral costs, outstanding debts, or everyday living expenses. This financial support can significantly ease the burden on the family during a difficult period, allowing them to focus on grieving and adjusting to life changes.

In addition to the standard death benefit, FSGLI also offers optional additional coverage, providing further protection and customization. This optional coverage can include benefits such as accidental death and dismemberment (AD&D) insurance, which provides an additional payout if the insured servicemember dies as a result of an accident or if they suffer a specific loss of body parts. Another option is the waiver of premium coverage, which allows the insured to suspend premium payments if they become disabled, ensuring that the policy remains in force even during periods of illness or injury.

These optional add-ons allow policyholders to tailor the insurance to their specific needs and preferences. For instance, AD&D insurance can provide extra financial security, knowing that the family will receive an additional benefit in the event of a tragic accident. The waiver of premium coverage is particularly useful for long-term servicemembers, as it ensures that the policy remains active even if they are unable to make payments due to disability.

By offering both a standard death benefit and optional additional coverage, FSGLI provides comprehensive protection for military families. This insurance policy is a testament to the support and care provided by the military system, ensuring that the families of servicemembers are financially protected and can navigate life's challenges with a sense of security.

Life Insurance: Term 80 Cheaper Than Term 30?

You may want to see also

Cost: Premiums are typically lower than commercial life insurance

Family Servicemembers Group Life Insurance (FSGLI) is a valuable benefit designed to provide financial security to the families of active-duty military personnel. One of its key advantages is the cost-effectiveness compared to commercial life insurance policies.

The lower premiums for FSGLI are a significant factor in making it an attractive option for military families. This affordability is a direct result of the group insurance structure, where the insurance company calculates the risk and premium based on the collective data of a large group of policyholders. By pooling the risks, the insurance provider can offer more competitive rates, which are then passed on to the policyholders. This group approach allows for a more efficient risk assessment, often leading to lower costs for individual members.

In contrast, commercial life insurance policies are tailored to individual needs, which can result in higher premiums. The personalized nature of these policies takes into account specific health conditions, lifestyle factors, and other individual circumstances, making them more expensive. FSGLI, being a group policy, simplifies the process by considering the overall health and demographics of the military population, thus reducing the overall cost for each member.

The lower premiums of FSGLI are particularly beneficial for military families, as they can provide essential financial protection without incurring substantial expenses. This cost-effective nature ensures that the insurance remains accessible to a wide range of servicemembers, allowing them to secure their families' financial future without the burden of high insurance costs.

In summary, the lower premiums of Family Servicemembers Group Life Insurance are a result of the group insurance model, which offers a more efficient and cost-effective solution for military families. This affordability is a crucial aspect of the policy, ensuring that financial security is accessible to those who serve their country.

Creditors and Life Insurance: What Creditors Can Take From You

You may want to see also

Portability: Servicemembers can transfer their policy to different locations

Servicemembers' Group Life Insurance (SGLI) offers a unique and valuable feature that significantly benefits military personnel and their families: portability. This feature allows servicemembers to transfer their life insurance policy to different locations, providing continuity and peace of mind as they move through their military career.

Portability is especially advantageous for those in the military, as assignments and deployments are often frequent and unpredictable. When a servicemember is assigned to a new base or location, they can ensure that their family is still protected by their life insurance policy. This means that the coverage remains in place, providing financial security for the family in case of the servicemember's untimely death. Without portability, the family would need to start the entire insurance process again, which can be time-consuming and may result in gaps in coverage.

The process of transferring the policy is straightforward. Servicemembers can contact the SGLI servicer and provide the necessary information to update the policy's address or location. This ensures that the policy is adjusted to reflect the new location, and the coverage remains active. It is essential to keep the SGLI servicer informed about any changes in address or deployment status to maintain continuous coverage.

One of the key advantages of portability is the ability to maintain coverage during deployments. Servicemembers can ensure that their families are protected even when they are away from home. This is particularly important for those in high-risk roles or those who frequently rotate through different bases. By keeping the policy portable, servicemembers can provide long-term financial security for their loved ones, regardless of their location.

In summary, the portability feature of SGLI is a critical aspect of this insurance program. It allows servicemembers to adapt their life insurance coverage to their dynamic military lifestyle, ensuring that their families remain protected wherever their military career takes them. This flexibility is a significant benefit, offering peace of mind and financial security to military families.

Life Insurance After Retirement: What You Need to Know

You may want to see also

Frequently asked questions

The Family Servicemembers Group Life Insurance is a federal program designed to provide life insurance coverage to the families of active-duty servicemembers in the U.S. Armed Forces. It is a cost-effective way to ensure financial security for the beneficiaries in the event of the insured servicemember's death while on active duty.

FSGLI offers two types of coverage: Basic and Additional. The Basic coverage is mandatory for all active-duty servicemembers and provides a standard amount of insurance. The Additional coverage is optional and allows servicemembers to increase the insurance benefit. The premiums are deducted from the servicemember's pay, and the policy is administered by the Servicemembers' Group Life Insurance (SGLI) program.

All active-duty members of the U.S. Armed Forces are automatically enrolled in the Basic coverage. This includes members of the Army, Navy, Air Force, Marine Corps, and Coast Guard. The Additional coverage can be elected by the servicemember, and the eligibility criteria are similar to the Basic plan. The insurance coverage is available to both enlisted personnel and commissioned officers.