Understanding the tax implications of life insurance policies is crucial for policyholders and financial planners. In the state of Ohio, the tax rate for life insurance policies can vary depending on the type of policy and the circumstances. This article aims to provide an overview of the tax rate applicable to life insurance in Ohio, offering insights into how it affects policyholders and their financial planning strategies. By exploring the specific tax regulations, individuals can make informed decisions regarding their life insurance coverage and ensure compliance with Ohio's tax laws.

What You'll Learn

Ohio's Life Insurance Tax Deduction Rules

Ohio residents who own life insurance policies may be eligible for tax deductions, but understanding the specific rules is crucial for maximizing this benefit. Ohio's tax laws allow for a deduction of the amount paid for life insurance premiums, but there are certain conditions and limitations to consider. Firstly, the deduction is limited to the amount paid for premiums in the current year, and it cannot exceed the federal standard deduction. This means that if you have other deductions that exceed the federal standard, you may not be able to claim the full amount of your life insurance premiums as a deduction.

To qualify for this deduction, the life insurance policy must meet specific criteria. It should be a valid life insurance contract issued by an insurance company authorized to do business in Ohio. The policy must also be owned by an individual or a trust for the benefit of an individual, and it should be in force for at least one year. Additionally, the premiums paid must be for a policy that provides death benefit protection, ensuring that the primary purpose of the insurance is to provide financial security for the insured's beneficiaries.

When calculating the deduction, it's important to note that only the amount paid for premiums is deductible. Any additional fees, such as policy loans or surrender charges, are not included. The deduction is also subject to a cap, which is the same as the federal standard deduction for that tax year. This cap ensures that the deduction does not exceed a certain threshold, providing a reasonable limit on the tax benefit.

Furthermore, Ohio's tax laws provide a unique aspect to consider. The state allows for a deduction of the amount paid for life insurance premiums, but it also offers an additional credit. This credit is designed to further reduce the taxable income of the policyholder. The credit amount is based on the percentage of the premiums paid, providing an additional tax benefit for those who have substantial life insurance coverage.

In summary, Ohio's life insurance tax deduction rules offer a valuable opportunity for residents to reduce their taxable income. By understanding the criteria, limitations, and calculation methods, individuals can ensure they maximize this benefit. It is essential to consult with a tax professional or accountant who specializes in insurance-related deductions to ensure compliance with all relevant regulations and to take full advantage of the available deductions and credits.

Christians' Perspective on Life Insurance: A Complex Issue

You may want to see also

State-Specific Tax Implications for Life Insurance

When it comes to life insurance, understanding the tax implications can be crucial, especially for residents of Ohio. The state has specific regulations regarding the taxation of life insurance policies, which can impact the overall cost and benefits for policyholders. Here's an overview of the state-specific tax considerations for life insurance in Ohio:

Ohio's Life Insurance Tax Laws: Ohio does not impose a tax on the proceeds of a life insurance policy upon the death of the insured individual. This means that the death benefit received by the beneficiaries is generally not subject to state income tax. However, there are a few important points to note. Firstly, if the policy is owned by an entity or a trust, the state may have different tax treatment rules. Secondly, if the policy is a modified endowment contract (MEC), it may be subject to a different tax rule, which could result in a higher tax liability. It is essential to understand the classification of your policy to avoid any unexpected tax consequences.

Federal Tax Implications: While Ohio does not tax the death benefit, federal tax laws play a significant role. The federal government imposes a tax on the income earned by life insurance companies, which is then passed on to the policyholders. This tax is calculated based on the investment income generated by the policy's cash value. Additionally, if the policyholder surrenders the policy for a cash value, there may be federal income tax implications. It is advisable to consult a tax professional to navigate these federal tax rules, especially when dealing with large policy values.

State Income Tax on Policyholders: Ohio residents who are policyholders should be aware that the state does not tax the policy's cash value or the investment income. However, if the policyholder takes a loan against the policy or surrenders it for a cash value, the state may consider this as taxable income. Any withdrawals or surrenders made during the policy's term could potentially be subject to state income tax. Understanding the tax treatment of policyholder actions is crucial to avoid unexpected tax bills.

Impact on Policy Design and Planning: The state-specific tax rules in Ohio can influence the way life insurance policies are structured. For instance, policyholders may consider purchasing policies that are not classified as MECs to avoid potential higher tax liabilities. Additionally, understanding the tax implications can help individuals plan their estate and ensure that the death benefit is utilized efficiently for their beneficiaries. Proper tax planning can also help minimize the overall cost of the policy.

In summary, Ohio's tax laws provide favorable treatment for life insurance policies, particularly regarding the death benefit. However, policyholders and insurance professionals should be aware of the potential tax implications on policyholder actions and the classification of the policy. Seeking professional advice can ensure that individuals make informed decisions regarding their life insurance policies and tax planning strategies.

Insuring Another Person's Life: Is It Possible?

You may want to see also

Tax Treatment of Life Insurance Premiums

The tax treatment of life insurance premiums is an important consideration for individuals and families, especially in states like Ohio, where specific tax regulations apply. When it comes to life insurance, understanding how premiums are taxed can help policyholders make informed decisions about their financial planning.

In Ohio, life insurance premiums are generally not tax-deductible for individuals. This means that the money paid towards life insurance policies is not directly tax-deductible as a standard deduction. However, there are some exceptions and considerations to keep in mind. For instance, if the life insurance policy is part of a qualified retirement plan, such as an employer-sponsored 401(k) plan, the premiums may be tax-deductible up to certain limits. This is because these plans often include life insurance as a benefit, and the premiums can be considered a business expense for the employer.

For individuals who purchase life insurance directly, the premiums are typically not deductible. However, there is a potential tax benefit when it comes to the death benefit received upon the insured individual's passing. The proceeds from a life insurance policy are generally not subject to income tax if the policy is owned by the insured and the beneficiary is not a spouse or a former spouse. This is because the death benefit is considered a form of insurance compensation, which is generally exempt from taxation.

It's important to note that the tax laws surrounding life insurance can be complex and may vary depending on the specific circumstances. Consulting with a tax professional or financial advisor is advisable to ensure compliance with Ohio's tax regulations and to understand how life insurance premiums and benefits fit into your overall financial strategy. They can provide personalized guidance based on your unique situation.

Additionally, individuals should be aware of the potential tax implications when considering the surrender or cash value of a life insurance policy. If you decide to take a loan or surrender the policy, there may be tax consequences, especially if the cash value has accumulated. Understanding these nuances is crucial for effective financial planning.

Life Insurance Basics: What You Need to Know

You may want to see also

Ohio's Life Insurance Tax Laws Explained

Ohio's life insurance tax laws can be a bit complex, but understanding them is crucial for residents and non-residents alike who own life insurance policies. The state imposes taxes on life insurance proceeds, and it's essential to know how this affects your financial planning.

When a life insurance policy pays out a death benefit, the proceeds are generally subject to federal estate tax. However, Ohio has its own set of rules regarding the taxation of these benefits. The state imposes an inheritance tax on the proceeds of life insurance policies, which is levied on the beneficiaries of the policy. The tax rate varies depending on the relationship between the insured and the beneficiary and the amount of the death benefit. For direct beneficiaries, such as a spouse or child, the tax rate is typically lower, ranging from 0% to 2% in 2023. This means that a significant portion of the death benefit may be exempt from taxation, providing a substantial benefit to the policyholder's family.

For non-direct beneficiaries, such as distant relatives or charities, the tax rate is higher, often ranging from 10% to 20%. This classification includes individuals who are not closely related to the insured, such as aunts, uncles, or nieces/nephews. The higher tax rate is designed to encourage closer family relationships and ensure that the proceeds are distributed among immediate family members.

It's important to note that Ohio's inheritance tax laws can be intricate, and the tax rate may vary based on the insured's date of birth and the policy's issuance date. For policies issued before a certain date, the tax rates might be different, and there could be exceptions or exclusions based on the policy's terms. Therefore, it is advisable to consult the specific tax laws in effect during the policy's lifetime or seek professional advice to ensure compliance with the latest regulations.

Additionally, Ohio residents should be aware of the state's residency requirements for life insurance policies. If the insured individual is a non-resident, the tax laws may differ, and the proceeds could be subject to different tax rates or rules. Understanding these nuances is essential for effective financial planning and ensuring that your loved ones receive the intended benefits without unnecessary tax burdens.

In summary, Ohio's life insurance tax laws involve inheritance taxes on death benefits, with varying rates based on beneficiary relationships. The state's rules are designed to provide tax benefits for direct beneficiaries while encouraging closer family relationships. Residents and non-residents should be aware of these laws and their potential impact on their financial plans, especially when dealing with life insurance policies.

Period Problems: Life Insurance Exam Impact

You may want to see also

Tax Rates for Life Insurance Payouts in Ohio

The tax implications of life insurance payouts in Ohio can be an important consideration for policyholders and beneficiaries. Understanding the tax rates associated with these payouts is crucial to ensure compliance with the law and to make informed financial decisions. Here's a detailed breakdown of the tax rates for life insurance payouts in Ohio:

Exemptions and Federal Tax Laws: In the United States, life insurance proceeds are generally exempt from federal income tax. This means that the money received from a life insurance policy is not subject to federal income tax at the federal level. However, it's important to note that state tax laws may vary, and Ohio is one of the states that follows federal tax regulations on this matter.

Ohio's Tax Treatment: Ohio's tax laws regarding life insurance payouts are aligned with federal guidelines. As per the Internal Revenue Code (IRC) Section 101(a), life insurance proceeds received by the insured's beneficiaries are typically exempt from state income tax. This exemption applies to the entire payout amount, providing tax relief to the recipients. For example, if a policyholder in Ohio purchases a life insurance policy and passes away, the beneficiary will receive the death benefit tax-free, at least at the federal level.

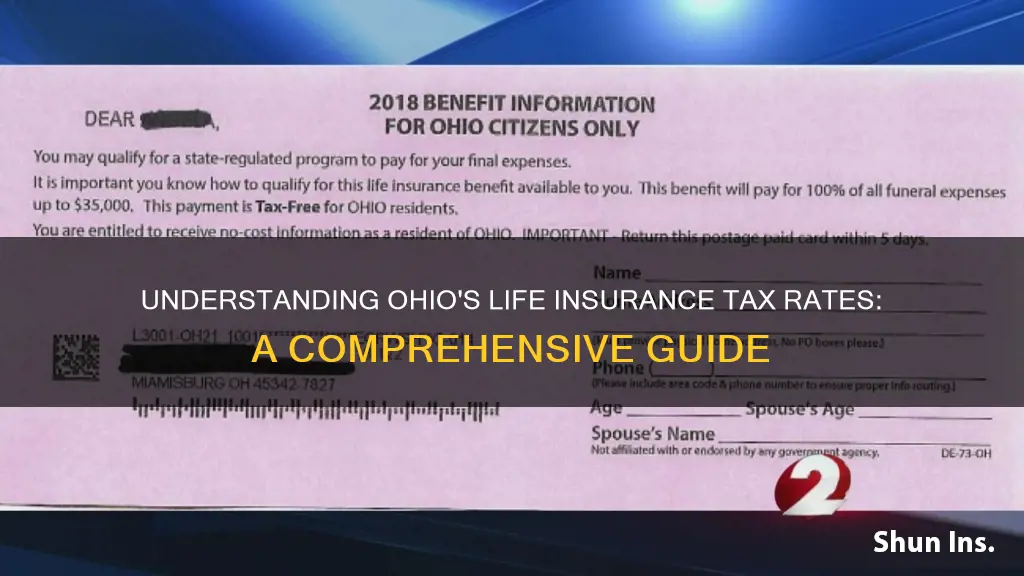

Special Considerations: It's worth mentioning that there are a few exceptions to this general rule. If the policyholder is a resident of Ohio and the insurance company is not a resident of the state, or if the policy was issued by a non-resident company, the state tax authorities may impose a tax on the death benefit. However, these scenarios are relatively rare and often depend on the specific circumstances of the policy and the state's tax laws.

Impact on Policyholders: For individuals, understanding the tax implications can be essential when deciding on the type of life insurance policy to purchase. Term life insurance, for instance, typically provides a death benefit that is tax-free, while permanent life insurance policies may have different tax considerations due to their investment components. Policyholders should consult with financial advisors or tax professionals to navigate these complexities and make choices that align with their financial goals and state tax obligations.

Captive Life Insurance: A Smart Business Strategy?

You may want to see also

Frequently asked questions

In Ohio, life insurance proceeds are generally exempt from state income tax. This means that the death benefit received from a life insurance policy is not subject to state income tax, providing financial relief to the beneficiaries.

Yes, Ohio has specific regulations. The state considers life insurance proceeds as "nontaxable income" for the beneficiary. However, if the policy is owned by an entity other than the insured individual, the proceeds may be subject to certain taxes. It's important to understand the ownership structure to ensure proper tax treatment.

Under federal tax law, life insurance proceeds are typically included in the gross income of the beneficiary. However, there are exceptions. If the policy is owned by the insured and the beneficiary is the spouse or a dependent, the proceeds may be tax-free. It's advisable to consult the latest IRS guidelines for specific federal tax implications.

Tax laws can indeed change, and it's essential to stay updated. While life insurance proceeds are generally exempt from state income tax in Ohio, future legislative changes could impact this. It is recommended to review the current tax laws and consult with a tax professional to ensure compliance with any potential modifications.