Life insurance is a financial tool that provides a safety net for individuals and their families in the event of unexpected death. It offers peace of mind by ensuring that loved ones are protected financially, covering essential expenses and providing financial security during challenging times. The primary purpose of life insurance is to help individuals leave a lasting legacy, support their dependents, and achieve their financial goals, even if they are no longer around. This insurance policy can be tailored to suit individual needs, offering various coverage options and benefits to suit different life stages and circumstances.

What You'll Learn

- Financial Security: Life insurance provides a safety net for beneficiaries in case of the insured's death

- Debt Management: It helps pay off debts and loans, ensuring financial stability for loved ones

- Income Replacement: Policies can offer a regular income stream to replace lost wages

- Mortgage Protection: Life insurance can cover mortgage payments if the primary earner passes away

- Legacy Planning: It allows individuals to leave a financial legacy for future generations

Financial Security: Life insurance provides a safety net for beneficiaries in case of the insured's death

Life insurance is a financial tool that offers a crucial safety net for individuals and their loved ones. Its primary purpose is to provide financial security and peace of mind, especially during challenging times. When an individual purchases life insurance, they essentially enter into a contract with an insurance company, agreeing to pay regular premiums in exchange for a financial benefit upon the occurrence of a specific event—the insured's death. This contract is a promise that, should the insured pass away, the insurance company will pay out a predetermined sum of money to the designated beneficiaries.

The beauty of life insurance lies in its ability to ensure that the financial responsibilities and commitments of the deceased are met. It provides a much-needed financial cushion for the family, covering expenses such as mortgage payments, children's education, funeral costs, and daily living expenses. This financial security is particularly vital for those who rely on the income of the insured individual, as it prevents the sudden loss of income from causing financial hardship and debt.

For example, consider a family with a breadwinner who has a substantial mortgage and two children in college. If the breadwinner were to pass away unexpectedly, the remaining family members would be left with a significant financial burden. Life insurance can step in and provide the necessary funds to cover the mortgage, ensuring that the family can maintain their home and avoid the stress of financial instability. Similarly, it can cover the costs of raising the children through college, ensuring their educational goals are met despite the loss of a parent.

Moreover, life insurance can also be used to cover funeral and burial expenses, which can be substantial and often unexpected. These costs can be a significant financial burden on the family, especially during an already emotionally challenging time. By having life insurance, beneficiaries can focus on grieving and honoring their loved one without the added worry of financial strain.

In summary, life insurance serves as a vital financial safety net, offering protection and peace of mind to both the insured and their beneficiaries. It ensures that financial obligations are met, providing stability and security during what can be a difficult and uncertain period. Understanding the value of life insurance and its potential impact on one's financial well-being is essential for making informed decisions about personal and family finances.

Life Insurance Policy Loans: Negative Amortization Explained

You may want to see also

Debt Management: It helps pay off debts and loans, ensuring financial stability for loved ones

Life insurance is a financial tool that provides a safety net for individuals and their families, offering numerous benefits that extend beyond the obvious. One of its most valuable uses is in the realm of debt management, which is a critical aspect of financial planning. When an individual purchases life insurance, they essentially enter into a commitment to provide financial security for their beneficiaries in the event of their death. This commitment can be leveraged to manage debts and loans, ensuring that loved ones are protected even when the primary breadwinner is no longer present.

In the context of debt management, life insurance acts as a powerful tool to address financial obligations. Upon the insured individual's passing, the life insurance policy's death benefit is paid out to the designated beneficiaries. This financial payout can be utilized to settle any outstanding debts, such as mortgages, personal loans, or credit card balances. By doing so, the loved ones of the deceased are relieved of the financial burden associated with these debts, allowing them to focus on healing and rebuilding their lives.

The process of using life insurance for debt management is straightforward. The insured individual names beneficiaries and chooses the appropriate death benefit amount. When the insured person's life is insured, the policy's value grows over time, providing a financial reserve. Upon death, the policy's proceeds are paid out, and the beneficiaries can use this money to pay off debts. This ensures that the financial obligations are met, and the loved ones are not left with the added stress of managing these debts during an already difficult time.

Furthermore, life insurance provides a sense of financial stability and peace of mind. It allows individuals to plan for the future, knowing that their family's financial well-being is protected. By managing debts effectively, life insurance ensures that the loved ones are not burdened with financial losses, which could have been avoided with proper planning. This aspect of financial security is particularly crucial for families who rely on a primary income earner, as it provides a safety net to maintain their standard of living even in the face of tragedy.

In summary, life insurance plays a vital role in debt management by offering a means to pay off debts and loans, thereby ensuring financial stability for the insured's loved ones. It empowers individuals to take control of their financial future and provides a safety net during challenging times. By understanding the use of life insurance in this context, individuals can make informed decisions to protect their families and manage their financial obligations effectively.

Marine Health Insurance: Lifetime Coverage for Veterans?

You may want to see also

Income Replacement: Policies can offer a regular income stream to replace lost wages

Life insurance is a financial tool that provides a safety net and peace of mind for individuals and their families. One of its primary uses is to ensure financial stability and security, especially in the event of the insured's untimely death. When it comes to income replacement, life insurance policies can be a powerful asset.

Income replacement is a critical aspect of life insurance, as it ensures that the financial obligations and lifestyle of the insured's family are maintained even after their passing. The primary goal is to provide a steady income stream to cover daily expenses, mortgage or rent payments, and other regular financial commitments. This is particularly important for families who rely on the primary breadwinner's income to sustain their standard of living. By having an income replacement policy, beneficiaries can avoid the financial strain and stress associated with sudden income loss.

Life insurance policies offering income replacement typically work by paying out regular benefits to the designated beneficiaries. These benefits can be structured as a lump sum or as periodic payments, often in the form of an annuity. The amount and duration of the payments can be customized to suit the specific needs of the insured's family. For instance, a policy might provide a fixed monthly income for a certain number of years, ensuring a consistent financial flow during the most critical periods. This feature is especially valuable for families with young children or those with ongoing financial commitments that require long-term support.

The beauty of income replacement policies lies in their flexibility. Insurers often allow policyholders to choose the amount and frequency of payments, ensuring that the policy aligns with the family's unique circumstances. This customization is essential, as it allows the policy to adapt to changing financial needs over time. For example, a family might opt for a higher initial income replacement to cover immediate expenses, and then gradually reduce the amount as their financial situation improves.

In summary, income replacement is a vital feature of life insurance, providing a reliable financial safety net for loved ones. It ensures that the insured's family can maintain their standard of living and cover essential expenses even in the absence of the primary income earner. With the flexibility to tailor the policy, individuals can create a comprehensive plan that suits their specific needs, offering both financial security and peace of mind. Understanding the role of income replacement in life insurance is a crucial step in making informed decisions about one's financial well-being.

Ohio Life and Health Insurance Exam: Challenging or Easy?

You may want to see also

Mortgage Protection: Life insurance can cover mortgage payments if the primary earner passes away

Life insurance is a financial tool that provides a safety net for individuals and their families, offering peace of mind and financial security. One of its primary uses is to ensure that loved ones are protected in the event of the primary earner's untimely death. This is especially crucial when it comes to mortgage protection.

Mortgage payments can be a significant financial burden, and the loss of a primary income source due to death can make it nearly impossible for a family to continue making these payments. This is where life insurance steps in as a vital safeguard. When the primary earner purchases a life insurance policy, the policy's death benefit is designed to provide a lump sum payment or regular income to the beneficiaries upon the insured individual's passing. This financial support can be directed towards covering mortgage payments, ensuring that the family can maintain their home and avoid the stress of financial hardship during an already difficult time.

The beauty of mortgage protection through life insurance lies in its ability to provide immediate financial relief. The death benefit can be structured to match the remaining mortgage balance, ensuring that the entire loan is paid off in the event of the insured's death. This prevents the family from facing a large debt or the potential loss of their home due to an inability to make payments.

Furthermore, life insurance with mortgage protection can be tailored to the specific needs of the family. The policy amount can be adjusted based on the size of the mortgage, the number of dependents, and the family's overall financial situation. This customization ensures that the coverage is adequate to support the family's lifestyle and financial obligations.

In summary, life insurance with a focus on mortgage protection is a powerful tool for families with mortgages. It provides a safety net that ensures the continuity of mortgage payments, prevents financial strain, and offers peace of mind. By understanding the importance of this aspect of life insurance, individuals can make informed decisions to protect their loved ones and secure their financial future.

Prudential Life Insurance: Grace Period and Late Payment Options

You may want to see also

Legacy Planning: It allows individuals to leave a financial legacy for future generations

Legacy planning is a crucial aspect of financial strategy that enables individuals to secure their financial legacy and provide for their loved ones in the future. It is a thoughtful and proactive approach to ensure that your hard-earned wealth is utilized according to your wishes and can benefit your family or chosen beneficiaries for generations to come. This process involves creating a comprehensive plan that outlines how your assets will be distributed and managed after your passing.

When considering legacy planning, it is essential to understand the various tools and vehicles available to achieve this goal. One of the most common and effective methods is through life insurance. Life insurance provides a financial safety net and can be a powerful tool in legacy planning. By purchasing a life insurance policy, you can ensure that a substantial sum of money is available to your beneficiaries upon your death. This financial legacy can be used to cover various expenses, such as funeral costs, outstanding debts, or even provide a long-term financial cushion for your loved ones.

The beauty of using life insurance for legacy planning lies in its flexibility and the ability to customize the policy to fit individual needs. You can choose the amount of coverage, the type of policy (term or permanent), and even opt for additional riders or benefits to tailor the policy to your specific goals. For example, a term life insurance policy can provide a temporary financial safety net, ensuring that your family is protected during a specific period, while a permanent policy can offer lifelong coverage and a potential cash value accumulation.

Furthermore, life insurance can be an efficient way to transfer wealth to future generations without incurring significant tax implications. Unlike other inheritance methods, such as gifting assets or selling them, life insurance proceeds are typically paid out tax-free to the designated beneficiaries. This feature allows you to provide a substantial financial gift without immediately impacting your current financial situation.

In summary, legacy planning is a vital aspect of financial management, and life insurance plays a significant role in this process. By utilizing life insurance, individuals can create a financial legacy, ensuring that their loved ones are provided for and that their wealth is passed on according to their wishes. It is a powerful tool that offers flexibility, tax advantages, and a means to secure a brighter future for future generations.

Federal Employees: Lifetime Health Insurance Benefits Explained

You may want to see also

Frequently asked questions

Life insurance is a financial tool designed to provide financial security and protection to individuals and their loved ones. It offers a safety net by ensuring that the beneficiaries receive a lump sum payment or regular income in the event of the insured person's death.

Life insurance plays a crucial role in financial planning by offering a means to secure one's family's financial future. It provides coverage for various expenses, such as mortgage payments, children's education, funeral costs, and daily living expenses, ensuring that the family can maintain their standard of living even after the insured individual's passing.

Yes, certain types of life insurance policies, such as whole life or universal life insurance, offer an investment component. These policies accumulate cash value over time, which can be borrowed against or withdrawn, providing a source of funds for various financial goals, including retirement planning or business ventures.

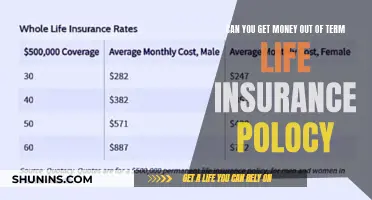

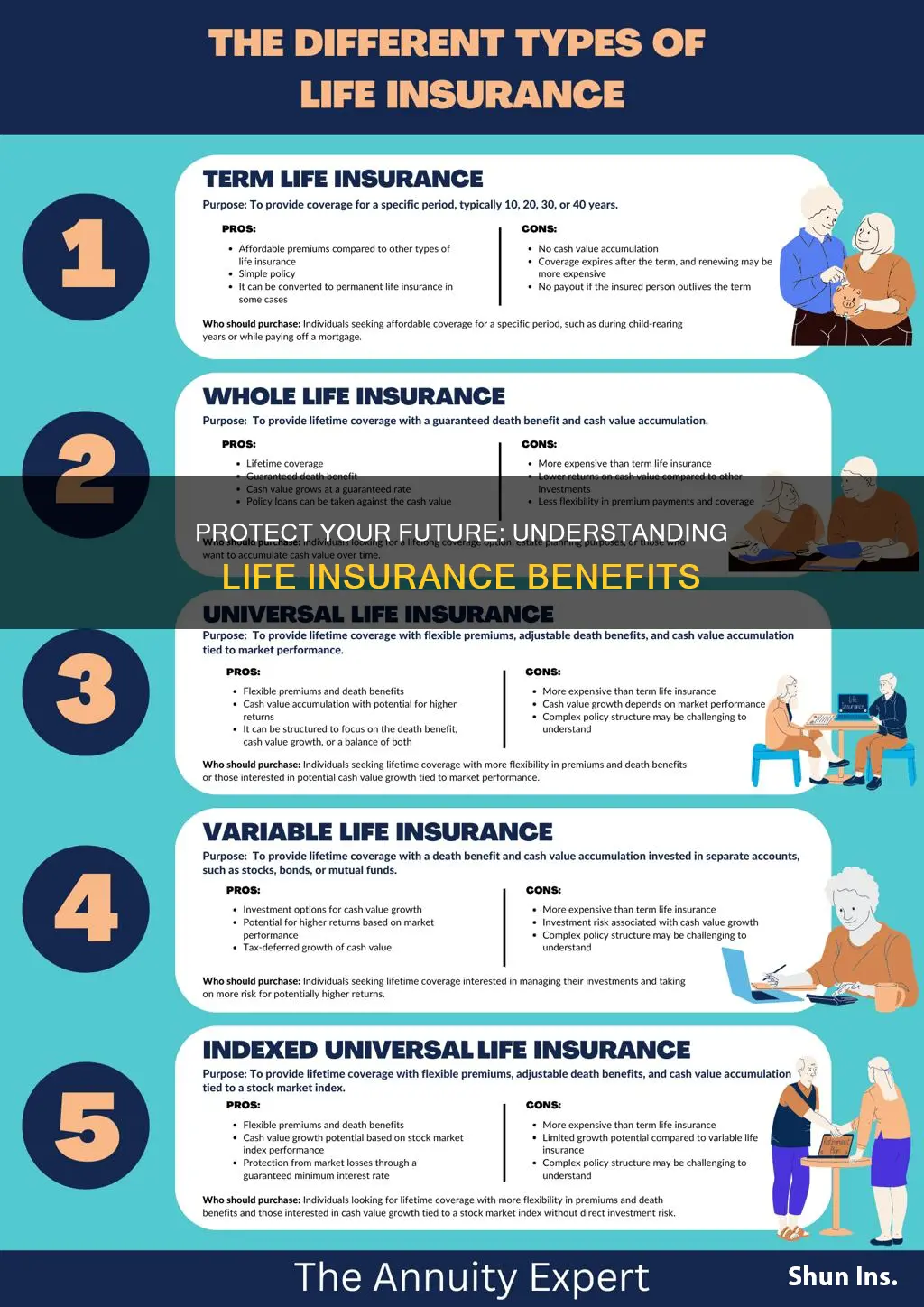

There are several types of life insurance policies, including term life insurance, whole life insurance, universal life insurance, and variable life insurance. Each type has its own features, benefits, and cost structures, allowing individuals to choose a policy that aligns with their specific needs and financial objectives.

While having savings and investments is beneficial, life insurance provides a unique form of financial protection. It ensures that your loved ones are financially secure, especially if your other financial resources are insufficient to cover the potential financial loss caused by your death. Life insurance can also offer tax-advantaged benefits and potential investment growth, making it a valuable component of a comprehensive financial plan.