USAA Life Insurance is a comprehensive insurance product offered by the United Services Automobile Association (USAA), a well-known financial services provider for military members and their families. This insurance policy is designed to provide financial protection and peace of mind to policyholders and their loved ones. It offers various coverage options, including term life, whole life, and universal life insurance, allowing individuals to choose a plan that best suits their needs and financial goals. USAA Life Insurance is known for its competitive rates, flexible payment options, and the association's commitment to serving the military community. Understanding the features and benefits of this insurance can help individuals make informed decisions about their long-term financial security.

What You'll Learn

- Eligibility: USAA life insurance is available to active and retired military members and their families

- Benefits: Policies offer coverage, accidental death benefits, and term life options

- Claims Process: USAA simplifies claims, providing support and guidance to policyholders

- Customer Service: Dedicated agents offer assistance and answer questions about USAA life insurance

- Reviews: Positive feedback highlights USAA's reliability and competitive rates

Eligibility: USAA life insurance is available to active and retired military members and their families

USAA Life Insurance is a specialized insurance product designed to cater to the unique needs of military personnel and their families. It is an exclusive offering by USAA (United Services Automobile Association), a well-known organization that provides financial services and insurance to current and former members of the U.S. Armed Forces and their families. This insurance is tailored to offer comprehensive coverage and support to those who serve and have served in the military.

Eligibility for USAA Life Insurance is an important aspect to consider for military members and their loved ones. It is primarily available to active and retired military personnel, including those who have served in the Army, Navy, Air Force, Marines, and Coast Guard. This coverage extends to their spouses and children as well, ensuring that the entire family can benefit from the financial security it provides. The insurance is designed to offer peace of mind, knowing that one's family is protected even if they are no longer serving in the military.

To be eligible, individuals must meet specific criteria set by USAA. Active-duty military personnel and veterans who have completed their service are generally eligible to apply. The insurance company may also consider the length of service and the type of military discharge when assessing eligibility. Spouses and children of eligible military members can also qualify for coverage, provided they meet the necessary requirements. It is essential to review the USAA guidelines to understand the exact criteria and any additional factors that may influence eligibility.

The benefits of USAA Life Insurance extend beyond just the military members. It provides financial protection and support to the family in the event of the insured's death. This coverage can help cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or daily living expenses for the family. By ensuring financial stability, USAA Life Insurance offers a sense of security and peace of mind, knowing that one's family is taken care of even in challenging circumstances.

In summary, USAA Life Insurance is a valuable resource for active and retired military personnel and their families. Its eligibility criteria are designed to support those who have served and continue to serve the nation. By providing comprehensive coverage, USAA ensures that military members and their loved ones can focus on their well-being and future, knowing they have a reliable financial safety net in place.

Life Insurance Policies: Can You Sell Them?

You may want to see also

Benefits: Policies offer coverage, accidental death benefits, and term life options

USAA Life Insurance offers a range of benefits designed to provide financial security and peace of mind to its policyholders. One of the key advantages is the comprehensive coverage it provides. This coverage ensures that individuals and their families are protected in the event of unforeseen circumstances. It typically includes a death benefit, which is a lump sum payment made to the beneficiary upon the insured's passing. This financial support can help cover various expenses, such as funeral costs, outstanding debts, or the daily living expenses of the family.

In addition to the standard death benefit, USAA Life Insurance policies often include accidental death benefits. This feature provides an extra layer of protection, recognizing that accidents can occur at any time. If the insured's death is a result of an accident, the accidental death benefit is paid out, offering a higher payout compared to the standard policy. This benefit is particularly valuable for those with active lifestyles, such as athletes or outdoor enthusiasts, who may face a higher risk of accidental injuries.

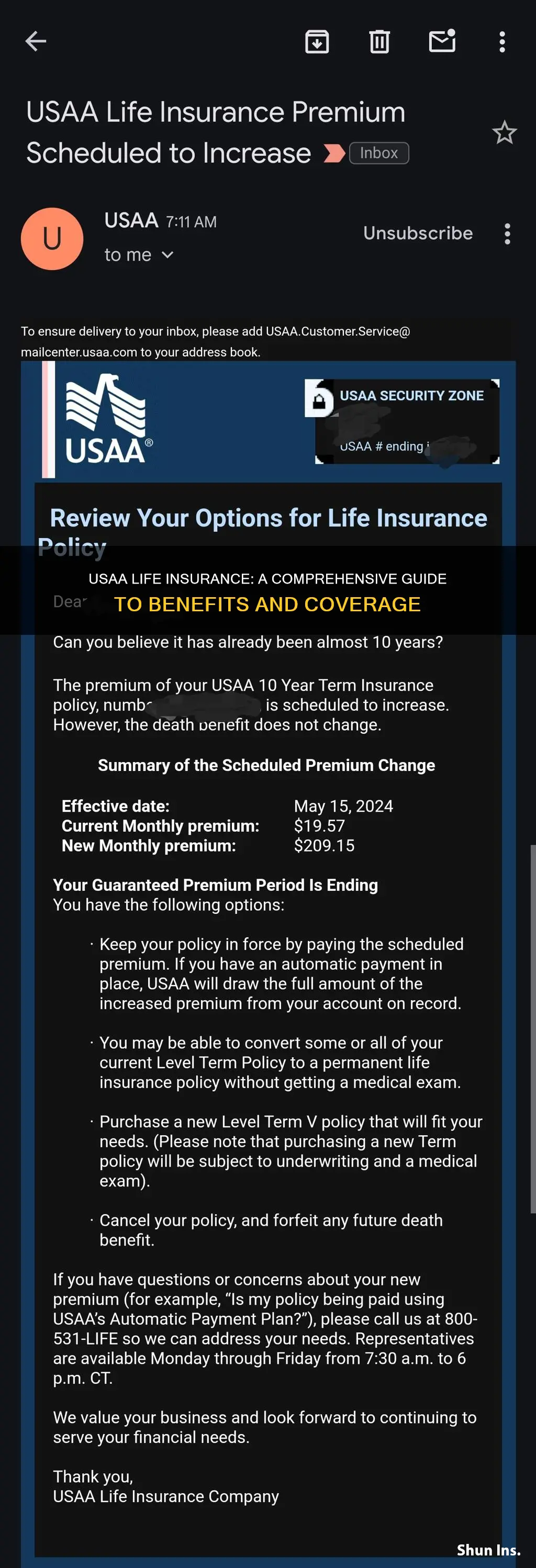

Another appealing aspect of USAA Life Insurance is the flexibility it offers through term life options. Term life insurance provides coverage for a specified period, or 'term', during which the policyholder pays regular premiums. If the insured individual survives the term, the policy expires, and no further payments are required. However, if the insured passes away during the term, the death benefit is paid out. This option allows individuals to secure coverage for a specific period, such as when they have a mortgage or young children, ensuring financial protection during these critical times.

The term life option is particularly attractive to those seeking affordable and flexible coverage. It allows individuals to tailor their policy to their specific needs and financial situation. For example, a young professional might opt for a shorter-term policy to cover a mortgage or a specific financial goal, while a family with young children might choose a longer-term policy to ensure ongoing financial support.

Furthermore, USAA Life Insurance policies often come with additional benefits and features. These may include the ability to convert the term life policy to a permanent life insurance plan, providing long-term coverage and a cash value accumulation. Some policies also offer the option to add riders or supplements, such as critical illness coverage or disability insurance, allowing policyholders to customize their protection.

Finding the Best Term Life Insurance for You

You may want to see also

Claims Process: USAA simplifies claims, providing support and guidance to policyholders

USAA Life Insurance Company offers a comprehensive claims process designed to be straightforward and supportive for policyholders. When a covered event occurs, such as the death of the insured individual, USAA aims to make the claims settlement process as smooth and efficient as possible. Here's an overview of how USAA simplifies claims and provides guidance to policyholders:

Initiating the Claim: Policyholders or their designated beneficiaries can initiate the claims process by contacting USAA's customer service team. This can be done through various channels, including phone, email, or online. When making the initial contact, it is essential to have the necessary documentation ready, such as the policy number, death certificate (if applicable), and any other relevant information. USAA representatives are trained to guide policyholders through the initial steps and provide them with the required forms and instructions.

Documentation and Evidence: USAA requires specific documentation to process the claim accurately. This includes providing proof of the insured's death, such as a death certificate, and any other supporting documents related to the policy. For example, if the policy includes a waiver of premium provision, beneficiaries should provide evidence of the insured's death to qualify for the benefit. USAA's claims team will review the submitted documents and may request additional information if needed.

Claims Settlement: Once the claim is approved and all necessary documentation is received, USAA proceeds with the settlement process. The company offers various payment options, including lump-sum payments, periodic payments, or a combination of both, depending on the policy terms and the beneficiary's preferences. USAA ensures that the payment is made promptly and securely, providing peace of mind during a challenging time.

Beneficiary Support: USAA understands that beneficiaries may have questions or concerns during the claims process. They provide dedicated support to help beneficiaries understand their rights and options. This includes explaining the policy terms, the claims process, and any available benefits. USAA's goal is to ensure that beneficiaries receive the necessary guidance and assistance throughout the entire claims journey.

Online Resources: USAA also offers online resources to simplify the claims process. Policyholders can access their policy information, track the status of their claim, and download necessary forms through their online account. This self-service option allows policyholders to manage their claims efficiently and conveniently. Additionally, USAA provides a comprehensive FAQ section and online tutorials to address common questions and concerns.

By streamlining the claims process, offering dedicated support, and providing online resources, USAA aims to minimize the burden on policyholders and beneficiaries during difficult times. Their goal is to ensure that the claims experience is as smooth and stress-free as possible, allowing individuals to focus on their loved ones and the important matters at hand.

Life Insurance Rating: Is Third-Best Good Enough?

You may want to see also

Customer Service: Dedicated agents offer assistance and answer questions about USAA life insurance

USAA Life Insurance offers a comprehensive range of life insurance products designed to provide financial security and peace of mind to its members. The company is known for its dedicated customer service, ensuring that members receive the support they need throughout their insurance journey. When it comes to USAA life insurance, having access to knowledgeable and helpful agents is a key advantage.

The customer service team at USAA is a dedicated group of professionals who are committed to assisting members with their insurance needs. These agents are highly trained and experienced in dealing with various aspects of life insurance, including policy details, coverage options, and claims processing. They are readily available to offer guidance and answer any questions members may have, ensuring a smooth and efficient experience. Whether it's understanding the different types of coverage available, comparing policies, or seeking clarification on any insurance-related matters, USAA's customer service agents are just a call or message away.

Members can reach out to these dedicated agents via multiple channels, including phone, email, or live chat. The agents are equipped to handle a wide range of inquiries, from providing general information about life insurance to offering tailored advice based on individual circumstances. They can explain the various life insurance products, such as term life, whole life, and universal life insurance, and help members choose the best fit for their needs. Additionally, they can assist with policy reviews, ensuring that members' coverage remains appropriate and up-to-date as their lives change.

One of the key benefits of USAA's customer service is the personalized approach they take. Agents take the time to understand each member's unique situation and provide tailored recommendations. They consider factors like age, health, financial goals, and family structure to offer the most suitable insurance solutions. This level of customization ensures that members receive the right coverage at the right price, providing them with the financial protection they desire.

Furthermore, USAA's customer service extends beyond policy-related inquiries. The agents can also assist with claims processing, ensuring a smooth and efficient experience during difficult times. They guide members through the claims process, providing the necessary documentation and support to help settle claims promptly. This dedicated assistance is a testament to USAA's commitment to being a trusted partner in their members' financial well-being.

In summary, USAA Life Insurance's customer service is a vital component of their commitment to members. The dedicated agents offer a high level of expertise and personalized assistance, ensuring that members can make informed decisions about their life insurance needs. With their accessibility and comprehensive support, USAA's customer service team plays a crucial role in providing financial security and peace of mind to its valued members.

Edelweiss Tokio Life Insurance: What You Need to Know

You may want to see also

Reviews: Positive feedback highlights USAA's reliability and competitive rates

USAA Life Insurance has garnered a positive reputation among its customers, with many praising its reliability and competitive pricing. Numerous reviews highlight the company's commitment to its policyholders, emphasizing that USAA stands out in a market often criticized for high costs and poor customer service.

One of the most frequently mentioned strengths of USAA is its reliability. Policyholders appreciate the company's consistent performance and its ability to honor its commitments. This reliability is particularly important in the context of life insurance, where policyholders rely on the insurer to provide financial security for their loved ones. USAA's commitment to its customers is further reinforced by its long-standing history and its focus on building long-term relationships.

In addition to reliability, USAA's competitive rates are a significant draw for many customers. The company's pricing is often cited as being more affordable compared to other insurers, without compromising on coverage quality. This competitive advantage is especially appealing to those seeking comprehensive life insurance at a reasonable cost. USAA's ability to offer competitive rates is a testament to its efficient operations and its focus on providing value to its customers.

The positive feedback also extends to USAA's customer service. Reviewers often mention the company's responsiveness and the helpfulness of its representatives. This level of service is crucial in building trust and ensuring that policyholders feel supported throughout their insurance journey. USAA's commitment to excellent customer service is a key differentiator, setting it apart from competitors who may lack this level of dedication.

Overall, the positive reviews of USAA Life Insurance emphasize the company's strengths in reliability, competitive rates, and customer service. These aspects collectively contribute to a positive customer experience, making USAA a preferred choice for those seeking reliable and affordable life insurance solutions.

LPR Diagnosis: Impact on Life Insurance Rates

You may want to see also

Frequently asked questions

USAA Life Insurance Company offers a range of life insurance products designed to provide financial protection and peace of mind to its members. These policies are tailored to meet the unique needs of military personnel, veterans, and their families.

USAA life insurance is available to current and former members of the U.S. military, their spouses, and eligible dependents. Membership is based on military service or affiliation, and eligibility criteria may vary.

USAA provides various life insurance options, including term life, whole life, and universal life policies. Term life insurance offers coverage for a specified period, while whole life provides permanent coverage. Universal life allows policyholders to adjust their premiums and death benefits over time.

You can obtain a quote or apply for USAA life insurance by visiting their official website, contacting their customer service representatives, or working with a licensed insurance agent associated with USAA. The application process typically involves providing personal and financial information to determine eligibility and customize the policy.