Veribly life insurance is a financial product designed to provide financial security and peace of mind to individuals and their loved ones. It is a type of insurance that offers a death benefit, which is a lump sum payment made to the policyholder's beneficiaries upon the insured individual's death. This benefit can help cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or the daily living expenses of the family. Veribly life insurance policies typically offer flexibility in terms of coverage amount, duration, and payment options, allowing individuals to tailor the policy to their specific needs and financial goals. It is a valuable tool for risk management and can be an essential component of a comprehensive financial plan.

What You'll Learn

- Definition: Life insurance is a contract between an insurer and an individual, promising financial protection for beneficiaries in the event of the insured's death

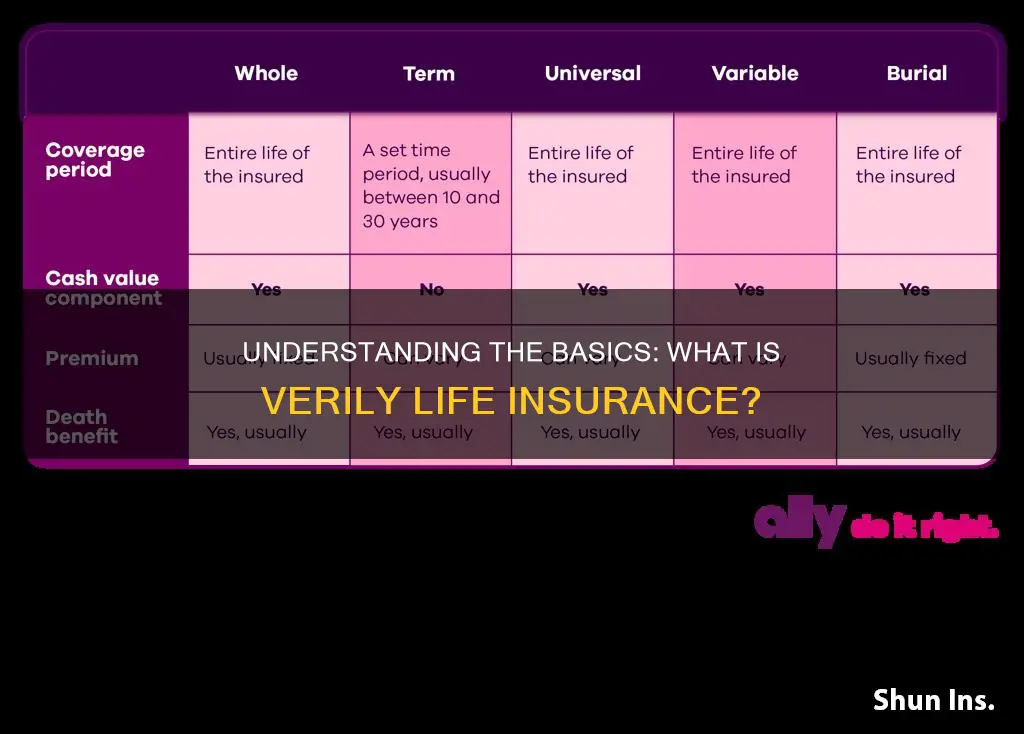

- Types: Term life, whole life, universal life, and variable life are the main types of life insurance

- Benefits: Life insurance provides financial security, covering expenses like funeral costs, mortgage payments, and living expenses for beneficiaries

- Premiums: Policyholders pay regular premiums to the insurer, which can be adjusted or fixed depending on the policy

- Claims: Upon the insured's death, the insurer reviews the claim, pays out the death benefit, and settles the policy

Definition: Life insurance is a contract between an insurer and an individual, promising financial protection for beneficiaries in the event of the insured's death

Life insurance is a financial product designed to provide security and peace of mind to individuals and their loved ones. It is a legal agreement, or contract, between an insurance company (the insurer) and a policyholder (the individual who purchases the insurance). This contract is a promise made by the insurer to pay a specified sum of money, known as the death benefit, to the beneficiaries named in the policy when the insured individual passes away. The primary purpose of life insurance is to offer financial protection and support to the beneficiaries during a difficult time, ensuring that their essential needs and financial goals are met.

In this contract, the individual (the insured) agrees to pay regular premiums to the insurer in exchange for the promise of financial coverage. The insurer, in turn, assesses the risk associated with insuring the individual and determines the premium amount accordingly. The process involves evaluating various factors such as the insured's age, health, lifestyle, and any pre-existing medical conditions. By doing so, the insurer can calculate the likelihood of the insured's death and set the premium rate to cover potential claims.

Upon the insured's death, the beneficiaries named in the policy are entitled to receive the death benefit. This financial payout can be used to cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or daily living expenses, ensuring that the family's financial stability is maintained even after the insured's passing. The amount of the death benefit is typically chosen by the policyholder, considering their specific needs and the financial obligations they wish to secure.

It is important to note that life insurance policies can vary in terms of coverage, duration, and other features. Different types of life insurance policies include term life insurance, which provides coverage for a specified period, and permanent life insurance, which offers lifelong coverage and includes a cash value component. Understanding the specific terms and conditions of a life insurance policy is crucial for individuals to ensure they receive the intended financial protection.

In summary, life insurance is a powerful tool for individuals to safeguard their loved ones' financial well-being. It provides a safety net, allowing beneficiaries to cope with the financial impact of the insured's death. By entering into this contract, individuals can gain peace of mind, knowing that their family's financial future is protected, even in the face of unforeseen circumstances.

Life Insurance: Choosing the Right Policy for You

You may want to see also

Types: Term life, whole life, universal life, and variable life are the main types of life insurance

Life insurance is a financial protection tool that provides a monetary benefit to the beneficiaries upon the insured individual's death. It is a way to ensure financial security for loved ones, covering expenses like mortgage payments, children's education, or daily living costs. When considering life insurance, it's essential to understand the different types available to choose the one that best suits your needs. Here are the main types of life insurance:

Term Life Insurance: This is a straightforward and affordable type of coverage that provides protection for a specified period, known as the 'term.' It is ideal for individuals who want coverage for a particular duration, such as until their children finish school or a mortgage is paid off. Term life insurance offers a fixed death benefit if the insured person passes away during the term. The premiums are typically lower compared to other types, making it a cost-effective option for those seeking temporary coverage. However, it does not accumulate cash value, and the policy ends when the term expires.

Whole Life Insurance: In contrast to term life, whole life insurance offers permanent coverage for the entire lifetime of the insured individual. It provides a guaranteed death benefit and accumulates cash value over time. The premiums are typically higher than term life, but they remain constant throughout the policy's life. With whole life insurance, policyholders can borrow against the cash value or withdraw funds, providing financial flexibility. This type is suitable for those seeking long-term financial security and a consistent premium payment.

Universal Life Insurance: This type of policy offers flexibility in premium payments and death benefit amounts. It combines permanent coverage with an investment component, allowing policyholders to adjust their premiums and death benefits over time. Universal life insurance provides a guaranteed death benefit and accumulates cash value, which can be used to pay premiums or taken out as a loan. The premiums are typically higher than term life but can be adjusted to fit changing financial circumstances. It is a good choice for those who want the flexibility to manage their insurance and investment needs.

Variable Life Insurance: Variable life insurance offers permanent coverage with an investment component, similar to universal life. However, the death benefit and cash value are linked to the performance of underlying investment accounts. Policyholders can choose from various investment options, allowing for potential higher returns. The premiums are typically higher, and they can vary based on the investment performance. This type is suitable for individuals who want both insurance protection and the opportunity for investment growth.

Understanding these types of life insurance is crucial in making an informed decision. Each type has its advantages and considerations, and the choice depends on individual financial goals, preferences, and circumstances. It is recommended to consult with a financial advisor to determine the most appropriate life insurance coverage for your specific needs.

Life Storage Insurance: Is It a Requirement?

You may want to see also

Benefits: Life insurance provides financial security, covering expenses like funeral costs, mortgage payments, and living expenses for beneficiaries

Life insurance is a financial tool that offers a safety net for individuals and their loved ones. It is a contract between an individual (the policyholder) and an insurance company, where the insurer promises to pay a designated sum of money (the death benefit) to the policyholder's beneficiaries upon the insured individual's death. This benefit is a crucial aspect of financial planning and provides a sense of security and peace of mind.

One of the primary benefits of life insurance is financial security. When an individual purchases a life insurance policy, they are essentially creating a financial safety net for their family or beneficiaries. The death benefit can be used to cover various expenses and provide financial stability during a difficult time. For example, the funds can be utilized to pay for funeral and burial costs, ensuring that the insured person's wishes are honored and the family is not burdened with unexpected expenses. This aspect is particularly important as funeral and burial costs can be substantial and often require immediate payment.

Moreover, life insurance can be a valuable asset in managing mortgage payments. For those with a mortgage, the death benefit can be used to settle the outstanding loan, preventing the loss of a home and providing financial relief to the family. This is especially beneficial for those who have recently purchased a property or have a substantial mortgage, as it ensures that the financial commitment is honored even if the primary income earner passes away.

In addition to covering specific expenses, life insurance can also provide for the daily living expenses of beneficiaries. The death benefit can be used to cover everyday costs such as groceries, utilities, and other basic necessities, ensuring that the family's standard of living is maintained even after the insured person's passing. This financial support can be crucial for the well-being of the beneficiaries, especially if they are left with the responsibility of raising children or managing other financial commitments.

The versatility of life insurance in providing financial security is a key advantage. It allows individuals to plan for various life events and ensures that their loved ones are protected. Whether it's covering funeral costs, mortgage payments, or daily living expenses, life insurance provides a comprehensive solution to potential financial challenges. By understanding the benefits and features of different life insurance policies, individuals can make informed decisions to safeguard their families' financial future.

Life Insurance: Can Someone Else Purchase It for You?

You may want to see also

Premiums: Policyholders pay regular premiums to the insurer, which can be adjusted or fixed depending on the policy

When it comes to life insurance, understanding the concept of premiums is crucial. Premiums are a fundamental aspect of any insurance policy, including life insurance. In simple terms, a premium is the amount of money a policyholder pays to the insurance company at regular intervals, typically monthly, quarterly, or annually. These payments are made to ensure that the insurer can provide financial protection and benefits as outlined in the policy.

The premium amount is determined by various factors, and it is a personalized calculation for each individual. Insurers consider factors such as age, health, lifestyle, and the desired coverage amount when setting the premium. For instance, a younger, healthier individual with a lower risk profile might pay lower premiums compared to an older person with pre-existing health conditions. The coverage amount, or the death benefit, which is the financial payout to the policyholder's beneficiaries upon the insured's passing, also influences the premium. Higher coverage amounts generally result in higher premiums.

Premiums can be either fixed or adjustable. Fixed premiums remain constant throughout the policy term, providing stability and predictability for the policyholder. This means that the policyholder pays the same amount regularly, and the insurer guarantees the same coverage. On the other hand, adjustable or variable premiums can change over time based on the policy's performance and market conditions. These policies often offer more flexibility but may also carry more financial risk.

It's important to note that while premiums are a regular expense, they are a necessary investment for financial security. By paying premiums, policyholders ensure that they and their loved ones are protected financially in the event of their passing. The insurer uses these premiums to manage risks, invest in assets, and ultimately provide the promised death benefit when the time comes.

Understanding the premium structure is essential for making informed decisions when choosing a life insurance policy. Policyholders should carefully review the premium payment options, terms, and conditions to ensure they align with their financial goals and risk tolerance. Regularly reviewing and adjusting premiums, if necessary, can help individuals stay on track with their insurance needs as their circumstances change over time.

Becoming an Independent Life Insurance Agent in Kansas

You may want to see also

Claims: Upon the insured's death, the insurer reviews the claim, pays out the death benefit, and settles the policy

When an individual purchases life insurance, they essentially enter into a contract with an insurance company, agreeing to pay regular premiums in exchange for a financial benefit upon the insured's death. This benefit is known as the death benefit, and it is a predetermined amount of money that the insurer promises to pay out to the policy's beneficiaries when the insured individual passes away. The process of claiming this benefit is a crucial aspect of life insurance and involves several steps.

Upon the insured's death, the first step is for the beneficiaries to notify the insurance company. This notification typically involves submitting a claim, which includes providing necessary documentation such as proof of death, the insured's policy details, and any other relevant information. The insurer then reviews the claim to ensure that all the provided information is accurate and complete. This review process is essential to verify the validity of the claim and to prevent any potential fraud.

During the review, the insurer will examine the policy's terms and conditions, including any specific clauses or exclusions that may impact the claim. They will also verify the identity of the insured and the beneficiaries to ensure that the claim is being made by the rightful parties. This step is crucial to protect both the insurer and the beneficiaries from any potential disputes or misunderstandings. Once the claim is approved, the insurer proceeds to the next phase.

The insurer then calculates and pays out the death benefit as promised in the policy. This amount is typically a lump sum or a series of regular payments, depending on the policy's terms. The payment is made to the designated beneficiaries, who can be individuals or entities specified by the insured in the policy. It is important to note that the insurer's role is to facilitate the payment process, ensuring that the beneficiaries receive the intended financial support.

After the death benefit is paid out, the insurer also settles the policy. This involves closing the policy account, updating their records, and providing any necessary documentation to the beneficiaries. The settlement process ensures that the policy is officially terminated, and the insurer's obligations under the contract are fulfilled. This step is crucial for both the insurer and the beneficiaries to move forward and close the chapter on the insured's life insurance policy.

Whole Life Insurance: Taxable in Canada?

You may want to see also

Frequently asked questions

Veriably life insurance, also known as 'whole life' or 'permanent life' insurance, is a type of long-term life insurance that provides coverage for the entire lifetime of the insured individual. It offers a guaranteed death benefit and a fixed premium that remains the same over the policy's duration.

Veriably life insurance is a permanent policy that stays in force as long as the premium is paid. It includes a savings component, known as cash value, which grows over time. In contrast, term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, and does not have a savings component.

This type of insurance offers several advantages, including a guaranteed death benefit, fixed premiums, and a cash value accumulation. The cash value can be borrowed against or withdrawn, providing financial flexibility. Additionally, veriably life insurance can be an excellent tool for wealth accumulation and building a financial legacy.

Yes, it is possible to convert a term life insurance policy to a veriably life insurance policy, but it depends on the insurance company's policies and the specific circumstances. Typically, a conversion option is available during the initial term period, allowing policyholders to switch to a permanent policy without a medical examination.