Whole life 95 insurance is a type of permanent life insurance that provides coverage for the entire life of the insured individual, with the exception of a 5-year waiting period. This insurance policy offers a guaranteed death benefit and a fixed premium that remains the same for the life of the policyholder. It is designed to provide financial security and peace of mind, as the policyholder's beneficiaries will receive a payout upon their death, regardless of the cause. The 5-year waiting period is a unique feature, allowing the policy to mature and build cash value over time before providing full coverage. This insurance product is often sought after for its long-term financial planning benefits and the certainty it offers to policyholders and their families.

What You'll Learn

- Definition: Whole Life 95 is a permanent life insurance policy with a guaranteed death benefit and fixed premiums

- Features: It offers lifelong coverage, a cash value component, and a guaranteed interest rate

- Benefits: Provides income replacement, estate planning, and tax-advantaged savings

- Cost: Premiums are typically higher than term life but offer long-term security

- Comparison: Whole Life 95 vs. term life: longer coverage, higher costs, and built-in savings

Definition: Whole Life 95 is a permanent life insurance policy with a guaranteed death benefit and fixed premiums

Whole Life 95 insurance is a specific type of permanent life insurance policy that offers a range of unique features and benefits. This policy is designed to provide long-term financial security and peace of mind to policyholders. Here's a detailed definition:

Whole Life 95, as the name suggests, is a permanent life insurance policy with a 95-year term. It is a form of whole life insurance, which means it provides coverage for the entire lifetime of the insured individual. One of its key advantages is the guaranteed death benefit, ensuring that the beneficiaries receive a specified amount upon the insured's passing. This guaranteed benefit is a significant feature, offering financial security to the policyholder's loved ones.

In this policy, the premiums are fixed, meaning they remain the same throughout the term. This predictability allows policyholders to plan their finances effectively. The fixed premiums are typically higher than those of term life insurance but offer the advantage of long-term stability. With Whole Life 95, individuals can secure their family's financial future, knowing that the insurance coverage will remain constant over the years.

The policy also accumulates cash value over time, which can be borrowed against or withdrawn. This feature provides an additional financial safety net and can be utilized for various purposes, such as funding education expenses or starting a business. Additionally, the policy's permanent nature means that it does not expire, providing lifelong coverage.

In summary, Whole Life 95 insurance is a comprehensive and reliable life insurance option. It offers a guaranteed death benefit, fixed premiums, and the potential for cash value accumulation. This policy is ideal for individuals seeking long-term financial protection and the assurance of knowing their loved ones will be taken care of, regardless of future circumstances.

Life Insurance: Can You Increase Your Coverage After a Downgrade?

You may want to see also

Features: It offers lifelong coverage, a cash value component, and a guaranteed interest rate

Whole Life 95 insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. One of its key features is lifelong coverage, ensuring that the policy remains in force as long as the premium payments are made. This is in contrast to term life insurance, which provides coverage for a specified period, typically 10, 20, or 30 years. With Whole Life 95, the insured individual can rest assured that their loved ones will be financially protected even if they outlive the initial term period.

In addition to lifelong coverage, this insurance product offers a cash value component. Over time, a portion of the premium payments goes into building up a cash value, which can be borrowed against or withdrawn. This feature provides policyholders with a financial asset that can be used for various purposes, such as funding education, starting a business, or supplementing retirement income. The cash value grows at a guaranteed interest rate, providing a secure and predictable return on the policyholder's investment.

The guaranteed interest rate is another attractive feature of Whole Life 95 insurance. This rate is typically fixed and ensures that the cash value of the policy will grow at a certain percentage each year. This predictability allows policyholders to plan their financial future with greater confidence. As the cash value accumulates, it can be used to pay for future premiums, ensuring that the policy remains in force even if the insured individual faces financial challenges.

Furthermore, the guaranteed interest rate provides a safety net for policyholders. It guarantees that the policy's cash value will not decrease, even during economic downturns or market volatility. This feature is particularly valuable for those seeking long-term financial security and stability. With Whole Life 95, individuals can build a substantial cash value that can be passed on as a legacy to beneficiaries or used to secure their financial future.

In summary, Whole Life 95 insurance offers a comprehensive set of features that make it an attractive choice for individuals seeking lifelong coverage, financial security, and a guaranteed return on their investment. The combination of lifelong coverage, a cash value component, and a guaranteed interest rate provides policyholders with a powerful tool to protect their loved ones and build a secure financial future.

Accessing Your SBI Life Insurance Customer ID

You may want to see also

Benefits: Provides income replacement, estate planning, and tax-advantaged savings

Whole Life 95 insurance is a type of permanent life insurance that offers a range of benefits, primarily designed to provide financial security and peace of mind to policyholders. One of its key advantages is income replacement, ensuring that beneficiaries receive a steady stream of income in the event of the insured's death. This financial support can help cover essential expenses and maintain the standard of living for the family, especially during challenging times. The policy's death benefit is typically tax-free, providing a significant financial cushion for the loved ones left behind.

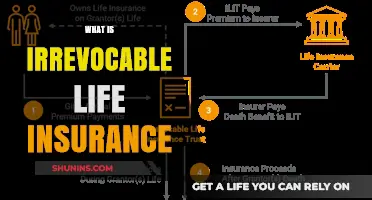

In addition to income replacement, this insurance product also serves as an effective estate planning tool. It allows individuals to pass on a substantial sum of money to their heirs, helping to ensure a secure financial future for their beneficiaries. The policy's cash value, which grows over time, can be borrowed against or withdrawn, providing access to funds for various purposes, such as education expenses or business ventures. This feature makes it a versatile financial instrument, catering to the evolving needs of the policyholder.

The tax-advantaged savings aspect of Whole Life 95 insurance is another significant benefit. Premiums paid into the policy are typically tax-deductible, providing an immediate tax benefit to the policyholder. Furthermore, the cash value accumulation within the policy grows tax-free, allowing it to accumulate over time without being subject to annual income tax. This feature enables the policy to build a substantial tax-free reserve, which can be utilized for various financial goals, such as retirement planning or funding a child's education.

Moreover, the long-term nature of this insurance policy ensures that the benefits are secure and reliable. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers permanent coverage, ensuring that the policy remains in force for the insured's entire life. This longevity provides a sense of financial stability and security, knowing that the policy will continue to provide benefits even as the insured ages.

In summary, Whole Life 95 insurance offers a comprehensive set of benefits, including income replacement, estate planning, and tax-advantaged savings. It provides a reliable and secure financial solution, ensuring that policyholders and their beneficiaries are protected and supported throughout their lives. With its permanent coverage and various financial advantages, this insurance product is a valuable tool for anyone seeking long-term financial security and peace of mind.

Life Insurance for Death Row Inmates: Is It Possible?

You may want to see also

Cost: Premiums are typically higher than term life but offer long-term security

Whole life insurance, often referred to as permanent life insurance, is a long-term financial commitment that provides coverage for the entire lifetime of the insured individual. One of the key aspects that sets whole life insurance apart from other types of life insurance is its cost structure, particularly in comparison to term life insurance.

When it comes to cost, whole life insurance premiums are generally higher than those of term life insurance. This is primarily due to the extended coverage period and the additional benefits associated with whole life policies. The higher premiums reflect the insurance company's commitment to providing a guaranteed death benefit for the policyholder's entire life, along with an accumulation of cash value over time. This cash value can be borrowed against or withdrawn, offering policyholders a financial asset that grows tax-deferred.

The long-term nature of whole life insurance means that the premiums are structured to ensure the policy remains in force for the insured's entire life. This is in contrast to term life insurance, which provides coverage for a specified period, typically 10, 20, or 30 years. As a result, the higher premiums for whole life insurance are designed to cover the extended period of risk and the additional benefits.

Despite the higher initial costs, whole life insurance offers long-term security and financial planning benefits. Policyholders can build up a substantial cash value, which can be used for various purposes, such as funding education expenses, starting a business, or providing retirement income. Additionally, the guaranteed death benefit ensures that beneficiaries receive a payout regardless of the insured's age or health at the time of death, providing peace of mind and financial security for loved ones.

In summary, while whole life insurance premiums are typically higher than those of term life insurance, the extended coverage and long-term financial benefits make it an attractive option for individuals seeking permanent life coverage and a growing financial asset. It provides a comprehensive solution for those who want to ensure their loved ones' financial security and also build a valuable asset over time.

Passing the Vue Life Health Exam: Easy Strategies

You may want to see also

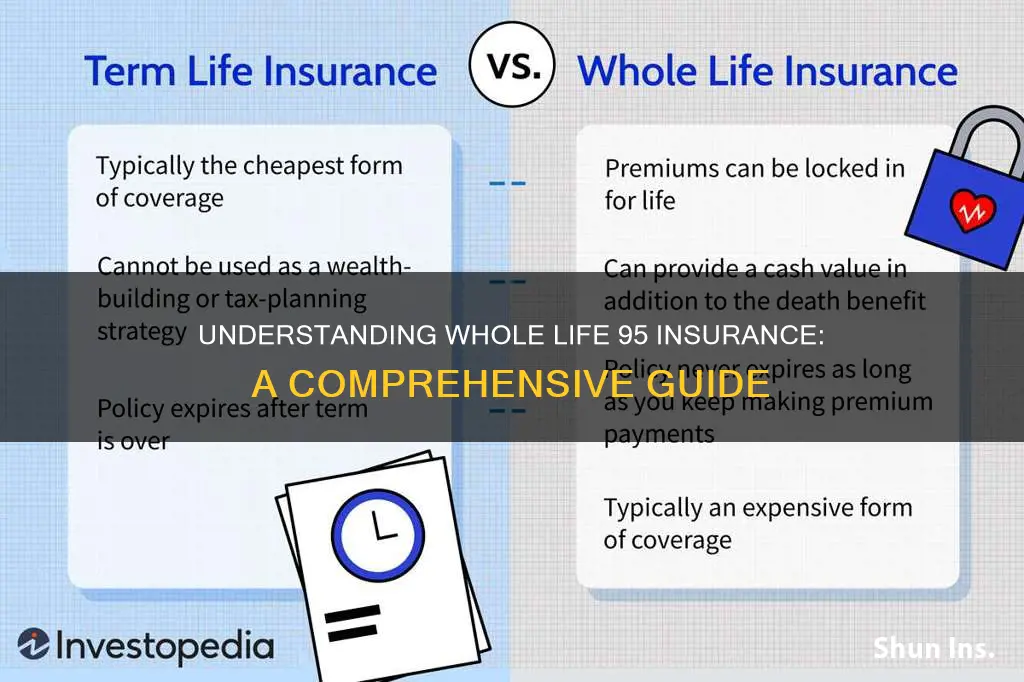

Comparison: Whole Life 95 vs. term life: longer coverage, higher costs, and built-in savings

Whole Life 95 insurance, often referred to as a permanent life insurance policy, is a type of long-term coverage that offers a range of benefits. It provides a death benefit to the policyholder's beneficiaries if the insured individual passes away, ensuring financial security for loved ones. One of the key advantages of Whole Life 95 is its longevity; it remains in force for the entire life of the insured, hence the term "permanent." This means that once the policy is in place, the coverage is guaranteed for life, providing peace of mind and long-term protection.

In contrast, Term Life insurance is a more temporary solution, offering coverage for a specified period, often 10, 20, or 30 years. It is typically more affordable than permanent insurance during the initial years, making it an attractive option for those seeking cost-effective coverage for a defined period. However, Term Life insurance does not accumulate cash value, and once the term ends, the policy may need to be renewed or replaced, potentially at a higher cost.

The primary difference between Whole Life 95 and Term Life lies in their duration and cost structure. Whole Life 95 provides lifelong coverage, ensuring that the death benefit is available even in the long term. This feature is particularly valuable for individuals who want to leave a financial legacy for their families or beneficiaries. On the other hand, Term Life is designed for specific periods, making it suitable for those who need coverage for a particular stage in life, such as when raising a family or paying off a mortgage.

The cost of Whole Life 95 is generally higher due to its permanent nature and the guaranteed death benefit. The premiums are typically higher because the insurance company is committed to providing coverage for the entire life of the insured. In contrast, Term Life premiums are lower during the initial years, making it an economical choice for short-term needs. As the policy term progresses, the cost of Term Life may increase, especially if the insured individual's health status changes.

Another advantage of Whole Life 95 is its built-in savings component. As the policy accumulates cash value over time, it can be borrowed against or withdrawn, providing a source of funds for the policyholder. This feature allows individuals to access their money without having to surrender the policy or take out a loan. In contrast, Term Life policies do not accumulate cash value, and any premiums paid are solely used to provide the death benefit during the specified term.

In summary, the choice between Whole Life 95 and Term Life depends on an individual's specific needs and financial goals. Whole Life 95 offers longer coverage, higher costs, and built-in savings, making it suitable for those seeking lifelong financial protection and a legacy. Term Life, with its lower initial costs and defined term, is ideal for short-term coverage needs, providing a cost-effective solution during specific life stages. Understanding these differences is crucial in making an informed decision regarding life insurance coverage.

Life Insurance Proceeds: When to Declare and Why

You may want to see also

Frequently asked questions

Whole Life 95 Insurance, also known as a 95-year term life insurance, is a type of permanent life insurance policy that provides coverage for the entire life of the insured individual, with the exception of a 5-year term. This means that the policy will remain in force for the insured's lifetime, as long as the premiums are paid, and the coverage will continue until the insured reaches the age of 95.

Traditional whole life insurance offers coverage for the entire life of the insured, but it typically has a fixed premium that does not change over time. In contrast, Whole Life 95 Insurance has a lower initial premium, which increases annually during the 5-year term. After this term, the premium stabilizes, and the coverage becomes more comparable to traditional whole life insurance.

One of the main advantages is the potential for lower initial costs, especially for younger individuals. The 5-year term provides a safety net, ensuring that the policyholder has coverage during their most vulnerable years. Additionally, the policy can be converted to a permanent plan after the term ends, allowing for long-term financial protection.

Yes, one potential drawback is the annual premium increase during the initial term, which may be a concern for those who want stable premiums. Another consideration is that the coverage may not be as comprehensive as traditional whole life insurance, especially for older individuals, as the policy's duration is limited to 95 years.