Choosing the right life insurance can be a challenging decision, as it's a personal and financial commitment. The type of life insurance you should get depends on your individual needs, such as your age, health, financial goals, and the level of coverage you require. There are two main types of life insurance: term life and permanent life. Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years, and is generally more affordable. On the other hand, permanent life insurance, including whole life and universal life, offers lifelong coverage and includes a savings component, making it a more comprehensive but typically more expensive option. Understanding the differences and benefits of each type can help you make an informed decision to ensure you and your loved ones are protected.

What You'll Learn

- Term Life: Temporary coverage, affordable, and covers specific periods

- Permanent: Long-term, provides lifelong coverage, and has a cash value

- Whole Life: Permanent with fixed premiums and a guaranteed death benefit

- Universal Life: Flexible premiums, adjustable coverage, and investment options

- Variable: Offers investment options, potential for higher returns, and adjustable benefits

Term Life: Temporary coverage, affordable, and covers specific periods

Term life insurance is a straightforward and cost-effective solution for those seeking temporary coverage. It provides a specified amount of financial protection for a defined period, typically ranging from 10 to 30 years. This type of insurance is ideal for individuals who want coverage for a specific goal, such as covering mortgage payments, providing for their children's education, or ensuring financial security during a particular phase of life. The beauty of term life insurance lies in its simplicity and affordability.

When considering term life insurance, you'll notice that the premiums are generally lower compared to other types of life insurance. This is because the coverage is limited to a specific term, and the insurance company doesn't have to account for long-term care or potential longevity risks. As a result, you can secure a substantial death benefit at a relatively low cost, making it an excellent choice for those on a budget. For instance, if you're a young professional with a family and a mortgage, a 20-year term policy could provide peace of mind and financial security for your loved ones during this critical period.

The term duration is a critical aspect of term life insurance. It allows you to tailor the coverage to your specific needs and financial goals. For example, if you're planning to buy a house in the next few years, a 10-year term policy might be sufficient to cover the initial mortgage payments. As your financial situation changes, you can adjust your coverage accordingly by renewing the policy or exploring other insurance options. This flexibility ensures that your insurance remains relevant and aligned with your evolving circumstances.

One of the advantages of term life insurance is its predictability. The premium remains consistent throughout the term, providing a stable financial commitment. This predictability is particularly beneficial for budgeting and financial planning. Additionally, term life insurance is a pure form of coverage, focusing solely on the specified period, which can be advantageous when comparing different insurance products.

In summary, term life insurance offers temporary coverage at an affordable price, making it an excellent choice for individuals seeking financial protection for a specific period. Its simplicity, cost-effectiveness, and flexibility allow you to customize the coverage to your unique needs. Whether you're a young family looking to secure your future or an individual with a short-term financial goal, term life insurance provides a practical solution to ensure your loved ones are protected during the most critical times.

Universal Life Insurance: Definition and Benefits Explained

You may want to see also

Permanent: Long-term, provides lifelong coverage, and has a cash value

When considering life insurance, it's essential to choose a policy that aligns with your long-term financial goals and provides comprehensive coverage. One type of life insurance that stands out for its longevity and value is permanent life insurance. This type of policy offers several advantages that make it a popular choice for those seeking long-term financial security.

Permanent life insurance, as the name suggests, provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which offers coverage for a specified period, permanent insurance remains in force as long as the premiums are paid. This lifelong coverage ensures that your loved ones are protected even in the long run, providing peace of mind and financial security. One of the key benefits of permanent life insurance is its ability to accumulate cash value over time. As you make regular premium payments, a portion of the premium goes towards building a cash reserve. This cash value grows tax-deferred and can be borrowed against or withdrawn, providing financial flexibility. The cash value can be used for various purposes, such as funding education, starting a business, or even providing additional financial support during retirement.

The accumulation of cash value in permanent life insurance policies makes them a valuable asset. It allows policyholders to build a substantial fund that can be utilized for various financial goals. For example, you can take out loans against the cash value to access funds for major purchases or investments without selling the policy. Additionally, the cash value can be used to pay for future premiums, ensuring that the policy remains in force even if you encounter financial challenges. This feature is particularly beneficial for those who want to build a financial safety net and ensure that their insurance coverage persists over the long term.

Another advantage of permanent life insurance is its potential to provide a death benefit, which is typically tax-free. When the insured individual passes away, the death benefit is paid out to the designated beneficiaries, offering a financial cushion during a challenging time. The tax-free nature of the death benefit ensures that the entire amount goes towards supporting your loved ones, providing a significant financial advantage over other forms of insurance.

In summary, permanent life insurance is an excellent choice for those seeking long-term financial security and comprehensive coverage. Its lifelong coverage, accumulation of cash value, and potential for tax-free death benefits make it a powerful tool for managing financial risks and providing for your loved ones' future. By investing in permanent life insurance, you can ensure that your family is protected and that your financial goals are met over the long haul.

Putting Life Insurance in Trust: What You Need to Know

You may want to see also

Whole Life: Permanent with fixed premiums and a guaranteed death benefit

Whole life insurance is a type of permanent life insurance that offers a range of benefits and provides long-term financial security. It is a popular choice for those seeking a comprehensive and reliable insurance solution. Here's an overview of what makes whole life insurance a valuable option:

This insurance policy is designed to provide coverage for your entire life, hence the term "permanent." Unlike term life insurance, which has a specific period of coverage, whole life insurance offers lifelong protection. Once you've purchased the policy, the coverage remains in force as long as you continue to pay the premiums. This feature ensures that your loved ones are protected financially, even in the long term, providing peace of mind.

One of the key advantages of whole life insurance is the predictability of its premiums. The initial premium amount is set at the time of purchase and remains fixed for the life of the policy. This means that you can plan your finances effectively, knowing exactly how much you'll pay each year. The stability of the premiums is particularly beneficial for long-term financial planning, allowing you to budget and save accordingly.

Another significant benefit is the guaranteed death benefit. This means that, upon your passing, the insurance company will pay out a predetermined amount to your designated beneficiaries. The death benefit is typically equal to the total amount paid in premiums over the life of the policy, plus any accumulated cash value (more on that in a moment). This guaranteed payout ensures that your family receives the financial support they need during a difficult time.

In addition to the death benefit, whole life insurance also builds cash value over time. A portion of each premium payment goes towards building a cash reserve, which grows tax-deferred. This cash value can be borrowed against or withdrawn, providing you with a source of funds for various financial needs, such as education expenses or business ventures. The accumulation of cash value is a unique feature that sets whole life insurance apart from other types of policies.

When considering your life insurance options, whole life insurance stands out for its permanence, fixed premiums, and guaranteed death benefit. It provides a reliable safety net for your loved ones and offers the potential for long-term financial growth through its cash value component. By choosing whole life insurance, you can ensure that your family's financial future is protected, and you'll have the peace of mind that comes with knowing you've made a wise investment.

Umbrella Insurance: Does It Cover Your Life?

You may want to see also

Universal Life: Flexible premiums, adjustable coverage, and investment options

Universal life insurance offers a unique and flexible approach to life coverage, providing policyholders with a range of benefits and options to suit their individual needs. One of its key advantages is the ability to customize premiums, allowing individuals to tailor their insurance plan according to their financial situation and goals. Unlike traditional term life insurance, where premiums are set for a specific period, universal life insurance offers a more adaptable structure. This means that policyholders can adjust their premium payments over time, making it easier to manage financial obligations during different stages of life. For instance, during the initial years, when income might be higher, individuals can opt for higher premium payments to build a substantial cash value in the policy. As time passes and financial circumstances change, premiums can be reduced or increased accordingly, ensuring that the insurance remains affordable and relevant.

The flexibility of universal life insurance extends beyond premium payments. Policyholders also have the freedom to adjust the coverage amount, which is another significant advantage. This feature allows individuals to increase or decrease the death benefit based on their evolving needs. For example, if a person starts a new business venture and wants to ensure comprehensive coverage for their growing enterprise, they can increase the coverage amount. Conversely, if they decide to downsize or retire, they can reduce the coverage to match their current financial situation. This adjustability ensures that the insurance policy remains a dynamic financial tool, adapting to life's various changes and uncertainties.

Furthermore, universal life insurance provides an opportunity for policyholders to invest their premiums wisely. The cash value accumulation in this type of policy can be invested in various options, such as stocks, bonds, or mutual funds. This investment aspect allows individuals to potentially grow their money over time, providing a financial safety net and a means to achieve long-term financial goals. The investment options available in universal life insurance can be tailored to an individual's risk tolerance and financial objectives, offering a personalized approach to wealth management.

In summary, universal life insurance stands out for its flexibility, allowing policyholders to customize premiums, adjust coverage, and make informed investment choices. This type of insurance provides a comprehensive solution for individuals seeking a tailored and adaptable approach to life insurance, ensuring that their financial needs are met as their life circumstances evolve. By offering both insurance protection and investment opportunities, universal life insurance empowers individuals to take control of their financial future with confidence.

Juvenile Life Insurance: Payouts for Minors?

You may want to see also

Variable: Offers investment options, potential for higher returns, and adjustable benefits

When considering your life insurance options, it's important to understand the different types available and how they can meet your specific needs. One type that offers a unique blend of financial security and investment potential is variable life insurance. This type of policy provides a safety net for your loved ones while also allowing you to potentially grow your money through investment options.

Variable life insurance is a flexible and customizable policy. It combines the core function of providing a death benefit with an investment component. The investment aspect is what sets it apart from traditional life insurance. With variable life insurance, a portion of your premium is allocated to an investment account, where it can be invested in various financial instruments such as stocks, bonds, and mutual funds. This investment strategy offers the potential for higher returns compared to more conservative investment options.

One of the key advantages of this type of insurance is the ability to adjust your policy's benefits over time. Life insurance needs can change as you age, get married, have children, or experience other life events. Variable life insurance policies often allow policyholders to increase or decrease the death benefit, ensuring that the coverage remains appropriate for your evolving circumstances. This adjustability is particularly beneficial for those who want to ensure their loved ones are adequately protected without the need for frequent policy reviews.

The investment options within variable life insurance policies provide an opportunity to potentially grow your money. The investment account can be managed by the insurance company or, in some cases, by an external investment manager. This allows you to benefit from professional management while still having control over your investment choices. As the value of your investments grows, so does the cash value of your policy, which can be borrowed against or used to pay premiums, providing a source of financial flexibility.

However, it's essential to approach variable life insurance with a long-term perspective. The potential for higher returns comes with increased risk. Market fluctuations can impact the value of your investments, and there is no guarantee of positive returns. It's crucial to carefully review the investment options and associated risks before making any decisions. Additionally, consider seeking advice from a financial advisor to ensure that the policy aligns with your overall financial goals and risk tolerance.

Family History: Life Insurance Impact

You may want to see also

Frequently asked questions

The type of life insurance you should consider depends on your individual needs and financial goals. It's important to evaluate your current and future financial obligations, such as mortgage payments, children's education costs, or any other long-term commitments. Term life insurance, which provides coverage for a specified period, is often a popular choice for those seeking affordable coverage for a defined term, such as 10, 20, or 30 years. Permanent life insurance, on the other hand, offers lifelong coverage and includes a savings component, making it suitable for those who want long-term financial security and the potential for cash value accumulation.

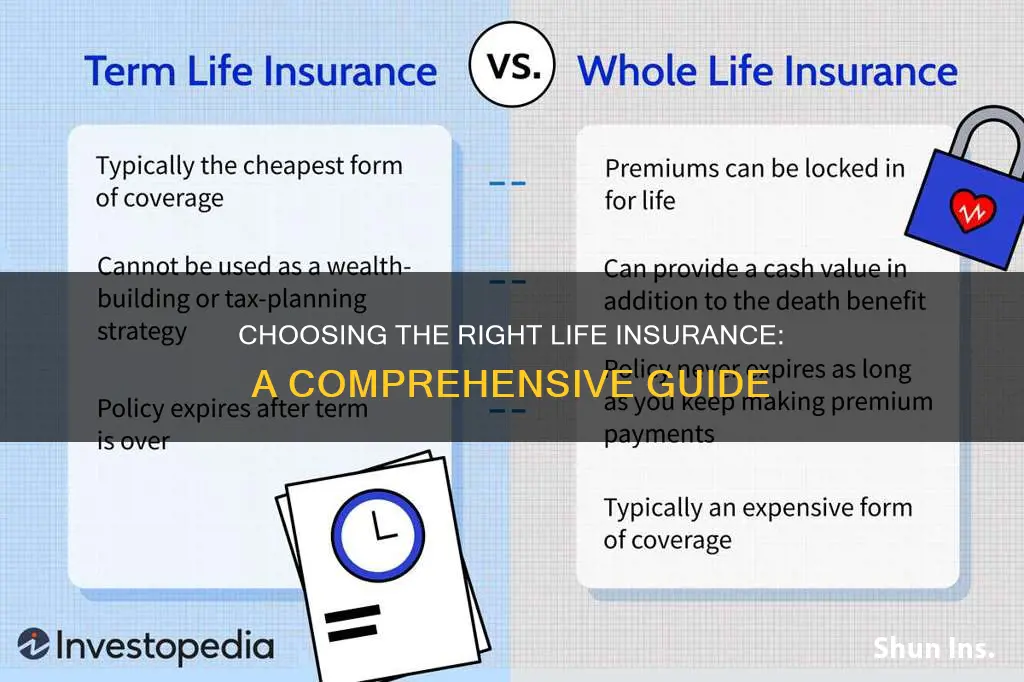

Term life insurance is generally more affordable and provides pure coverage for a specific period, making it ideal for covering temporary financial responsibilities. It's a good option if you have a limited budget or want to ensure your family is protected during a particular phase of life. Permanent life insurance, with its lifelong coverage and savings features, is more expensive but offers flexibility and the potential for cash value growth. This type of policy can be suitable for those seeking long-term financial planning and the ability to build a cash reserve that can be borrowed against or withdrawn.

Whole life insurance provides guaranteed level premiums and lifelong coverage, making it a stable and predictable option. It also offers a fixed death benefit and a cash value component that grows tax-deferred. Universal life insurance, on the other hand, offers flexibility in premium payments and death benefit amounts. It provides more control over premium payments and can accumulate cash value, but the death benefit and premiums can vary over time. Consider your risk tolerance, financial situation, and long-term goals when deciding between the two, as whole life may be more suitable for those seeking long-term stability, while universal life offers more flexibility.

Yes, it is possible to obtain life insurance even with pre-existing health conditions, but the process and terms may vary. Insurers often consider factors like the severity and management of your health issues when determining eligibility and premium rates. Some companies offer standard rates for certain conditions, while others may require a medical exam or offer coverage with a higher premium or specific exclusions. It's advisable to shop around and compare quotes from multiple insurers to find the best options for your situation. Additionally, improving your health and maintaining a healthy lifestyle can positively impact your insurance rates and eligibility.