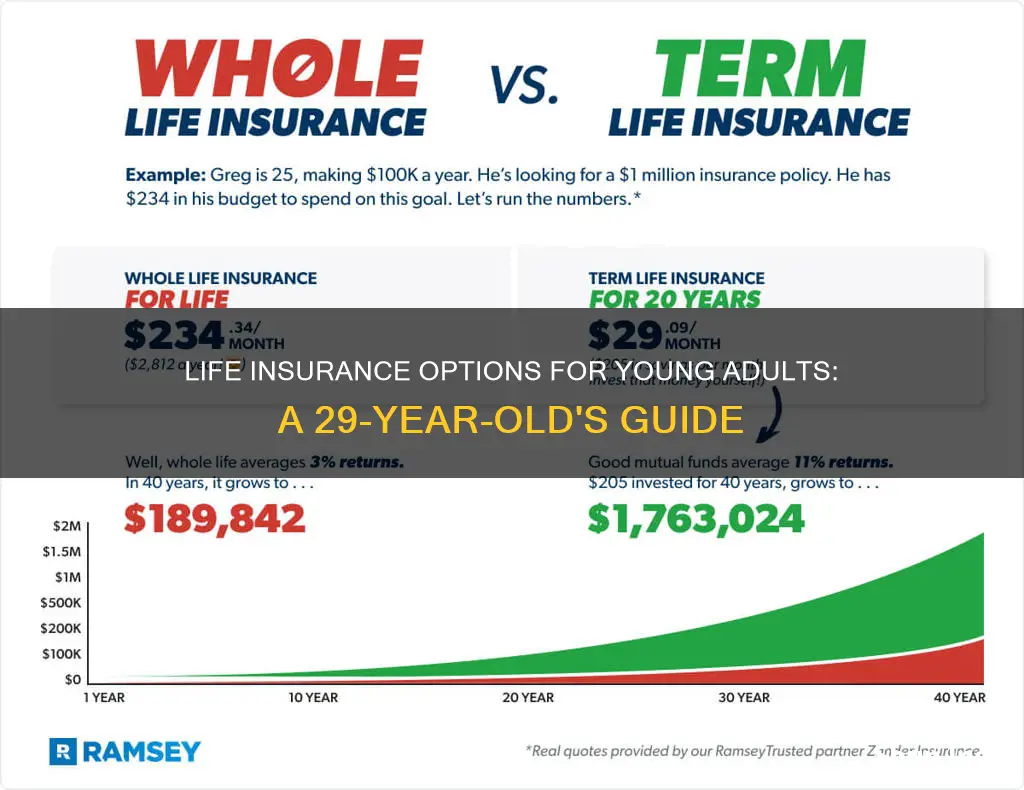

For a 29-year-old, choosing the right life insurance is crucial for financial security. Term life insurance is often recommended as it provides coverage for a specific period, typically 10, 20, or 30 years, at a lower cost compared to permanent life insurance. This type of policy offers a death benefit if the insured passes away during the term, ensuring financial protection for loved ones. Additionally, term life insurance can be converted to permanent coverage if needed, allowing for long-term financial planning. It's essential to consider individual needs, such as family responsibilities and financial goals, when selecting a policy to ensure adequate coverage and peace of mind.

What You'll Learn

- Term Life: Affordable coverage for a set period, ideal for young adults

- Whole Life: Permanent policy with cash value, offering lifelong protection

- Universal Life: Flexible premium, adjustable death benefit, suitable for long-term needs

- Critical Illness: Covers major health issues, providing financial support when needed

- Disability Insurance: Protects income if you become unable to work due to illness or injury

Term Life: Affordable coverage for a set period, ideal for young adults

For a 29-year-old, term life insurance is often the most suitable and cost-effective option. This type of policy provides a specific period of coverage, typically 10, 15, 20, or 30 years, and is ideal for young adults who want to protect their loved ones during this time. The beauty of term life insurance is its simplicity and affordability. It offers a straightforward solution to ensure financial security for your family without the complexity and higher costs associated with permanent life insurance.

As a young adult, you might be focused on building your career, saving for a home, or starting a family. During this phase of life, your financial obligations and long-term goals are often well-defined, and term life insurance can provide the necessary coverage at a price that fits your budget. The premiums for term life insurance are generally lower compared to other types of policies because the risk of death is lower for younger individuals. This makes it an excellent choice for those who want to maximize their coverage without breaking the bank.

When considering term life insurance, you'll choose a specific term length that aligns with your needs. For instance, if you're planning to take out a mortgage or have children who will rely on your financial support for their education, a 20-year term policy could be perfect. This way, your coverage will last until your mortgage is paid off or your children become financially independent. The peace of mind that comes with knowing your family is protected during these critical years is invaluable.

One of the advantages of term life insurance is its flexibility. You can adjust your coverage as your life circumstances change. For example, if you get married and start a family, you might want to increase your coverage to ensure your loved ones are adequately protected. Similarly, if you pay off your mortgage early or your children become financially self-sufficient, you can consider converting your term policy into a permanent one or simply canceling it to avoid unnecessary costs.

In summary, term life insurance is an excellent choice for 29-year-olds who want affordable and tailored coverage. It provides a safety net for your family during the years when your financial responsibilities are most significant. With its straightforward nature and flexibility, term life insurance allows you to focus on your goals and dreams while ensuring your loved ones are protected. Remember, it's a wise investment in your future and the future of your loved ones.

How to Get Life Insurance on Someone Else

You may want to see also

Whole Life: Permanent policy with cash value, offering lifelong protection

When considering life insurance at age 29, a whole life policy is an excellent choice for those seeking long-term financial security and coverage. This type of insurance is a permanent, lifelong commitment, providing a sense of stability and peace of mind. Here's a breakdown of why it's a suitable option for young adults:

Whole life insurance is a comprehensive and permanent policy, meaning it offers coverage for the entire life of the insured individual. This is in contrast to term life insurance, which provides coverage for a specified period, typically 10, 20, or 30 years. By choosing whole life, you ensure that your loved ones are protected financially for the long haul. The policy guarantees a death benefit, which is a fixed amount paid to the policy's beneficiaries upon the insured's passing. This benefit is often tax-free, providing a significant financial cushion during challenging times.

One of the key advantages of whole life insurance is its accumulation of cash value. As you make regular premium payments, a portion of each payment goes towards building a cash reserve. This cash value grows over time, allowing you to borrow against it or withdraw funds if needed. The cash value can be a valuable asset, providing financial flexibility and the potential for tax-advantaged growth. For instance, you can use the cash value to secure a loan, providing immediate access to funds without selling the policy.

The lifelong protection aspect of whole life insurance is particularly beneficial for young adults. As you age, the likelihood of developing health issues increases, and premiums for other types of insurance may become more expensive. With whole life, your premium remains consistent, providing uninterrupted coverage. This consistency ensures that your loved ones are protected even if your health status changes over time. Moreover, the policy's permanent nature means you won't have to worry about re-evaluating your coverage or finding new insurance as your life circumstances evolve.

In summary, whole life insurance with its permanent policy structure and cash value accumulation is an ideal choice for 29-year-olds seeking long-term financial protection. It offers guaranteed lifelong coverage, a death benefit, and the potential for tax-advantaged growth. By investing in this type of policy, you can provide financial security for your future and the well-being of your loved ones. It is a wise decision that ensures peace of mind and stability for years to come.

Life Insurance: Covering Husbands, Wives, and Their Families

You may want to see also

Universal Life: Flexible premium, adjustable death benefit, suitable for long-term needs

Universal life insurance is a versatile and flexible type of life insurance that can be an excellent choice for a 29-year-old individual looking for long-term financial protection. This policy offers a range of unique features that make it adaptable to various life stages and changing needs. One of its key advantages is the flexibility in premium payments. Unlike traditional term life insurance, where you pay a fixed premium for a specified period, universal life allows you to adjust your payments over time. This means you can start with lower premiums in your 20s and increase them as your financial situation improves or when you have more dependents. This flexibility ensures that you can tailor the policy to your budget and evolving circumstances.

The death benefit, which is the amount paid out upon your passing, is another aspect where universal life shines. It is adjustable, allowing you to increase or decrease the death benefit as needed. This feature is particularly useful for those who want to ensure their loved ones are financially secure for an extended period. For instance, you might start with a lower death benefit in your 20s and gradually increase it as you build a career and accumulate assets. This way, you can provide comprehensive coverage without overpaying for insurance that might not be necessary in the early years of your life.

Furthermore, universal life policies often include an investment component. A portion of your premium payments is allocated to an investment account, which can grow over time, earning interest and dividends. This investment aspect allows your money to work harder and potentially accumulate a substantial cash value. As the policyholder, you have the freedom to allocate more or less of your premium to the investment portion, depending on your financial goals and risk tolerance. This feature can be especially beneficial for long-term financial planning, providing you with a tool to build wealth alongside protecting your loved ones.

In summary, universal life insurance is a powerful financial tool for a 29-year-old. Its flexibility in premium payments and adjustable death benefit make it adaptable to your changing life circumstances. Additionally, the investment component offers the potential for long-term growth, allowing you to build a financial safety net and achieve your goals. When considering life insurance, exploring options like universal life can provide the necessary coverage and financial security for the future.

VGLI Whole Life Insurance: Is It Worth the Cost?

You may want to see also

Critical Illness: Covers major health issues, providing financial support when needed

When considering life insurance at 29, critical illness coverage is an essential aspect to explore. This type of insurance provides financial protection against some of the most significant health challenges an individual might face. At 29, you are at a stage in life where building a solid financial foundation is crucial, and critical illness insurance can be a valuable tool in this process.

Critical illness insurance is designed to pay out a lump sum if you are diagnosed with a specified list of critical illnesses. These illnesses are typically severe and can have a profound impact on your ability to work and earn an income. The coverage ensures that you or your beneficiaries receive financial support when you need it most. For a 29-year-old, this can be particularly beneficial as it provides a safety net for your future plans and financial goals.

The key advantage of critical illness insurance is its ability to cover the potential long-term financial implications of major health issues. For instance, if you were diagnosed with a critical illness like cancer, multiple sclerosis, or heart attack, the financial burden of treatment, medication, and potential lifestyle changes could be immense. Critical illness insurance would provide a tax-free payout, allowing you to focus on recovery and long-term care without the added stress of financial worries.

When choosing a critical illness policy, it's important to review the list of covered illnesses and ensure it aligns with the potential risks. Different providers may offer various critical illnesses, and some may include less common conditions. It's also worth considering the policy's waiting period, which is the time after diagnosis before the payout is received. A shorter waiting period can provide quicker financial relief, but it may also affect the overall cost of the policy.

Additionally, you should evaluate the policy's payout structure. Some policies offer a single lump sum, while others provide regular payments over an extended period. The choice depends on your personal circumstances and financial goals. For instance, if you have a mortgage or dependants, a regular income stream from the policy could be more beneficial. Critical illness insurance is a powerful tool to safeguard your financial future and provide peace of mind as you navigate life's challenges.

Ameritas Life Insurance: What You Need to Know

You may want to see also

Disability Insurance: Protects income if you become unable to work due to illness or injury

When considering life insurance at 29, it's important to think about the various types of coverage available to ensure you're adequately protected. One often overlooked but crucial aspect is disability insurance, which provides a safety net in the event that you become unable to work due to illness or injury. This type of insurance is designed to replace a portion of your income if you're unable to perform your job duties, offering financial security during a challenging time.

Disability insurance typically kicks in when you're unable to work for an extended period, often defined as a specific number of days (e.g., 90 days). It's not just for physical injuries; it also covers mental health conditions and chronic illnesses that prevent you from working. The insurance company will assess your claim based on the terms of your policy, which may include a waiting period before benefits start and a maximum benefit period.

The beauty of disability insurance is that it allows you to maintain a steady income stream when you're least able to afford financial instability. It's a form of protection that ensures your long-term financial goals remain on track, even when life takes an unexpected turn. For a 29-year-old, this can be particularly valuable, as it provides peace of mind and financial security during a time when your earning potential is at its peak.

When choosing a disability insurance policy, consider the following: the percentage of your income that will be replaced, the duration of the benefit period, and any exclusions or limitations. It's also worth exploring whether your employer offers group disability insurance, as this can often be more affordable than purchasing a personal policy. Additionally, review the policy's definition of disability to understand what conditions are covered and how they are determined.

In summary, disability insurance is a vital component of a comprehensive financial plan for a 29-year-old. It ensures that your income is protected if you're unable to work, allowing you to focus on your health and recovery without the added stress of financial uncertainty. By understanding the options available and carefully selecting a policy, you can make an informed decision that provides valuable long-term benefits.

Understanding Government Life Insurance: A Comprehensive Guide

You may want to see also

Frequently asked questions

For a 29-year-old, term life insurance is often the most suitable choice. This type of policy provides coverage for a specific period, typically 10, 20, or 30 years, and offers a straightforward and cost-effective way to secure financial protection for your loved ones. It's a good option if you want coverage for a particular period, such as until your children are financially independent or a mortgage is paid off.

The amount of life insurance needed depends on various factors, including your income, family responsibilities, debts, and future financial goals. A 29-year-old might consider starting with a policy that covers 10 times their annual income. For example, if your annual income is $50,000, you could opt for a $500,000 term life insurance policy. This coverage amount can provide financial security for your family in the event of your untimely passing, ensuring they have the means to cover essential expenses and maintain their standard of living.

While term life insurance is generally affordable and offers excellent value for money, it may not be the most comprehensive solution for long-term financial planning. Term policies do not accumulate cash value, meaning the money paid in premiums doesn't grow over time. If you're looking for a policy that can grow and provide a financial benefit beyond the term period, you might consider permanent life insurance, such as whole life or universal life insurance, which offers lifelong coverage and an investment component.