Life insurance is often taken out to protect one's family and ensure their financial stability in the event of the policyholder's death. One of the biggest financial commitments that life insurance can help with is the repayment of a mortgage. This is where mortgage protection insurance comes in. It is a type of life insurance that is designed to pay off the remaining mortgage debt if the policyholder dies during the policy term. This type of insurance is often sold by banks and mortgage lenders, and the death benefit goes directly to the lender, not the policyholder's family. This article will explore the pros and cons of mortgage protection insurance and whether it is the right choice for you.

| Characteristics | Values |

|---|---|

| Purpose | To ensure your home is paid off if you die with an outstanding balance on the loan |

| Beneficiary | The lender, who will be paid the remaining balance of your mortgage |

| Payout | Decreases as you pay down your mortgage |

| Premiums | Remain the same throughout the policy term |

| Accessibility | No medical exam required; may not ask health questions |

| Add-ons | Riders are available to customize your policy |

What You'll Learn

Life insurance policies can be customised to fit your needs

For example, life insurance policies can be customised to cover mortgage payments. This is called mortgage protection insurance (MPI), and it is designed to pay off the policyholder's mortgage if they pass away during the policy term. This helps beneficiaries eliminate significant debt and secure a home for their family. MPI policies generally don't require a medical exam, which can make this policy more accessible to homeowners. However, MPI policies have limited advantages and serious drawbacks compared to other types of coverage, such as term life insurance. Term life insurance typically provides more flexibility, as it allows you to choose your coverage amount and policy length, and the payout can be used for any purpose.

Life insurance policies can also be customised to fit your needs in other ways. For instance, you can add riders, which are add-on coverages, to a mortgage life insurance policy. Life insurance policies can also be tailored to cover what is necessary, such as high-value or unique assets that may not be covered by standard policies. This targeted approach can result in significant savings while maintaining optimal protection levels.

Additionally, life insurance policies can be customised to fit your financial goals and the needs of your beneficiaries. For example, if you are looking for affordability and only need coverage for a specific period, term life insurance may be the best option. On the other hand, if you want lifetime coverage and to build cash value, whole or universal life insurance could be more suitable. Life insurance policies can also be adjusted to reflect major life changes, such as marriage, divorce, or the birth of a child.

Term Life Insurance: Multiple Payments or One-Time Premium?

You may want to see also

Mortgage protection insurance is distinct from private mortgage insurance

Mortgage protection insurance, also known as MPI, is a type of credit life insurance. It is a voluntary form of insurance that covers your mortgage payments for a specific period if you lose your job or become disabled. It can also pay off the remaining mortgage when you die. MPI is designed to protect the borrower, not the lender, and the payout goes directly to the lender. The cost of MPI depends on factors such as age, health, lifestyle, location, and occupation, with premiums ranging from $20 to $100 per month or more.

Private mortgage insurance, or PMI, on the other hand, is a type of insurance that lenders may require borrowers to purchase if their down payment is less than 20%. It is designed to protect the lender, not the homeowner, in the event of the borrower's default or foreclosure. Unlike MPI, PMI does not cover mortgage payments in cases of job loss, disability, or death. The cost of PMI is included in the monthly mortgage payment, and it can be cancelled once the loan-to-value ratio reaches 80% or 78%.

While both types of insurance are important, they serve different purposes. MPI provides financial protection for the borrower, ensuring that their mortgage payments are covered during difficult times or that their mortgage is paid off upon their death. On the other hand, PMI safeguards the lender's interests by reducing their risk of loss if the borrower defaults on their loan.

It is worth noting that term life insurance policies can also be used to cover mortgage payments in the event of the policyholder's death. These policies offer more flexibility than MPI as they allow beneficiaries to use the payout for any purpose, including but not limited to paying off the mortgage. Additionally, term life insurance policies can be tailored to an individual's specific needs and financial situation.

Calculating Life Insurance Age Reductions: A Step-by-Step Guide

You may want to see also

Mortgage life insurance is more expensive for the level of coverage

Mortgage life insurance is a policy that pays off your mortgage debt if you die. While it ensures that your family won't lose the house, it's not always the best option for life insurance due to its high cost and limited coverage.

Mortgage life insurance is often more expensive than traditional life insurance policies for the level of coverage provided. This is because mortgage life insurance premiums are not underwritten, meaning they don't consider individual risk factors such as age, health, or medical history. As a result, even healthy individuals may end up overpaying for their insurance compared to other options.

The lack of underwriting also means that mortgage life insurance may be more accessible to those with poor health or medical history, as these factors are not considered in the pricing. However, this can result in higher premiums for everyone, regardless of their health status. Additionally, mortgage life insurance policies generally don't require a medical exam, which further contributes to their higher cost.

Another factor contributing to the high cost of mortgage life insurance is the limited flexibility of the policy. The beneficiary of a mortgage life insurance policy is typically the mortgage lender, not the policyholder's loved ones. This means that the death benefit goes directly to the lender to pay off the remaining mortgage balance, and the family doesn't receive any funds to use at their discretion. In contrast, traditional life insurance policies give beneficiaries a tax-free payout that they can use for any purpose, including paying off the mortgage, covering daily expenses, or saving for future needs.

Furthermore, mortgage life insurance policies typically have high premiums and lack transparency in their pricing. It can be challenging to obtain quotes for mortgage life insurance online, making it difficult to compare policies and prices without direct contact with the insurer. The high cost and limited coverage of mortgage life insurance policies lead many to recommend traditional term life insurance policies, which offer more flexibility and better value.

Whole Life Insurance: Taxable Distributions and Their Implications

You may want to see also

Term life insurance is often a better option

Life insurance is often taken out to cover the cost of a mortgage in the event of the policyholder's death. This is to ensure that the policyholder's loved ones can continue to live in the family home.

Mortgage protection insurance, or MPI, is a type of credit life insurance that pays the lender directly. It is not always a requirement and is distinct from private mortgage insurance, which may be required if the down payment is less than 20%.

While mortgage protection insurance can be a good option for those who have been denied term life insurance for medical reasons, term life insurance is often a more affordable option with more benefits.

In addition, term life insurance can be used to cover short-term protection when the mortgage amount is highest and long-term protection to cover the entire duration of the mortgage. This combination approach can work within a budget and provide flexibility.

Term Life Insurance: Temporary Cover for Permanent Peace of Mind?

You may want to see also

Mortgage life insurance doesn't require a medical exam

Mortgage life insurance, also known as mortgage protection insurance (MPI), is a type of insurance that pays off the remaining balance on your mortgage when you die. This ensures that your family can keep your shared home.

Mortgage life insurance is often sold through banks and mortgage lenders instead of life insurance companies. This is because the beneficiary of the policy is the lender, not your family. The lender will receive the payout directly, and your family won't be able to choose how the money is used.

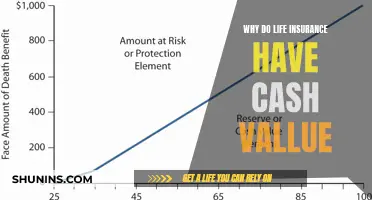

Mortgage life insurance policies generally don't require a medical exam, and in some cases, may not even ask health questions. This can make the policy more accessible to those who don't want to take a medical exam or want coverage more quickly. However, because of this, you are likely to pay more for your coverage than you would for traditional term life insurance, especially if you are in good health. Additionally, your cost per dollar of coverage increases over time since premiums are level while the death benefit decreases.

If you're looking for a policy that covers more than just your mortgage, there are other life insurance options available, such as term or whole life insurance. These policies can be used to pay off your mortgage and cover other financial responsibilities.

Life Insurance Options for People with Tic Disorders

You may want to see also

Frequently asked questions

Mortgage protection insurance, or MPI, is a type of credit life insurance that pays off the remaining balance of your mortgage when you die. The beneficiary of the policy is the lender, not your family, and the death benefit is usually reduced each year to correspond with the new amortized mortgage balance outstanding.

Mortgage protection insurance is designed to be easy to manage. It is often sold through banks and mortgage lenders, and policies are typically guaranteed, so you don't need to take a medical exam to qualify for coverage. The death benefit goes straight to the lender, and your beneficiaries must file a claim but don't have to manage the funds once paid out.

With a life insurance policy, your amount of cover will stay the same regardless of when a valid claim is made during the policy term. In contrast, the potential payout from mortgage protection insurance to cover a repayment mortgage reduces over time. Life insurance also offers more flexibility, as the payout can be used for any purpose, whereas MPI pays the lender.

Mortgage protection insurance is a simple and appealing idea, as it ensures your home is paid off if you die with an outstanding balance on the loan. It can also be a good option for those with serious pre-existing medical conditions who would otherwise be unable to buy traditional life insurance.

Mortgage protection insurance can be expensive for the level of coverage you receive, and the payout decreases over time. It also lacks flexibility, as your family won't have the freedom to spend the money as they like. In some cases, a term life insurance policy can be a cheaper and more flexible option.