Life insurance is a crucial financial tool that provides financial security for your loved ones in the event of your untimely demise. However, if you smoke, it can significantly impact your life insurance options and rates. Smokers often face higher premiums due to the increased risk of health issues associated with smoking. This article will explore the various life insurance options available to smokers, including term life, whole life, and universal life policies, and discuss how smoking can affect your eligibility and coverage. Understanding these factors can help you make informed decisions about your life insurance needs and find the best policy to suit your circumstances.

What You'll Learn

- Smoking and Term Life: Higher rates for term life insurance due to health risks

- Smoker's Discounts: Some insurers offer discounts despite smoking history

- Quitting Smoking: Improved rates post-quit, but benefits take time

- Health Impact: Smoking affects life insurance eligibility and premiums

- Alternative Policies: Consider whole life or universal life for smokers

Smoking and Term Life: Higher rates for term life insurance due to health risks

Smoking significantly impacts one's health and, consequently, their life insurance rates. Term life insurance, a popular and affordable option, is no exception. When you smoke, your body is exposed to harmful chemicals that can lead to various health issues, including heart disease, lung cancer, and respiratory problems. These health risks make insurers view smokers as higher-risk candidates for life insurance. As a result, smokers often face higher premiums for term life insurance compared to non-smokers.

The primary reason for this disparity is the increased likelihood of developing health complications that can lead to premature death. Insurers consider the potential for shorter life expectancy and the higher risk of severe illnesses associated with smoking. For instance, smoking can accelerate the narrowing of arteries, leading to heart attacks and strokes, which are leading causes of death among smokers. This increased risk is reflected in the higher rates charged to smokers.

The impact of smoking on life insurance rates can be substantial. Smokers may find themselves paying significantly more for the same coverage compared to non-smokers. The exact amount can vary depending on factors such as the insurer, the policy type, the coverage amount, and the individual's smoking habits. Generally, the more you smoke, the higher the premium, as insurers assess the risk based on the volume of cigarettes smoked daily.

It's important to note that the negative health effects of smoking are not limited to the smoker alone. Secondhand smoke can also pose risks to non-smokers, especially children and those with respiratory conditions. This is another factor that insurers consider when determining rates, as it highlights the broader impact of smoking on society.

To mitigate the higher rates, smokers can take steps to improve their health and potentially lower their insurance premiums. Quitting smoking is the most effective way to reduce the risk of developing smoking-related diseases and can lead to significant savings on life insurance. Additionally, maintaining a healthy lifestyle, including regular exercise and a balanced diet, can also positively impact insurance rates.

Understanding Twitter's #LifeInsuranceNY Tag: A Comprehensive Guide

You may want to see also

Smoker's Discounts: Some insurers offer discounts despite smoking history

When it comes to life insurance, smokers often face higher premiums due to the increased health risks associated with smoking. However, some insurance companies recognize that not all smokers are the same and offer discounts to those who have quit smoking or have a history of smoking but have been smoke-free for a certain period. This approach can be beneficial for individuals who have successfully reduced their smoking habits or have quit altogether.

Smoking cessation is a significant factor in determining eligibility for these discounts. Insurers often require proof of smoking cessation, which can be provided through various means. One common method is a nicotine patch test, where a small patch is worn to monitor nicotine levels in the body. Another approach is to request a medical professional's statement confirming the individual's smoking history and their status as a non-smoker. Some insurers may also accept self-reported data, but it's essential to provide accurate and honest information.

The duration of smoke-free status also plays a crucial role. Insurers typically require a certain number of months or years of being smoke-free before offering discounts. For instance, they might offer reduced rates after a year of not smoking or even lower premiums if the individual has been smoke-free for several years. It's important to note that the specific requirements can vary between insurance providers.

Additionally, the type of life insurance policy can influence the availability of discounts. Term life insurance, which provides coverage for a specified period, often has more flexible criteria for smokers. In contrast, whole life insurance, which offers lifelong coverage, may have stricter requirements. It's advisable to compare different policies and insurers to find the best options for smokers seeking affordable life insurance.

Obtaining life insurance with a smoking history can be challenging, but it is not impossible. By providing proof of smoking cessation and meeting the insurer's criteria, smokers can access more affordable life insurance options. It is recommended to consult with insurance agents or brokers who specialize in working with smokers to find the most suitable policies and potentially secure discounts.

Primerica Whole Life Insurance: Is It Worth the Investment?

You may want to see also

Quitting Smoking: Improved rates post-quit, but benefits take time

Quitting smoking is a significant step towards a healthier and more secure future, and it can have a profound impact on your life insurance rates and coverage. While it may take time for the full benefits to become apparent, the improvements in your health post-quit can lead to better insurance rates and increased coverage options. Here's a detailed look at what you can expect:

Improved Health and Insurance Rates: When you quit smoking, your body begins to heal and recover. Within a few weeks to a few months, you'll start noticing positive changes. Your lung function improves, and your risk of respiratory issues decreases. This improved health status translates into better life insurance rates. Insurance companies often view non-smokers as lower-risk individuals, leading to more competitive premiums. You may find that your insurance rates decrease over time, sometimes significantly, as your body continues to recover from the effects of smoking.

Time-Dependent Benefits: While the initial improvements in health are noticeable, it's important to understand that the full range of benefits may take longer to materialize. Here's why: Firstly, the damage caused by smoking can accumulate over years, and reversing this damage takes time. For example, if you've had a history of smoking, it might take a few years for your risk of heart disease to return to that of a non-smoker. Secondly, insurance companies often consider your smoking history and recent smoking habits. They may require a certain period (e.g., one to two years) of being smoke-free to fully assess your risk and adjust your rates accordingly.

Increased Coverage Options: As your health improves post-quit, you may find that insurance providers offer you more favorable coverage options. This could include higher coverage amounts, extended policy terms, or access to specialized plans tailored for non-smokers. For instance, you might be eligible for term life insurance with longer coverage periods or whole life insurance with a higher cash value accumulation. The improved rates and coverage options can provide you with greater financial security and peace of mind.

Long-Term Health Benefits: Quitting smoking is not just about immediate health improvements; it's a long-term commitment to a healthier lifestyle. Over time, you'll reduce your risk of various smoking-related diseases, including lung cancer, heart disease, and stroke. This reduced risk can lead to better overall health and potentially lower healthcare costs. As a result, insurance companies may view you as a more stable and lower-risk policyholder, further enhancing your insurance benefits and rates.

In summary, quitting smoking is a rewarding journey that can lead to improved life insurance rates and coverage. While the initial health benefits are significant, it's essential to be patient and allow your body time to heal fully. As you progress in your smoke-free journey, you'll notice a positive impact on your insurance rates and coverage options, providing you with a more secure financial future. Remember, the long-term benefits of quitting smoking are well worth the effort and commitment.

Life Insurance for Young Adults: What You Need to Know

You may want to see also

Health Impact: Smoking affects life insurance eligibility and premiums

Smoking is a significant health risk factor that can have a profound impact on an individual's life insurance eligibility and premium costs. When it comes to life insurance, insurers often consider the health habits and lifestyle choices of applicants to assess their risk profile. For smokers, the implications can be particularly challenging.

The health effects of smoking are well-documented and include an increased risk of various life-threatening conditions. Smokers are more susceptible to respiratory issues such as chronic obstructive pulmonary disease (COPD) and lung cancer. Additionally, smoking contributes to cardiovascular problems, including an elevated risk of heart attacks, strokes, and peripheral artery disease. These health concerns directly influence life insurance assessments. Insurers may view smokers as high-risk candidates due to the potential for early and frequent claims, which can impact their underwriting decisions.

In terms of eligibility, smokers might find it more challenging to secure comprehensive life insurance coverage. Standard life insurance policies often have higher premiums for smokers due to the increased likelihood of health-related claims. Some insurers may even deny coverage or offer limited options to smokers, especially those with severe smoking habits or a history of smoking-related illnesses. It is crucial for smokers to be aware of these potential challenges and consider making lifestyle changes to improve their health and potentially qualify for more favorable insurance terms.

Quitting smoking can significantly improve an individual's life insurance prospects. By reducing or eliminating this harmful habit, smokers can lower their risk profile and potentially qualify for lower premiums or even better coverage options. Insurers often provide incentives for policyholders who take steps towards a healthier lifestyle, such as reduced rates or additional benefits.

Furthermore, the impact of smoking on life insurance extends beyond individual policies. Group life insurance plans offered by employers may also be affected. Employers often consider the overall health and lifestyle of their workforce when selecting insurance providers. A higher prevalence of smoking among employees could result in higher insurance premiums for the employer, which may, in turn, be passed on to the employees.

In summary, smoking has a direct and significant impact on life insurance eligibility and costs. Smokers may face challenges in obtaining comprehensive coverage and could be subject to higher premiums. However, quitting smoking can lead to improved health and more favorable insurance terms. Understanding these health impacts is essential for individuals to make informed decisions about their life insurance needs and take steps towards a healthier lifestyle.

Life Insurance Options for Emphysema Patients

You may want to see also

Alternative Policies: Consider whole life or universal life for smokers

If you're a smoker looking for life insurance, you might find that traditional term life insurance policies can be more challenging to obtain or may come with higher premiums. However, there are alternative policies that can provide coverage tailored to your needs. Two such options to consider are whole life and universal life insurance.

Whole life insurance is a permanent policy that offers lifelong coverage. It provides a guaranteed death benefit and a fixed premium that remains the same for the entire term of the policy. This type of insurance is particularly attractive to smokers because it offers a level of stability and predictability. With whole life, you can build cash value over time, which can be borrowed against or withdrawn if needed. This feature can be especially valuable for long-term financial planning.

Universal life insurance is another permanent policy that provides flexible coverage. It allows you to adjust your premium payments and death benefit over time. This flexibility is advantageous for smokers as it enables you to adapt the policy to changing financial circumstances. Universal life policies also accumulate cash value, which can be used to pay premiums or taken out as a loan. This feature provides a level of financial security and control that might be appealing to those with smoking-related health concerns.

When considering these alternative policies, it's essential to understand that smoking can impact your health and, consequently, your insurance rates. Insurance providers often consider smoking habits and health status when determining premiums. However, by opting for whole life or universal life insurance, you can still secure coverage despite your smoking history. These policies may require a medical examination and a review of your health records, but they offer a more comprehensive and long-term solution compared to temporary term life insurance.

It's recommended to consult with an insurance advisor who specializes in working with smokers. They can guide you through the process, help you understand your options, and provide tailored advice based on your specific circumstances. Additionally, comparing quotes from different insurance companies will ensure you find the best rates and coverage for your needs. Remember, while smoking may affect your insurance options, there are still ways to secure the financial protection you and your loved ones deserve.

Universal Life Insurance: Lapses and How to Avoid Them

You may want to see also

Frequently asked questions

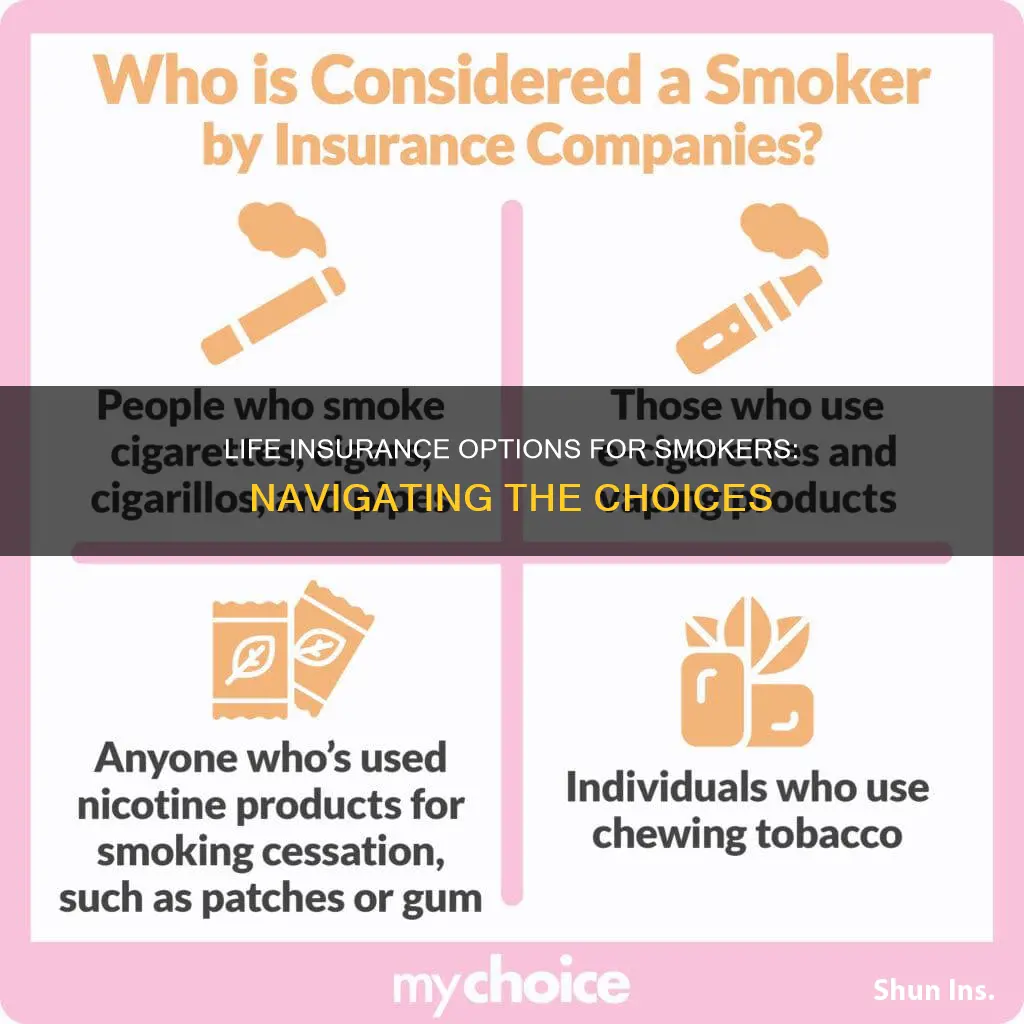

Yes, smokers can obtain life insurance, but it's important to note that smoking can significantly impact the type and cost of coverage. Insurers often categorize smokers into different risk groups, which can affect the premiums and terms of the policy. Non-smokers typically fall into a lower-risk category, while smokers may be considered higher-risk, leading to higher premiums.

Smoking can influence the underwriting process, where insurers assess the risk of insuring an individual. Smokers may be asked to provide additional medical information, undergo a more extensive medical examination, or even be declined coverage. The insurer will consider factors like the number of cigarettes smoked daily, the duration of the smoking habit, and any previous or current health issues related to smoking.

Some insurance companies offer reduced rates for smokers who quit or have been smoke-free for a certain period. This is often referred to as a "smoker's quit" or "non-smoker's discount." Additionally, certain policies may provide coverage for smokers, but with higher premiums and more limited benefits. It's advisable for smokers to disclose their smoking status to the insurer and explore options that cater to their specific needs and health status.