Life insurance is a financial tool that provides coverage and benefits to beneficiaries upon the insured's death. However, the taxation of life insurance proceeds can vary depending on the type of policy and the circumstances of the insured's death. Understanding the tax implications of different life insurance mechanisms is crucial for individuals and their financial planners to make informed decisions and optimize their insurance strategies. This article will explore the various tax treatments of life insurance, including term life, permanent life, and whole life policies, to shed light on the potential tax advantages and disadvantages associated with each.

What You'll Learn

Tax Treatment of Life Insurance Premiums

The tax treatment of life insurance premiums is an important consideration for individuals and can significantly impact their overall financial planning. When you pay premiums for life insurance, there are specific tax implications that can affect your finances, especially in the long term. Understanding these rules can help you make informed decisions and optimize your insurance strategy.

In many countries, life insurance premiums are generally tax-deductible for individuals. This means that the amount you pay in premiums can be subtracted from your taxable income, reducing the overall tax liability. For example, if you have a high-income job and purchase a substantial life insurance policy, you can claim a deduction for the premiums paid, which can result in a lower tax bill. This deduction is often available for both term and permanent life insurance policies, providing flexibility for policyholders.

However, it's essential to note that the tax rules can vary depending on the type of life insurance policy and the jurisdiction. For instance, in some countries, only term life insurance premiums may be deductible, while permanent life insurance may not qualify. Additionally, the amount of the premium that can be deducted might be limited to a certain percentage of your income or a specific cap. It is crucial to consult the tax laws in your region to understand the applicable rules.

When it comes to the tax treatment of life insurance benefits, there is also a difference. If you pass away while the policy is in force, the death benefit received by your beneficiaries is typically not subject to income tax. This means that the proceeds from the life insurance policy are generally tax-free, providing a significant financial benefit to your loved ones. On the other hand, if you outlive the policy and the death benefit is paid to you, it may be taxable income, depending on the tax laws in your country.

Furthermore, the tax treatment of life insurance can also influence your investment decisions. Some life insurance policies offer investment components, allowing policyholders to grow their money over time. The tax implications of these investment returns can vary, and understanding the tax rules associated with these policies is essential for effective financial planning. By considering these tax aspects, individuals can make informed choices about their life insurance coverage and ensure that their financial strategies are aligned with their long-term goals.

Life and Health Insurance Exam: How Long Does It Last?

You may want to see also

Tax Implications of Death Benefits

The tax implications of death benefits from life insurance can be complex and vary depending on several factors. When an individual purchases life insurance, they typically name a beneficiary who will receive the death benefit upon the insured person's passing. These death benefits can have significant tax consequences for both the insured and the beneficiary.

In general, life insurance death benefits are generally not subject to income tax for the insured individual during their lifetime. This is because the insurance policy is considered a form of long-term savings or investment, and the premiums paid are often tax-deductible expenses. However, once the insured person dies, the death benefit becomes a taxable event. The tax treatment of the death benefit depends on the type of policy and the beneficiary's relationship to the insured.

For policies with a cash value component, such as whole life or universal life insurance, the death benefit may be subject to income tax. The cash value portion of the policy grows tax-deferred, and upon death, the beneficiary receives the death benefit, which includes both the principal and the accumulated interest. This amount is generally taxable as ordinary income for the beneficiary. The tax liability can be significant, especially for high-income beneficiaries, as the death benefit may be substantial.

On the other hand, term life insurance policies, which provide coverage for a specific period, typically do not have a cash value component. As a result, the death benefit received by the beneficiary is generally not taxable. This is because term life insurance is primarily designed to provide financial protection during a specific period, and the death benefit is intended to replace lost income or cover expenses, which are not typically considered taxable events.

It's important to note that there are some exceptions and special rules that may apply. For example, if the insured individual is considered a key employee in a small business, the death benefit may be subject to a different tax treatment. Additionally, in some cases, the death benefit may be exempt from taxation if it meets certain criteria, such as being used to pay for funeral expenses or if the policy is owned by a trust. Understanding these nuances is crucial for individuals and their financial advisors to ensure proper planning and compliance with tax laws.

DUI's Impact on Life Insurance: What You Need to Know

You may want to see also

Tax-Deferred Growth in Permanent Life Insurance

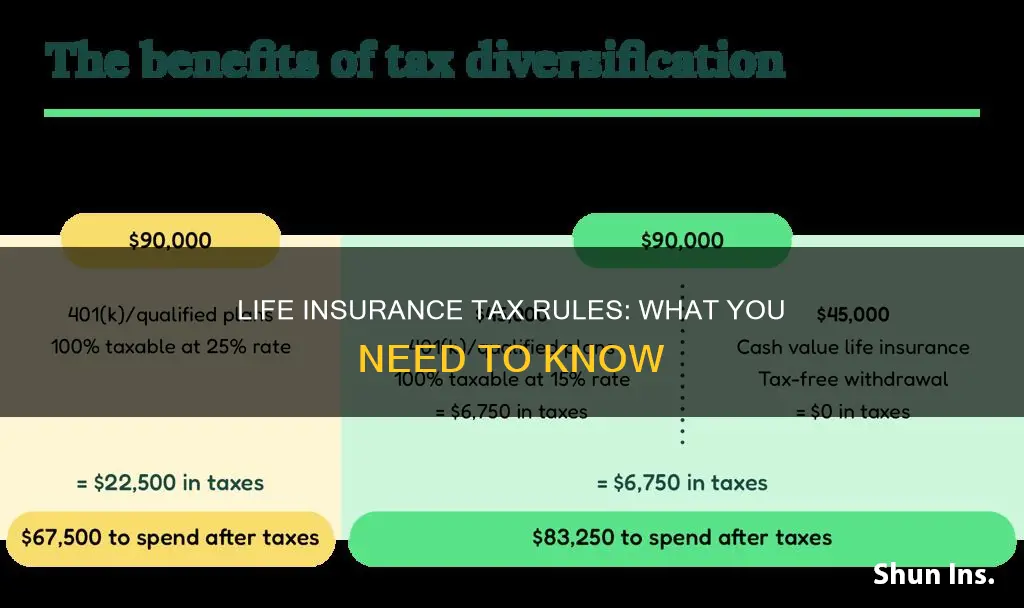

Tax-deferred growth is a key feature of permanent life insurance, offering a powerful tool for long-term wealth accumulation. Unlike traditional savings accounts or investments, permanent life insurance allows your money to grow tax-free until it's needed. This means that the cash value of your policy, which is the portion of your premium payments that's invested, can accumulate without being taxed each year. As a result, your money has the potential to grow faster over time.

Here's how it works: When you make premium payments, a portion of each payment goes towards building cash value, which is invested in a variety of assets. This investment grows tax-deferred, meaning you don't pay taxes on the earnings or interest accrued each year. As your cash value grows, it can be used for various purposes, such as loaning yourself money, paying for college, or providing a financial safety net for your beneficiaries.

One of the significant advantages of tax-deferred growth in permanent life insurance is its potential to outpace traditional investment returns. Over time, the power of compounding interest can lead to substantial growth in your policy's cash value. This is particularly beneficial for long-term financial goals, such as retirement planning or funding a child's education. By allowing your money to grow tax-free, permanent life insurance can provide a more efficient and effective way to build wealth.

Additionally, the tax-deferred nature of permanent life insurance can be advantageous in estate planning. The cash value of your policy grows free of income and estate taxes, which can be a valuable asset for your beneficiaries. Upon your passing, the death benefit, which is typically tax-free, can be paid out to your heirs, providing a substantial financial gift without triggering a tax liability.

In summary, tax-deferred growth in permanent life insurance offers a unique and powerful way to build wealth over time. By allowing your money to grow tax-free, this type of insurance provides an efficient and effective means of achieving long-term financial goals while also offering potential tax advantages for your beneficiaries. Understanding this feature can help individuals make informed decisions about their insurance and investment strategies.

Cancer Diagnosis: Will Your Life Insurance Rates Increase?

You may want to see also

Taxable Income from Annuity Payouts

When it comes to life insurance, understanding the tax implications of different policies is crucial for making informed financial decisions. One aspect that often raises questions is the taxation of annuity payouts. Annuities, a type of life insurance product, provide regular payments to the policyholder or their beneficiaries over a specified period or for life. While annuities offer financial security and a steady income stream, it's essential to know how these payouts are taxed to optimize your financial strategy.

Annuity payouts are generally considered taxable income. This means that the amount received from an annuity contract is subject to taxation, and the tax treatment can vary depending on the type of annuity and the individual's circumstances. The Internal Revenue Service (IRS) categorizes annuity payments as either a distribution or a return of premium. Understanding these categories is key to comprehending the tax rules.

Distributions from an annuity occur when the policyholder receives payments after the annuity contract has been in force for at least one year. These distributions are typically taxable as ordinary income. The tax rate applied to these payouts depends on the policyholder's income and tax bracket. For instance, if an individual receives a lump-sum distribution from an annuity, it may be taxed as ordinary income, and the tax rate will be based on their overall income for the year.

On the other hand, returns of premium refer to the refund of premiums paid into the annuity contract before it was surrendered or terminated. These returns are generally not taxable income. They represent the original investment and any associated interest or earnings. However, if the policyholder has already received distributions from the annuity, the return of premium may be subject to tax as ordinary income if it exceeds the total premiums paid.

It's important to note that the tax laws surrounding annuities can be complex, and there are specific rules and exceptions. For instance, qualified retirement annuities, which are subject to certain restrictions, may offer tax advantages. Additionally, the tax treatment of annuity payouts can be influenced by the policyholder's age and the timing of distributions. Consulting with a tax professional or financial advisor is recommended to ensure compliance with tax regulations and to make the most of your annuity investment.

Credit Life Insurance: What's Not Covered?

You may want to see also

Tax Advantages of Term Life Insurance

Term life insurance offers several tax advantages that can provide significant benefits to policyholders. Firstly, the premiums paid for term life insurance are generally tax-deductible expenses. This means that individuals can reduce their taxable income by the amount of their life insurance premiums, which can result in lower tax liabilities. This is particularly advantageous for those in higher tax brackets, as the tax savings can be substantial.

Secondly, the death benefit received by the beneficiary upon the insured individual's passing is typically not subject to income tax. This is a significant advantage, as it ensures that the entire death benefit can be used for the intended purpose, such as covering funeral expenses, paying off debts, or providing financial support to dependents. Unlike some other forms of insurance payouts, the death benefit from term life insurance is often exempt from taxation, allowing the funds to be utilized tax-free.

The tax-free nature of the death benefit is a key feature that sets term life insurance apart. It ensures that the proceeds are not subject to income tax, capital gains tax, or estate tax. This is in contrast to other types of insurance payouts, such as those from whole life insurance or universal life insurance, where the death benefit may be subject to taxation, potentially reducing the overall value received by the beneficiary.

Additionally, term life insurance can be a valuable tool for estate planning. The death benefit can be designated to be paid out to specific beneficiaries, providing a tax-efficient way to transfer wealth. By utilizing term life insurance in this manner, individuals can ensure that their assets are distributed according to their wishes while also taking advantage of the tax benefits associated with the policy.

In summary, term life insurance provides valuable tax advantages, including tax-deductible premiums and a tax-free death benefit. These features make term life insurance an attractive option for individuals seeking to minimize their tax liabilities while providing financial security for their loved ones. Understanding these tax benefits can help individuals make informed decisions when choosing the right life insurance policy for their needs.

Life Insurance Alternatives: Exploring Other Options

You may want to see also

Frequently asked questions

Life insurance proceeds paid out to beneficiaries are generally tax-free. The insurance company pays out the death benefit, which is typically tax-free, as it is considered a gift or inheritance.

For the policyholder, life insurance can provide tax advantages. Premiums paid for certain types of permanent life insurance policies may be tax-deductible, and the cash value accumulation within the policy can grow tax-deferred until withdrawn.

The cash value of a life insurance policy can accumulate over time, and any interest or investment earnings on this cash value are generally tax-deferred. This means no taxes are paid on the growth until the policyholder withdraws or surrenders the policy.

Term life insurance primarily provides coverage for a specific period. While there are no tax benefits for the death benefit itself, the premiums paid for term insurance may be partially tax-deductible, especially for those in higher tax brackets.

The tax treatment can vary based on the type of policy. For instance, whole life insurance and universal life insurance offer tax-deferred growth, while term life insurance focuses on providing coverage for a defined term without significant tax advantages.