When it comes to life insurance, understanding the reasons for potential denial can be crucial. Many factors can influence whether an individual is approved for life insurance coverage, and being aware of these can help applicants navigate the process more effectively. Common reasons for denial include pre-existing health conditions, such as chronic diseases or severe obesity, which may increase the risk of early mortality. Additionally, lifestyle choices like smoking, excessive alcohol consumption, or drug use can significantly impact eligibility. Age and occupation also play a role, as younger individuals and those in high-risk professions may face higher premiums or denials. It's essential for applicants to be transparent about their health and lifestyle to ensure a fair assessment and potentially secure the coverage they need.

What You'll Learn

- Health Conditions: Pre-existing medical issues like heart disease or diabetes can lead to denial

- Age: Young adults may face higher premiums or denial due to lower risk assessment

- Lifestyle Factors: Smoking, excessive drinking, and drug use can significantly impact eligibility

- Occupation Hazards: High-risk jobs like skydiving or mining may result in insurance denial

- Financial History: Insolvency or significant debt can make it difficult to secure life insurance

Health Conditions: Pre-existing medical issues like heart disease or diabetes can lead to denial

Pre-existing medical conditions can significantly impact an individual's ability to secure life insurance, and certain health issues may lead to denial or higher premiums. One of the most common reasons for rejection is heart disease. Insurers often view individuals with a history of heart attacks, angina, or other cardiovascular problems as high-risk candidates. This is because heart disease can lead to premature death, and the likelihood of complications during the policy term is considered too high. Similarly, diabetes is another condition that may result in a denial or increased costs. Insurers assess the severity and control of diabetes, as poorly managed diabetes can lead to various health complications, including kidney failure, blindness, and an increased risk of heart disease.

Other chronic illnesses that could potentially cause issues are hypertension, cancer, and chronic obstructive pulmonary disease (COPD). Hypertension, or high blood pressure, is a major concern as it often indicates a higher risk of cardiovascular events. Cancer, especially certain types with a high mortality rate, can also lead to denial, as the disease and its treatment can be costly and life-threatening. COPD, a chronic lung disease, can result in frequent hospitalizations and reduced life expectancy, making it a red flag for insurance companies.

In addition to these conditions, insurers may also consider the individual's overall health and lifestyle. Obesity, for instance, is often associated with various health issues, including heart disease and diabetes, and can lead to higher insurance premiums or denial. Similarly, a history of smoking can significantly impact the underwriting process, as smoking increases the risk of various cancers, heart disease, and respiratory issues.

It is important to note that the impact of these health conditions on insurance eligibility can vary. Some individuals with pre-existing conditions may still be able to secure coverage, but they might have to pay higher premiums or meet specific medical requirements. Additionally, the severity and management of the condition play a crucial role in the underwriting process. Proper medical management and a healthy lifestyle can sometimes mitigate the risks associated with these health issues.

Understanding these factors is essential for individuals seeking life insurance, as it highlights the importance of maintaining a healthy lifestyle and managing any existing medical conditions effectively. By being proactive and transparent about their health, individuals can increase their chances of obtaining favorable insurance terms and ensure financial security for their loved ones.

Uncover Credit Life Insurance: Check Your Policy Status

You may want to see also

Age: Young adults may face higher premiums or denial due to lower risk assessment

Young adults often encounter unique challenges when it comes to obtaining life insurance, and their age can significantly impact the terms and availability of coverage. One of the primary reasons for this is the risk assessment that insurance companies make when evaluating young adults for life insurance policies.

Insurance providers typically consider age as a critical factor in determining the likelihood of an individual's mortality. Young adults, especially those in their late teens and early twenties, are generally considered to be in a lower-risk category for life insurance companies. This is because they have a longer life expectancy and are less likely to experience the types of health issues that often lead to early death, such as heart disease, cancer, or severe accidents. As a result, insurance companies may view young adults as less attractive prospects for life insurance, leading to higher premiums or even policy denial.

The risk assessment for young adults is further influenced by their lifestyle choices and habits. Many young people are more likely to engage in risky behaviors, such as excessive drinking, drug use, or dangerous hobbies, which can negatively impact their health and increase the likelihood of accidents. Insurance companies may take these factors into account when deciding whether to offer a policy and at what premium rate. For instance, a young adult with a history of reckless driving or a sedentary lifestyle may be considered a higher-risk individual, potentially resulting in higher insurance costs or a refusal of coverage.

Additionally, the type of life insurance policy sought by young adults can also play a role in the decision-making process. Term life insurance, which provides coverage for a specified period, is often more affordable for young individuals as they are considered low-risk. However, permanent life insurance, which offers lifelong coverage, may be more expensive due to the longer-term commitment and the potential for the policyholder to outlive the policy. Young adults might find it more challenging to secure permanent life insurance, especially if they have not yet established a long-term financial commitment or a stable income.

In summary, young adults may face higher premiums or even denial of life insurance due to the lower risk assessment by insurance companies. Their age, lifestyle choices, and the type of policy sought all contribute to the overall evaluation. It is essential for young adults to understand these factors and potentially explore ways to improve their risk profile, such as adopting healthier habits, to increase their chances of obtaining affordable life insurance coverage.

Uncover the Secrets: Extraordinary Life Insurance Explained

You may want to see also

Lifestyle Factors: Smoking, excessive drinking, and drug use can significantly impact eligibility

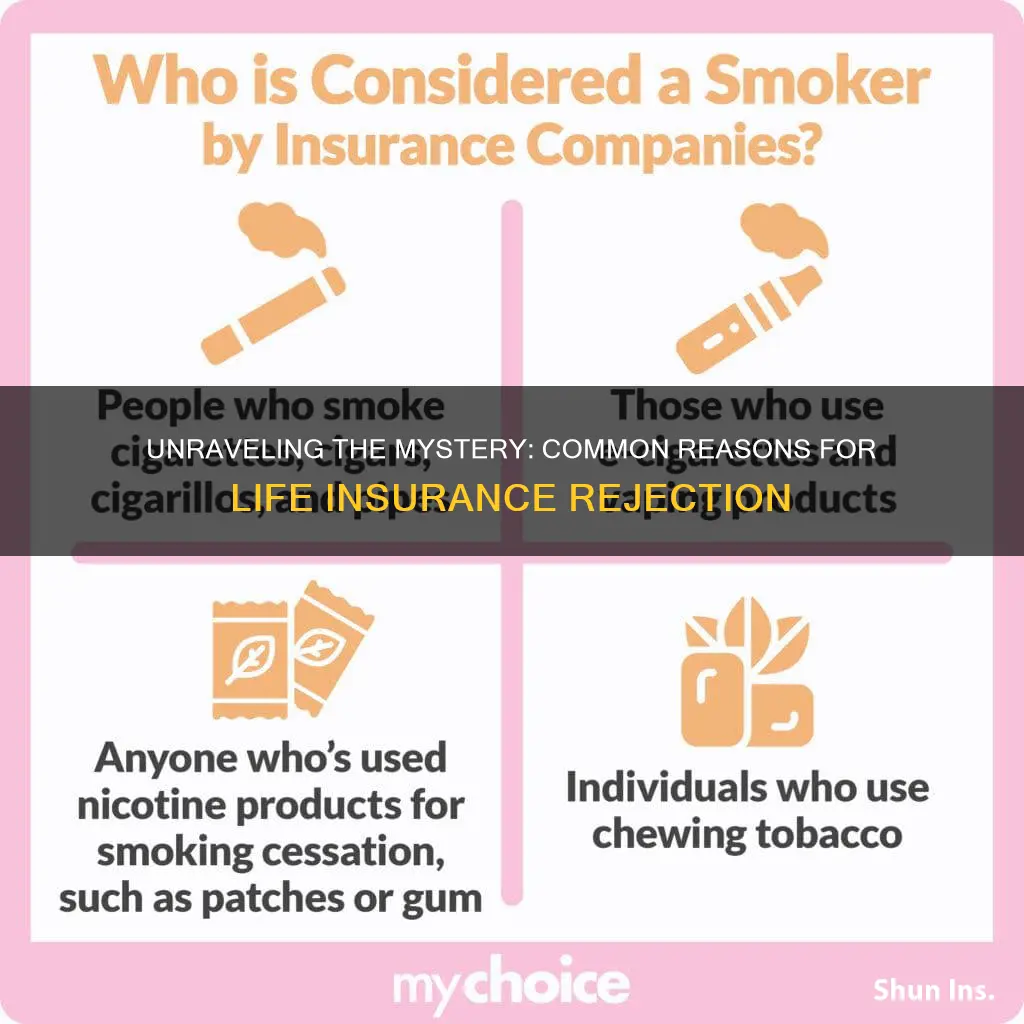

Lifestyle choices play a crucial role in determining an individual's eligibility for life insurance, and certain habits can lead to higher risk assessments for insurers. One of the most well-known factors is smoking. Smokers are often considered high-risk candidates for life insurance due to the increased likelihood of developing smoking-related health issues, such as lung cancer, heart disease, and respiratory problems. Insurance companies may view smokers as less healthy and more prone to early mortality, which can result in higher premiums or even denial of coverage. The impact of smoking on life insurance eligibility is significant, and insurers often require smokers to undergo additional health assessments or provide evidence of a quit-smoking program to gauge their commitment to a healthier lifestyle.

Excessive alcohol consumption is another lifestyle factor that can affect life insurance eligibility. Heavy drinking can lead to liver damage, increased risk of accidents, and a higher likelihood of engaging in risky behaviors. Insurance providers may view excessive drinking as a sign of poor health and increased mortality risk. In some cases, individuals who drink heavily may be denied coverage or offered limited options with higher premiums. It's important to note that moderate drinking, as defined by the guidelines of most countries, is generally not a cause for concern and may not significantly impact insurance eligibility.

Drug use, including illegal drugs and the misuse of prescription medications, is a critical consideration for life insurers. Drug addiction can lead to severe health complications, accidents, and a higher risk of sudden death. Insurance companies may deny coverage or impose strict conditions on individuals with a history of drug abuse. The use of illegal drugs is often seen as a significant risk factor, as it can indicate a tendency towards risky behavior and potential health deterioration. Additionally, the misuse of prescription drugs, such as opioids, can also result in higher insurance premiums or denial of coverage due to the associated health risks.

Insurers often require individuals to disclose their lifestyle habits and may conduct thorough investigations to assess the impact of these choices on their health and longevity. It is essential for applicants to be transparent and honest about their smoking, drinking, and drug use history to ensure accurate risk assessments. While lifestyle factors can influence eligibility, many insurers also recognize the potential for improvement and may offer coverage with certain conditions or adjustments to premiums, encouraging individuals to make positive lifestyle changes.

Life Insurance Coverage: What US Life Insurance Offers

You may want to see also

Occupation Hazards: High-risk jobs like skydiving or mining may result in insurance denial

Engaging in high-risk occupations can significantly impact your ability to secure life insurance. Insurers often view certain professions as inherently dangerous, and this can lead to higher premiums or even denial of coverage. Occupations that involve extreme physical activity, hazardous environments, or a higher likelihood of injury or death are typically considered risky.

Skydiving, for instance, is an extreme sport that requires specialized training and equipment. The inherent danger of jumping from an aircraft and the potential for severe injuries make this activity a red flag for insurance companies. Similarly, mining operations expose workers to various hazards, including cave-ins, toxic fumes, and heavy machinery, which can result in serious accidents and long-term health issues.

Insurers assess the risk associated with different occupations and may deny coverage or charge higher premiums for individuals in these high-risk jobs. The reasoning behind this is straightforward: occupations with a higher likelihood of accidents or health complications translate into a greater potential for insurance claims. As a result, individuals in such professions may find it challenging to obtain comprehensive life insurance coverage.

It's important to understand that the level of risk associated with a job is a critical factor in insurance decisions. Insurers consider the nature of the work, the potential for injuries, and the overall health and safety standards of the industry. For example, a construction worker may face different risks compared to a skydiver, and these factors are carefully evaluated during the underwriting process.

Being aware of the potential challenges when applying for life insurance, especially if you have a high-risk occupation, is essential. It is advisable to disclose all relevant information accurately and be prepared for potential adjustments in coverage or premiums. While high-risk jobs may present obstacles, it is still possible to secure life insurance, but it may require additional considerations and a thorough understanding of the insurance provider's policies.

Military Life Insurance: Discharge and Your Coverage

You may want to see also

Financial History: Insolvency or significant debt can make it difficult to secure life insurance

A person's financial history can significantly impact their ability to obtain life insurance. One of the primary concerns for insurance companies is the financial stability of the applicant. Insolvency or being in significant debt can raise red flags and make it challenging to secure life insurance coverage.

When an individual files for bankruptcy or is declared insolvent, it indicates a severe financial crisis. Insurance providers view this as a high-risk factor because it suggests a lack of financial responsibility and the potential for further financial distress. In such cases, the insurance company may deny coverage or offer limited options, as the risk of defaulting on premiums is considered too high.

Significant debt, especially if it is unsecured or has a high interest rate, can also be a cause for concern. Insurance companies assess the likelihood of the applicant defaulting on payments or facing financial difficulties that could lead to insolvency. If an individual's debt-to-income ratio is high, it may indicate a struggle to manage finances effectively, which could result in a higher risk profile for the insurer.

Furthermore, a history of frequent financial defaults or late payments can further complicate matters. Insurance providers often review credit reports and payment histories to gauge an individual's financial behavior. Consistent late payments or defaults on loans and credit cards may suggest a pattern of irresponsible financial management, making it harder to obtain favorable life insurance terms.

In summary, a poor financial history, including insolvency or significant debt, can make it challenging to secure life insurance. Insurance companies assess financial stability and responsibility, and any signs of financial distress may lead to denied coverage or limited options. It is essential for individuals to address their financial situation and demonstrate financial literacy to increase their chances of obtaining the desired life insurance coverage.

Canceling Westpac Life Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

Life insurance companies may deny coverage for various reasons, including pre-existing medical conditions, lifestyle choices, and age. They often assess the risk of insuring an individual based on their health, occupation, and lifestyle factors.

Yes, pre-existing health issues can lead to denial or higher premiums. Conditions like heart disease, cancer, diabetes, or severe mental health disorders may require a thorough medical examination and may result in the insurer denying coverage or offering limited benefits.

Smoking is a significant risk factor for life insurance companies. Regular smokers may face higher premiums or even denial of coverage due to the increased risk of health issues like lung cancer, heart disease, and respiratory problems.

Yes, certain high-risk occupations may impact life insurance eligibility. Jobs with a higher likelihood of accidents or injuries, such as construction workers, pilots, or firefighters, may be considered more risky and could result in denial or additional medical exams.

Engaging in extreme sports or hobbies like skydiving, rock climbing, or racing can be a concern for insurers. These activities may increase the perceived risk of an untimely death, potentially leading to higher premiums or denial of coverage.