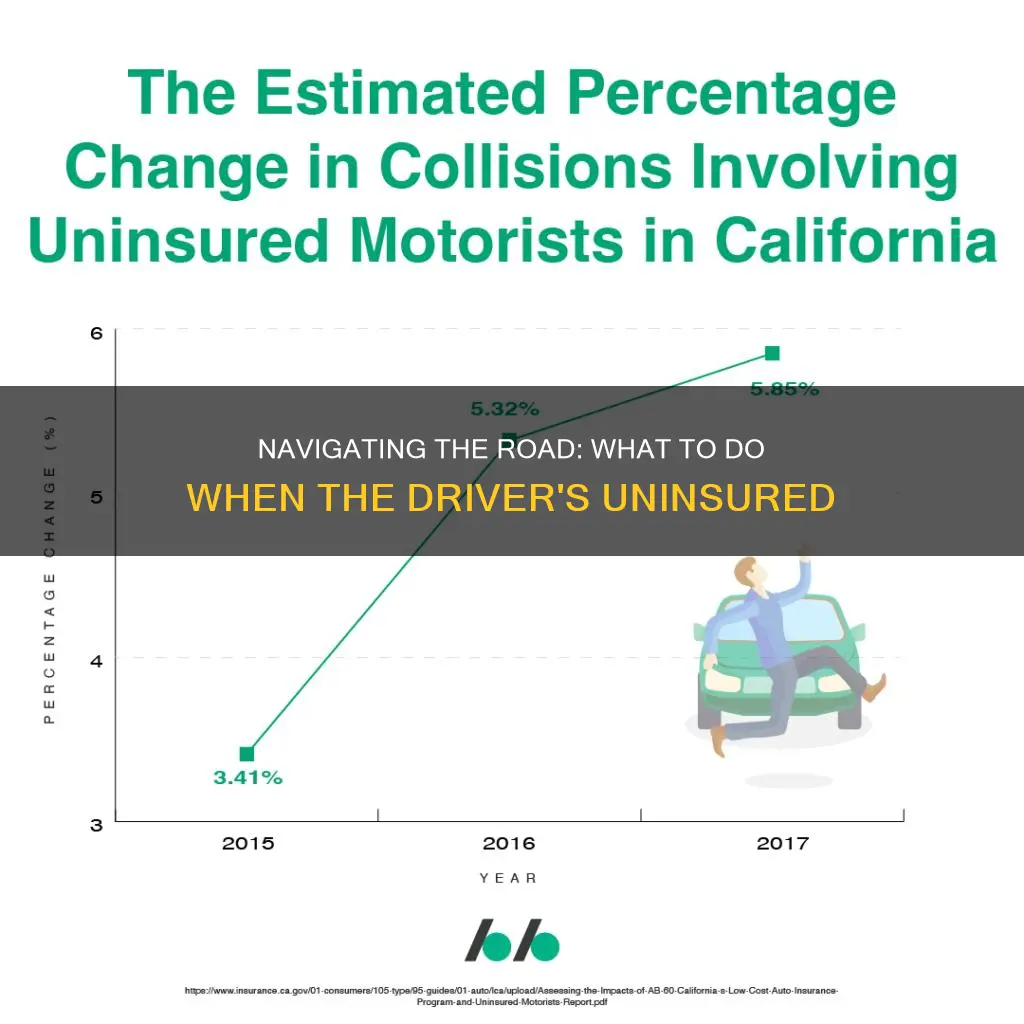

Driving without insurance is illegal and can lead to serious consequences. If you are involved in an accident with an uninsured driver, it's important to know your rights and take the necessary steps to protect yourself. This guide will provide information on what to do if you are in an accident with a driver who has no insurance, including how to file a claim, seek medical attention, and contact your insurance company.

What You'll Learn

- Report the Incident: Contact your insurance company and report the accident, providing details of the driver's lack of insurance

- Gather Evidence: Collect witness statements, photos, and any other relevant documentation to support your claim

- Contact the Driver: Attempt to communicate with the driver to understand the situation and seek compensation

- File a Claim: Initiate the claims process with your insurance provider, providing all necessary documentation

- Legal Action: If necessary, consult a lawyer to explore legal options for recovery

Report the Incident: Contact your insurance company and report the accident, providing details of the driver's lack of insurance

If you've been involved in an accident with a driver who has no insurance, it's crucial to take immediate action to protect your interests and ensure you receive the necessary support. Here's a step-by-step guide on what to do in such a situation:

Contact Your Insurance Company: The first and most important step is to notify your insurance provider as soon as possible. Inform them about the accident and provide all the relevant details. When reporting the incident, clearly state that the other driver was uninsured. This information is vital as it will impact the claims process and your coverage. Your insurance company will guide you through the necessary steps and may ask for specific documentation, such as police reports, witness statements, or photos of the damage.

Gather Evidence: While reporting to your insurance, it's essential to collect and document as much evidence as you can. Take photos of the accident scene, including any visible damage to your vehicle and the other party's property. Get contact information from any witnesses who can provide an account of the incident. These details will be crucial when supporting your claim and proving the other driver's lack of insurance.

Understand Your Policy: Review your insurance policy to understand the coverage you have. Different policies may have varying provisions for accidents involving uninsured drivers. Some policies offer coverage for medical expenses, property damage, or even compensation for lost wages. Knowing your policy's specifics will help you navigate the claims process effectively.

File a Police Report: In most cases, it is advisable to file a police report, especially if the accident resulted in injuries or significant property damage. This report will provide an official record of the incident, which can be useful when dealing with insurance claims. The police report will also help establish the sequence of events and may be required by your insurance company.

Negotiate and Claim Compensation: Once your insurance company has all the necessary information, they will assist you in filing a claim. They will work on your behalf to negotiate with the at-fault driver's insurance company (or lack thereof) to settle the claim. If the other driver has no insurance, your insurance provider may step in to help you recover the compensation you deserve. This process can vary, and it's essential to follow your insurance company's instructions and provide any additional information they request.

Remember, acting promptly and providing accurate information to your insurance company is crucial. They will guide you through the legal and financial aspects of dealing with an accident involving an uninsured driver, ensuring you receive the appropriate compensation and support during this challenging time.

Chiropractic Care After a Car Accident: Understanding Insurance Billing

You may want to see also

Gather Evidence: Collect witness statements, photos, and any other relevant documentation to support your claim

If you find yourself in an accident where the driver is uninsured, it's crucial to act promptly and methodically to protect your rights and increase your chances of a successful claim. One of the most important steps you can take is to gather evidence. This process is essential to support your claim and help you navigate the often complex legal process. Here's a detailed guide on how to collect the necessary evidence:

Witness Statements: One of the most valuable pieces of evidence is a witness statement. After the accident, ask anyone who saw the incident for a detailed account of what they witnessed. This can include other drivers, pedestrians, or even bystanders. Encourage them to provide their full names, contact information, and a clear description of the events. Witness statements can provide an unbiased account of the accident, which can be crucial in establishing liability. Ensure that you get these statements as soon as possible after the accident, as memories can fade over time.

Photographic Evidence: Take extensive photographs of the accident scene, including the damage to all vehicles involved, the surrounding area, and any relevant road markings or traffic signs. Capture close-up shots of any skid marks, debris, or other physical evidence that could support your case. Also, take photos of any injuries you or other passengers sustained immediately after the accident. These visual records can provide a powerful and objective representation of the incident.

Documentation and Records: Gather all relevant documentation and records related to the accident. This includes medical records and bills for any injuries sustained, repair estimates or invoices for vehicle damage, and any communication or correspondence with the uninsured driver or their insurance company (if they provide any). Keep a detailed log of all events, including dates, times, and locations. This documentation will help you build a comprehensive case and provide evidence of the financial impact of the accident.

Police Report: Contact the local police department and request a copy of the accident report. This official document will include details such as the officer's observations, witness statements, and a summary of the incident. A police report can be a valuable piece of evidence and is often required by insurance companies to process claims.

Keep a Record of Communications: Document all communication related to the accident, including emails, letters, and phone calls. Record the date, time, and content of each interaction. This is especially important if the uninsured driver or their representatives deny responsibility or become uncooperative. Having a detailed record of your communications can help you track the progress of your claim and provide evidence of your efforts to resolve the matter.

By gathering this evidence, you are taking proactive steps to support your claim and ensure that your rights are protected. It is essential to act promptly, as evidence can deteriorate or become less relevant over time. Remember, the more comprehensive your evidence, the stronger your case will be, and the higher the likelihood of a successful outcome in your pursuit of compensation.

Auto Insurance Policies: Short-Term Coverage, Long-Term Peace of Mind

You may want to see also

Contact the Driver: Attempt to communicate with the driver to understand the situation and seek compensation

If you've been involved in an accident with a driver who has no insurance, it's important to remain calm and take the necessary steps to protect your interests. One of the most crucial actions you can take is to contact the driver and attempt to communicate with them. This initial step can provide valuable insights into the situation and potentially lead to a resolution without involving legal proceedings.

When approaching the driver, it's essential to remain composed and professional. Start by explaining the circumstances of the accident clearly and concisely. Provide details about the damage to your vehicle and any injuries you or other passengers may have sustained. By doing so, you create a factual basis for the conversation, ensuring that the driver understands the severity of the situation.

During the conversation, try to gather as much information as possible. Ask the driver about their insurance status and why they might not have coverage. Understanding their perspective can help you assess the likelihood of reaching a settlement without legal intervention. It's also a good idea to inquire about their financial situation, as this can impact the compensation they might be able to offer.

If the driver is cooperative and willing to communicate, you may be able to negotiate a settlement directly. Discuss the costs associated with the accident, including medical bills, vehicle repairs, and any other relevant expenses. Present your case clearly and be prepared to negotiate a fair compensation amount. Remember, the goal is to reach a mutually agreeable solution that satisfies both parties.

In some cases, the driver may be reluctant to provide information or may become defensive. If this happens, it's important to remain firm but respectful. You can suggest that you will be in touch with your insurance company and legal representatives to pursue the matter further. This approach sends a clear message while leaving room for a potential resolution without escalating the situation.

Verify Auto Insurance Coverage: Quick and Easy Steps

You may want to see also

File a Claim: Initiate the claims process with your insurance provider, providing all necessary documentation

If you've been involved in an accident with a driver who has no insurance, it's crucial to act promptly and efficiently to protect your rights and interests. Here's a step-by-step guide on what to do in such a scenario:

- Document the Incident: After ensuring everyone's safety, gather evidence at the scene. Take photos of the damage to both vehicles, including any visible injuries or scars. Capture the license plate number of the uninsured driver, and if possible, get contact information from any witnesses. This documentation will be essential when filing your claim.

- Contact Your Insurance Company: Reach out to your insurance provider as soon as possible. Inform them about the accident and provide them with the details you've gathered. They will guide you through the claims process and explain the necessary steps to take. Be transparent and provide all the information they require to assess the claim accurately.

- File a Police Report: In most cases, it is advisable to file a police report. This report will document the accident, including the fact that the other driver was uninsured. It can be a valuable piece of evidence when dealing with insurance companies and may be required by your insurer.

- Initiate the Claims Process: When you file a claim with your insurance company, they will provide you with specific instructions. This process typically involves submitting a detailed account of the incident, including the date, time, location, and a description of the accident. You will also need to provide the insurance company with the information you documented at the scene. Be prepared to answer questions and provide additional details if needed.

- Provide All Necessary Documentation: This is a critical step in the claims process. Ensure you have all the required documents ready, such as:

- Police report (if applicable)

- Photos of the damage

- Witness statements (if available)

- Medical records and bills if you or any passengers sustained injuries

- Repair or replacement estimates for your vehicle

- Any other relevant documentation related to the accident

Your insurance provider will guide you on the specific documents they need to process the claim efficiently. Be prompt in providing these documents to avoid delays in your settlement.

Remember, each insurance company may have its own procedures, so it's essential to follow their instructions carefully. Filing a claim with an uninsured driver can be complex, but with the right documentation and a proactive approach, you can navigate the process effectively and ensure you receive the compensation you deserve.

Understanding OBEL: Auto Insurance's Critical Code

You may want to see also

Legal Action: If necessary, consult a lawyer to explore legal options for recovery

If you've been involved in an accident where the driver was uninsured, it's crucial to understand your legal rights and options. In such situations, taking prompt and appropriate legal action can significantly impact your ability to recover damages and seek justice. Here's a guide on what to consider:

Understand Your Rights: When a driver is uninsured, they are operating their vehicle without the required insurance coverage, which is illegal in most jurisdictions. As a victim, you have the right to seek compensation for any injuries, property damage, or losses incurred due to the accident. This is where consulting a legal professional becomes essential.

Consult a Lawyer: Engaging a lawyer who specializes in personal injury or motor vehicle accident cases is the next step. They can provide valuable insights into your legal options and guide you through the complex process of seeking compensation. A lawyer will assess the details of your case, including the circumstances of the accident, the extent of your injuries, and any property damage. They will also investigate the driver's insurance status and the potential liability of other parties involved.

Explore Legal Options: Your lawyer will help you understand the legal avenues available to recover damages. This may include filing a claim against the uninsured driver's assets, if applicable, or exploring other legal options such as:

- Uninsured Motorist Coverage: In some cases, your own insurance policy might offer coverage for accidents involving uninsured drivers. Review your policy to see if this coverage is available and what the process entails.

- Third-Party Claims: If the uninsured driver has any assets, such as a vehicle, savings, or property, you may be able to file a claim against these assets to recover damages.

- Personal Injury Claims: If you've suffered injuries, you can pursue a personal injury claim to seek compensation for medical expenses, pain and suffering, and lost wages.

Legal Proceedings: If a fair settlement cannot be agreed upon, your lawyer will guide you through the legal process, which may involve filing a lawsuit against the uninsured driver. This could lead to a trial, where a judge or jury will determine the amount of compensation you are entitled to.

Taking legal action in the event of an accident with an uninsured driver is a serious step, but it is often necessary to ensure you receive the compensation you deserve. A qualified lawyer will provide the necessary support and expertise to navigate this process effectively. Remember, acting promptly and seeking legal advice can significantly improve your chances of a successful outcome.

When to Expect Your Auto Insurance Compensation

You may want to see also

Frequently asked questions

In the event of an accident with an uninsured driver, it's crucial to remain calm and take immediate action. First, ensure your safety and that of any passengers by moving to a safe location if possible. Then, contact the authorities and report the incident. Gather evidence such as taking photos of the scene, vehicle damage, and any relevant information about the other driver. This evidence will be essential for any potential legal proceedings.

Protecting yourself in such situations involves several steps. Firstly, ensure you have comprehensive insurance coverage, including uninsured motorist coverage, which will provide financial protection if the other driver is at fault and has no insurance. Secondly, keep a record of all expenses related to the accident, including medical bills, repair costs, and any lost wages. This documentation will be vital when making a claim.

Yes, you have legal rights and options in this scenario. You can file a claim with your insurance company, especially if you have the required coverage. They will guide you through the process and help you recover the damages. Additionally, you may consider taking legal action against the uninsured driver to seek compensation for your losses. Consult with a legal professional to understand your rights and the best course of action.

If the driver cannot be traced or located, it can be challenging to pursue compensation. In such cases, you should still report the accident to your insurance company, who may be able to assist in the claims process. They might also provide guidance on how to proceed and what steps you can take to recover any eligible expenses.

Preventing accidents with such drivers involves being vigilant and taking certain precautions. Always drive defensively and be aware of your surroundings. Maintain a safe distance from other vehicles, especially on busy roads. Regularly check your vehicle's maintenance and ensure it is in good working condition to minimize the risk of mechanical failures. Additionally, consider installing a dashcam to record your driving, which can be useful in case of disputes or accidents.