Home insurance is essential to protect your home and possessions against damage or theft. When considering house insurance, it is important to ensure you have adequate coverage in the event of a disaster. This includes checking you have enough insurance to rebuild your home, replace your possessions, cover additional living expenses, and protect your assets.

The cost to rebuild your home will depend on the current construction costs in your area, so it is important to review your policy regularly to ensure your coverage is sufficient. You should also consider whether you have enough insurance to replace your possessions, as most policies cover personal possessions for between 50% and 70% of the amount of insurance on your home.

Additional living expenses coverage will pay for temporary accommodation and living costs if you need to live away from your home due to an insured disaster. It is important to check the limits of this coverage to ensure it is sufficient for your needs.

Finally, consider whether you have enough insurance to protect your assets. Liability insurance will cover you against lawsuits for bodily injury or property damage caused by you, your family members, or your pets.

By regularly reviewing your home insurance policy and considering these key areas, you can ensure you have adequate coverage to protect your home and possessions.

| Characteristics | Values |

|---|---|

| Coverage for rebuilding home | Current construction costs, square footage, local construction costs, type of exterior wall construction, number of rooms, type of roof, special features, improvements |

| Coverage for replacing possessions | 50-70% of the insurance on the structure of the home, actual cash value, replacement cost |

| Coverage for additional living expenses | Hotel bills, restaurant meals, transportation, other living expenses |

| Liability coverage | Lawsuits for bodily injury or property damage, court costs, damages |

What You'll Learn

Will my insurance cover the cost of rebuilding my home?

Home insurance policies vary, but most standard policies will cover the cost of rebuilding your home in the event of a total loss. However, it is important to ensure that you have adequate coverage, as you may be responsible for a significant portion of the rebuilding costs if your insurance does not cover the full amount.

Understanding Replacement Cost

The replacement cost of a home is the amount it would cost to rebuild the property using similar materials in the event of damage. This is different from the market value of a home, which is the price it would sell for on the real estate market, taking into account factors such as location and land value. Replacement cost is calculated based on factors such as the home's size, local construction and labour costs, and the home's construction style.

Determining the Right Amount of Coverage

To ensure that your insurance covers the cost of rebuilding your home, it is important to have adequate dwelling coverage. Dwelling coverage is the part of your homeowners insurance policy that pays to rebuild your home from the ground up after a covered disaster. It is important to note that insurance companies may have different tools and methods for calculating replacement cost, so it is always a good idea to consult with a professional to get an accurate estimate.

Endorsements for Additional Coverage

In some cases, the cost of rebuilding your home may exceed your policy's dwelling coverage limit. To account for this, you can consider adding endorsements to your policy, such as extended replacement cost coverage or guaranteed replacement cost coverage. Extended replacement cost coverage provides an extra percentage of coverage above your dwelling limit, usually ranging from 125% to 150%. On the other hand, guaranteed replacement cost coverage ensures that your home will be replaced regardless of how much the actual cost exceeds the limits.

The 80% Rule

It is important to note that most insurance companies require your dwelling coverage to be at least 80% of the replacement cost value of your home. This is known as the "80% rule." If your home is insured below this threshold, your insurer may only reimburse you for the actual cash value, which factors in depreciation.

Regular Reviews

To ensure that your insurance coverage keeps pace with rising costs and inflation, it is recommended to review your coverage amounts annually. This will help you avoid being underinsured and ensure that you have adequate protection in the event of a total loss.

Farmers Insurance: Has the Harvest Begun?

You may want to see also

Will my insurance cover the cost of replacing my possessions?

Whether your insurance will cover the cost of replacing your possessions depends on the type of coverage you have.

Actual Cash Value (ACV)

If you have an ACV policy, your insurance company will pay out the replacement cost of your item minus depreciation. For example, if you bought a couch for $2,000 a few years ago but it has since depreciated by $500, and the cost of a new couch is now $2,200, your insurance company will pay out $1,700. ACV policies are usually cheaper, but they may not offer sufficient coverage if many of your belongings are damaged at once.

Replacement Cost Value (RCV)

If you have an RCV policy, your insurance company will pay out the full cost of replacing your item with a new one of similar make and quality, without deducting for depreciation. For example, if your television is stolen, your insurance company will pay out the cost of a new television of the same brand. RCV policies are more expensive, but they will likely result in a higher payout from your insurer.

Personal Property Coverage

Personal property coverage is another type of insurance that covers your belongings. It is often referred to as Coverage C on a homeowners policy. It can protect your personal belongings in the event of a covered loss, such as theft, damage, or destruction. It is important to note that personal property coverage does not include items that are considered personal property, such as cars, pets, or items that fly or hover.

Scheduled Personal Property Coverage

If you have expensive items that you want more coverage for, you can add scheduled personal property coverage to your standard homeowners insurance policy. This will provide extra protection and may include additional perils. You can also choose to have a lower deductible or no deductible for scheduled items. This type of coverage is especially useful for items such as jewelry, watches, and other luxury items.

Farmers Insurance Launches Mobile App: Revolutionizing the Way Policyholders Manage Their Coverage

You may want to see also

Will my insurance cover additional living expenses?

When considering home insurance, it is important to ask yourself: "Will my insurance cover additional living expenses?"

Additional living expenses coverage (often shortened to ALE) is a standard component of most home insurance policies. It covers the costs of living elsewhere temporarily if your home becomes uninhabitable due to an insured disaster, such as a hurricane or a fire. It is also known as "loss of use" coverage.

ALE covers the difference between your normal living expenses and the additional costs incurred while your home is being repaired or rebuilt. This includes hotel bills, restaurant meals, transportation costs, storage fees, moving costs, pet boarding, laundry expenses, and food costs. It is important to note that ALE does not cover your regular expenses, such as mortgage payments, utility bills, or groceries.

The amount of ALE coverage provided by your insurance policy is typically a percentage (usually 20-30%) of your dwelling coverage. For example, if your dwelling coverage is $200,000, your additional living expenses coverage might be $40,000. However, you may be able to increase this amount or opt for "actual loss sustained" coverage, which removes any financial caps on your claims.

To make a claim for additional living expenses, you must provide detailed records and receipts of your expenses. Keep in mind that ALE is only applicable if your home is uninhabitable due to a covered peril or evacuation order. It does not cover voluntary renovations or damage due to excluded perils like flooding.

Home Insurance: Who's Covered?

You may want to see also

Will my insurance protect my assets?

While insurance is an essential tool for protecting your financial stability, it does have limitations. It's important to understand the role of insurance in asset protection and how to protect your assets effectively.

Insurance plays a vital role in safeguarding your assets, but it's only one component of a comprehensive asset protection strategy. Its primary function is to shift the financial burden of potential losses from you to an insurance company. By purchasing insurance, you're essentially pooling your risks with other policyholders, which can help reduce the financial impact of unfortunate events.

However, insurance alone doesn't guarantee complete protection for your assets. Here are some key considerations and strategies to ensure your insurance protects your assets effectively:

- Understand your insurance policies: Take the time to read and comprehend the terms and conditions of your policies. Be aware of what's covered and what's not, and address any concerns with your insurance agent. Ensure your policies cater to your specific needs and risks.

- Don't compromise on coverage: Avoid choosing policies with lower premiums at the expense of adequate coverage. Always assess the value of your assets and ensure you have sufficient coverage to protect them.

- Supplement your existing policies: If your current insurance policies don't provide the desired level of protection, consider supplemental policies for specific risks. For instance, if your home insurance doesn't cover flooding, invest in a separate flood insurance policy.

- Regularly review and update your policies: Keep your insurance policies up to date as your assets and circumstances change. Increase your coverage limits when you acquire new assets, renovate your home, or if your properties' value increases significantly.

- Understand the different types of insurance: There are two basic types of insurance: liability insurance and property insurance. Liability insurance covers damages you cause to others, including personal injuries and property damage. Property insurance, on the other hand, covers damages to your property caused by others.

- Determine the correct types and amounts of insurance: It's crucial to have the right types and amounts of insurance to protect your assets effectively. Consult with professionals to assess your specific needs and risks.

- Implement a comprehensive asset protection strategy: In addition to insurance, consider other measures such as creating an emergency fund, diversifying your investments, and using legal structures like trusts and corporations to shield your assets from potential lawsuits or creditors.

Farmers Insurance Group: Is 21st Century Insurance Included?

You may want to see also

Will my insurance cover liability for accidents?

Liability insurance is a mandatory part of car insurance in most states and will cover you in the event of an accident that is your fault. It covers the costs of the other driver's property and bodily injuries, as well as the cost of defending or settling any lawsuits brought against you as a result of the accident.

There are two types of liability coverage: bodily injury liability and property damage liability. Bodily injury liability covers the cost of other parties' injuries, including emergency care, continued medical costs, lost wages, and legal expenses. Property damage liability covers the cost of damage to other parties' property, including their vehicle, buildings, guardrails, utility poles, and fences. It's important to note that liability insurance does not cover damage to your own vehicle or injuries to passengers in your car.

The minimum liability coverage required varies from state to state, and it's important to review your policy to understand what is covered and what is excluded. While liability insurance provides financial protection, it may not cover all costs associated with an accident. In some cases, you may need additional coverage, such as comprehensive and collision insurance, to ensure you are fully protected.

In the event of an accident, it is crucial to follow the appropriate steps, including notifying your insurance company and collecting relevant information from the other driver and any witnesses. Understanding your insurance policy and your state's insurance laws will help you navigate the claims process and ensure you are adequately protected in the event of an accident.

Housing Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Your policy needs to cover the cost of rebuilding your home at current construction costs. It's important to insure your home for at least 80% of its replacement value.

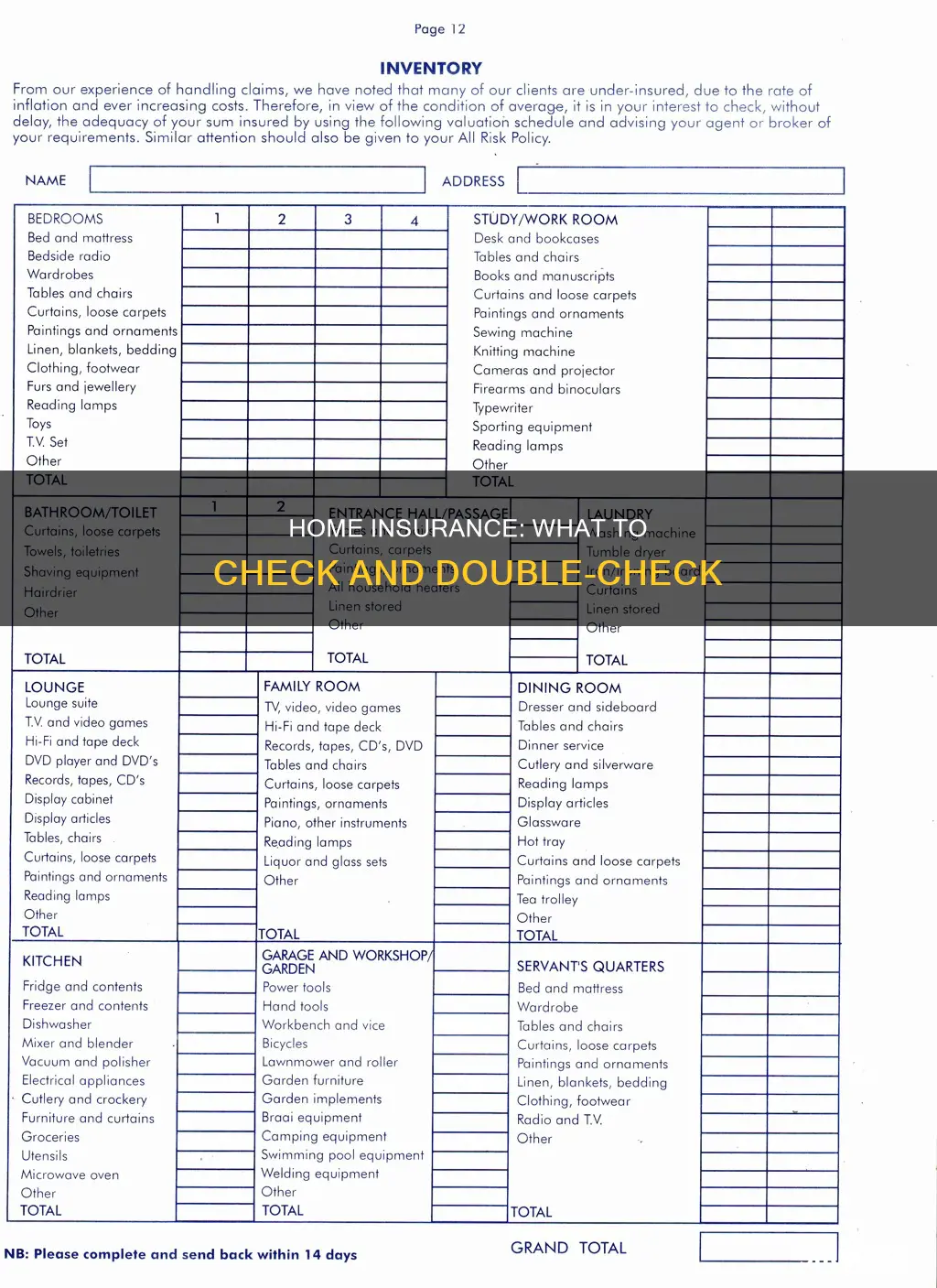

Most homeowners insurance policies provide coverage for your personal possessions for approximately 50% to 70% of the amount of insurance you have on the structure of your home. The best way to determine if this is enough coverage is to conduct a home inventory.

Coverage for additional living expenses pays the extra costs of temporarily living away from your home if you can't live in it due to an insured disaster. It covers hotel bills, restaurant meals, transportation, and other living expenses incurred while your home is inaccessible or being rebuilt.

It's important to have adequate liability protection. This covers you against lawsuits for bodily injury or property damage that you or your family members may cause to other people. It also pays for damage caused by pets.

A home's replacement cost can vary based on local construction and labour costs, the age of the home, its square footage, the number of rooms, the architectural style, special features, and renovations or upgrades.