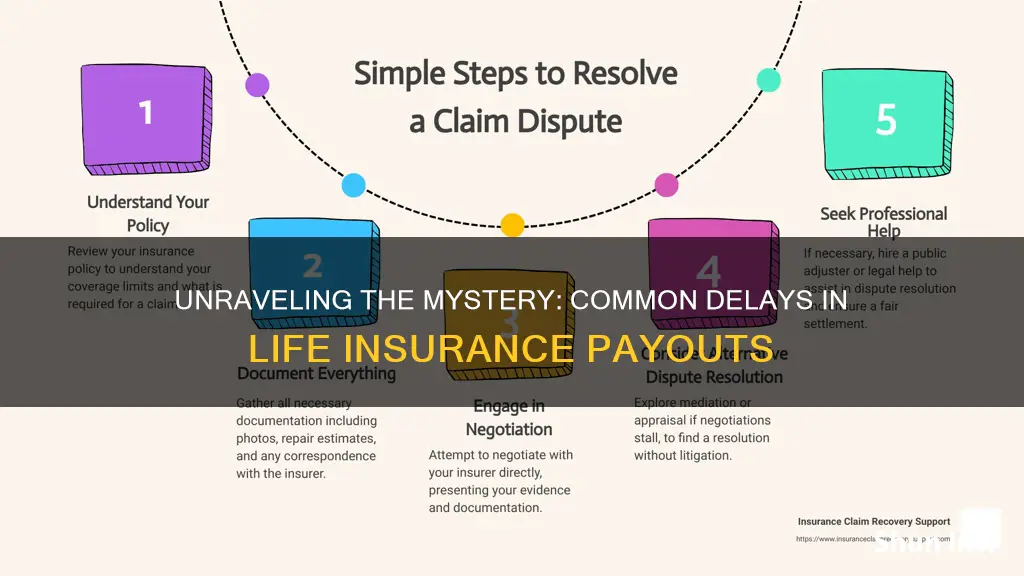

Life insurance is a crucial financial safety net, but the process of receiving a payout can sometimes be delayed, causing unnecessary stress for beneficiaries. Delays in life insurance payouts can occur due to various reasons, including administrative errors, missing documentation, or the need for additional verification. Common causes of delay include the complexity of the claim, especially when the cause of death is unclear or disputed, and the need for medical or legal investigations. In some cases, the insurance company may require additional information or evidence, such as death certificates, medical records, or witness statements, which can extend the processing time. Understanding these potential delays can help policyholders and their families navigate the claims process more effectively and ensure a smoother experience when they need it most.

What You'll Learn

- Policy Misunderstanding: Misinterpretation of policy terms can lead to delays in claims processing

- Missing Documentation: Incomplete or missing paperwork is a common cause of payout delays

- Medical Record Review: Complex medical records may require extensive review, causing delays

- Beneficiary Disputes: Disagreements among beneficiaries can complicate and delay the payout process

- Fraud Investigation: Insurance companies may need to investigate potential fraud, which can extend the payout timeline

Policy Misunderstanding: Misinterpretation of policy terms can lead to delays in claims processing

Misunderstanding the terms of a life insurance policy can be a significant pitfall for policyholders, often resulting in unnecessary delays when making a claim. This issue is prevalent because insurance policies are complex documents, often laden with technical jargon and intricate language. As a result, many policyholders may not fully comprehend the coverage they have or the specific conditions under which a claim can be made.

One common scenario where policy misunderstanding occurs is when a policyholder believes that a particular condition or exclusion is irrelevant or not applicable to their situation. For instance, some might overlook the importance of the waiting period, which is a standard clause in most life insurance policies. This waiting period, typically 30 days, ensures that the insurance company has time to verify the cause of death and process the claim. Without understanding this clause, a policyholder might mistakenly believe that the insurance payout is immediate, leading to confusion and potential delays when the claim is filed.

Another critical aspect that can be misinterpreted is the definition of 'death' as per the policy. Different insurance providers may have specific criteria for determining death, which could include the time of death, the cause, and even the method. For example, some policies might require a medical examiner's report or a specific cause of death, which the policyholder might not be aware of. Misinterpreting these definitions can lead to claims being denied or significantly delayed as the insurance company seeks clarification.

Furthermore, policyholders may also encounter delays due to a lack of understanding about the claim submission process. This includes knowing the necessary documentation, the correct channels to file a claim, and the time frame within which the claim must be made. For instance, some policies require a claim to be filed within a specific period after the insured's death, and failing to meet this deadline could result in a claim being invalid. Misinformation or a lack of clarity on these procedures can cause unnecessary delays, as the insurance company may need to guide the policyholder through the process.

To avoid these delays, it is crucial for policyholders to thoroughly review their insurance policies, seek clarification from their insurance providers, and ensure they have a comprehensive understanding of the terms and conditions. Additionally, keeping all relevant documents organized and easily accessible can facilitate a smoother claims process when the need arises.

Standard Life Health Insurance: Maternity Coverage Explained

You may want to see also

Missing Documentation: Incomplete or missing paperwork is a common cause of payout delays

The process of claiming life insurance benefits can sometimes be delayed due to various reasons, and one of the most frequent culprits is the lack of proper documentation. When an insurance company receives a claim, it needs to verify the accuracy of the information provided and ensure that all necessary paperwork is in order. Incomplete or missing documentation can lead to significant delays in the payout process, causing frustration for the policyholder and their beneficiaries.

Missing or incomplete documentation typically includes a range of documents, such as the original death certificate, the insurance policy document, and any supporting evidence required to prove the identity of the deceased and the validity of the claim. For instance, if the policyholder named a beneficiary, the insurance company will need to confirm the beneficiary's details and relationship to the deceased. This often requires additional paperwork, such as a marriage certificate or a birth certificate, to establish the beneficiary's legal status. Without these documents, the insurance provider may be unable to process the claim promptly.

In some cases, the insurance company may request additional information to support the claim, such as medical records, especially if the death was due to a covered cause. These records help the insurer understand the circumstances surrounding the death and ensure that the claim is legitimate. Delays can occur if these records are not provided or are incomplete, as the insurance company will need to investigate further to verify the information.

To avoid such delays, it is crucial for policyholders and their beneficiaries to ensure that all required documents are gathered and submitted promptly after the insured individual's passing. This includes obtaining the necessary death certificates, gathering the original insurance policy documents, and collecting any additional paperwork that may be requested. Having a clear understanding of the documentation requirements and providing them in a timely manner can significantly reduce the processing time for life insurance payouts.

Furthermore, insurance companies often provide guidance and support to policyholders and beneficiaries during the claims process. They may offer assistance in obtaining the necessary documents and can provide a list of required paperwork to ensure that nothing is overlooked. By working closely with the insurance provider and providing all the requested information, policyholders can help expedite the payout process and minimize the potential delays caused by missing documentation.

Chest Pain: Can It Impact Your Life Insurance Eligibility?

You may want to see also

Medical Record Review: Complex medical records may require extensive review, causing delays

The process of settling life insurance claims can sometimes be delayed due to the complexity of medical records, which often require thorough and meticulous review. This is a critical step in ensuring the accuracy and validity of the claim, especially in cases where the cause of death or the insured's medical history is not immediately clear. When an insurance company receives a claim, they must verify the information provided, and this often involves scrutinizing the deceased's medical records to understand their health status and any pre-existing conditions.

Complex medical records can arise from various situations. For instance, in cases of chronic illnesses or long-term health issues, the records may span multiple healthcare providers and specialists, making it challenging to piece together a comprehensive medical history. Additionally, medical records can be written in different formats and languages, further complicating the review process. The insurance company's medical experts must carefully analyze these records to determine if the insured's health was a contributing factor to their death or if there were any pre-existing conditions that could affect the claim.

Another aspect that can cause delays is the potential for discrepancies or missing information in the records. In some cases, the insured may have had multiple doctors or hospitals involved in their care, and the records from each provider might not be consistent or complete. This can lead to a lengthy process of contacting and obtaining additional medical documentation to fill in the gaps. Furthermore, the insurance company may require clarification on certain medical terms or procedures, especially if they are not familiar with specific medical jargon.

The review process also involves checking for any potential fraud or misrepresentation. Insurance companies must ensure that the medical information provided is accurate and not manipulated to gain an unfair advantage. This scrutiny can be time-consuming, especially when dealing with complex cases that require multiple expert opinions. As a result, the entire claim settlement process may be delayed to ensure a fair and thorough investigation.

In summary, the complexity of medical records is a significant factor that can cause delays in life insurance payouts. It requires a detailed and careful examination of the insured's medical history, which can be a lengthy process due to various factors, including the involvement of multiple healthcare providers, potential discrepancies, and the need for expert opinions. Insurance companies must navigate these challenges to ensure the integrity of the claims process and provide fair settlements to the policyholders.

Finding Life Insurance: Tools for the Right Policy Search

You may want to see also

Beneficiary Disputes: Disagreements among beneficiaries can complicate and delay the payout process

Beneficiary disputes can significantly impact the timely distribution of life insurance proceeds, often leading to prolonged legal battles and financial strain for all involved parties. When a policyholder passes away, the designated beneficiaries are entitled to receive the insurance payout. However, in cases where multiple beneficiaries are involved, disagreements can quickly arise, complicating the process. These disputes often stem from various factors, including differing interpretations of the policy terms, the amount of coverage, or the order of priority among beneficiaries.

One common scenario is when beneficiaries have conflicting claims regarding their rights to the insurance money. For instance, if a policy has multiple primary beneficiaries, they might disagree on the distribution of the proceeds, especially if the policy doesn't specify a clear division. This could lead to legal proceedings, where the court will need to resolve the dispute, which can take considerable time. During this period, the payout is often on hold, causing financial strain for the surviving family members who may rely on the insurance funds.

In some cases, beneficiaries might also contest the validity of the policy or the identity of the insured individual. This could be due to a lack of understanding of the policy terms, a misunderstanding of the situation, or even fraudulent activities. When such disputes arise, the insurance company must conduct thorough investigations, which can delay the payout process significantly. The company may need to gather evidence, consult legal experts, and potentially involve law enforcement, all of which contribute to the delay.

To mitigate these delays, it is crucial for policyholders to clearly communicate their wishes regarding beneficiaries and the distribution of proceeds. Updating the policy regularly to reflect any changes in beneficiaries can also help prevent future disputes. Additionally, having a clear and concise will or trust in place can provide a legal framework for resolving beneficiary disputes, ensuring a smoother and faster payout process when the time comes.

In conclusion, beneficiary disputes can be a significant source of delay in life insurance payouts, often resulting from unclear policy terms, multiple beneficiaries, or conflicting claims. These disputes can lead to legal battles, investigations, and financial strain for the beneficiaries. By being proactive in communicating and updating their wishes, policyholders can help minimize the potential for such delays and ensure a more efficient distribution of insurance proceeds.

Marketing Life Insurance: Social Media Strategies for Success

You may want to see also

Fraud Investigation: Insurance companies may need to investigate potential fraud, which can extend the payout timeline

When it comes to life insurance payouts, one of the critical factors that can significantly delay the process is the need for fraud investigation. Insurance companies have a responsibility to protect themselves and their policyholders from fraudulent activities, which can unfortunately occur in various forms. These investigations are essential to ensure that the payout is made to the rightful beneficiary and that the insurance company's funds are not misused.

Fraud in life insurance can take many forms, such as false claims, forged documents, or even identity theft. For instance, a beneficiary might provide false information about the insured individual's health or lifestyle, claiming that the insured had a pre-existing condition that was not disclosed. In other cases, fraudsters may manipulate death certificates or provide fake evidence of the insured's death. These fraudulent activities can lead to significant financial losses for the insurance company and may even result in legal consequences if not addressed promptly.

The investigation process typically involves a thorough review of all relevant documents, including the insurance policy, death certificates, medical records, and any other evidence related to the insured's life and death. Insurance companies often employ fraud detection teams or external specialists to conduct these inquiries, ensuring an unbiased and comprehensive assessment. This process can be time-consuming, as it requires careful examination of each piece of evidence and may involve interviews with various individuals, including the policyholder, beneficiaries, and medical professionals.

During the investigation, the insurance company may also need to verify the identity of the insured and the beneficiaries. This includes cross-referencing personal details, financial information, and any other data provided by the policyholder and beneficiaries. The company might also look into the insured's financial history, employment records, and any potential motives for fraud. All these steps are crucial to ensure that the payout is made to the correct person and that the insurance company's interests are protected.

The duration of the fraud investigation can vary depending on the complexity of the case and the amount of evidence that needs to be reviewed. In some instances, it may take several weeks or even months to complete the inquiry. During this time, the payout process is paused, and the insurance company cannot release the funds. This delay can be frustrating for beneficiaries who are already dealing with the emotional aftermath of a loved one's passing. Therefore, it is essential for insurance companies to have robust fraud detection mechanisms in place to minimize these delays and ensure a swift and fair resolution for all parties involved.

Life Insurance Calculation: A Guide for Retired CSRS Employees

You may want to see also

Frequently asked questions

Delays in life insurance payouts can occur due to various administrative and regulatory processes. Common reasons include the need for additional documentation, such as proof of death certificates, which may take time to obtain and verify. The insurance company may also require further investigation into the cause of death, especially in cases of suspicious circumstances or when the policy has specific terms and conditions.

During the investigation phase, the insurance company will assign a claims adjuster or a team to review the policy, gather relevant information, and assess the validity of the claim. This process can take several weeks or even months, depending on the complexity of the case. The adjuster will communicate with the beneficiaries, providing updates and requesting any necessary additional information to expedite the payout.

Yes, there are instances where a life insurance company may deny a claim. This can happen if the policyholder's death is not deemed a covered event under the policy terms. For example, if the death results from a pre-existing medical condition that was not disclosed during the application process, the insurance company may reject the claim. Additionally, fraud or misrepresentation can lead to claim denial.

If there is a suspicion of fraud, the insurance company will initiate an investigation to verify the circumstances surrounding the policyholder's death. This may involve working with law enforcement agencies and conducting thorough background checks. If fraud is confirmed, the claim will be denied, and legal action may be taken against the beneficiaries or individuals involved.

While beneficiaries cannot directly control the speed of the payout, they can facilitate the process by promptly providing all the required documentation to the insurance company. This includes death certificates, medical records, and any other supporting evidence. Quick response and cooperation with the insurance adjuster's requests can help minimize delays and ensure a smoother claims settlement process.