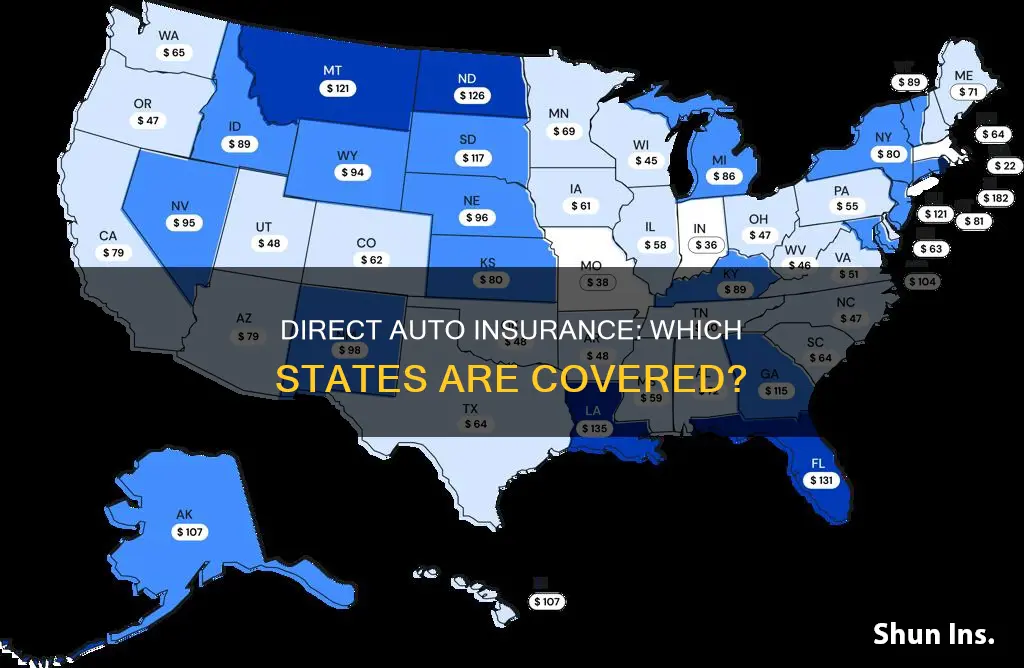

Direct Auto Insurance is a non-standard car insurance provider that caters to high-risk drivers. It is available in a limited number of states, including Alabama, Arkansas, Delaware, Florida, Georgia, Illinois, Louisiana, Michigan, Mississippi, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, and Washington. The company offers a range of standard coverages, such as liability, collision, and comprehensive insurance, as well as common add-ons like towing and rental reimbursement. Direct Auto also provides flexible payment options and various discounts to its customers.

| Characteristics | Values |

|---|---|

| Number of States Covered | 15-18 |

| States Covered | Alabama, Arkansas, Delaware, Florida, Georgia, Louisiana, Michigan, Mississippi, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, Washington |

| Type of Insurance | Non-standard/Non-owner/High-risk |

| Type of Coverage | Automobile/Motorcycle/Commercial Auto/Life/Accident Medical Expense/Access to Medicare and Federal Health Insurance Marketplace |

What You'll Learn

- Direct Auto Insurance is available in 15-18 states

- Alabama, Arkansas, Delaware, Florida, Georgia, Louisiana, Michigan, Mississippi, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, and Washington

- Specialises in insurance for high-risk drivers

- Offers flexible payment options

- Has higher-than-average customer complaints?

Direct Auto Insurance is available in 15-18 states

The company offers all the standard coverages, including liability, collision, comprehensive, uninsured motorist, personal injury protection, and medical payments. Common policy add-ons, such as towing coverage, rental reimbursement, and roadside assistance, are also available. Direct Auto Insurance assists with SR-22 filing and offers flexible payment options.

The exact number of states that Direct Auto Insurance is available in may vary, as one source mentions 15 states, while another mentions 18 states, with a focus on the Southeast region. It's always a good idea to check the company's website or contact their customer service for the most up-to-date and accurate information regarding the states they operate in.

Direct Auto Insurance has a high level of customer complaints, with a complaint index score of 4.3 from the National Association of Insurance Commissioners, indicating four times as many complaints as the average insurance company. The company has also received a failing grade from collision repair professionals for its handling of collision claims.

Auto Insurance in Florida: Affordable or Not?

You may want to see also

Alabama, Arkansas, Delaware, Florida, Georgia, Louisiana, Michigan, Mississippi, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, and Washington

Direct Auto Insurance offers coverage in 16 states across the United States. These include Alabama, Arkansas, Delaware, Florida, Georgia, Louisiana, Michigan, Mississippi, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, and Washington.

Direct Auto Insurance provides affordable coverage, with friendly agents helping customers choose the right amount of coverage for their needs. The company offers a range of insurance policies for cars, motorcycles, and life insurance. They also assist customers in setting up affordable payment plans that work for their budgets and help them find any discounts they may be entitled to.

With 47 locations in Alabama alone, Direct Auto Insurance emphasizes simplicity and savings. Customers can visit a nearby location or search by city, state, or ZIP code to find the nearest office. The company caters to customers regardless of their driving history, offering respect and assistance in understanding their policies and coverage options.

Direct Auto Insurance provides a straightforward and personalized experience, ensuring that insurance is easy to choose and fits within individual budgets.

Handicap Permit: Impact on Auto Insurance Rates and Coverage

You may want to see also

Specialises in insurance for high-risk drivers

Direct Auto Insurance is a specialist in non-standard car insurance for high-risk drivers. It offers all the standard coverages, including liability, collision, comprehensive, uninsured motorist, personal injury protection, and medical payments. It also provides common policy add-ons like towing coverage, rental reimbursement, and roadside assistance.

High-risk drivers are those with multiple accidents, traffic violations, or DUIs on their record. They may also be those who are ineligible for standard car insurance due to poor credit or a lapse in coverage. Direct Auto Insurance is ideal for those seeking coverage that meets their state's minimum requirements.

The company has a wide range of discount options and multiple payment methods, including debit card, credit card, e-check, and cash (at local branches). Direct Auto Insurance also offers a mobile app, allowing policyholders to sign and view policy documents, access their ID cards, make payments, file claims, and request roadside assistance.

In addition to car insurance, Direct Auto Insurance also offers individual term life insurance, accident medical expense coverage, and access to Medicare and the federal health insurance marketplace. The company is available in a limited number of states, including Alabama, Arkansas, Delaware, Florida, Georgia, Louisiana, Michigan, Mississippi, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, and Washington.

Other companies that offer competitive rates for high-risk drivers include State Farm, Erie, Geico, Progressive, Amica, and USAA. These companies provide coverage for drivers with at-fault accidents, speeding tickets, DUI/DWI convictions, and bad credit.

Insuring a Friend's Car: Your Options

You may want to see also

Offers flexible payment options

Direct Auto Insurance offers flexible payment options to its customers. This includes accepting payments via debit card, credit card, e-check, or cash (at local branches). Direct Auto also offers a range of discounts to its customers, such as multi-vehicle, multi-policy, military, dynamic drive, safe driver, good student, driving courses, prior coverage, safety equipment, and payment discounts. Customers can also save money by enrolling in autopay, opting for paperless statements, or paying their policies in full.

Direct Auto Insurance is a part of the Direct General Group and is known for providing non-standard car insurance to high-risk drivers. The company offers all the standard coverages, including liability, collision, comprehensive, uninsured motorist, personal injury protection, and medical payments. In addition to standard car insurance, Direct Auto also offers several additional options, such as roadside assistance, rental reimbursement, and towing and labor coverage.

Direct Auto Insurance is available only in a limited number of states, including Alabama, Arkansas, Delaware, Florida, Georgia, Louisiana, Michigan, Mississippi, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, and Washington. The company serves its customers through licensed independent agent partners strategically located in these states.

Direct Auto Insurance is based out of Chicago and was formed in 2007. The company became a member of the Nodak Insurance Group family in September 2018 and was acquired by National General Insurance in 2016. In 2021, Allstate purchased National General and its subsidiaries, making Direct Auto a part of Allstate. Despite this, Direct Auto continues to operate independently and has retained its name.

Auto Insurance Mandate: Safety, Security, and Financial Protection

You may want to see also

Has higher-than-average customer complaints

Direct Auto Insurance has received an above-average number of customer complaints. The National Association of Insurance Commissioners (NAIC) gave the company a complaint index score of 4.3, indicating that Direct Auto has received four times as many complaints as the average insurance company. Direct Auto's NAIC rating is 10.92, further emphasising that the company has more customer complaints than the average competitor, adjusted for size.

A review of Direct Auto Insurance on U.S. News & World Report also mentions that the company has higher-than-average customer complaints. WalletHub, another review platform, rates Direct Auto Insurance at 4.0/5, indicating average performance, but notes that the rating is influenced by a large number of customer complaints.

The Better Business Bureau (BBB) reports 306 total complaints against Direct Auto Insurance in the last three years, with 71 complaints closed in the last 12 months. The BBB provides examples of various complaints, including issues with service and repairs, customer service, and claims handling.

One common issue raised by customers is difficulty reaching representatives and long wait times when trying to contact the company. There are also complaints about unexpected changes in payment amounts and issues with policy cancellations and reimbursements. Some customers have reported problems with claims handling, including delays, lack of communication, and denial of claims.

It is important to note that the presence of complaints does not necessarily indicate poor service, and the context and specifics of each situation should be considered. However, the higher-than-average volume of complaints against Direct Auto Insurance is a factor that potential customers may want to consider when evaluating their insurance options.

Get Back on the Road: Auto Insurance After Cancellation

You may want to see also

Frequently asked questions

Direct Auto Insurance operates in 18 states.

Direct Auto Insurance is available in Alabama, Arkansas, Delaware, Florida, Georgia, Illinois, Louisiana, Michigan, Mississippi, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, and Washington.

Direct Auto Insurance caters to high-risk drivers, including those with multiple accidents, traffic violations, or DUIs on their record.

The standard coverage options offered by Direct Auto Insurance include liability, collision, comprehensive, uninsured motorist, personal injury protection, and medical payments.

Direct Auto Insurance offers various optional coverage options, such as accidental death benefits, emergency roadside assistance, Mexico auto insurance, towing coverage, and rental reimbursement.