Life insurance and annuities are both long-term financial products that can be used to provide for your loved ones after your death or to fund your retirement. They are also both subject to tax implications, which can vary depending on the type of policy or contract you have and when and how you withdraw your funds. So, what tax form do you need to cash in a life insurance annuity?

What You'll Learn

Taxation of qualified vs non-qualified annuities

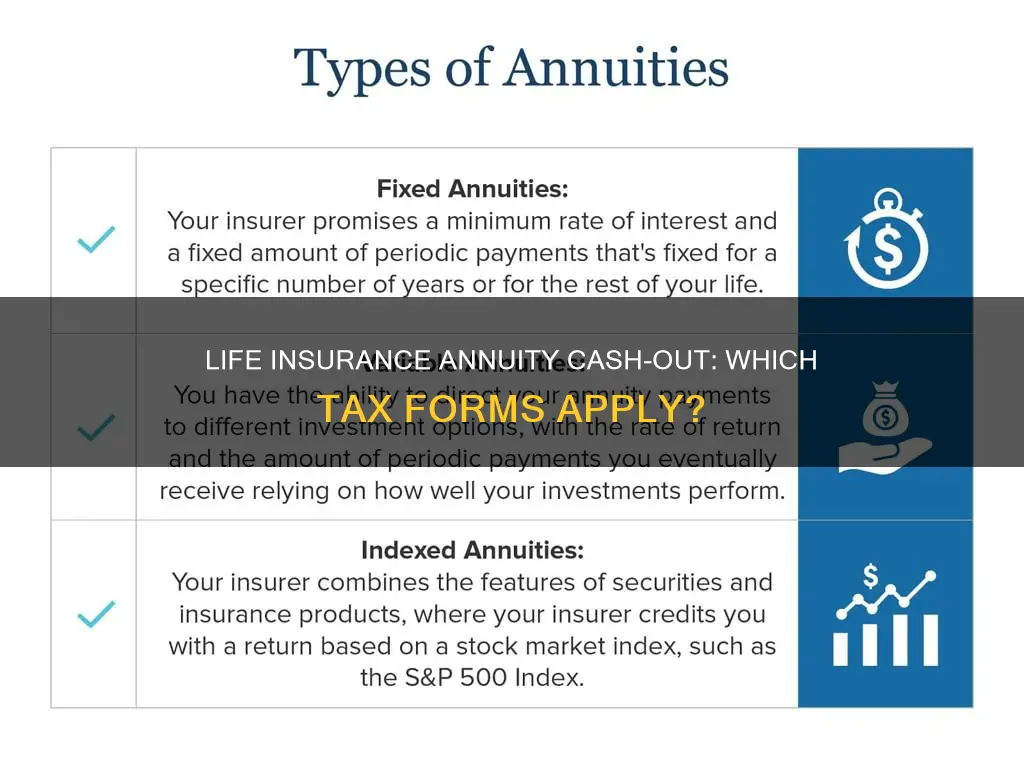

Taxation on annuities depends on whether they are qualified or non-qualified. The type of annuity is defined by factors such as whether it is immediate or deferred, and whether it is fixed, variable, or indexed.

Qualified annuities are generally funded with pre-tax dollars, although Roth annuities are funded with after-tax money. Qualified annuities are subject to required minimum distribution (RMD) guidelines, and you will pay normal income taxes on the entire distribution amount. However, payouts from annuities purchased with a Roth IRA or Roth 401(k) may be tax-free if certain requirements are met.

Non-qualified annuities, on the other hand, are funded with after-tax dollars and grow tax-deferred. They are exempt from RMD guidelines during the owner's life. With non-qualified annuities, you do not pay taxes on the principal, only on the growth. When you withdraw money from a non-qualified annuity, the money you put in can be withdrawn tax-free, but you will be taxed on any growth.

Both qualified and non-qualified annuities can provide a steady stream of income for life, but they are designed to meet distinct needs. It is important to consider the general tax rules of each type of annuity to make the most of them. Consulting a tax advisor or insurance professional can help you understand the tax implications of each type of annuity.

Credit Life Insurance: Mandatory or Optional?

You may want to see also

Withdrawals from variable annuities

If you cash in the entire annuity for a lump sum, you will have to pay income taxes on all of the earnings in one year. However, if you withdraw some of the money and keep the rest growing in the account, your first withdrawals will be considered taxable earnings. Once you have pulled out all of the earnings, any further withdrawals will be considered a tax-free return of principal. Your insurer will calculate the portion of principal and earnings for each withdrawal.

In general, you can recover the cost of your pension or annuity tax-free over the period you are to receive the payments. The amount of each payment that is more than the part that represents your cost is taxable.

If you receive a large sum of money, especially after the death of a loved one, you may need some time to decide what to do with the money. Waiting can help beneficiaries avoid rash decisions. You can also choose to take periodic payments from the proceeds of a life insurance policy instead of a lump sum.

Backdating Life Insurance: Understanding the Risks and Benefits

You may want to see also

Interest earned on beneficiary life insurance

Life insurance proceeds are generally not taxable to the beneficiary. However, interest earned on beneficiary life insurance is taxable. This means when a beneficiary receives life insurance proceeds after a period of interest accumulation rather than immediately upon the policyholder's death, the beneficiary must pay taxes on the interest. For example, if a beneficiary receives a $500,000 death benefit that earns 10% interest for one year before being paid out, they will owe taxes on the $50,000 growth.

If you receive a large sum of money from life insurance, you may want to consider taking periodic payments (such as weekly, monthly, or yearly) instead of a lump sum. This way, you can recover the cost of your annuity tax-free over the period you receive the payments. The amount of each payment that is more than the part that represents your cost is taxable.

There are a few other tax implications of life insurance to be aware of. Life insurance is generally exempt from taxes when your beneficiaries are paid the death benefit, your cash value increases, you borrow money from your cash value, you withdraw cash value but it's less than what you paid in premiums, or you exchange your life insurance for a different policy or an annuity. However, life insurance can be taxed when your beneficiaries owe estate or inheritance taxes, you cancel or lapse a policy with a cash value worth more than you paid, you have an outstanding policy loan when you cancel or lapse your policy, or your policy is a modified endowment contract.

Voluntary Group Life Insurance: What Employees Need to Know

You may want to see also

Cash value life insurance taxable scenarios

Cash value life insurance is a type of permanent plan, such as whole life and universal life insurance. With this type of policy, a portion of your premium payments goes toward the death benefit while the remainder builds cash value over time. This cash value can be borrowed against to pay premiums or purchase an annuity, and it can grow over time and accrue interest.

While the cash value of life insurance isn't usually taxable, there are some scenarios where you may have to pay taxes on it. Here are some taxable scenarios to consider:

Withdrawals

You can generally withdraw an amount equal to your total premium payments without owing taxes. However, once your withdrawals exceed the amount you've put into your policy, you will typically owe income tax on those withdrawals.

Policy Loans

You can borrow from the cash value of your policy, and this type of loan may not generate a tax bill as long as the policy is maintained. However, if your policy ends before you've repaid the loan, you may have to pay taxes on the amount above the policy's basis, which is the interest earned.

Surrendering or Cashing Out

When you surrender or cash out your policy, you can receive the cash value of your account plus accrued interest minus any loans, unpaid premiums, and surrender fees. This net cash surrender value is generally taxable if it exceeds the amount you paid in premiums.

Modified Endowment Contracts

Overfunding your life insurance policy can lead to it being converted into a Modified Endowment Contract (MEC), which has tax consequences. Withdrawals and loans from a MEC are generally taxable.

Beneficiary Payments

Life insurance is generally exempt from taxes when your beneficiaries are paid the death benefit. However, your beneficiaries may owe estate or inheritance taxes, which could result in tax consequences.

It's important to note that the tax implications of cash value life insurance can vary depending on your unique situation. Consulting a tax advisor or insurance professional can help you understand the specific tax consequences of your policy.

Pregnancy: A Life-Changing Event with Insurance Implications

You may want to see also

Annuity taxation and retirement plans

Annuities can be a great addition to your retirement plan, but it's important to be aware of the potential tax implications to make the most of your savings. Taxation on annuities depends on the type of annuity you have and when you withdraw funds.

Qualified vs. Non-Qualified Annuities

The type of annuity you own determines how it is taxed. Qualified annuities are generally funded with pre-tax dollars, while non-qualified annuities are funded with after-tax dollars. Qualified annuities include Roth annuities, which are funded with after-tax money. Non-qualified annuities, on the other hand, are exempt from required minimum distribution guidelines during the owner's lifetime.

Withdrawals and Distributions

The timing of your withdrawals from an annuity can impact any penalties and taxes incurred. Withdrawals made before the age of 59 1/2 are typically subject to a 10% early withdrawal penalty tax. This applies to both qualified and non-qualified annuities, but the specifics vary. For qualified annuities, the entire distribution amount may be subject to the penalty, while for non-qualified annuities, only the withdrawn earnings and interest are usually penalized. Additionally, you may need to pay surrender charges to the annuity issuer.

Periodic vs. Non-Periodic Payments

The frequency of your annuity payments also affects their tax status. Periodic payments, made at regular intervals (weekly, monthly, or yearly) for an extended period, are generally taxed on the amount exceeding the cost of the contract. Non-periodic payments, on the other hand, are taxed differently. You include the payment in gross income only to the extent that it exceeds the cost of the contract.

Tax-Free Exchanges

It's worth noting that exchanging one annuity contract for another, or exchanging for a life insurance or endowment contract, can be done tax-free. This is true even if the new contract is funded by multiple payments from the old annuity. However, if the annuity is exchanged for a life insurance or endowment contract, any interest accumulated is considered ordinary income.

Life Insurance Allocation: Understanding Your Percent Coverage

You may want to see also

Frequently asked questions

Annuities are long-term insurance products sold by life insurance companies. They are considered long-term investments that may be suitable for retirement.

You may need to fill out IRS Publication 575, which covers Pension and Annuity Income.

Yes, there are two main categories: annuities that help you save for retirement and annuities that help you create income in retirement.

Yes, there may be tax consequences depending on the type of annuity and when you withdraw funds. For example, withdrawals from variable annuities may be subject to ordinary income tax and a 10% penalty if taken before the age of 59 1/2.