Term insurance and ROP (return of premium) insurance are two types of life insurance policies. Term insurance is a simple and affordable form of life insurance that offers coverage for a specified term, such as 10, 20, or 30 years. If the policyholder dies during the term, the death benefit goes to their beneficiaries. However, if the policyholder outlives the term, their coverage simply ends, and they do not receive any reimbursement of the premiums paid. On the other hand, ROP insurance is a type of term life insurance that provides a death benefit if the policyholder dies during the term but also refunds the premiums paid if the policyholder outlives the policy term. This added benefit makes ROP insurance considerably more expensive than a regular term policy. When deciding between term and ROP insurance, it is important to consider your financial situation, risk tolerance, and tax situation.

| Characteristics | Values | |

|---|---|---|

| Type of Insurance | Term Insurance | Return of Premium (ROP) Insurance |

| Payout | No payout if the policyholder outlives the term | Death benefit paid to beneficiaries if the policyholder dies during the term; Refund of premiums paid if the policyholder outlives the term |

| Cost | Lower premiums | Higher premiums |

| Investment | N/A | Opportunity to invest the difference between standard and ROP premiums |

| Riders | N/A | Available for an additional cost |

What You'll Learn

- Return of Premium (ROP) term life insurance provides a death benefit to beneficiaries if the policyholder dies during the term

- ROP insurance is more expensive than regular term insurance but guarantees a refund of premiums paid

- ROP plans offer additional benefits such as survival benefits, tax benefits, and coverage for critical illnesses

- ROP riders can increase the cost of a term life insurance policy by 20-40%

- ROP insurance is not offered by many companies but includes providers like Mutual of Omaha, AAA, and Assurity

Return of Premium (ROP) term life insurance provides a death benefit to beneficiaries if the policyholder dies during the term

Return of Premium (ROP) term life insurance is a type of insurance policy that provides a death benefit to beneficiaries if the policyholder dies during the term. It also refunds the premiums paid if the policyholder outlives the policy term. This is in contrast to a standard term life insurance policy, where no payout is received if the policyholder outlives the term.

With ROP term life insurance, policyholders can receive a refund of all premiums paid at the end of the contract. This addresses the common complaint that if one doesn’t die, premiums are lost to insurance companies. However, ROP insurance is considerably more expensive than regular term policies, and the returned amount doesn't account for inflation.

When considering ROP insurance, it's important to evaluate whether the additional cost is worth the potential benefits. Policyholders can compare the cost of ROP insurance to the potential returns of investing the difference in premiums. Additionally, factors such as risk tolerance, tax situation, and investment options should be considered when making a decision.

ROP term life insurance provides both death and maturity benefits within the same plan. It offers tax benefits under sections 80C and 10(10D) of the Income Tax Act, 1961, providing tax exemptions on premiums paid and benefits received.

When choosing an ROP term life insurance policy, it's important to consider factors such as cost, financial strength, customer satisfaction, convertibility, and available riders. Shopping around and comparing different providers can help find the best premium rates.

The Slippery Slope of Insurance: Understanding the "Sliding" Concept

You may want to see also

ROP insurance is more expensive than regular term insurance but guarantees a refund of premiums paid

Return of Premium (ROP) insurance is a type of term life insurance that provides a death benefit to beneficiaries if the policyholder dies during the term of the policy. However, if the policyholder outlives the policy term, ROP insurance refunds the premiums paid, which is not the case with a standard term life insurance policy.

ROP insurance is more expensive than regular term insurance. The rider can cost 20-40% more, and the payable premiums are quite heavy in comparison to traditional insurance plans. This is because, in addition to life coverage, ROP plans offer a guaranteed refund of premiums paid, which can be thought of as an investment component.

Despite the higher cost, ROP insurance may be appealing to those who want to force themselves to save money and who are risk-averse. It is also a good option for those seeking both insurance coverage and the benefit of a premium refund on maturity. Additionally, ROP insurance offers tax benefits, as the payable premiums are eligible for tax benefits under Section 80C of the Income Tax Act, 1961.

Before choosing an ROP plan, it is important to consider the pros and cons and make an informed decision based on specific needs and requirements. The high cost of ROP insurance may be a deterrent for some, and it is worth noting that the money returned is not adjusted for inflation. As an alternative, one could invest the difference between standard and ROP premiums to potentially achieve better returns.

The Hidden Hazards of Adverse Selection: Unraveling Insurance's Dark Secret

You may want to see also

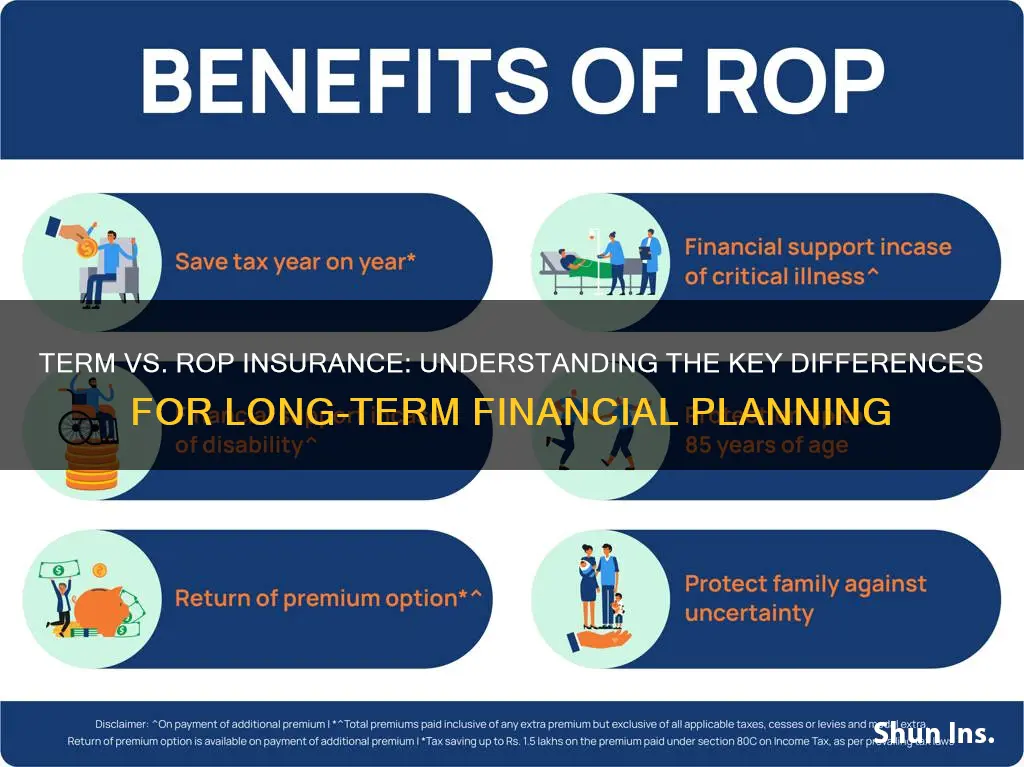

ROP plans offer additional benefits such as survival benefits, tax benefits, and coverage for critical illnesses

ROP plans offer a range of benefits to the policyholder, including:

- Survival benefits: If the policyholder survives the policy term, they will receive a full refund of the premiums they have paid. This can be seen as an investment component of the plan, and the money can be used to fund retirement.

- Tax benefits: The premiums paid towards the plan are eligible for tax benefits under the Income Tax Act, 1961.

- Critical illness coverage: ROP plans can include critical illness coverage, which provides financial protection in the event of a critical illness such as a heart attack, stroke, or cancer. This coverage can help with medical costs and other expenses related to the illness.

- Accidental death benefit: ROP plans may also include an accidental death benefit, which provides additional financial protection in the event of an accidental death.

- Waiver of premium: This benefit waives future premium payments under specific conditions, such as if the policyholder becomes disabled.

- Disability benefit: ROP plans may also include a disability benefit, which provides financial protection in the event of a disability.

- Protection against other illnesses: ROP plans may also offer protection against other serious illnesses, such as kidney failure, liver failure, and paralysis.

- Loan option: ROP plans often have a cash value component, which means the policyholder can borrow against the policy if needed.

Overall, ROP plans offer a range of benefits that can provide financial protection and peace of mind to the policyholder and their loved ones.

The Dark Side of Short-Term Insurance: Uncovering the Hidden Pitfalls

You may want to see also

ROP riders can increase the cost of a term life insurance policy by 20-40%

Return of Premium (ROP) is a type of term life insurance policy that provides a death benefit to beneficiaries if the policyholder dies during the term of the policy but refunds the premiums paid if the policyholder outlives the policy term.

A standard term life insurance policy, on the other hand, does not offer any payout if the policyholder outlives the term. ROP insurance is therefore more expensive than a regular term policy.

The ROP rider on average will run 20%-40% higher than purchasing a policy without it. This is a substantial increase in cost. For example, a 30-year-old male non-smoker taking out a 30-year term life policy with a $1,000,000 face value can expect to pay approximately $720 per year without the ROP rider, and $1,180 per year with the rider – a difference of $460 per year or a 63.88% increase.

Whether or not the ROP rider is worth the extra cost depends on the likelihood that the policyholder will invest the money elsewhere at a higher rate of return. If the policyholder can afford the higher premium and is confident that their investment returns will be higher than the rate of inflation, then they may be better off without the ROP rider. However, if the policyholder has a low-risk tolerance or prefers the guaranteed rate of return offered by the ROP rider, then it may be a worthwhile investment.

The Intricacies of Insurance Occurrences: Unraveling the Legal and Financial Implications

You may want to see also

ROP insurance is not offered by many companies but includes providers like Mutual of Omaha, AAA, and Assurity

ROP insurance is not offered by many companies, but it does include providers like Mutual of Omaha, AAA, and Assurity.

Mutual of Omaha is considered the best overall provider of ROP insurance. Qualified applicants can get a same-day decision on coverage and skip the medical exam. The company includes a terminal illness living benefit on its ROP policies, and you can convert your policy to a permanent life insurance policy. You can also renew coverage after the level term period until age 100 if you want. Mutual of Omaha also offers a wide variety of riders on its ROP policies, including a waiver of premium rider, accidental death benefit, and children's term rider.

AAA is a good option if you are unsure of how long you want your term insurance to last, as it offers 15-, 20-, and 30-year terms on its ROP policies. AAA is also one of the few companies that offer no-medical-exam underwriting. However, you cannot customise your policy with riders.

Assurity is a certified B corporation, which means the company meets high standards of accountability and transparency and is committed to social equity and the environment. It also receives fewer complaints than expected for a company of its size. You can add a range of riders to your coverage, including a disability waiver of premium and a critical illness benefit. The conversion period for ROP and other term policies lasts until two years before the end of the policy's level term period or until you turn 65.

Understanding Short-Term Insurance: Temporary Coverage, Long-Term Peace of Mind

You may want to see also

Frequently asked questions

In a traditional term insurance plan, the policyholder's nominee(s) will receive a sum of money, known as the sum assured, upon the policyholder's death during the policy term. However, if the policyholder outlives the policy term, there are no accrued benefits upon the maturity of the plan. On the other hand, ROP insurance, or Term Life with Return of Premium, is a type of term life insurance that provides a death benefit to beneficiaries if the policyholder dies during the term of the policy but also refunds the premiums paid if the policyholder outlives the policy term.

ROP insurance offers a guaranteed refund on the policy's maturity, addressing the common complaint that premiums are lost to insurance companies if the policyholder does not die. It also acts as a vehicle for saving money and can provide financial protection for loved ones. Additionally, ROP insurance offers tax benefits, as the premiums and benefits received are usually tax-free.

ROP insurance is considerably more expensive than regular term insurance, with the rider costing 20-40% more. The returned amount also does not account for inflation, and early termination of the policy may result in a loss of premiums.