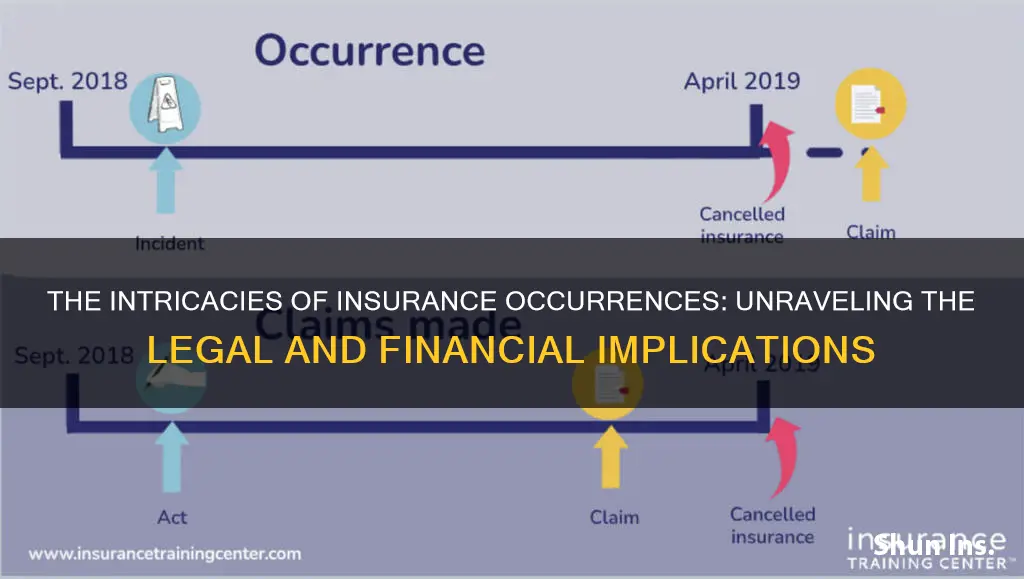

In insurance, an occurrence is defined as an accident or single event that results in an insurance claim. This includes continuous or repeated exposure to the same harmful conditions, such as hazardous chemicals, which may cause damage or injury long after the initial exposure. Occurrence policies cover claims made during the life of the policy, even if they are filed after the policy is cancelled or has expired. This is in contrast to claims-made policies, which only cover claims filed while the policy is active. Occurrence policies are typically more expensive due to the longer coverage they provide.

| Characteristics | Values |

|---|---|

| Definition | An occurrence is an event that could lead to an insurance claim. |

| Type of Policy | Occurrence policies are one of the two types of insurance policies, the other being claims-made policies. |

| Coverage | Occurrence policies cover claims made for injuries sustained during the life of an insurance policy. |

| Time of Filing a Claim | Claims can be filed even after the policy is cancelled or is no longer in force. |

| Applicability | Occurrence policies are applicable for events that may cause injury or damage years after they occur, such as exposure to hazardous chemicals. |

| Caps | Insurers typically place a cap on the total coverage offered through occurrence policies. |

| Cost | Occurrence policies are more expensive than claims-made policies. |

| Premium | Premiums for occurrence policies tend to be fixed and do not increase unless the risk profile of the insured changes. |

What You'll Learn

- Occurrence-based insurance policies cover losses that occur during the policy period, even if the policy is no longer active when the claim is filed

- Occurrence policies are typically more expensive than claims-made policies

- Occurrence policies are designed to protect against long-tail events, which are incidents that could cause injury or damage years after they occur

- Occurrence policies cover claims made for injuries sustained during the life of the insurance policy

- In commercial general liability (CGL) coverage, an occurrence is an accident, including continuous or repeated exposure to harmful conditions

Occurrence-based insurance policies cover losses that occur during the policy period, even if the policy is no longer active when the claim is filed

Occurrence-based insurance policies provide coverage for losses that occur during the policy period, even if the policy is no longer active when the claim is filed. This means that the insured party has the right to request compensation for damages that occurred within the timespan that the policy was active, even if several years have passed since and the insurance agreement is no longer in force.

Occurrence-based insurance policies are designed to protect against long-tail events, which are incidents that could cause injury or damage years after they occur. For example, exposure to hazardous chemicals or a chemical spill may take years or even decades to produce visible injuries or illnesses. Occurrence-based policies will provide coverage even if many years pass before injuries or damages become known, or if the policyholder has switched insurers or cancelled their insurance altogether.

Occurrence-based insurance policies typically have per-occurrence caps (funds available to pay for covered losses) and aggregate caps (amount used for all claims during the policy period). These limits establish the maximum an insurer will pay if the policyholder suffers a loss under the policy. With occurrence-based policies, these limits will reset annually, giving the policyholder a new block of coverage for claims that arise in the following year. Over many years, an occurrence policy will provide much more protection than a claims-made policy, which is why occurrence policies often cost more.

Occurrence-based insurance policies offer several advantages, including long-term protection and fixed costs. As long as coverage is in place when an incident occurs, a claim can be made on that period years into the future. Additionally, occurrence policy costs tend to be fixed, with premiums generally remaining stable over time and only increasing if the risk profile of the insured changes.

However, there are also some disadvantages to occurrence-based insurance policies. They tend to be more expensive than claims-made policies, especially during the first few policy years. They can also be riskier for insurers, as they must project the potential claim costs for their policyholders many years into the future. If the insurer underestimates those costs, they may not charge enough to cover future claims, straining their financial reserves and solvency. Additionally, occurrence policies can complicate the purchase decision, as the policyholder must consider their potential risks and claim costs in the future when buying the policy. If the policy limit is set too low, they may have to pay for a claim out of pocket later on.

Understanding the Fundamentals: Is Insurance Term or Permanent?

You may want to see also

Occurrence policies are typically more expensive than claims-made policies

In insurance, an occurrence is defined as an accident, or a single event that results in a claim. Occurrence policies cover claims made for injuries sustained during the life of an insurance policy, even if they are filed after the policy is cancelled. They are designed to protect against long-tail events, which are incidents that could cause injury or damage years after they occur, such as exposure to hazardous chemicals.

Occurrence policies also have fixed costs, which do not increase unless the risk profile of the insured changes. In contrast, claims-made policies have lower initial premiums, but these typically increase over time to reflect a higher risk probability.

Another factor that makes occurrence policies more expensive is that they are providing more coverage because the aggregating limits apply to future claims. This means that occurrence policies offer greater peace of mind, as the limit is applied to only a 12-month period. Conversely, a claims-made limit could be exhausted sooner since it could apply to multiple years of risk.

It is worth noting that, over time, the cost of claims-made policies tends to even out with occurrence policies as businesses face more exposures. Additionally, occurrence policies may be simpler to manage, as they do not require the purchase of an extended reporting period or "tail coverage" if the insured switches insurers or cancels their policy.

Understanding General Aggregate Limits: The Cap on Insurance Claims

You may want to see also

Occurrence policies are designed to protect against long-tail events, which are incidents that could cause injury or damage years after they occur

In insurance, an occurrence is defined as an accident, including continuous or repeated exposure to substantially the same harmful conditions. An occurrence policy is designed to protect against long-tail events, which are incidents that could cause injury or damage years after they occur. For example, a chemical spill is a long-tail event because it often takes decades for visible injuries or diseases to manifest. Occurrence policies are different from claims-made policies, which only provide benefits if a claim is filed while the policy is active.

Occurrence policies offer long-term protection, allowing individuals to make a claim on a policy years into the future, as long as coverage was in place when the incident occurred. This type of policy is particularly relevant in cases where an individual is exposed to hazardous chemicals, as a significant amount of time could pass before they fall ill. Occurrence policies also cover claims made for injuries sustained during the life of an insurance policy, even if they are filed after the policy is cancelled.

Occurrence policies are typically more expensive than claims-made policies due to the extended coverage they provide. They also have fixed costs, with premiums generally remaining stable over time and only increasing if the risk profile of the insured changes. However, occurrence policies can be harder to obtain, and there is a risk that the level of damages incurred may be underestimated, resulting in additional out-of-pocket expenses.

Understanding the difference between occurrence and claims-made policies is crucial for insurance buyers to ensure they have the right coverage in place. Occurrence policies focus on the timing of the event that gives rise to a claim, while claims-made policies centre on the timing of the claim itself.

The Language of Fire Insurance: Understanding the Terms and Conditions

You may want to see also

Occurrence policies cover claims made for injuries sustained during the life of the insurance policy

An occurrence policy provides coverage for incidents that happen during the policy period, regardless of when a claim is filed. This means that the insured party has the right to request compensation for damages that occurred within the timespan that the policy was active, even if several years have passed and the insurance agreement is no longer in force. Occurrence policies are designed to protect against long-tail events, which are incidents that could cause injury or damage years after they occur. For example, exposure to hazardous chemicals may not result in illness until a significant amount of time has passed.

Occurrence policies are an alternative to claims-made policies, which only provide benefits if a claim is filed while the policy is active. Claims-made policies are commonly written by insurance companies and are a popular option when there is a delay between the event occurring and the claimant filing a claim. However, occurrence policies offer long-term protection and are more suitable for businesses that feel current transactions may lead to greater chances of claims in the future.

Insurers usually place a cap on the total coverage offered through occurrence policies. One form of cap limits the amount of coverage offered each year but allows the coverage limit to reset annually. For instance, a company with five years of occurrence coverage and an annual cap of $1 million will have a total coverage limit of $5 million.

Occurrence policies are typically more expensive than claims-made policies due to the guarantee of future coverage. Additionally, occurrence policy costs tend to be fixed, with premiums generally not increasing unless the risk profile of the insured changes.

Understanding the Nuances of Convertible Term Life Insurance: Attained vs. Original Age

You may want to see also

In commercial general liability (CGL) coverage, an occurrence is an accident, including continuous or repeated exposure to harmful conditions

In insurance terms, an occurrence is defined as an accident, including continuous or repeated exposure to harmful conditions. It is an event that could lead to an insurance claim. In commercial general liability (CGL) coverage, an occurrence is an accident, encompassing continuous or repeated exposure to substantially the same general harmful conditions. CGL insurance protects businesses from claims of bodily injury, property damage, and personal and advertising injury (slander and false advertising).

CGL policies can be purchased on an occurrence or claims-made basis. Occurrence policies provide coverage for incidents that occur during the policy period, regardless of when the claim is filed. This means that if an incident happens while the policy is active, the insurer will cover the claim even if the policy has expired by the time the claim is made. Occurrence policies are designed to protect against long-tail events, which are incidents that may cause injury or damage years after they occur, such as exposure to hazardous chemicals.

On the other hand, claims-made policies only provide coverage if the incident occurs and the claim is filed during the policy period. Claims-made policies may include an extended reporting period, which covers claims made for a specified time after the policy expires, typically 30 to 60 days.

Occurrence policies offer long-term protection and fixed costs. However, they tend to be more expensive than claims-made policies and may be harder to obtain. It's important to consider the advantages and disadvantages of each type of policy when deciding which one is best for your business.

In summary, in the context of CGL coverage, an occurrence refers to an accident, including continuous or repeated exposure to harmful conditions, and CGL occurrence policies provide coverage for incidents that occur during the active policy period, even if the claim is filed after the policy expires.

A Decade of Security: Unraveling the Benefits of 10-Year Level Term Insurance

You may want to see also

Frequently asked questions

An occurrence is an event that could lead to an insurance claim. It is synonymous with an accident and refers to bodily injury or property damage that occurs during an active insurance policy. Occurrence policies cover claims made for injuries sustained during the life of an insurance policy, even if they are filed after the policy is cancelled.

A claims-made policy provides coverage for claims filed during the policy period, whereas an occurrence policy covers incidents that happen during the policy period, regardless of when the claim is filed. Claims-made policies are typically cheaper than occurrence policies, which offer long-term protection.

Common occurrences in home insurance include break-ins, fires, burst pipes, or dog bites that lead to liability claims. In commercial general liability insurance, occurrences can include slip and fall accidents or property damage caused by a fire.

Advantages of an occurrence policy include long-term protection and fixed costs. As long as the incident occurred during the policy period, a claim can be filed years later, even if the policy is no longer active. Additionally, occurrence policy costs tend to be stable and only increase if the insured's risk profile changes. However, occurrence policies are usually more expensive than claims-made policies and may be harder to obtain. There is also a risk of underestimating the level of damages, which can result in out-of-pocket expenses.