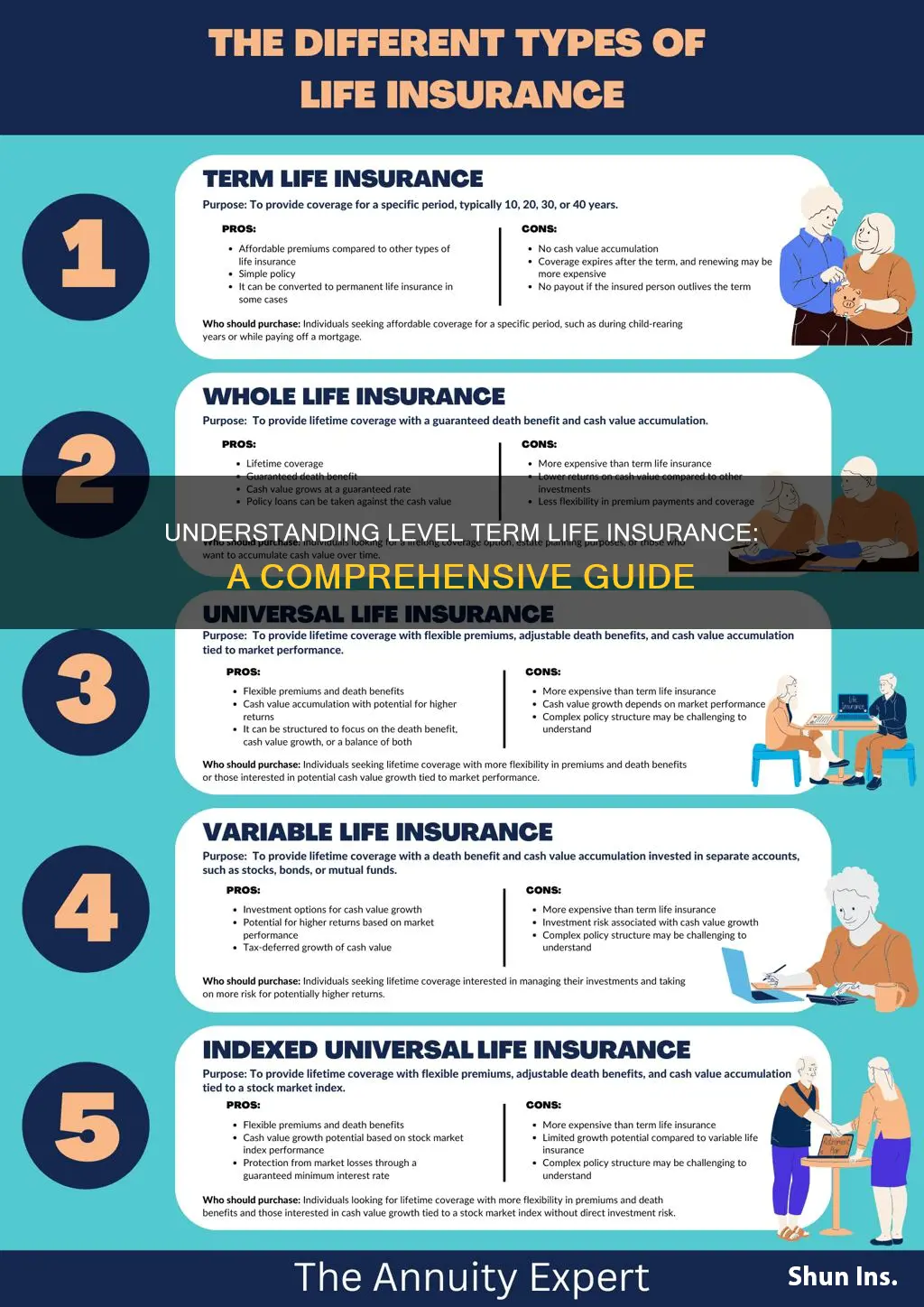

Life insurance is a crucial financial tool that provides coverage for a predetermined period or until the insured's death. One type of life insurance that stands out for its stability and predictability is level term life insurance. Unlike other forms of term life insurance, which may increase in cost over time, level term life insurance offers a fixed premium for the entire term of the policy. This means that the coverage amount and the monthly or annual premium remain constant throughout the policy's duration, providing a reliable and consistent level of protection for the insured and their beneficiaries.

What You'll Learn

- Level Term Life: Fixed coverage amount, no increases over time

- Term Life Insurance: Pure protection, no investment component, no increases

- Pure Protection: No investment, no guarantees, just pure insurance coverage

- Fixed Coverage: Consistent amount, no adjustments, no increases

- No Increase: Level premiums, no policy value growth

Level Term Life: Fixed coverage amount, no increases over time

Level term life insurance is a type of policy that provides a fixed amount of coverage for a specified period, typically 10, 15, 20, or 30 years. Unlike other forms of life insurance, the coverage amount does not increase over time. This means that the policyholder's beneficiaries receive the same death benefit throughout the term of the policy, regardless of changes in the policyholder's age or health.

The primary advantage of level term life insurance is its predictability and simplicity. With this policy, you know exactly how much coverage you have for the entire term, and the cost of the policy remains consistent as well. This can be particularly beneficial for those who want a straightforward and easy-to-understand insurance product. For example, if you purchase a $200,000 level term life policy at age 30 for a 20-year term, your beneficiaries will receive $200,000 if you pass away during that 20-year period, and the policy's cost will remain the same each year.

This type of insurance is often chosen by individuals who want to provide a specific level of financial protection for a defined period. It is commonly used to cover expenses such as mortgage payments, children's education, or business debts. For instance, a young family might opt for a $500,000 level term life policy to ensure that their children can afford a college education if something happens to the parents. The fixed coverage amount ensures that the financial goal remains achievable without the complexity of adjusting the policy over time.

One of the key benefits of level term life insurance is its affordability. Since the coverage amount doesn't increase, the insurance company can offer competitive rates, making it an attractive option for those on a budget. Additionally, the simplicity of the policy means less paperwork and fewer adjustments, which can be advantageous for both the policyholder and the insurance provider.

In summary, level term life insurance offers a fixed coverage amount that remains constant throughout the policy's term. This type of insurance is ideal for those seeking simplicity, predictability, and a defined level of financial protection. By choosing level term life, individuals can ensure that their beneficiaries receive the intended financial support without the complexities often associated with other life insurance products.

Farmers Life Insurance: Is It a Participating Whole Life Policy?

You may want to see also

Term Life Insurance: Pure protection, no investment component, no increases

Term life insurance is a straightforward and effective way to protect your loved ones financially. It provides a specified amount of coverage for a predetermined period, known as the "term." This type of insurance is designed to offer pure protection without any investment or growth components, making it a simple and direct solution for life coverage.

When you choose term life insurance, you're opting for a policy that focuses solely on providing a death benefit if the insured individual passes away during the specified term. Unlike permanent life insurance, which includes an investment component, term insurance does not accumulate cash value or offer any returns on premiums paid. This simplicity is one of its key advantages.

The beauty of term life insurance lies in its affordability and flexibility. Since there's no investment aspect, the premiums are typically lower compared to permanent life insurance. This makes it an attractive option for individuals seeking cost-effective coverage without the complexity of an investment component. Additionally, term policies are highly customizable, allowing you to choose the term length, death benefit amount, and other features that align with your specific needs and financial goals.

During the term, the insurance company guarantees the payment of the death benefit if the insured person dies. This benefit is paid out to the policy's beneficiaries, providing them with the financial support they need during a challenging time. Once the term expires, the policy ends, and further coverage may need to be reconsidered based on your evolving circumstances.

In summary, term life insurance offers pure protection without the added complexity of investment features. It is an excellent choice for those seeking affordable and flexible life coverage. With its straightforward nature, term insurance provides peace of mind, ensuring that your loved ones are financially protected during the specified term.

Best Life Insurance: Choosing the Right Type for You

You may want to see also

Pure Protection: No investment, no guarantees, just pure insurance coverage

When considering life insurance, it's important to understand the different types of coverage available to ensure you choose the right plan for your needs. One such type is "Pure Protection," a life insurance policy that provides a straightforward and simple approach to coverage. This type of insurance is designed to offer a basic level of financial protection without any additional features or investment components.

Pure Protection life insurance, as the name suggests, focuses solely on providing a death benefit to the policyholder's beneficiaries in the event of the insured's passing. Unlike other life insurance policies, it does not include any investment options or guarantees of increased value over time. This means that the policyholder's premium payments are used exclusively to fund the insurance coverage, with no additional returns or potential profits.

The simplicity of Pure Protection is one of its key advantages. By eliminating investment components, the policy becomes more straightforward and easier to understand. Policyholders can rest assured that their premiums are directly allocated to the insurance coverage, providing a clear and transparent financial arrangement. This type of policy is particularly appealing to those who prefer a no-frills approach to life insurance, prioritizing basic protection over potential financial gains.

In contrast to other life insurance plans, Pure Protection does not offer any additional benefits or guarantees. There are no riders or optional add-ons that could increase the policy's value or provide additional financial incentives. This lack of complexity ensures that the policy remains focused on its primary purpose: providing financial security to the insured's loved ones. As a result, the policy is often more affordable compared to other types of life insurance, making it an attractive option for those seeking cost-effective coverage.

When considering Pure Protection, it is essential to evaluate your specific needs and financial goals. This type of life insurance is best suited for individuals who prioritize basic insurance coverage and are not interested in the potential returns associated with investment-based policies. By understanding the differences between Pure Protection and other life insurance options, you can make an informed decision and choose a plan that aligns with your preferences and requirements.

Life Insurance Proceeds: Taxable in California?

You may want to see also

Fixed Coverage: Consistent amount, no adjustments, no increases

Fixed coverage life insurance is a type of policy that provides a consistent and unchanging amount of coverage throughout the term of the policy. Unlike other forms of life insurance, where the death benefit can increase over time, fixed coverage ensures that the insured individual's beneficiaries receive the same amount of financial protection from the very beginning. This type of policy is particularly appealing to those who prefer stability and predictability in their insurance plans.

With fixed coverage, the insurance company agrees to pay out a predetermined sum upon the insured's death, regardless of any changes in the market or the insured's health status. This means that the coverage amount remains the same for the entire duration of the policy, providing a sense of security and peace of mind to the policyholder. For example, if a person purchases a $100,000 fixed coverage policy at age 30, their beneficiaries will receive exactly $100,000 if the insured passes away during the term of the policy, without any adjustments.

One of the key advantages of fixed coverage is its simplicity and ease of understanding. Since the death benefit is fixed, there are no complex calculations or adjustments based on market fluctuations or changing health conditions. This clarity allows individuals to make informed decisions about their insurance needs without the added complexity of variable policies. Additionally, fixed coverage can be an attractive option for those who want to ensure a specific level of financial protection for their loved ones, especially if their income or financial situation is expected to remain stable over the long term.

In contrast to variable life insurance, which offers a flexible death benefit that can increase or decrease based on market performance, fixed coverage provides a consistent and reliable level of protection. This makes it an ideal choice for individuals who prioritize stability and want to avoid the potential risks associated with market volatility. By locking in the coverage amount, fixed policies offer a sense of long-term financial security, ensuring that the insured's beneficiaries are protected according to the initial agreement.

When considering life insurance, it is essential to evaluate your specific needs and preferences. Fixed coverage can be a valuable option for those seeking a straightforward and stable insurance solution. It provides a consistent level of protection without the complexities and potential risks of variable policies. Understanding the differences between fixed and variable coverage can help individuals make informed decisions and choose the type of life insurance that best aligns with their financial goals and risk tolerance.

Unraveling the Consequences: Life Insurance Bad Faith Explained

You may want to see also

No Increase: Level premiums, no policy value growth

When considering life insurance, one of the key aspects to understand is the concept of 'no increase' or 'level premiums'. This type of policy is designed to provide a consistent and predictable level of coverage throughout the entire term of the insurance. Unlike other types of policies, where premiums may increase over time, level term life insurance maintains a fixed premium amount, ensuring that the cost of coverage remains the same year after year.

In a traditional life insurance policy, the premiums are typically calculated based on the insured individual's age, health, and other risk factors. As the insured person ages, their risk profile may change, leading to premium increases. However, with a 'no increase' policy, the premiums are locked in at the initial rate, providing financial stability and peace of mind. This is particularly beneficial for those who want long-term coverage without the worry of rising costs.

The term 'level premiums' refers to the consistent payment amount that the policyholder makes to the insurance company. This structure ensures that the insured individual's coverage remains at the same level, providing a steady level of protection. For example, if someone purchases a $100,000 level term life insurance policy at age 30, they will pay the same annual premium for the next 10, 20, or 30 years, depending on the policy term chosen.

One of the advantages of this type of insurance is the predictability it offers. Policyholders can plan their finances more effectively since they know exactly how much they will pay annually. This is especially useful for long-term financial planning, such as budgeting for children's education or covering mortgage payments. Additionally, the lack of policy value growth means that the primary focus is on providing pure insurance coverage without the investment component often associated with other life insurance products.

In summary, 'no increase' or 'level premiums' in life insurance refers to policies that offer consistent coverage and predictable costs. This type of insurance is ideal for individuals seeking long-term financial security without the uncertainty of increasing premiums. By understanding this concept, you can make an informed decision when choosing life insurance, ensuring that your coverage meets your specific needs and budget requirements.

Life Insurance: Monthly Payment Options for Policyholders

You may want to see also

Frequently asked questions

The term you are looking for is "level term life insurance." This type of policy provides a fixed death benefit for a specified period, typically 10, 15, 20, or 30 years. The premium remains the same throughout the term, and the coverage amount does not change, ensuring a consistent level of protection.

Unlike permanent life insurance (e.g., whole life or universal life), level term life insurance is designed to provide coverage for a specific period. It offers a straightforward and cost-effective solution for individuals who need insurance for a particular duration, such as covering mortgage payments or providing financial security for a family during a specific stage of life.

There are several benefits to opting for level term life insurance. Firstly, it is generally more affordable than permanent life insurance because it doesn't accumulate cash value or investment components. Secondly, the fixed premium makes budgeting easier, as you know exactly how much you'll pay annually. Lastly, if you outlive the term, the policy expires without any further payments, and you've paid only for the coverage you received.