Dealing with insurance adjusters can be overwhelming, especially in the aftermath of a car accident. While you expect them to do the right thing, you may feel that your best interests are not their priority. If you disagree with an insurance adjuster's evaluation, it is important to know that you have the right to dispute their assessment. Here are some steps you can take if you find yourself in this situation:

- Gather evidence: Document the accident scene, obtain medical records, collect repair estimates, and gather all relevant records pertaining to your insurance claim.

- Review your policy: Understand your insurance coverage and rights under the policy to ensure you are aware of your entitlements.

- Be persistent: Don't settle for less than what you believe you are owed. Negotiate with the insurer for a fair settlement.

- Consider a second opinion: Get an independent appraiser or lawyer to assess your claim's value and provide a different perspective.

- Mediation and arbitration: Explore alternative dispute resolution methods to resolve disagreements without going to court.

- Speak with a lawyer: Seek legal counsel to understand your options and take the appropriate legal action if necessary.

- File a complaint: If you are unable to reach an agreement with the insurance company, you can file a complaint with them or the relevant regulatory authorities.

Remember, the insurance adjuster's determination is not final, and you have the right to challenge their assessment. By following these steps, you can protect your rights and seek fair compensation.

What You'll Learn

Contact an attorney for a free consultation

If you disagree with an insurance adjuster, it is important to know that you have the right to dispute their assessment. The adjuster's word is not final, and you can take steps to protect your rights and seek fair compensation.

One of the first steps you can take is to contact an attorney for a free consultation. Many law firms offer free initial consultations, during which you can discuss your case and receive guidance on the best course of action. An experienced attorney will be able to review your case, explain your rights, and help you navigate the complex insurance claims process.

- Legal Expertise and Guidance: Attorneys have a thorough understanding of insurance laws and regulations. They can explain your rights, interpret complex policy language, and guide you through the claims process. This can be especially helpful if you feel overwhelmed or unsure about your next steps.

- Protect Your Rights: Insurance adjusters work for the insurance company, not for you. An attorney will advocate for your rights and ensure that your best interests are protected. They can help you challenge the adjuster's determination of liability and negotiate for a fair settlement.

- Evidence and Documentation: Attorneys can assist you in gathering and organizing the necessary evidence and documentation to support your claim. This includes medical records, repair estimates, insurance policy documents, and correspondence with the insurance company and adjuster.

- Communication and Negotiation: Attorneys are skilled negotiators and can communicate effectively with insurance adjusters and their legal teams. They can handle all communication with the insurance company, present your case, and negotiate on your behalf for a higher settlement.

- Identifying Options: During the free consultation, an attorney can assess your case and explain the legal options available to you. They can help you understand if you have a valid dispute, the potential outcomes, and the likelihood of success. This information will empower you to make informed decisions.

- No Upfront Cost: With a free consultation, you can gain valuable insights and legal advice without any financial risk or obligation. This makes it a risk-free opportunity to explore your options and decide if you want to proceed with legal representation.

When choosing an attorney, it is essential to select a firm with experience in handling insurance disputes and a proven track record of success. Look for attorneys who specialize in insurance claims and personal injury cases, as they will have a deep understanding of the strategies and tactics involved.

Remember, you are not alone in this process. By contacting an attorney for a free consultation, you can gain clarity, protect your rights, and improve your chances of receiving the fair compensation you deserve.

Unraveling the Path to Becoming an Insurance Adjuster in Tennessee

You may want to see also

Review your insurance policy and understand your rights

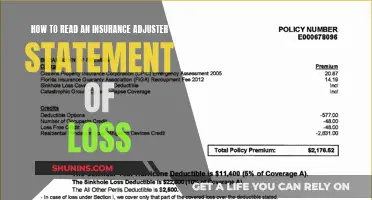

An insurance policy is a legal contract between the insurance company and the insured. It is essential to review your insurance policy regularly to ensure you understand your rights and responsibilities, the coverage provided, and any exclusions or limitations. Here are some key points to keep in mind when reviewing your insurance policy and understanding your rights:

- Read the Fine Print: Insurance policies can be complex and filled with legal jargon. Take the time to read the entire policy, including the fine print, to understand the specific terms, conditions, and exclusions. Pay close attention to the declarations page or policy summary, which outlines key information such as insured risks, policy limits, and the policy period.

- Understand Your Coverage: Familiarize yourself with the types of coverage provided by your policy. Know what events or damages are covered and what is specifically excluded. For example, in the context of a car accident, understand if your policy covers repairs, medical bills, and liability claims.

- Know Your Rights and Responsibilities: Insurance policies outline the rights and responsibilities of both parties. Understand what you are entitled to as the insured and what actions you need to take to maintain your coverage. For instance, you may need to promptly report any incidents or provide necessary documentation to support your claim.

- Be Aware of Claim Settlement Processes: Learn how a claim is settled under your policy. Understand if the insurer has the right to inspect the damages, review police reports, or request additional information. Know whether they have the final say in determining the settlement amount or if there is a process for negotiation or internal review.

- Review Cancellation Rights: Both you and the insurer typically have the right to cancel the policy under certain circumstances. Understand the conditions under which cancellation is allowed and any applicable time frames or cooling-off periods.

- Understand the Complaints Process: Insurance policies should outline the steps you can take if you are unhappy with the claims process or the insurer's decision. Know how to file a complaint, including any time limits, and the options for external review or dispute resolution.

- Seek Legal Advice: If you are unsure about your rights or how to interpret your policy, consider seeking legal advice. Attorneys specializing in insurance law can help you understand your policy, navigate the claims process, and protect your rights if you disagree with the insurance adjuster's decision.

Remember, insurance policies can vary, and it is crucial to thoroughly review your specific policy to understand your rights and coverage fully. Don't hesitate to reach out to your insurance provider or a legal professional for clarification if needed.

Pursuing a Career in Insurance Adjusting: A Guide to Licensing and Opportunities in Pennsylvania

You may want to see also

Gather evidence and documentation to support your case

Gathering evidence and documentation is crucial if you disagree with an insurance adjuster's assessment. Here are some steps to help you with the process:

- Photographs and Videos: Take clear and dated photographs or videos of the accident scene, including damage to vehicles, traffic signs, signals, vehicle license plates, and the exact location of the accident from different angles. These visual records are powerful tools to paint a picture of the incident and can be shared with your insurer as proof.

- Police Reports: Obtain a copy of the police report, which typically includes details of the crash, statements from those involved and witnesses, and sometimes an officer's opinion about how the accident occurred. This report is valuable to insurance adjusters and can influence their findings.

- Witness Statements: Collect names and contact information of witnesses, as their statements can provide third-party confirmation of your version of events. Uninvolved witnesses, such as pedestrians or nearby residents, are often seen as more credible by insurance adjusters as they have no personal interest in the outcome of the case.

- Medical Records and Bills: Gather all medical records and bills related to your injuries, including diagnostic images, treatment details, and out-of-pocket expenses like prescriptions and transportation costs. This documentation is essential to establish the extent and cause of your injuries, especially if you intend to claim compensation for them.

- Lost Wages: If your injuries have caused you to miss work, gather evidence such as doctor's notes, income verification (pay stubs, direct deposit records, tax returns), and a letter from your employer detailing the days missed and your pay rate. This information will support your claim for lost wages.

- Pain and Suffering: Document any physical or emotional pain and its impact on your quality of life. Consider keeping a daily journal to describe the progression of your injury and the overall effect on your well-being. This documentation can entitle you to substantial compensation.

- Vehicle Damage and Repair Bills: Collect repair estimates and bills for any damage to your vehicle. If your car is a total loss, you'll need proof of its pre-accident condition, such as receipts and photos. This evidence will be crucial when negotiating with the insurance adjuster about the value of your vehicle.

- Correspondence and Claim Forms: Keep all letters, emails, and other communications related to your insurance claim, including claim forms, correspondence with the insurance adjuster and company, and any internal review requests. This documentation will be valuable if you need to appeal the adjuster's decision or file a complaint.

- Insurance Policy and Related Documents: Review and understand your insurance policy, including coverage limits and clauses related to your specific situation. Ensure you have all the necessary documents, such as a copy of your insurance policy, car registration, driving license, and any other relevant paperwork.

Navigating the Path to Becoming an Insurance Adjuster in California: A Comprehensive Guide

You may want to see also

Negotiate with the insurer for a fair settlement

Negotiating with an insurance company for a fair settlement can be a challenging and stressful process. Here are some tips to help you navigate the negotiation process and secure a fair outcome:

Know the Value of Your Vehicle

Before entering negotiations, it is crucial to have a clear understanding of your vehicle's worth. This includes considering factors such as the year of manufacturing, the value of similar vehicles for sale online, and using online tools or websites like Kelley Blue Book (KBB) and Edmunds to determine its market value. Having a written estimate from a qualified mechanic or expert witness can also strengthen your position during negotiations.

Gather Supporting Evidence and Documentation

Documentation is key when negotiating with an insurance adjuster. Ensure you have a comprehensive record of all relevant documents, such as repair bills or estimates, police reports, eyewitness statements, photos or videos of the accident scene, and pay stubs. This evidence will support your claim and demonstrate the extent of the damages or injuries you have suffered.

Calculate a Full Settlement Amount

Using the evidence you have gathered, calculate a fair settlement amount that covers all pertinent past, current, and future economic and non-economic damages. This should include medical bills, lost income, property damage, pain and suffering, and any other losses or expenses related to the accident. Knowing your bottom line will help you stay focused during negotiations and ensure you receive adequate compensation.

Be Prepared for Negotiations

The negotiation process can be complex and emotionally challenging. It is important to be well-prepared and organized before engaging with the insurance adjuster. Know your rights, be clear about your demands, and be prepared to justify your requested settlement amount. Remember that the adjuster's goal is to minimize costs for the insurance company, so they may employ various tactics to reduce your compensation.

Seek Legal Assistance if Needed

If you feel overwhelmed or unsure about handling the negotiation process on your own, consider consulting with a personal injury lawyer or a public adjuster. They can provide valuable expertise and support throughout the process, ensuring your rights are protected and helping you achieve a fair settlement. Remember that their fees should be considered when deciding whether to hire legal representation.

Get the Settlement in Writing

Once you and the insurance adjuster reach an agreement, be sure to get the settlement offer in writing. This will protect both parties and ensure that the agreed-upon terms are clearly outlined and understood.

Unraveling the Path to Becoming an Insurance Adjuster in North Carolina

You may want to see also

File a complaint with the insurance company or regulatory body

If you disagree with an insurance adjuster, it's important to know that you have the right to dispute their assessment and seek a fair settlement. Here are some steps you can take if you find yourself in this situation:

- Understand your rights and policy: Know that the adjuster works for the insurance company and might not have your best interests in mind. Review your insurance policy to understand your coverage limits and rights. Ensure that your claim falls within your coverage and that you haven't missed any important fine print.

- Collect evidence and documentation: Gather and organize all relevant documents, including letters, emails, communications, repair estimates, medical records, and photographs of property damage. This comprehensive collection of information will be crucial if you need to appeal the adjuster's decision.

- Communicate your concerns: Express your disagreement with the adjuster's estimate to the insurance company. They might adjust their offer based on your feedback. If you still disagree, you can request an internal review of your claim.

- Write a formal complaint letter: If the internal review doesn't resolve the issue, you can submit a written complaint to the insurance company's complaints department. Address your complaint to the appropriate person, as advised by the claims adjuster.

- Contact regulatory authorities: If your complaint remains unresolved, you can seek help from regulatory bodies, such as the Arizona Department of Insurance (as mentioned in the context of Arizona). An unbiased representative will review your case and help resolve the matter.

- Consider legal options: If you suspect insurance bad faith or unfair practices, consult an attorney or a specialized lawyer, such as a car accident lawyer or an insurance bad faith lawyer. They can guide you through legal options and ensure your rights are protected.

Remember, it's your right to challenge the insurance adjuster's assessment, and by following these steps, you can effectively navigate the process of disputing their decision and seeking a fair outcome.

Unraveling the Path to Becoming an Insurance Adjuster in Georgia

You may want to see also

Frequently asked questions

First, carefully review the adjuster's estimate for any errors or missing items. Next, obtain a second opinion from another adjuster or contractor. Then, negotiate with the adjuster, providing any additional evidence to support your claim. If you still disagree, file a complaint with your insurance company and, as a last resort, consider hiring an attorney.

Review the adjuster's report carefully and do not deposit or send any checks until you agree with all the items and costs. Look for any discrepancies or missing items. If you are not satisfied, return the check and request that the adjuster revise the report.

You have the right to a second opinion and can dispute the insurance company's decision, including the value of the vehicle and the amount to repair it. If you cannot come to an agreement, you can submit an appeal under the Insurance Act, involving an independent umpire to review the estimates.

First, determine why your insurer denied your claim so you can accurately appeal the decision. Then, collect any necessary information and evidence to prove that your policy should cover the accident. Finally, write an appeal letter to your insurance company explaining why their denial of your claim was incorrect and citing any relevant evidence.

If your appeal is denied, you have several options. You can consider mediation, where a neutral third party helps facilitate a resolution. If your policy includes an arbitration clause, you can proceed with arbitration, which involves presenting your case to an arbitrator for a final decision. As a last resort, you may choose to file a lawsuit against the insurance company, but keep in mind that lawsuits are timely and costly.