When it comes to managing cash value life insurance, policyholders have several options to consider. Cash value life insurance policies accumulate cash value over time, which can be used for various purposes. One common approach is to borrow against the cash value, allowing policyholders to access funds without surrendering the policy. Another strategy is to use the cash value to pay for future premiums, ensuring the policy remains in force. Additionally, some individuals choose to take out loans or make withdrawals from the cash value, providing financial flexibility. Understanding these options can help policyholders make informed decisions about how to utilize the cash value of their life insurance policy.

What You'll Learn

- Tax Benefits: Understand how cash value can be tax-advantaged, offering potential tax benefits

- Loan Options: Explore borrowing against the policy's cash value for various financial needs

- Investment Opportunities: Diversify by investing the cash value in various investment options

- Policy Loans: Learn about taking out loans against the policy's cash value

- Surrender Value: Discover the financial impact of surrendering the policy for its cash value

Tax Benefits: Understand how cash value can be tax-advantaged, offering potential tax benefits

When it comes to cash value life insurance, understanding the tax advantages can be a game-changer for your financial strategy. Cash value insurance policies, such as whole life or universal life, offer a unique opportunity to build tax-advantaged wealth over time. Here's how:

Tax-Deferred Growth: One of the key tax benefits is the ability to grow your cash value within the policy tax-deferred. This means that the earnings on the cash value account are not subject to annual income tax. As the cash value accumulates, it can grow tax-free, allowing your money to work harder for you. This is particularly advantageous compared to traditional savings accounts or investments, where earnings are often taxed each year.

Tax-Free Loans: Another advantage is the option to take tax-free loans against the cash value of your policy. You can borrow money from your insurance policy without incurring immediate tax consequences. This can be a valuable tool for accessing funds for various purposes, such as starting a business, funding education, or making significant investments, all while keeping your earnings tax-free.

Tax-Efficient Wealth Transfer: Cash value life insurance can also be an effective way to transfer wealth to beneficiaries in a tax-efficient manner. Upon your passing, the death benefit payout to your beneficiaries is generally not subject to income tax. This ensures that your loved ones receive the full value of the policy without incurring tax liabilities.

Additionally, the cash value can be used to pay for the policy's premiums, reducing the overall cost of insurance. Over time, this can result in significant tax savings, as you may be able to avoid paying taxes on the premiums and the subsequent earnings.

Understanding these tax benefits can empower you to make informed decisions about your cash value life insurance policy. It highlights the potential for long-term wealth accumulation and efficient wealth management, making it an attractive financial tool for those seeking tax-advantaged growth and security.

Understanding Life Insurance: A Comprehensive Guide to Its Benefits

You may want to see also

Loan Options: Explore borrowing against the policy's cash value for various financial needs

When it comes to utilizing the cash value of your life insurance policy, one of the most common and practical options is to consider borrowing against it. This strategy allows you to access the accumulated cash value as a loan, providing a flexible way to meet various financial needs without having to surrender your policy or withdraw the entire sum. Here's a detailed look at the loan options available:

Policy Loans: One of the most straightforward ways to borrow against your life insurance policy's cash value is by taking out a policy loan. This process involves borrowing a portion of the cash value, which is typically interest-free, as long as the policy remains in force. You can choose the loan amount based on your financial requirements and the policy's cash value. The loan is secured by the policy itself, ensuring that the insurance company has a claim on the borrowed amount. Repayments are usually made through reduced premiums or increased cash value accumulation, ensuring that the policy remains active.

Withdrawal and Loan: Another approach is to withdraw a portion of the cash value and then use that money to secure a loan. This method provides more flexibility in terms of the loan amount and repayment terms. You can withdraw the cash value and then take out a personal loan or a line of credit using the withdrawn funds as collateral. This option is beneficial if you need a larger loan amount or prefer more control over the repayment schedule. However, it's essential to consider the tax implications of withdrawing the cash value, as it may be subject to income tax.

Line of Credit: A line of credit against your life insurance policy offers a flexible borrowing solution. You can borrow up to a predetermined limit, typically based on the policy's cash value, and repay it over time with interest. This option is ideal for managing short-term financial needs or unexpected expenses. Repayments are usually made in monthly installments, and the interest rate is often competitive compared to other forms of borrowing. It provides a safety net while allowing you to maintain the policy's value.

Benefits of Borrowing Against Cash Value: Borrowing against the cash value of your life insurance policy offers several advantages. Firstly, it allows you to access funds without the need for a medical exam or extensive paperwork, which is often required for traditional loans. Secondly, the interest rates on policy loans are generally lower than those of personal loans or credit cards, making it a cost-effective borrowing option. Additionally, the loan is secured by the policy, reducing the risk for the lender and potentially providing better terms for the borrower.

When considering loan options, it's crucial to evaluate your financial situation and understand the potential risks and benefits. Always ensure that you can afford the repayments and that borrowing against your life insurance policy aligns with your long-term financial goals. Consulting with a financial advisor or insurance professional can provide valuable guidance in making the most of your cash value while ensuring the policy's continued effectiveness as a financial safety net.

Pregnant and Want Life Insurance? Here's What You Need to Know

You may want to see also

Investment Opportunities: Diversify by investing the cash value in various investment options

When it comes to utilizing the cash value of your life insurance policy, one of the most effective strategies is to diversify your investments. This approach allows you to maximize the potential returns while also managing risk effectively. Here's a detailed guide on how to achieve this:

Understanding Cash Value Investment Options:

Life insurance policies, particularly whole life and universal life policies, accumulate cash value over time. This cash value can be borrowed against or withdrawn, providing a source of funds for various purposes. One of the primary benefits of investing this cash value is the ability to grow your money over the long term. You can choose from a range of investment options offered by the insurance company, which may include fixed accounts, index accounts, or even mutual funds. Understanding the features and risks associated with each option is crucial for making informed decisions.

Diversification Strategy:

Diversification is a key principle in investment management. By spreading your cash value across different investment options, you can reduce the impact of any single investment's performance on your overall portfolio. Here's how you can approach this:

- Fixed Accounts: Consider investing a portion of your cash value in fixed-rate accounts, which offer a guaranteed return over a specified period. These are typically low-risk options, making them suitable for conservative investors.

- Index Accounts: These accounts track a specific market index, such as the S&P 500. They provide diversification across various sectors and industries, offering the potential for higher returns over the long term.

- Mutual Funds: Investing in mutual funds allows you to access a diversified portfolio of stocks, bonds, or other securities. This option provides instant diversification and is managed by professional fund managers.

Benefits of Diversification:

- Risk Mitigation: Diversification reduces the risk associated with individual investments. If one investment underperforms, the gains from others can compensate, leading to a more stable overall return.

- Long-Term Growth: By investing in a mix of options, you can balance risk and reward. This approach allows you to take advantage of potential growth opportunities while also preserving capital.

- Flexibility: Diversification provides flexibility in asset allocation, enabling you to adjust your strategy based on market conditions and your financial goals.

Regular Review and Adjustment:

It's essential to regularly review and adjust your investment strategy. Market conditions and personal financial goals may change over time, requiring you to rebalance your portfolio. Consult with a financial advisor to ensure your investment choices align with your risk tolerance and objectives.

By diversifying your cash value investments, you can create a well-rounded financial strategy that maximizes growth potential while managing risk effectively. This approach ensures that your life insurance policy's cash value works harder for your financial future.

Life Insurance: Getting a Million-Dollar Policy

You may want to see also

Policy Loans: Learn about taking out loans against the policy's cash value

When considering what to do with the cash value of your life insurance policy, one option is to explore policy loans. This strategy allows policyholders to access the cash value accumulated within their life insurance policy as a loan, providing a means to utilize this financial asset without surrendering the policy or taking a withdrawal. Policy loans offer a unique way to leverage the benefits of life insurance while maintaining its long-term value.

The process of taking out a policy loan is straightforward. You can borrow a portion of the cash value, typically up to a certain percentage, and repay the loan with interest over time. The loan is secured by the policy itself, ensuring that the insurance company has a claim on the policy's cash value if the borrower defaults. This arrangement provides a secure and relatively low-risk way to access funds.

One of the advantages of policy loans is that they are often tax-advantaged. The interest paid on the loan is typically not subject to income tax, as it is considered a return on the policy's cash value. This feature can make policy loans an attractive option for those seeking tax-efficient ways to utilize their life insurance's financial resources. Additionally, the loan repayments are made directly to the insurance company, ensuring that the policy remains in force and continues to provide coverage.

It's important to note that policy loans should be approached with caution. While they offer flexibility, they also come with potential risks. If the borrower fails to repay the loan, the insurance company may reduce the death benefit or surrender the policy to recover the loan amount. Therefore, it is crucial to carefully consider the loan amount, repayment terms, and potential consequences before proceeding.

In summary, policy loans provide a strategic way to access the cash value of your life insurance policy. By borrowing against the accumulated value, you can utilize these funds for various purposes while maintaining the policy's long-term benefits. However, it is essential to understand the terms and potential risks associated with policy loans to make an informed decision regarding your life insurance's cash value utilization.

AAdvantage Life Insurance: What You Need to Know

You may want to see also

Surrender Value: Discover the financial impact of surrendering the policy for its cash value

When considering what to do with the cash value of a life insurance policy, one of the options is to surrender the policy. Surrendering a policy means returning it to the insurance company in exchange for the cash value accumulated within it. This decision can have significant financial implications, and understanding these impacts is crucial for making an informed choice.

The surrender value of a life insurance policy is the amount of money the policyholder receives when they decide to surrender it. This value is essentially the cash equivalent of the policy's accumulated benefits. Over time, as the policy grows, it builds up cash value, which can be borrowed against or withdrawn. When a policyholder surrenders the policy, they essentially cash in this accumulated value. The process involves contacting the insurance company, providing necessary documentation, and agreeing to the terms of surrender.

The financial impact of surrendering a policy can be both positive and negative. On the positive side, the surrender value provides immediate access to the cash, offering policyholders a means to utilize the funds for various purposes. This could include paying off debts, investing in new opportunities, or simply having a financial cushion. For those who no longer need the insurance coverage, surrendering the policy can be a way to recoup some of the initial investment. However, it's important to note that surrendering a policy may also result in a loss of potential future benefits.

On the negative side, surrendering a life insurance policy can lead to a loss of the policy's long-term value. Life insurance policies, especially those with cash value accumulation, are designed to provide financial security over an extended period. By surrendering the policy, the policyholder may give up the potential for future death benefits, which could have been significant, especially if the policy has been in force for many years. Additionally, there may be surrender charges imposed by the insurance company, which can further reduce the net amount received.

In summary, surrendering a life insurance policy for its cash value can be a strategic financial move, providing access to funds when needed. However, it should be approached with caution, as it may result in the loss of potential long-term benefits. Policyholders should carefully consider their financial goals and the reasons for considering surrender, ensuring they make an informed decision that aligns with their overall financial strategy.

Life Insurance for Widows: Navigating Financial Security

You may want to see also

Frequently asked questions

The cash value of a life insurance policy is the amount of money that has accumulated within the policy over time. It is essentially the investment component of the policy, which grows tax-deferred. This value can be borrowed against or withdrawn, providing a source of funds for various financial needs.

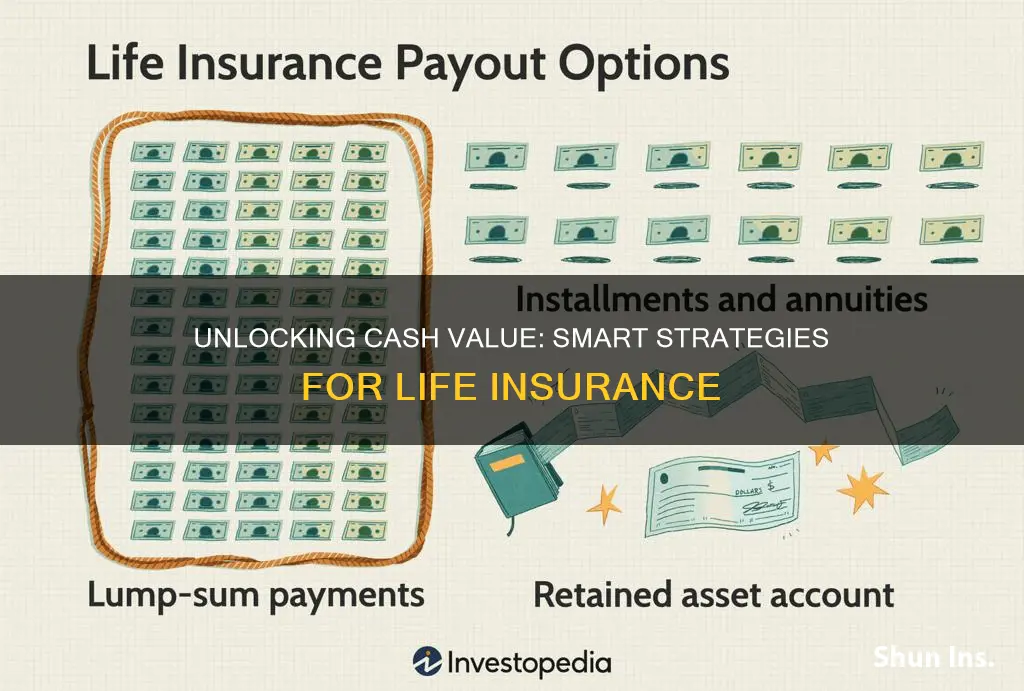

You can access the cash value through policy loans, also known as policy withdrawals. This allows you to borrow money from your policy's cash value without selling the policy. The loan is typically interest-free and can be repaid with interest, ensuring the policy's value remains intact. Alternatively, you can take out a lump sum payment or use the cash value to pay for premiums, providing financial flexibility.

While accessing the cash value can provide financial benefits, it is important to understand the risks involved. Withdrawing funds may reduce the policy's death benefit, potentially impacting your beneficiaries. Additionally, if the policy is surrendered, you may incur surrender charges, and the cash value may be subject to income tax. It is advisable to consult with a financial advisor to understand the implications and explore alternative options that align with your financial goals.