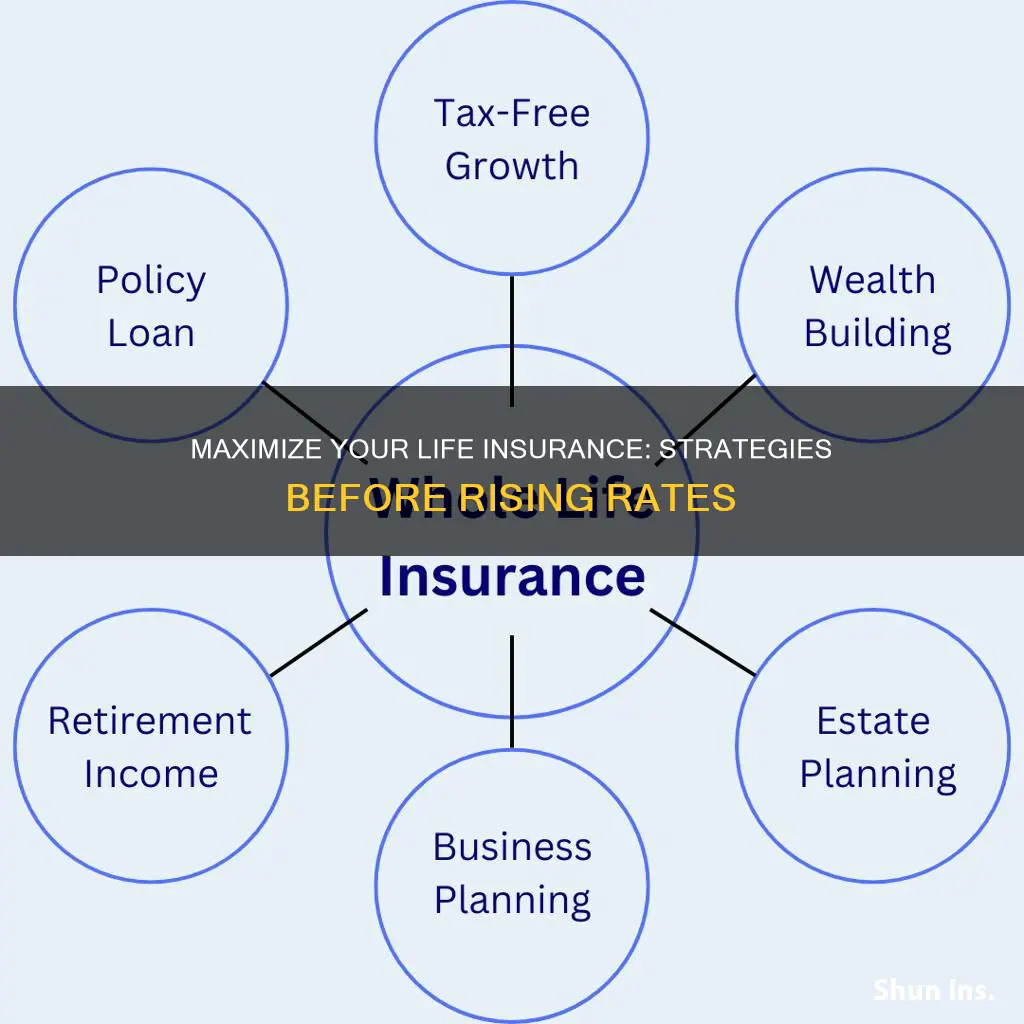

Life insurance is a crucial financial tool, but with changing market conditions, it's important to review and adjust your policy to ensure you're getting the best value. As insurance rates are expected to rise, now is the time to consider how to optimize your life insurance coverage. Whether you're a policyholder looking to maximize your benefits or a new buyer, understanding the options available can help you make informed decisions. This guide will explore strategies to enhance your life insurance policy, including adjusting coverage, reviewing beneficiaries, and considering alternative insurance products, all while keeping an eye on potential rate increases.

What You'll Learn

- Review Policy: Assess your policy's coverage, benefits, and exclusions

- Rate Changes: Understand potential rate hikes and their impact

- Adjust Premiums: Consider premium adjustments to maintain coverage

- Beneficiary Selection: Choose beneficiaries carefully to avoid complications

- Term Length: Evaluate term length options for optimal coverage

Review Policy: Assess your policy's coverage, benefits, and exclusions

When reviewing your life insurance policy before potential rate increases, it's crucial to assess the coverage, benefits, and exclusions to ensure you're adequately protected and making the most of your policy. Here's a step-by-step guide to help you navigate this process:

Understand Your Policy's Current Coverage: Begin by thoroughly examining the details of your existing life insurance policy. Identify the type of coverage you have, whether it's term life, whole life, or universal life. Note the death benefit amount, which is the primary feature of life insurance, representing the financial payout to your beneficiaries upon your passing. Understanding the coverage limits and any adjustments made over time is essential.

Evaluate Benefits and Riders: Life insurance policies often come with various benefits and optional riders that can enhance your coverage. Review these carefully:

- Accidental Death Benefit: Some policies offer an additional payout if the insured person's death is a result of an accident.

- Critical Illness Rider: This rider provides a lump sum payment if the insured is diagnosed with a critical illness, allowing for early treatment and potentially avoiding a terminal diagnosis.

- Long-Term Care Rider: It can provide financial assistance for long-term care needs, which may become more significant as you age.

- Waiver of Premium Rider: This rider waives future premiums if the insured becomes disabled, ensuring the policy remains in force.

Identify Exclusions and Limitations: Every insurance policy has certain exclusions and limitations. These are specific events or conditions that are not covered by the policy. For instance, pre-existing health conditions, certain high-risk activities, or specific causes of death might be excluded. Understanding these exclusions is vital to ensure you're not relying on coverage that might not be available in the future.

Assess Your Current Needs: Evaluate your financial obligations and goals to determine if your current coverage is sufficient. Consider your family's income needs, mortgage or debt payments, education expenses, and other long-term financial commitments. If your circumstances have changed, such as starting a family, purchasing a home, or acquiring significant assets, you may need to adjust your coverage accordingly.

Consider Rate Increases and Market Trends: Research the potential reasons for rate increases in life insurance, such as changes in your age, health, or the overall market conditions. If you anticipate a rate hike, it might be beneficial to review and potentially increase your coverage now to lock in current rates. Market trends and economic factors can influence insurance rates, so staying informed is essential.

By thoroughly reviewing your policy's coverage, benefits, and exclusions, you can make informed decisions to protect your loved ones and ensure your life insurance remains a valuable asset. It's a proactive approach that can provide peace of mind, especially when considering the potential impact of rate increases on your insurance premiums.

Finding Life Insurance Policies: A Comprehensive Guide

You may want to see also

Rate Changes: Understand potential rate hikes and their impact

Understanding potential rate hikes and their impact on your life insurance policy is crucial, especially if you're considering changes to your coverage. Here's a detailed guide to help you navigate this aspect:

Recognize the Factors Influencing Rates: Life insurance rates are primarily determined by several key factors. These include your age, health, lifestyle, and family medical history. Younger individuals generally pay lower premiums as they are considered less risky. Conversely, older policyholders might experience rate increases due to the higher likelihood of health issues. Additionally, factors like smoking, excessive alcohol consumption, or dangerous hobbies can significantly impact your rates. Understanding these influences empowers you to make informed decisions.

Stay Informed About Market Trends: Keep abreast of market trends and economic conditions that could affect life insurance rates. Economic downturns or recessions might lead to rate hikes as insurance companies adjust their pricing strategies. Similarly, changes in interest rates can impact the cost of borrowing, which is often a factor in life insurance calculations. Regularly reviewing industry news and market reports can provide valuable insights into potential rate fluctuations.

Review Your Policy Regularly: It's essential to periodically review your life insurance policy. Insurance companies often conduct periodic reviews, but you should also take the initiative. Assess your current coverage and compare it with your evolving needs. If you've experienced significant life changes, such as marriage, the birth of a child, or career advancements, your insurance requirements may have shifted. Adjusting your policy accordingly can help you avoid unnecessary rate increases later.

Consider Policy Options: When reviewing your policy, explore the various options available. Term life insurance, for instance, offers coverage for a specified period, often at lower rates. Conversely, permanent life insurance provides lifelong coverage but typically comes with higher premiums. Understanding these options allows you to choose the most suitable plan for your circumstances, potentially saving you money in the long run.

Take Advantage of Discounts: Insurance companies often offer discounts that can reduce your premiums. These discounts may include healthy lifestyle incentives, such as non-smoker or fitness-related rewards. Additionally, bundling multiple policies with the same provider can lead to significant savings. Review your policy documents and inquire about available discounts to maximize your financial benefits.

By staying proactive and informed, you can effectively manage potential rate hikes on your life insurance policy. Regular reviews, understanding market trends, and exploring policy options are essential steps to ensure your coverage remains appropriate and cost-effective.

Unlock Whole Life Insurance Benefits with Mass Mutual

You may want to see also

Adjust Premiums: Consider premium adjustments to maintain coverage

When it comes to life insurance, one of the most critical decisions you can make is to review and adjust your premiums to ensure you maintain adequate coverage. As life insurance rates can fluctuate over time, especially with changing market conditions and increased life expectancy, it's essential to stay proactive and consider premium adjustments. This proactive approach allows you to keep your policy aligned with your current financial situation and future needs.

Adjusting your premiums can be a strategic move to ensure you don't find yourself underinsured when rates inevitably rise. Here's a step-by-step guide to help you navigate this process:

- Assess Your Current Policy: Begin by thoroughly reviewing your existing life insurance policy. Understand the coverage amount, the current premium, and the policy's terms. Identify any potential gaps in coverage that may need addressing.

- Evaluate Your Financial Situation: Consider your current financial health. Have your income, assets, and liabilities changed recently? Are there any significant life events, such as a new job, a mortgage, or a growing family, that could impact your insurance needs? Assessing your financial situation will help you determine if premium adjustments are necessary.

- Adjust Premiums Strategically: If you've identified a need for increased coverage or a change in your financial circumstances, it's time to adjust your premiums. You can opt for a higher premium payment to maintain or increase the death benefit. This ensures that your loved ones receive the intended financial support in the event of your passing. Alternatively, if you can afford to reduce your coverage, lowering the premium can be a cost-effective strategy.

- Explore Payment Options: Life insurance companies often offer various payment options, such as annual, semi-annual, or monthly payments. Choosing a payment plan that suits your financial capabilities can make premium adjustments more manageable. Some insurers may also provide the flexibility to make lump-sum payments, which can result in significant savings over time.

- Review Regularly: Life insurance needs can change over time, so it's essential to review your policy periodically. As your financial situation evolves, so might your insurance requirements. Adjusting premiums accordingly ensures that you remain adequately covered without unnecessary financial strain.

By proactively considering premium adjustments, you can ensure that your life insurance policy remains relevant and effective, providing the necessary financial security for your loved ones. Remember, staying informed and taking control of your insurance decisions can lead to significant long-term benefits.

Life Insurance Options for Cancer Patients and Survivors

You may want to see also

Beneficiary Selection: Choose beneficiaries carefully to avoid complications

When it comes to life insurance, one of the most crucial decisions you can make is choosing the right beneficiaries. This decision can significantly impact the distribution of your insurance proceeds and potentially lead to legal complications if not handled properly. Here's a guide on how to select beneficiaries carefully to avoid any future issues:

Understand the Importance of Beneficiary Designations: Life insurance policies often allow you to name multiple beneficiaries, and you can specify the percentage of the payout each should receive. This flexibility is a powerful tool, but it also requires careful consideration. If you don't designate beneficiaries or make changes to your policy, the default rules of inheritance may apply, which might not align with your wishes.

Consider Family Structure and Relationships: Start by evaluating your personal relationships and the current family structure. Are you married? Do you have children, and are they biological or adopted? If you have a blended family, consider the dynamics and relationships between all family members. It's essential to choose beneficiaries who are likely to remain in your life and support your wishes, especially if there are any potential conflicts or changes in family circumstances.

Avoid Common Pitfalls: One of the most common mistakes is to name only immediate family members as beneficiaries, especially if you have a large insurance policy. This can lead to financial strain on your spouse or children, who may not have the financial means to manage a substantial payout. Additionally, be cautious about naming beneficiaries who are under legal age (typically 18 or 21, depending on the jurisdiction) as they may not have the legal capacity to manage the funds.

Plan for the Future: Consider the long-term implications of your beneficiary choices. If you have minor children, you might want to name a trusted family member or a professional guardian as an additional beneficiary to ensure their financial security. This can provide peace of mind, knowing that your children will be cared for even if something happens to you and their primary caregiver.

Review and Update Regularly: Life insurance needs and personal circumstances change over time. It's essential to review your beneficiary designations periodically. Major life events like marriages, births, deaths, or significant financial changes should prompt you to update your policy. Regularly reviewing and adjusting your beneficiaries will help ensure that your wishes are honored and that your loved ones are protected.

By carefully selecting beneficiaries and considering the potential impact on your loved ones, you can avoid legal complications and ensure that your life insurance proceeds are distributed according to your intentions. Remember, this decision is a critical part of your overall financial planning strategy.

Life Insurance for NHS Employees: What's Covered?

You may want to see also

Term Length: Evaluate term length options for optimal coverage

When considering your life insurance options, one crucial aspect to evaluate is the term length. Term life insurance provides coverage for a specified period, and choosing the right term length is essential to ensure you have adequate protection during the years when it's needed most. Here's a guide on how to approach this decision:

Assess Your Current and Future Needs: Start by evaluating your current financial obligations and long-term goals. Consider factors such as mortgage or rent payments, children's education expenses, business debts, or any other financial commitments that require a steady income. If you have a substantial amount of debt or financial responsibilities, a longer term length might be advisable to ensure that your beneficiaries are protected until these obligations are met. Additionally, think about your future plans. Are you planning to start a family, buy a home, or take on significant financial commitments in the next few years? If so, a longer term might provide the necessary coverage during these pivotal life stages.

Evaluate the Cost and Affordability: Term life insurance premiums can vary based on the term length. Longer-term policies generally have higher premiums because the insurance company assumes a higher risk of paying out a claim over an extended period. If you have a limited budget, you might need to opt for a shorter term length to keep costs manageable. However, it's important to strike a balance. Choosing a term that is too short might leave you and your beneficiaries vulnerable if an unforeseen event occurs before the policy ends. Consider your financial situation and explore different term options to find the most affordable yet comprehensive solution.

Consider the Stage of Life: Different life stages call for different insurance needs. For example, young families might benefit from longer-term coverage to protect against the financial impact of a parent's untimely death. As you age, you may be able to opt for shorter terms or explore other insurance options, such as permanent life insurance, which can provide lifelong coverage. Review your life stage and future plans to determine the most suitable term length.

Review and Adjust Regularly: Life is unpredictable, and your insurance needs may change over time. It's essential to periodically review your life insurance policy and adjust the term length if necessary. Major life events like marriage, divorce, the birth of a child, or significant financial changes can impact your insurance requirements. Regularly assessing your coverage ensures that you maintain adequate protection without overpaying for unnecessary extended coverage.

By carefully evaluating the term length, you can optimize your life insurance coverage, ensuring that you and your loved ones are protected during the most critical years. It's a strategic decision that requires consideration of your current and future financial obligations, as well as your long-term life goals.

Life Insurance Agents: How Many Are There in the US?

You may want to see also

Frequently asked questions

If you wish to modify your policy, it's advisable to review your current coverage and assess your needs. Consider whether you require additional coverage or if you can opt for a lower death benefit. Contact your insurance provider to discuss options like increasing or decreasing the policy amount, which can help you manage costs without compromising essential protection.

Yes, several strategies can help. Firstly, maintaining a healthy lifestyle by quitting smoking, exercising regularly, and managing any pre-existing health conditions can improve your overall health and potentially lower your insurance rates. Additionally, paying premiums annually instead of in installments might be more cost-effective in the long run.

One way to secure your current rate is to consider converting your term life insurance to a permanent policy. This option provides lifelong coverage and often has a guaranteed premium, protecting you from future rate hikes. However, it's essential to evaluate the long-term financial implications and choose the coverage term that best suits your needs.

Yes, you can shop around for better deals from other insurance companies. Compare policies, coverage options, and premiums to find a suitable alternative. Keep in mind that switching policies might require a medical examination, especially if you have any changes in health status since your initial policy purchase.