Prepaid insurance is the fee associated with an insurance contract that has been paid in advance of the coverage period. It is treated as an asset in accounting records and is gradually charged to expense over the period covered by the insurance contract. Prepaid insurance is typically recorded because insurance providers bill insurance in advance. Businesses may also prepay expenses to receive discounts or to lock in current rates.

When adjusting the prepaid insurance account on a worksheet debit, the insurance expense account is debited and the prepaid insurance account is credited. This is done to reflect the expense incurred for the period. The amount charged to expense in an accounting period is only the amount of the prepaid insurance asset assigned to that period.

What You'll Learn

Prepaid insurance is a current asset

Prepaid insurance is treated as an asset in accounting records, which is gradually charged to expense over the period covered by the related insurance contract. It is commonly recorded because insurance providers prefer to bill insurance in advance. If a business were to pay late, it would risk having its insurance coverage terminated.

Prepaid insurance is nearly always classified as a current asset on the balance sheet, as the term of the related insurance contract that has been prepaid is usually for a period of one year or less. If the prepayment covers a longer period, then the portion of the prepaid insurance that will not be charged to expense within one year should be classified as a long-term asset.

Prepaid insurance is considered a prepaid asset because it benefits future accounting periods. It relieves businesses of the monthly premium expense, reducing their costs while conferring the benefit of having coverage. It is also considered an asset because of its redeemable value. Any remaining prepaid portion of the premium could be refunded to the business if the policy is cancelled before the period covered by those premiums has expired.

Prepaid insurance is important because a business should correctly record all of its transactions and resources to have accurate financial statements. Recording prepaid insurance as an asset and adjusting that asset as the policy is consumed on a monthly basis ensures that the business is accurately recording the true value of the policy over time.

Navigating Fire Damage Claims: The Benefits of Engaging a Public Insurance Adjuster

You may want to see also

It is an expense that is paid in advance

Prepaid insurance is an expense paid in advance of the coverage period. It is the fee associated with an insurance contract that has been paid before the insurance coverage has come into effect. In other words, it is the amount paid for an insurance contract that has not yet been used through the passage of the time period stated in the contract.

Insurance premiums are normally paid a full year in advance, but they may cover longer periods. When they are not used up or expired, these payments show up on a company's balance sheet as a current asset.

Prepaid insurance is commonly recorded because insurance providers prefer to bill insurance in advance. If a business were to pay late, it would risk having its insurance coverage terminated. In particular, medical insurance providers usually insist on being paid in advance.

When prepaid insurance is recorded, it is initially treated as an asset. This is because it has future economic benefits. As the benefits of the expenses are recognised, the related asset account is decreased and expensed. This is done through an adjusting entry at the end of each accounting period.

For example, let's say a company pays an insurance premium of $2,400 on November 20 for the six-month period of December 1 through May 31. On November 20, the payment is entered with a debit of $2,400 to prepaid insurance and a credit of $2,400 to cash. As of November 30, none of the $2,400 has expired and the entire $2,400 will be reported on the balance sheet as prepaid insurance. On December 31, an adjusting entry will debit insurance expense for $400 (the amount that expired: 1/6 of $2,400) and will credit prepaid insurance for $400. This means that the debit balance in prepaid insurance on December 31 will be $2,000 (5/6 of the $2,400 cost), since this is the amount that has not yet expired. At the end of each month, an adjusting entry of $400 will be recorded to debit insurance expense and credit prepaid insurance.

The Long Wait: Understanding Delayed Responses from Insurance Adjusters

You may want to see also

It is recorded as an asset in the balance sheet

Prepaid insurance is recorded as an asset on the balance sheet because it is a future expense that has been paid in advance. It is the fee associated with an insurance contract that has been paid before the coverage period begins. This is often the case as insurance providers prefer to bill in advance, and if a business were to pay late, it would risk having its insurance coverage terminated.

Prepaid insurance is initially recorded as an asset because it has future economic benefits. As the benefits of the expenses are recognised, the related asset account is decreased and expensed. This is done through an adjusting entry, which is an entry that does not record a new business transaction but instead adjusts a previously recorded transaction.

Prepaid insurance is usually classified as a current asset on the balance sheet, as it is usually consumed within a year. However, if the prepayment covers a longer period, then the portion of the prepaid insurance that will not be charged as an expense within a year is classified as a long-term asset.

Prepaid insurance is recorded as a debit to the Prepaid Expense account, as this account is an asset account, and assets are increased by debits. This is balanced by a credit to the corresponding account used to make the payment, such as the Cash or Checking account.

Becoming an Insurance Adjuster in Minnesota: A Comprehensive Guide

You may want to see also

It is adjusted as the expense is consumed

When adjusting the prepaid insurance account, it is essential to understand that the debit movement in this account represents the consumption of the prepaid expense over time. This adjustment is a critical step in accurately reflecting a company's financial position and ensuring compliance with the matching principle of accounting. Here is a detailed explanation of this concept:

"It is adjusted as the expense is consumed" refers to the process of allocating prepaid insurance costs over the period they are applicable. Insurance is a prepaid expense because it is paid for in advance, and as time passes, the business effectively uses or "consumes" the insurance coverage. The adjustment made to the prepaid insurance account on the worksheet involves debiting the account and crediting the insurance expense account. This process recognizes the expense for the period in which the insurance coverage is utilized.

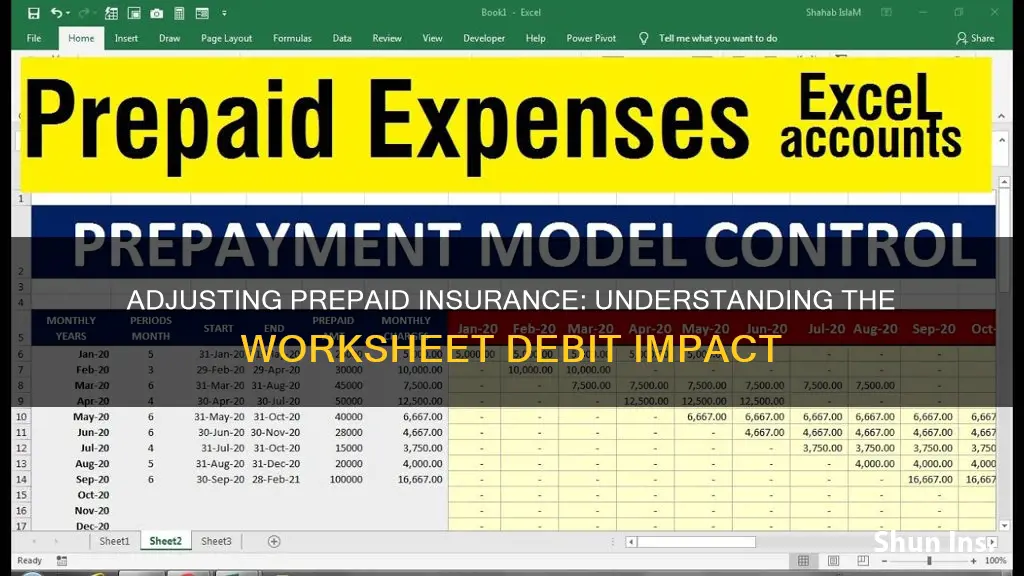

For example, consider a company that pays $12,000 for a one-year insurance policy. At the beginning of the policy period, the company records this payment as a prepaid expense, debiting the prepaid insurance account. Over the next twelve months, the company needs to recognize the insurance expense each month. To do this, an adjusting entry is made, debiting the prepaid insurance account and crediting the insurance expense account with a monthly amount of $1,000 ($12,000/12 months). This adjustment reflects the consumption of the prepaid insurance expense over time.

The frequency of these adjustments can vary depending on the specific circumstances and preferences of the business. Some companies may choose to make monthly adjustments, while others might opt for quarterly or semi-annual adjustments. Regardless of the frequency, the key principle remains the same: the prepaid insurance account is debited to recognize the portion of the expense that has been consumed during the period.

It is important to note that the adjusting entries made to the prepaid insurance account do not change the total amount of insurance expense recognized over the entire policy period. Instead, they ensure that the expense is allocated and recognized in the appropriate periods, matching the revenue generated during those periods. This matching principle is a fundamental concept in accounting, ensuring that expenses are accurately aligned with the related revenue, providing a clear picture of a company's financial performance.

By adjusting the prepaid insurance account as the expense is consumed, businesses can maintain accurate financial records and make more informed decisions. This process allows them to manage their cash flow effectively, understand their periodic expenses, and ensure compliance with accounting standards. Properly accounting for prepaid expenses is crucial for financial statement users, such as investors and creditors, to gain a complete and transparent understanding of the company's financial health and operations.

The Art of Settlement: Unraveling the Insurance Adjuster's Decision-Making Process

You may want to see also

It is charged to expense over the period covered by the insurance contract

Sure! Here is some information on adjusting the prepaid insurance account on a worksheet:

When adjusting the prepaid insurance account on a worksheet, it is essential to understand that insurance is a cost that a company incurs in advance and benefits from over a specific period. Prepaid insurance is an asset account, and the amount is expensed over the period in which it provides protection or coverage. This process is known as "charging insurance to expense over the period covered by the insurance contract."

The concept behind this treatment is that the insurance provides a future economic benefit to the company over a specified time, and it is more accurate to match the cost with the revenue generated during that period. By allocating the insurance cost to multiple periods, the business can better reflect the expense in its financial statements. This process is crucial for accurate financial reporting and providing a clearer picture of the company's financial health.

Now, let's focus on the phrase, "It is charged to expense over the period covered by the insurance contract," and break it down into a few paragraphs:

When a company purchases insurance, it is acquiring protection or coverage for a specific period into the future. This could be insurance for property protection, liability coverage, or any other type of insurance necessary for the business's operations. The insurance contract outlines the period for which the policy is effective, and the business can benefit from the coverage during this time. As the insurance coverage extends into the future, it is treated as a prepaid expense, and the cost is allocated over the life of the policy.

Charging the insurance expense over the period covered by the contract is a way to match the cost with the revenue it helps to generate. This is in line with the matching principle of accounting, which states that expenses should be recognized in the same period as the related revenues. By allocating the insurance cost to multiple periods, the business can avoid significant fluctuations in expenses and provide a more stable representation of its financial performance.

For example, if a company purchases a one-year insurance policy for $12,000, it does not mean that the entire $12,000 is expensed immediately. Instead, the cost is divided by 12 to expense $1,000 each month over the year. This monthly expense is then recorded in the income statement, reflecting the portion of insurance cost applicable to that month. This process ensures that the expense is matched with the revenue-generating activities of the business during that period.

The process of adjusting the prepaid insurance account and charging it to expense ensures that the business's financial statements accurately represent its financial position and performance. It is a critical step in the accounting process, providing transparency and a true reflection of the company's operations to stakeholders and decision-makers.

Unraveling the Accuracy of AAA Insurance Adjusters: An In-Depth Analysis

You may want to see also

Frequently asked questions

Prepaid insurance is the insurance premium paid by a company in an accounting period that didn't expire in the same accounting period. The unexpired portion of the insurance is shown as an asset on the company's balance sheet.

Prepaid insurance is initially recorded as a debit to the Prepaid Insurance account and a credit to the Cash account. As the insurance is used, the expired portion is moved from the Prepaid Insurance account to the Insurance Expense account through an adjusting entry.

The journal entry for prepaid insurance is a debit to the Prepaid Insurance account and a credit to the Cash account. The adjusting entry to recognise the expense is a debit to the Insurance Expense account and a credit to the Prepaid Insurance account.

Prepaid insurance is considered an asset because it provides future economic benefits to the company. It is a current asset because it can be easily liquidated or converted to cash within one year.

Prepaid insurance can provide a discount for the company and relieve the obligation of payment for future accounting periods. Additionally, it can help to lock in current rates and may offer tax deductions for the business.