Auto insurance rates in Michigan are increasing due to a variety of factors, including legislative changes, rising repair and medical costs, and an increase in traffic accidents and claims. Michigan operates under a no-fault insurance system, which has contributed to higher insurance rates, as drivers are required to carry personal injury protection (PIP) coverage with high minimum limits. While legislative reforms were introduced in 2019 and 2020 to lower costs and increase choices for drivers, insurance rates are expected to rise in the future due to new legal changes, increasing repair and medical costs, and a higher number of car thefts.

| Characteristics | Values |

|---|---|

| Date of rate increase | July 1, 2023 |

| Reason for rate increase | To increase fees for catastrophic claims |

| Who is affected by the rate increase? | All insured drivers in Michigan |

| Who collects the increased fees? | Michigan Catastrophic Claims Association (MCCA) |

| Average annual cost of car insurance in Michigan for 2024 | $887 for minimum coverage, $3,010 for full coverage |

| Average monthly rate for minimum coverage | $74 |

| Average monthly rate for full coverage | $251 |

What You'll Learn

The impact of Michigan's No-Fault Insurance System

Michigan's No-Fault Insurance System has had a significant impact on auto insurance rates in the state. Under this system, drivers are required to carry Personal Injury Protection (PIP) coverage, which provides benefits such as medical expenses, lost wages, and rehabilitation services, regardless of who is at fault in an accident. While this ensures that drivers receive prompt medical care, it also contributes to higher insurance rates.

The no-fault system has historically led to increased insurance premiums in Michigan. The unlimited PIP coverage previously mandated meant that insurers had to account for potentially high medical expenses when setting their rates, resulting in higher costs for drivers. Michigan's generous PIP benefits have been a significant factor in these rising insurance rates.

In recent years, however, reforms have been implemented to address the high insurance rates associated with the no-fault system. In 2019, Michigan governor Gretchen Whitmer signed Public Acts 21 and 22 into law, giving drivers the option to choose from different PIP coverage levels, ranging from $50,000 for Medicaid recipients to unlimited coverage. These changes reduced the overall claims liability for insurers and allowed them to offer more affordable policies.

The impact of the no-fault system on insurance rates is also influenced by other factors, such as the rise in traffic accidents, distracted driving, increasing repair costs, and medical expenses. These factors have contributed to the strain on insurance companies, leading to higher premiums for Michigan drivers.

While the recent reforms have helped bring down insurance rates, it's important to note that individual premiums can still vary. Factors such as driving record, age, location, and vehicle type continue to play a significant role in determining the rates paid by Michigan drivers.

In summary, Michigan's No-Fault Insurance System has had a notable impact on auto insurance rates, with the mandatory PIP coverage being a significant contributing factor to higher premiums. However, recent reforms providing more PIP coverage options have helped alleviate some of the financial burden on drivers, although other factors continue to influence insurance rates in the state.

Denied an Auto Insurance Claim? Here's What to Do

You may want to see also

Increase in traffic accidents and claims

Michigan has witnessed a rise in road accidents and subsequent insurance claims in recent years. This increased frequency and severity of accidents have exerted financial pressure on insurance companies, leading to higher premiums for drivers across the state.

One of the primary factors contributing to the surge in traffic accidents is Michigan's growing population. As the state attracts more residents, the number of vehicles on the roads has also increased, elevating the chances of collisions. The swelling population has resulted in greater traffic congestion, particularly in urban areas, which further heightens the risk of accidents.

Another critical factor is the rise in distracted driving. The pervasive use of smartphones and other electronic devices while driving has led to a worrying number of accidents and subsequent insurance claims. According to statistics, distracted driving-related accidents in 2023 were predominantly caused by cell phone usage, including talking, texting, or dialling (1,726 crashes), using a hands-free device (205 crashes), and other electronic device usage (1,610 crashes). Passenger distraction and other distracting activities within the vehicle also played a significant role, contributing to 735 and 5,696 crashes, respectively.

The increase in traffic accidents and claims in Michigan is also influenced by the rise in the number of young and older drivers on the roads. Young drivers, particularly those aged 16 to 20, continue to be overrepresented in crashes and fatalities. In 2023, this small age group was responsible for more than 15% of all car crashes in Michigan, and the number of fatalities in this age group increased by 6% from the previous year. Additionally, with more older drivers on the road, accidents involving individuals aged 65 and above have increased across all categories.

The combination of these factors has resulted in a higher frequency and severity of accidents, straining insurance companies and ultimately leading to increased auto insurance rates in Michigan.

Allstate: Smart Home and Auto Bundling

You may want to see also

Rising repair costs and medical expenses

Michigan's auto insurance rates have been increasing due to several factors, including rising repair costs and medical expenses. This trend is not unique to Michigan, as auto insurance premiums have generally increased across the United States. Here is a more detailed explanation:

Rising Repair Costs:

The cost of vehicle repairs has been steadily increasing, especially for newer cars equipped with advanced technology. These modern vehicles have sophisticated computer systems and intricate components that require specialized knowledge and tools for repairs. As a result, the complexity and expense of repairing these advanced vehicles have skyrocketed, leading to higher insurance premiums. This is a nationwide issue, with motor vehicle maintenance costs up 13% from July 2022 to July 2023, according to the Bureau of Labor Statistics.

Additionally, the cost of diagnosing newer vehicles is more expensive, and the frequency of repairs is higher. For example, if an airbag deploys, the replacement cost can run into the thousands of dollars, as newer cars may have up to eight airbags.

Rising Medical Expenses:

Alongside repair costs, the cost of medical care is also on the rise. In the event of an accident, medical treatments and rehabilitation services can be costly, and these expenses fall under the coverage provided by auto insurance companies. As medical expenses continue to climb, insurance companies are forced to compensate by increasing premiums for their policyholders. This is especially crucial in Michigan, which operates under a no-fault insurance system, meaning each driver's insurance covers their medical expenses, regardless of who is at fault in an accident.

The no-fault system, combined with Michigan's generous PIP (Personal Injury Protection) benefits, has been a significant contributor to high insurance rates in the state. While the recent reforms in Michigan's auto insurance laws have provided drivers with more flexibility in choosing their level of PIP coverage, the rising cost of medical care continues to drive up insurance rates.

Other Factors Influencing Auto Insurance Rates:

Apart from rising repair and medical costs, there are other factors contributing to the increase in auto insurance rates in Michigan:

- Increase in traffic accidents and claims: The growing population in Michigan has led to more vehicles on the road, naturally increasing the likelihood of accidents. Additionally, the rise in distracted driving due to smartphone usage has resulted in a higher number of accidents and subsequent insurance claims.

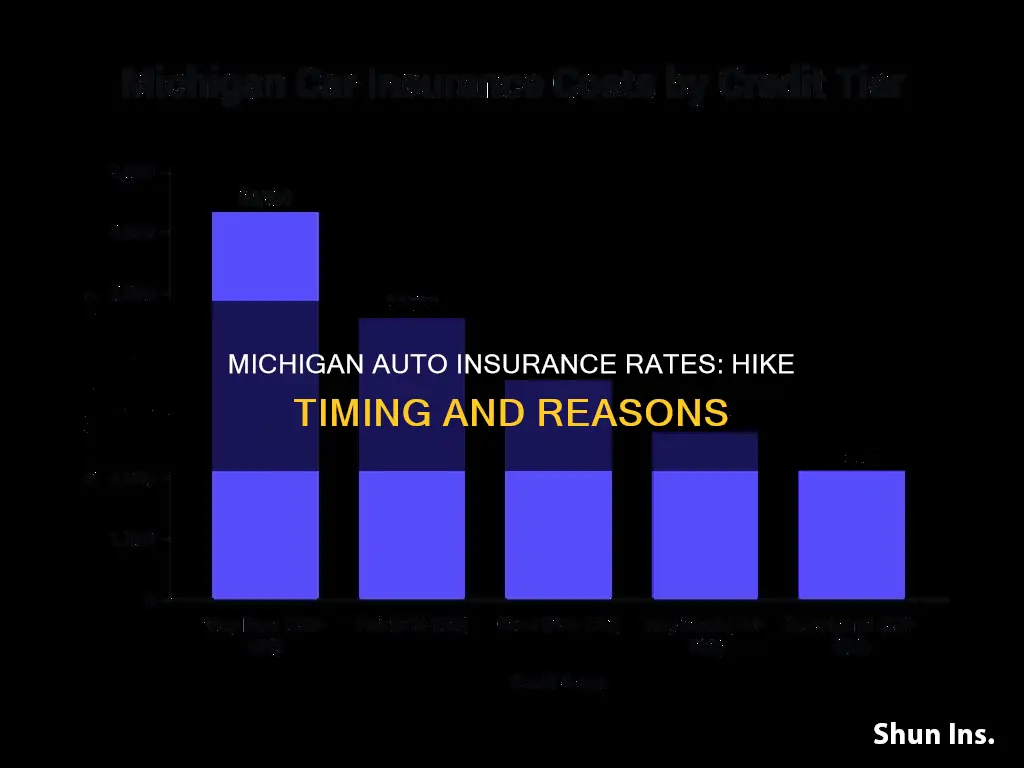

- Changes in credit score and driving record: Insurance companies consider an individual's credit score and driving record when determining their premium. A low credit score or a history of traffic violations can lead to higher insurance rates.

- Location: Urban areas generally have higher insurance rates than rural areas due to increased traffic congestion and the higher likelihood of accidents.

- Vehicle type and age: The make, model, and age of a vehicle can impact insurance rates. Sports cars and luxury vehicles often have higher premiums due to their repair costs and market value. Older vehicles may also have higher premiums due to the likelihood of mechanical failure or the lack of modern safety features.

Allstate Auto Insurance: Why So Expensive?

You may want to see also

Changes in credit score and driving record

Credit scores and driving records are key factors that can influence auto insurance rates in Michigan. A poor credit score can lead to higher insurance premiums, as it indicates a higher risk of filing insurance claims. Insurance companies view individuals with lower credit scores as more likely to file claims and have accidents, resulting in increased rates. Maintaining a good credit score is essential for keeping insurance rates affordable.

When determining insurance rates, insurance companies also consider an individual's driving record, including traffic violations, accidents, and claims. A history of traffic violations or accidents indicates a higher risk of future claims, leading to higher insurance rates. By contrast, a clean driving record can help lower insurance premiums over time.

In Michigan, the auto insurance landscape has undergone significant changes in recent years, including legislative reforms to lower coverage costs and increase choices for drivers. These reforms allowed drivers to choose their level of personal injury protection (PIP) coverage, which was previously unlimited and contributed to high insurance costs. The reforms also introduced a fee schedule for medical providers, capping the amount they could charge for certain services related to auto accidents.

While Michigan's no-fault insurance system ensures prompt medical care for drivers, it has also contributed to higher insurance rates. The generous PIP benefits, including medical expenses, lost wages, and rehabilitation services, have resulted in higher premiums for drivers across the state. However, with the recent reforms, drivers now have the option to choose different levels of PIP coverage or opt out if they have qualifying health insurance.

It's worth noting that Michigan has some of the highest minimum insurance requirements in the country, which further contributes to higher insurance rates. Michigan drivers pay an average of $7,161 per year for full-coverage insurance, which is 270% more than the national average.

Point Penalty: How a Single Driving Demerit Affects Auto Insurance Rates

You may want to see also

The role of vehicle type and age

The type of vehicle and its age play a significant role in determining auto insurance rates in Michigan.

Insurance providers consider the make and model of a car when determining the premium. Some vehicles are more prone to theft or have higher repair costs, leading to higher insurance rates. For example, sports cars and luxury vehicles typically have higher premiums due to their higher repair costs and market value.

The age of a vehicle also influences insurance costs. Older vehicles may have a higher likelihood of mechanical failure or lack modern safety features. As a result, they often come with higher premiums or require additional coverage for repairs.

By understanding these factors, individuals can make informed decisions to keep their auto insurance premiums as affordable as possible.

Auto One Insurance Company: What Happened and Why?

You may want to see also

Frequently asked questions

The state's costly no-fault law is the key factor. Not only are insurance claim payouts in Michigan among the highest in the country, but they also primarily stem from no-fault/personal injury protection (PIP) claims.

The cost of vehicle repairs and medical expenses has been increasing steadily. Newer cars often come equipped with advanced technology, which makes repairs more expensive. Additionally, there has been a rise in traffic accidents and claims in Michigan.

Some of the factors that determine auto insurance rates include your age, driving history, credit score, and the type of vehicle you drive. Insurers also take into account the average cost of car repairs and medical expenses in your area.

The average car insurance cost in Michigan is $887 for state-mandated minimum coverage and $3,010 for full coverage.