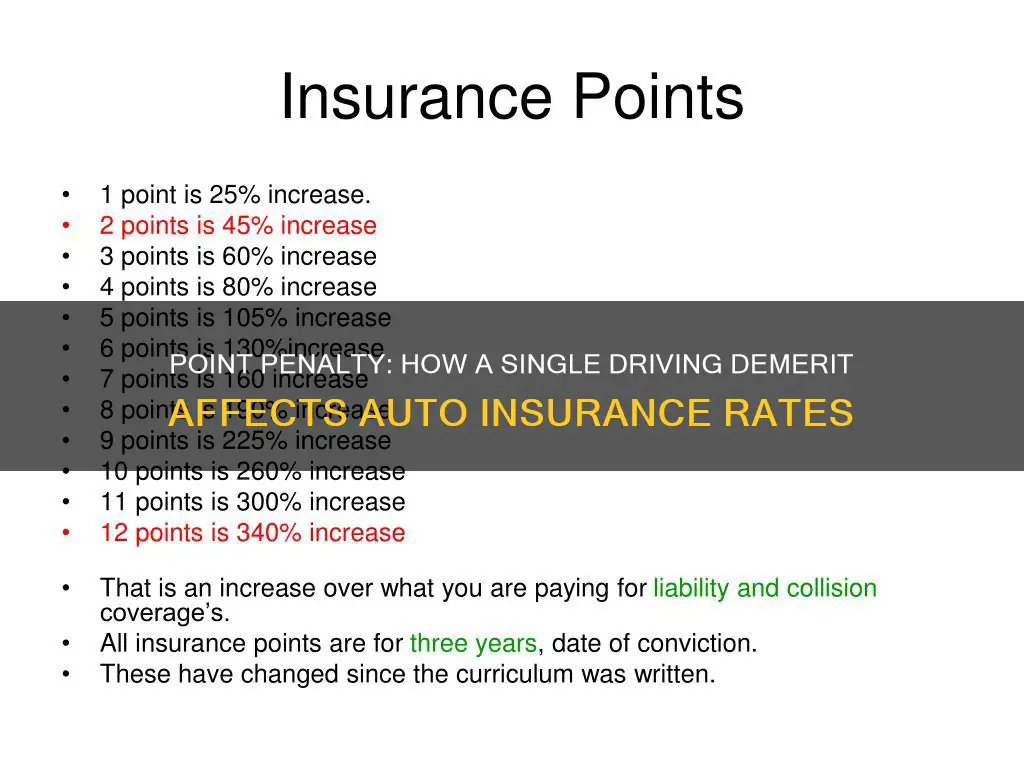

The impact of a single point on auto insurance depends on the state and the insurance company. While one point is unlikely to affect a driver's insurance costs, additional violations or claims could potentially raise insurance rates by 50% or more. Insurance companies have their own points systems for policy pricing, which consider serious traffic violations, claims history, and more.

| Characteristics | Values |

|---|---|

| One point impact on insurance | One point is unlikely to affect a driver's insurance costs, if it is the only point on the driver's record. |

| Insurance company awareness | Insurance companies are not notified every time a driver gets a ticket; they pull the driver's DMV record at renewal time, when the driver increases coverage, buys a new car, or at the end of the insurance policy's term. |

| Insurance increase | Insurance can increase between 10% and 38% for one point. The average cost of auto insurance with one point is $306 per month. |

| Insurance points vs. license points | Insurance companies use a separate proprietary point system to help them set rates for individual drivers. |

| Points by state | Forty-one of the 50 states use a license-points system. The other nine states (Hawaii, Kansas, Louisiana, Minnesota, Mississippi, Oregon, Rhode Island, Washington, and Wyoming) keep track of the number of traffic violations. |

| Points by violation | Points vary by the severity of the infraction. For example, a speeding ticket may only put one point on a driver's record, while a reckless driving ticket could put four or more points. |

| Defensive driving courses | In some states, a defensive driving course can get points wiped off a driver's record. |

What You'll Learn

How much does auto insurance increase with one point?

The effect of a single point on auto insurance rates depends on the state and the insurance company. The average cost of auto insurance with one point on a driver's license is $306 per month, with an increase of between 10% and 38%. However, some companies may not increase rates at all for a single point.

While the number of points on a driver's license does not directly affect insurance costs, the violations that led to those points do. Insurance companies consider drivers with more points on their record to be higher-risk and will often increase their rates accordingly. The specific increase varies by company and depends on factors such as the driver's age, previous record, and the type of violation.

In addition, the length of time that points remain on a driver's record varies by state and the type of violation. Minor violations may be removed after a few years, while more serious offenses can stay on a record for much longer.

Auto Insurance Deductibles: Are They Tax Write-Offs?

You may want to see also

How do points on your license affect your insurance rates?

The effect of points on your license on your insurance rates depends on the state you live in, the insurance company you use, and the type of violation.

In most states, traffic violations and accidents are tracked using a point system. These point systems vary by state. While insurance companies do not track state license points, they do care about the traffic violations that earn you those points. Insurance companies have their own points systems for policy pricing, which consider serious traffic violations, claims history, and more.

In some states, a single point on your license may not affect your insurance rates at all. This is because one point is usually assigned for a minor violation, like driving with broken taillights or an expired license, which some insurance companies might not hear about.

However, if you already have a point on your record, an additional violation or claim could potentially raise your insurance rates by 50% or more. This is because having a point on your record means you are one point closer to exceeding your state's point limit and losing your driving privileges.

The increase in insurance rates also depends on the insurance company you use. For example, State Farm raises rates by 12% for a one-point infraction, while Geico raises rates by 22%.

To find out how many points are on your license, you can request a copy of your driving record using your state DMV's online portal, by mailing a request, or by visiting your local DMV in person. Some states allow you to check for free, while others charge a fee.

Insurance Gap: Covering a Month-Long Gap

You may want to see also

How long do points on your license last?

The length of time that points stay on your license depends on the type of violation and the state you are in. In Florida, points from traffic violations remain on your driving record for three years from the date of conviction. This means that from the moment you pay the fine, attend court, or are found guilty of the offense, the associated points will stay on your license for this duration. In California, points can remain on your driving record for as little as 39 months to as long as ten years. For example, 1-point violations remain for 39 months, while failure to appear in court for a DUI remains on your record for ten years.

In most states, minor violations such as speeding tickets will drop off your record in three to five years. More severe infractions, such as DUIs, tend to stick around for seven to ten years and, in some states, decades. For example, in Florida, it takes 75 years for a DUI to come off your driving record.

It's important to note that even if you serve a suspension, the points will not be removed, and they will continue to last until the end of the three-year period. Additionally, insurance increases resulting from the citation will typically remain in effect for at least this three-year period or until you lose your "Safe Driver" status.

GAP Insurance: What It Covers

You may want to see also

How to reduce points on your license

While one point is unlikely to affect a driver's insurance costs, multiple points can raise rates significantly higher. The average cost of auto insurance with one point on your license is $306 per month.

Defensive Driving Course

Many states allow drivers to take a state-approved defensive driving course to remove a few points from their licenses. For example, in Alaska, drivers can take a defensive driving course to remove two points from their licenses once every 12 months. In Delaware, drivers can take a defensive driving course to receive a three-point credit to their driving record, valid for three years.

Fight the Ticket

If you feel the ticket was unwarranted or there were mitigating circumstances, you can go to court and ask for the ticket to be dismissed or reduced. You may be able to get the points reduced or even eliminated.

Verify Points Drop Off

Points will impact your insurance rates as long as they stay on your driving record. Check your DMV record when the points are set to drop off to ensure they have been removed. If they have not, contact the DMV to request the points be expired.

Accident Prevention Courses

Taking accident prevention courses, driver safety courses, and other driver's education classes at traffic school can help reduce points and provide relief from expensive auto insurance rates.

Auto Insurance Billing: Doctor's Office Refusal

You may want to see also

How to get cheaper insurance with points on your license

While one point on your license is unlikely to affect your insurance costs, multiple points can lead to a significant increase in your insurance premium. The exact increase depends on the state you live in, the insurance company, and the type of violation. For example, in California, disobeying a traffic control signal resulted in a 20.2% rate increase, while speeding led to a 25.6% increase.

- Take a driving class: In select states, insurance companies may offer a discount for taking an approved defensive driving or driver's education course.

- Take advantage of other discounts: Most car insurance companies offer a number of discounts for eligible drivers. Common discounts include bundling, paid-in-full, and good student status.

- Shop around for a new policy: If you've tried everything with your current insurance provider, compare quotes from other insurers to see if you can get a better deal.

- Improve your credit: If your state allows it, improving your credit score may bring down your car insurance rates, as insurers typically see drivers with poor credit as riskier to insure.

- Increase your deductibles: If you're struggling to find an affordable rate, consider increasing your deductibles. This will lower your premium, but keep in mind that you'll have to pay higher out-of-pocket costs in the event of a claim.

- Remove points from your license: Some states allow you to take an approved defensive driving course or attend traffic school to get points removed from your license. This can help improve your driving record and potentially lower your insurance rates.

Commission Earnings of Auto Insurance Agents

You may want to see also

Frequently asked questions

It depends on the state and the insurance company, but 1 point can increase insurance by between 10% and 38%. The average cost of auto insurance with 1 point is $306 per month.

The more points you have, the worse your record looks to a car insurance company. Each auto insurer has its own method of evaluating applicants, so the points on your driving record may or may not have a direct impact on the rates you pay for car insurance.

You can check your driving record using your state DMV’s online portal, by mailing a request, or by visiting your local DMV in person. Some states allow you to check for free, but others charge a fee of $2 to $25.