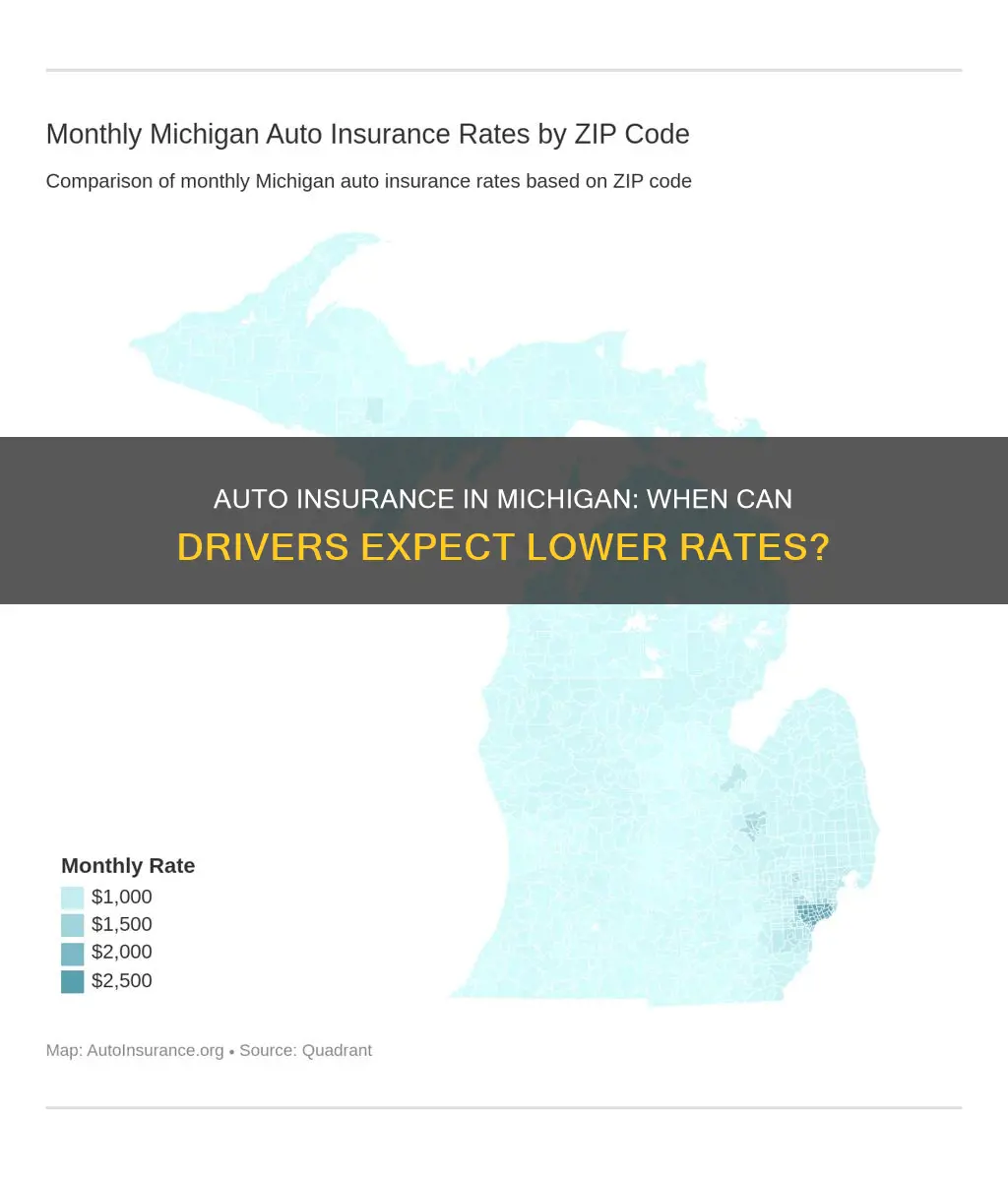

Michigan drivers have been paying the highest car insurance rates in the country, with costs 100% higher than the national average. However, in 2020, Michigan introduced reforms to its auto insurance laws, which aimed to lower costs and increase choices for drivers. These changes included giving drivers the option to choose their level of personal injury protection (PIP) coverage and introducing a fee schedule for medical providers, capping the amount they can charge for auto accident-related services. As a result, Michigan car insurance rates fell by 17.8% between 2021 and 2024, with drivers saving an average of $787 per year on full-coverage insurance. Despite this positive trend, several risk factors, such as increasing car theft and repair costs, could lead to higher rates in the future.

| Characteristics | Values |

|---|---|

| Insurance rates in Michigan | Decreased by 17.8% since 2021 |

| Insurance rates nationally | Increased |

| Reason for decrease in Michigan | 2019 State Law |

| Reason for increase nationally | Increased risk from national trends |

| Average savings for Michigan drivers | $787 per year |

| Previous insurance requirement in Michigan | Unlimited personal injury protection (PIP) coverage |

| Current insurance options in Michigan | Four PIP coverage levels ranging from $50,000 to unlimited coverage |

| Insurance rates in Michigan in 2023 | Increased |

| Factors contributing to the increase | Increase in traffic accidents and claims, rising repair costs and medical expenses, changes in credit score and driving record, location, vehicle type and age |

| Average cost of full-coverage insurance in Michigan | $3,643 annually |

| Average cost of minimum coverage insurance in Michigan | $1,360 per year |

What You'll Learn

Michigan's auto insurance law changes

On May 30, 2019, Michigan governor Gretchen Whitmer signed Public Acts 21 and 22 into law, making changes to the state's no-fault auto insurance rules. These reforms aimed to address the high insurance rates in Michigan, which had made it one of the most expensive places to insure a vehicle. The new law introduced several significant changes, including:

- Giving drivers the option to choose their level of personal injury protection (PIP) coverage. Previously, all drivers were required to have unlimited PIP coverage, which was a major contributor to high insurance costs. The new law allows drivers to select from four PIP coverage levels, ranging from $50,000 for Medicaid recipients to unlimited coverage.

- Implementing a fee schedule for medical providers, capping the amount they can charge for certain medical services related to auto accidents. This measure aimed to reduce the inflated costs associated with medical treatments, making insurance more affordable for drivers.

- Prohibiting auto insurance companies from using non-driving factors such as sex, marital status, credit score, and educational level in setting insurance rates.

- Establishing a Fraud Investigation Unit to investigate criminal and fraudulent activity related to the insurance and financial markets.

- Increasing transparency requirements for the Michigan Catastrophic Claims Association (MCCA), including annual reporting and audits.

- Requiring prior approval of auto insurance rates and policies by the Michigan Department of Insurance and Financial Services (DIFS) before being offered to consumers.

These changes took effect for auto insurance policies issued or renewed after July 1, 2020. The impact of these reforms has been positive, with Michigan drivers saving an average of $787 per year on full coverage insurance. However, there are concerns that new legal changes and other factors, such as increasing car theft and repair costs, could lead to higher insurance rates in the future.

American Family Auto Insurance: Is It Worth the Hype?

You may want to see also

PIP coverage

Personal Injury Protection (PIP) coverage is a mandatory component of auto insurance in Michigan. It covers all reasonable and necessary medical expenses for the policyholder's lifetime, up to the maximum coverage amount selected, if they are injured in an auto accident. PIP coverage also includes wage loss, survivor loss benefits, and replacement services for up to three years after the accident.

Prior to July 1, 2020, Michigan drivers were required to have unlimited PIP coverage, which contributed significantly to high insurance costs in the state. However, under Michigan's new auto insurance law, drivers can now choose from different PIP coverage levels, including $500,000, $250,000, $50,000 (for Medicaid recipients), or no PIP coverage (if the policyholder has qualifying health insurance). These changes provide drivers with more flexibility in managing their insurance costs and have helped to lower insurance rates in the state.

If a specific PIP coverage level is not chosen by the insured, the unlimited PIP coverage option is selected by default. It is important to note that PIP coverages separate from the medical coverage, such as wage loss and replacement services, are still included in the policy even if the insured chooses to opt out of PIP medical coverage or selects a lower coverage limit.

The new law also requires auto insurance companies to reduce statewide average PIP medical premiums for eight years. As a result, drivers in Michigan have seen a decrease in their insurance rates, with an average savings of $787 per year on full-coverage insurance. However, individual premiums can vary depending on factors such as driving record, age, location, and the type of vehicle.

Auto Insurance in Seattle: What's the Cost?

You may want to see also

High insurance rates

Michigan has historically had some of the highest insurance rates in the country, with drivers paying up to 270% more for coverage than the national average. While legislative changes in 2019 and 2020 helped reduce insurance costs, rates remain high relative to other states. Several factors contribute to high insurance premiums in Michigan, including the state's no-fault insurance system, high claims payouts, rising repair and medical costs, and a high percentage of uninsured drivers.

The No-Fault Insurance System

Michigan operates under a no-fault insurance system, which means that each driver's insurance covers their medical expenses and lost wages, regardless of who was at fault in an accident. This system has contributed to higher insurance rates in the state. Under the no-fault system, drivers are required to carry personal injury protection (PIP) coverage, which provides benefits such as medical expenses and lost wages. While this system ensures that drivers receive prompt medical care, it adds to the overall cost of insurance.

High Claims Payouts

Not only are insurance claim payouts in Michigan among the highest in the country, but a significant portion of them stems from no-fault/personal injury protection (PIP) claims. The high cost of PIP coverage in Michigan, with a minimum limit of $250,000, leads to higher payouts and thus higher losses for insurance companies. This, in turn, results in higher premiums for drivers.

Rising Repair and Medical Costs

The cost of vehicle repairs and medical expenses has been steadily increasing. Newer cars often come with advanced technology, making repairs more expensive. Additionally, the rising cost of healthcare has also contributed to higher insurance rates. As the cost of medical treatments increases, insurance companies are forced to compensate by increasing premiums for policyholders.

High Percentage of Uninsured Drivers

Michigan has one of the highest percentages of uninsured drivers in the country, with more than 25% of drivers lacking auto insurance. This is significantly higher than the national average. When uninsured drivers are involved in an accident, insured drivers and their insurance companies bear the cost, leading to higher insurance rates for those with insurance.

Other Factors

Other factors contributing to high insurance rates in Michigan include the state's generous PIP benefits, which previously included unlimited coverage, and the impact of insurance fraud. Additionally, legislative changes that introduced a fee schedule for medical providers may not have had the intended effect of reducing costs, as medical providers can now charge more for certain services related to auto accidents.

Understanding 'NB' in Auto Insurance: What Does It Mean?

You may want to see also

Insurance fraud

Auto insurance fraud is a serious crime in Michigan, and it can be committed in several ways. It involves deceiving an insurance company about a claim related to a personal or commercial motor vehicle. This can include providing misleading information or false documentation to support a claim. Some common examples of auto insurance fraud are:

- Lying about previous accidents or traffic violations when applying for insurance.

- Exaggerating the extent of injuries or property damage to receive a larger settlement.

- Staging accidents or intentionally causing damage to vehicles to claim insurance money.

- Misrepresenting the circumstances of an accident or the extent of damage.

- Falsifying or inflating repair or medical bills to increase the claim amount.

The consequences of committing auto insurance fraud in Michigan are severe. It is considered a felony, and violators can face up to four years in jail and up to $50,000 in fines, in addition to court costs and legal fees. A fraud conviction can also carry long-term repercussions, such as the stigma and limitations of being a convicted felon.

To combat auto insurance fraud, Michigan has established a Fraud Investigation Unit within the Department of Insurance and Financial Services (DIFS). This unit works to investigate criminal and fraudulent activities related to insurance and financial markets and collaborates with law enforcement to prosecute these crimes. Individuals can report suspected insurance fraud to DIFS by calling their hotline, sending an email, or using their website.

It is important to note that insurance fraud can also be committed by insurance companies themselves. In some cases, insurance providers may lie or use false statements to avoid paying valid claims. Policyholders who suspect insurance company fraud can also report it to the DIFS Fraud Investigation Unit for investigation and potential prosecution.

Salvage Title Insurance: Is It Possible?

You may want to see also

High repair costs

Automobile repair costs have been steadily increasing over the years, and this has a direct impact on insurance rates. Inflation is one factor contributing to this increase, with the consumer price index (CPI) of automotive repair and maintenance rising by 12% between August 2022 and August 2023. This means that even if the number of claims remains the same, insurance companies will have to pay out more for each individual property damage claim. As a result, insurers tend to adjust premiums upwards to cover their increased financial risk.

The rising repair costs are influenced by the advancements in automotive technology. Modern cars are now equipped with sophisticated computer systems and intricate components that require specialized knowledge and tools for repairs. Consequently, the cost of repairing these advanced vehicles has skyrocketed, which, in turn, leads to higher insurance premiums.

Additionally, the type of vehicle plays a significant role in determining insurance rates. Insurance providers consider the make, model, and year of a vehicle when setting rates. Generally, more expensive or high-performance vehicles tend to have higher insurance premiums due to the increased cost of repairs.

The impact of rising repair costs on insurance rates is particularly notable in Michigan, where car insurance rates are already among the highest in the country. Michigan's no-fault insurance system and high minimum insurance requirements further contribute to the elevated insurance rates in the state. While the recent insurance reforms in Michigan have provided drivers with more flexibility in managing their costs, the increasing repair costs continue to be a significant factor in determining insurance premiums.

To summarize, the continuous rise in automobile repair costs is a key factor in the upward adjustment of insurance rates. This trend is further influenced by the complexity of repairs in modern vehicles and the type of vehicle being insured. As a result, insurance companies are compelled to increase premiums to mitigate their financial risk, ultimately impacting the affordability of insurance for drivers.

Open Claim: New Auto Insurance?

You may want to see also

Frequently asked questions

Michigan has some of the highest minimum insurance requirements of any state, which means higher prices for more required coverage. Michigan is also a no-fault state, which means that each driver's insurance covers their own medical expenses, regardless of who was at fault in an accident. This has historically contributed to higher insurance rates in the state.

Michigan requires drivers to carry the minimum insurance of personal injury protection (PIP), property protection insurance (PPI) and residual bodily injury and property damage liability (BI/PD) on every vehicle they use.

There are several ways to lower your car insurance rates in Michigan. You can check for discounts and bundle options, choose a different coverage limit, compare quotes from multiple insurance companies, eliminate add-on coverages, increase your car insurance deductible, and weigh collision coverage against repair costs.