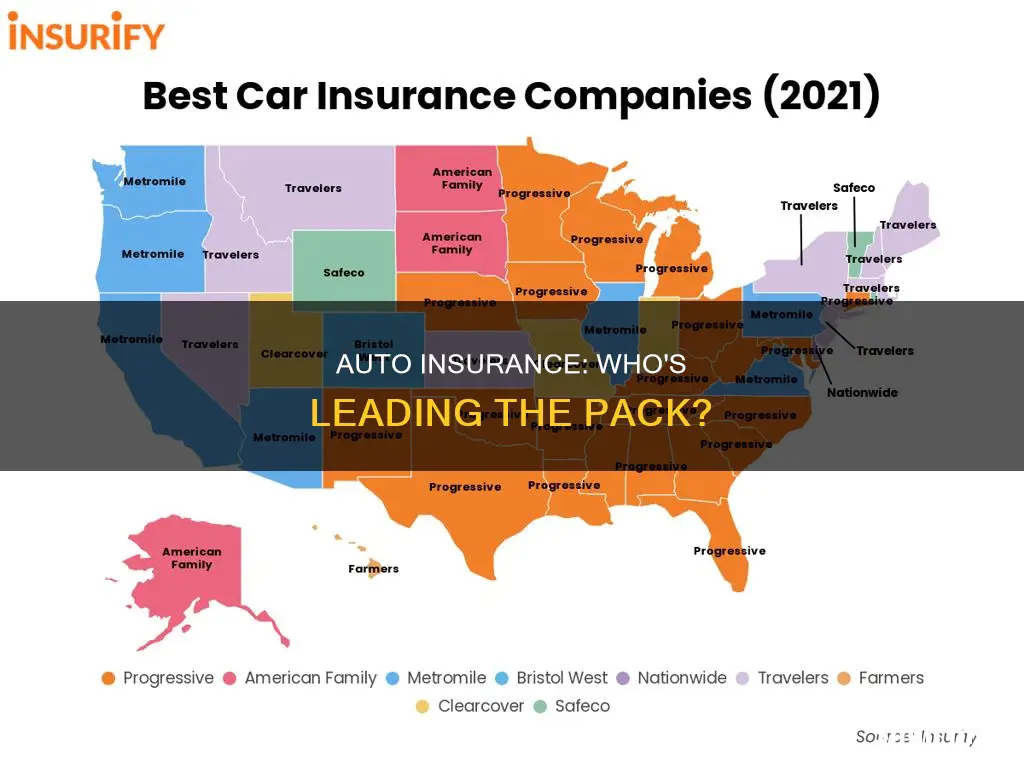

The best auto insurance company for you will depend on your driving record, state and other individual factors. Here is a list of some of the top-rated car insurance companies:

- USAA

- Auto-Owners

- Nationwide

- State Farm

- Geico

- Amica

- Progressive

- Erie

- Liberty Mutual

- Safeco

- Travelers

- American Family

| Characteristics | Values |

|---|---|

| Company | USAA |

| Ranking | 1st |

| Availability | All 50 states and Washington, D.C. |

| Customer Service | Top-rated |

| Claims Handling | Top-rated |

| Customer Loyalty | Top-rated |

| Most Likely to be Recommended | Top-rated |

| Most Likely to be Renewed | Top-rated |

| Best for Seniors | Top-rated |

| Best for Discounts | Top-rated |

| Average Annual Rate | $1,335 |

What You'll Learn

USAA: Best for military members and veterans

USAA is an insurance company that offers policies exclusively to military members, veterans and their families. It is the top-rated car insurance company, according to US News, and is at or near the top in all of the subcategories considered, including customer service and claims handling.

USAA has the most affordable premiums, more than 35% below the national average. It also has the lowest average rate for good drivers, which is $1,335 per year, according to US News. USAA also offers a discount of up to 60% if you store your car while you’re deployed and up to 15% for drivers who garage their cars on a base.

USAA has high customer satisfaction ratings and offers a discount for storing your car on a military base. It also has a SafePilot telematics program.

USAA is available in all 50 states and Washington, D.C.

Mylo Auto Insurance: Your Personalized Policy Partner

You may want to see also

Erie: Best for drivers who caused an accident

Erie Insurance is a great choice for drivers who have caused an accident. It offers affordable premiums and has a top score for its collision repair claims processes and a low level of complaints.

Erie has the best rates for drivers who have caused an accident with injuries or property damage. USAA is a bit cheaper, but its policies are only available to military members, veterans and their families.

Causing an accident leads to an average of a 49% increase if there are injuries and a 48% increase if there is property damage. Erie’s costs only go up by 35% if you cause an accident with injuries and just 29% if you cause property damage.

Erie is available in 12 states and Washington, D.C. It offers gap insurance and new car replacement coverage, as well as accident forgiveness and vanishing deductibles. It’s easy to budget costs with Erie’s Rate Lock, which keeps your price the same year after year unless you make certain changes to your policy, such as adding a car.

However, Erie has high rates for drivers with bad credit. It also offers a poor digital experience, mainly because of its low-rated mobile app.

Auto Insurance: Texas vs Utah — Who Wins?

You may want to see also

Progressive: Best for drivers with a DUI

Progressive is a good choice for drivers with a DUI on their record. Progressive is the second-largest auto insurance company in the country, dominating just over 14% of the market. Its nationwide availability and extensive list of coverage options make it a great choice for all types of drivers, even those who have a DUI conviction and need their insurer to file an SR-22 or FR-44 on their behalf. Progressive offers several lines of insurance to allow for bundling and convenient tools to help you keep your policy within your budget.

Progressive offers three tiers of accident forgiveness and will issue an SR-22 certificate if you need your license reinstated. Progressive also offers a Snapshot telematics program, which can help safe drivers receive a discount. However, rates may increase for less-safe drivers.

Progressive has a lower-than-average customer satisfaction rating from J.D. Power and an above-average number of complaints.

Auto Insurance Claims: Work Authorization and You

You may want to see also

Geico: Great for drivers with poor credit

Geico is a great option for drivers with poor credit. It has national availability and an easy shopping experience. Geico is the cheapest auto insurance company for drivers with poor credit, with rates that are 36% cheaper than the national average.

Geico has more than 300 independent offices across the U.S. and is licensed to issue auto insurance in all 50 states and Washington, D.C. It offers 16 discounts and a variety of optional add-ons, such as emergency roadside assistance, rental car reimbursement and mechanical breakdown insurance.

Geico started by insuring U.S. government employees and military personnel. Today, the company sells insurance to all types of drivers. It has the best car insurance for college students and is one of the largest auto insurance companies in the U.S.

Sinkhole Safety: Understanding Auto Insurance Coverage

You may want to see also

Auto-Owners: Best for new cars

Auto-Owners is a great option for those who have recently purchased a new car. The company offers a "purchase price guarantee" that pays you the original purchase price if your car is totalled within the first two years. There is also "total loss to a new automobile" coverage, which replaces a totalled vehicle with a new one if the loss occurs within 90 days of your vehicle purchase.

Auto-Owners also offers gap insurance, which pays the difference between your insurance payout and the amount still owed on a lease or loan if your new car is stolen or totalled. This is especially useful for new cars, which depreciate quickly.

Auto-Owners is available in 26 states: Alabama, Arizona, Arkansas, Colorado, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Missouri, Nebraska, North Carolina, North Dakota, Ohio, Pennsylvania, South Carolina, South Dakota, Tennessee, Utah, Virginia, and Wisconsin.

Auto-Owners has a low NAIC complaint index and a superior AM Best financial strength rating. It also has a high Bankrate Score, which reflects a weighted rank of industry-standard ratings for financial strength and customer experience, in addition to average quoted rates.

Uber-Ready: Understanding Auto Insurance Coverage for Ride-Sharing

You may want to see also

Frequently asked questions

According to various sources, the best auto insurance company overall is either Amica, Geico, or Nationwide.

USAA is the best auto insurance company for military members and veterans.

Progressive is the best auto insurance company for high-risk drivers.