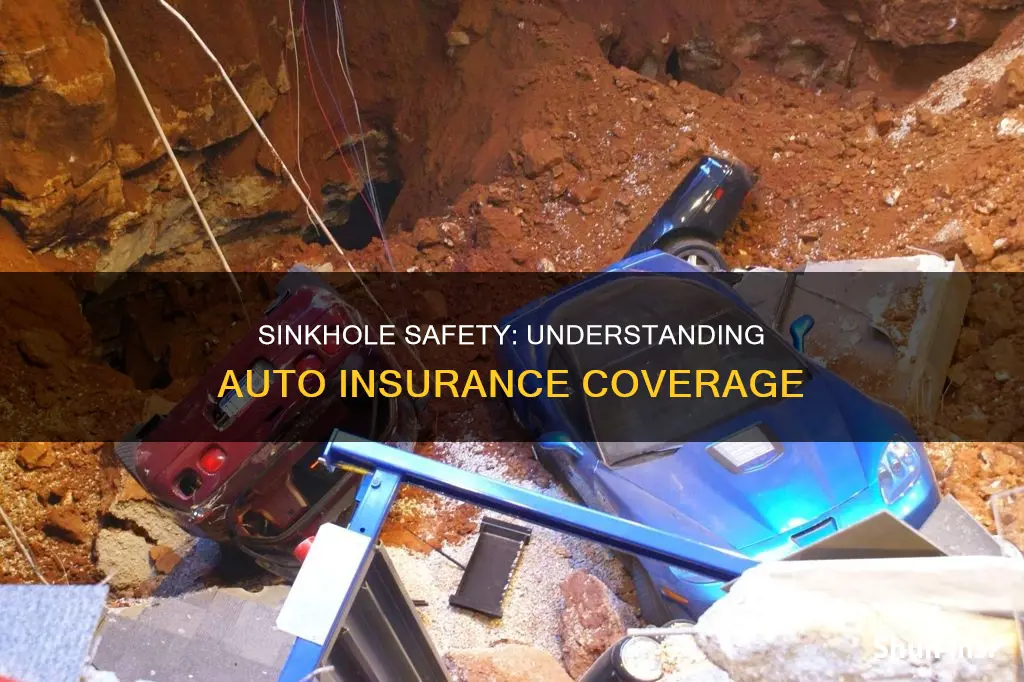

Sinkholes can be catastrophic, swallowing up cars, roadways, and homes. They can also cause minor depressions in the earth's surface, which can be barely visible but still highly destructive. While sinkholes are relatively rare, they are devastating and costly when they occur. In this regard, it is essential to know whether auto insurance covers sinkhole damage. Comprehensive car insurance will cover sinkhole damage as it can be categorized as accidental damage. If the car disappears completely, it can be claimed as a total loss. However, it is worth noting that basic car insurance policies, also known as third-party insurance, do not cover sinkhole damage.

| Characteristics | Values |

|---|---|

| What type of insurance covers sinkholes? | Comprehensive car insurance coverage |

| What does comprehensive car insurance cover? | Weather-related events, including hail and floods, along with other non-collision incidents, such as auto theft and vandalism |

| Is comprehensive car insurance required by law? | No |

| What does sinkhole insurance cover? | Damage to your house, unattached structures (like a shed) and personal property |

| What are the two types of sinkhole insurance? | Sinkhole insurance as an endorsement to your home insurance and catastrophic ground cover collapse |

| What is a sinkhole? | A depression or hole that forms in the earth’s crust |

| What causes sinkholes? | Natural causes (after-effects of earthquakes, erosions in the earth's surface or the presence of excess groundwater) and man-made causes (excessive drilling, mining, construction, heavy traffic, etc.) |

What You'll Learn

Comprehensive car insurance covers sinkhole damage

Comprehensive car insurance is not required by law in any state, so you may not have it if you only purchased the minimum coverage instead of full coverage auto insurance. Check your policy to see if it's comprehensive. If you don't have comprehensive coverage, you may be able to add it to your current policy as an endorsement or rider, but there will be an additional premium to pay.

If you have comprehensive car insurance and need to file a claim for sinkhole damage, you will need to take pictures and document the damage, location, size, and any other details. You can then submit a claim to your auto insurance agent, either in person or online, and they will review the damages and determine how much coverage you'll receive.

While sinkholes are relatively rare, they can be devastating and costly when they do occur. They are caused by an abrupt collapse or settlement of land, often due to underground water dissolving rock and creating cavities over time. As such, they can be unpredictable and hard to insure against, but comprehensive coverage will give you peace of mind if you live in an area prone to sinkholes.

Toyota Gap Insurance: How to Check

You may want to see also

Standard homeowners insurance doesn't cover sinkhole damage

Standard homeowners insurance does not cover sinkhole damage. While sinkholes are relatively rare in the U.S., they can be catastrophic to your home. Even the best home insurance policies won’t cover earth movement such as a sinkhole. You’ll need to purchase separate sinkhole insurance if you want coverage for damage to your house or belongings from this potentially devastating event.

Sinkhole insurance is a special insurance policy that covers your home, other structures, and personal belongings from sinkhole damage. It may also pay to stabilize your home’s land and cover the cost of repairing your foundation. Sinkhole insurance is typically added as an endorsement to a homeowners insurance policy, and there may be an additional premium for this type of endorsement.

When a sinkhole event happens, it is usually categorized under the exclusion section of a home policy as "earth movement". Most homeowners insurance policies do not include sinkhole coverage, but some states require sinkhole endorsements to be available in areas prone to this type of loss. Florida and Tennessee are the only states that require insurance companies to offer sinkhole coverage. In other states, insurance carriers can choose whether or not to offer it.

If you live in an area prone to sinkholes, it’s worth considering sinkhole insurance. Remember that most homeowners insurance companies do not cover sinkhole claims. Without sinkhole insurance, you would have to pay out-of-pocket to repair or rebuild your home.

Full Auto Insurance Coverage Explained

You may want to see also

Sinkhole insurance is expensive

While sinkholes are relatively rare, they can be devastating and costly when they occur. In the US, standard homeowners insurance policies do not cover sinkholes as they are difficult to predict and expensive to insure. In some cases, insurers can even discontinue underwriting coverage for an area after a sinkhole has occurred.

In high-risk areas, insurance companies may be required to offer optional sinkhole insurance as an endorsement or a stand-alone policy. However, this coverage can be very expensive, with annual premiums exceeding the average cost of a standard homeowners insurance policy. For example, in some Florida counties with a history of sinkholes, sinkhole insurance can cost around $2,000-$4,000 per year, with a high deductible.

The high cost of sinkhole insurance is a significant factor in why many homeowners choose not to invest in it. In Pasco County, Florida, for instance, basic homeowner's insurance might cost around $1,000 annually, while adding sinkhole insurance could increase this by an additional $3,000 to $4,000. As a result, many families find it impractical and unaffordable.

To obtain sinkhole insurance, a geological survey of the property is typically required to ensure there is no obvious risk of a sinkhole collapse. The customer usually bears the cost of this survey, adding to the overall expense.

Given the financial burden of sinkhole insurance, homeowners must carefully consider their property's risk against the cost of coverage. While sinkhole insurance is valuable in high-risk areas, it may not be necessary in regions where sinkholes are unlikely to occur.

Does Auto Insurance Cover Dents? Understanding Your Policy's Dent Protection

You may want to see also

Sinkhole insurance is worth it for high-risk areas

Sinkholes are a rare but potentially catastrophic event. They occur when land collapses suddenly, and while they are relatively uncommon, they can be devastating and costly when they do happen. In the US, sinkholes are most common in Alabama, Florida, Kentucky, Missouri, Pennsylvania, Tennessee, and Texas.

Standard homeowners insurance policies typically do not cover damage caused by sinkholes or other types of earth movement, such as landslides or earthquakes. However, in high-risk areas, insurance companies may be mandated to offer optional sinkhole insurance as an endorsement or a stand-alone policy. An endorsement is an addition to a standard insurance policy that modifies the coverage and may also be referred to as an add-on or policy rider.

Major insurance companies like Nationwide, Travelers, and USAA provide sinkhole endorsements in high-risk areas, but their coverage may be restricted to events caused by previous mining operations and exclude naturally occurring sinkholes. Local insurance providers may also provide sinkhole insurance to at-risk communities. For example, Florida homeowners can purchase sinkhole insurance from Citizens Property Insurance Corp., which covers losses and damages caused by naturally occurring sinkholes.

Before purchasing sinkhole insurance, insurance providers will typically require a geological survey of your property to assess the risk of a sinkhole collapse. The customer is generally responsible for the cost of this survey.

Sinkhole insurance can be expensive, with annual premiums in some Florida counties exceeding the average cost of a standard homeowners insurance policy in the state. However, considering the potential financial devastation caused by sinkholes, it is worth purchasing this coverage if you live in a high-risk area.

To determine if sinkhole insurance is worth it for your specific situation, you should consult a professional study or research the history of sinkhole occurrences in your area. Balancing the probability of a sinkhole occurring with the cost of coverage will help you make an informed decision.

Insurance Fraud: Credit Impact

You may want to see also

Sinkhole insurance may not cover mine subsidence damage

While sinkhole insurance is available, it's important to note that it may not cover damage caused by mine subsidence. Mine subsidence refers specifically to land movement caused by the collapse of man-made underground mines. This is distinct from naturally occurring sinkholes, which are typically caused by the dissolution of rock by underground water supplies.

Standard homeowners insurance policies often exclude coverage for mine subsidence damage due to the unpredictable nature of this type of event. In some cases, insurers may even discontinue underwriting coverage for an area once a sinkhole has formed. As a result, homeowners in areas vulnerable to mine subsidence damage may need to purchase separate mine subsidence insurance or add this coverage to their existing policies.

Mine subsidence insurance is generally only offered in states with a significant number of properties established over abandoned mines, such as Colorado, Illinois, Indiana, Kentucky, Ohio, Pennsylvania, West Virginia, and Wyoming. The availability and specifics of coverage may vary by state. For example, in Illinois, mine subsidence coverage is automatically included in property insurance policies in 34 at-risk counties, while in Indiana, this coverage can cost up to $138 for $200,000 in coverage.

It's important to note that mine subsidence insurance typically only covers the structure of the home, excluding personal belongings. Additionally, coverage may be limited to damage caused by previous mining operations, rather than naturally occurring sinkholes. As such, it's crucial to carefully review the terms and conditions of any insurance policy to understand the specific coverage provided.

To determine if your property is at risk for mine subsidence damage, you can consult local sources, such as the seller or developer of your home, or check with a county clerk's office or zoning board for information about mine locations or subsidence episodes in your area. Online maps are also available in some states, such as Illinois, Indiana, and Pennsylvania, which allow residents to search for their addresses and identify nearby mines.

AAA Auto Insurance: Is Roadside Assistance Standard?

You may want to see also

Frequently asked questions

Auto insurance covers sinkholes, but only if you have comprehensive coverage. If you lack comprehensive coverage, auto insurance will not cover sinkhole damage.

A sinkhole endorsement is an addition to your standard insurance policy that covers sinkholes. It may also be called an add-on or policy rider.

Contact your insurance agent or broker and ask them to add comprehensive coverage to your auto insurance policy.

Catastrophic ground collapse coverage must meet specific conditions, such as the abrupt collapse of the ground, a depression visible to the naked eye, structural damage, and the government condemning your property and requiring you to vacate. Sinkhole insurance, on the other hand, covers a broader range of sinkhole-related damages.

Sinkhole insurance can be expensive, so you need to balance your property's risk with the cost of coverage. Consult the history of your area to determine the probability of a future sinkhole and decide accordingly.