Yes, an employer can ask for proof of your auto insurance, especially if you drive your personal vehicle for work or for business-related purposes. This is to ensure that you are adhering to the minimum coverage rules in your state, and that your insurance is up-to-date. If you are in an accident, your employer may be held liable, so they will want to ensure you have adequate insurance. Proof of insurance is a document that verifies your policy, and you can provide this physically or digitally.

| Characteristics | Values |

|---|---|

| Can an employer ask for proof of auto insurance? | Yes |

| When will an employer ask for proof of auto insurance? | If you drive your personal vehicle to work or for business-related purposes |

| Why would an employer need proof of auto insurance? | To ensure your policy is up-to-date and meets the state's minimum standards, and to reduce their share of financial responsibility if you are in an accident |

| What counts as proof of insurance? | Physical or digital documentation that proves your insurance coverage is up-to-date and meets the state's minimum requirements |

| What is included in proof of insurance? | Names of insured parties, vehicle information, policy number, policy effective and expiration dates, coverage amounts and limits |

What You'll Learn

When will an employer ask for proof of auto insurance?

An employer will ask for proof of auto insurance if you drive your own vehicle to work or for work-related purposes. This includes driving to and from the office, or for running work-related errands such as taking deposits to the bank.

Employers may ask for proof of insurance to ensure that you are adhering to the minimum auto coverage required by your state. They may also want to ensure that you are fully protected in the event of an accident. This is particularly important if you are driving during work hours, as your personal auto insurance may not cover you.

If you are driving your own vehicle for work, your employer will likely ask for proof of insurance on a bi-annual or semi-annual basis. This is to ensure that your policy is up-to-date and valid.

It is worth noting that some lawyers argue that requiring proof of insurance from employees is a form of subtle discrimination and may not always be enforceable.

Progressive's Vehicle Insurance Valuation

You may want to see also

Why would an employer need proof of auto insurance?

An employer may ask for proof of auto insurance for a variety of reasons, primarily if you are using your personal vehicle for work-related purposes or driving for work. This includes driving to and from work, running work-related errands, or using your car to perform tasks related to your job.

Firstly, employers want to ensure that you have valid and up-to-date insurance to protect themselves from liability in the event of an accident. If you are in an accident while on the clock, your employer may be held responsible for any damages or losses. By confirming your insurance coverage, they can reduce their financial responsibility. This is especially important as employers are often subject to vicarious liability laws, which means they can be held liable for your negligent acts during work hours.

Secondly, employers want to confirm that you meet the minimum auto coverage requirements for your state. This includes liability coverage, which is required in almost every state and helps cover medical expenses and property damage incurred by others in an accident. Additionally, they want to ensure you have adequate levels of insurance to protect yourself and the company in the event of an accident. This includes collision and comprehensive insurance, which cover damage to your vehicle, and personal injury protection, which covers medical expenses for you and your passengers.

Furthermore, employers may ask for proof of insurance as part of a regular verification process to ensure that you maintain adequate coverage between policy renewals and when driving for work-related purposes. This helps to avoid any risks to the company, as driving without insurance is a major liability concern.

Auto Insurance: Hurricane Damage Covered?

You may want to see also

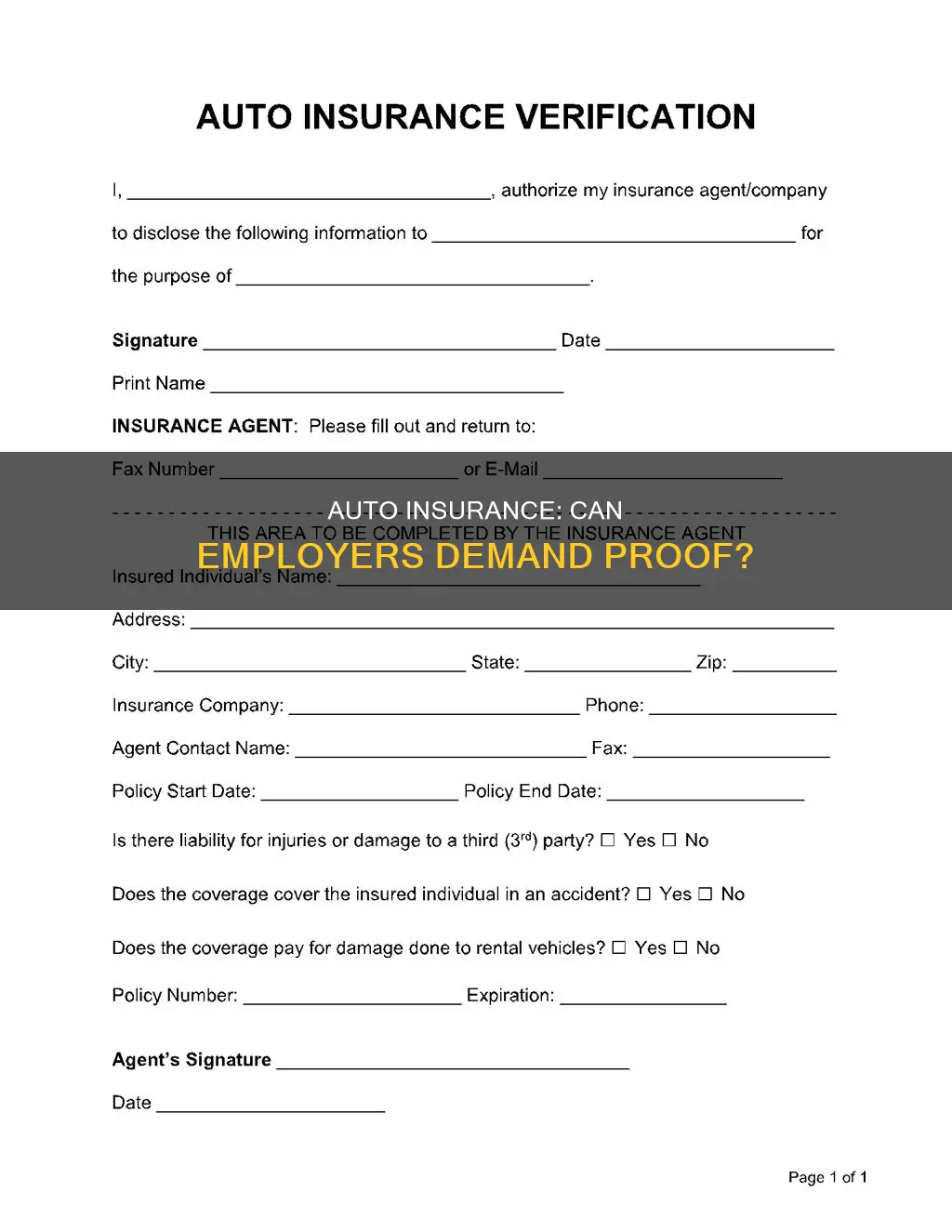

What is proof of insurance?

Proof of insurance is a document or ID card that contains information about you and your insurance policy. It typically includes your name, the name of your insurer, your policy number, and the effective dates of the policy. It may also include details about your vehicle, such as the make, model, and vehicle identification number (VIN).

Proof of insurance is important because it verifies that you have an active insurance policy and allows authorities, employers, or finance companies to check that you have the required coverage. For example, if you are pulled over by the police or involved in an accident, you will need to show proof of insurance. Similarly, when buying a car or registering a vehicle with the DMV, you will need to provide proof of insurance.

You can usually access your proof of insurance in a few different ways, such as by requesting a physical copy from your insurer, printing a copy yourself, or accessing a digital copy through your insurer's website or mobile app. It is a good idea to keep a copy of your proof of insurance in your vehicle, either physically or electronically, so that you can easily provide it when needed.

Gap Insurance: Florida's Ultimate Car Protection

You may want to see also

What counts as proof of insurance?

Proof of insurance is a document that shows your insurance coverage is up-to-date and meets the state's minimum requirements. It is usually provided by your insurance company after you buy a policy, and it can be accessed physically or digitally.

Physical proof of insurance is typically in the form of an ID card, which includes the following information:

- The names of the insured parties

- Vehicle information, such as the make, model, and Vehicle Identification Number (VIN)

- The policy number

- Policy effective and expiration dates

- Coverage amounts and limits

You can also access proof of insurance digitally through your insurance company's mobile app or website. This is accepted in most states, except for New Mexico, where an electronic copy is not recognised during a traffic stop.

Liberty Mutual: Vehicle Insurance Explained

You may want to see also

How much insurance coverage is needed?

The amount of insurance coverage you need depends on several factors, including your state's requirements, your net worth, and the value of your vehicle. Here's a detailed breakdown:

Minimum Coverage Requirements:

Firstly, it's important to understand the minimum coverage requirements in your state. Most states mandate a minimum amount of liability coverage, which includes bodily injury liability and property damage liability. The minimum limits for liability coverage vary but commonly include $25,000 per person and $50,000 per accident for bodily injury, and $25,000 for property damage. However, your state may require higher or lower limits, so be sure to check your local regulations.

Assessing Your Net Worth:

When deciding on the amount of coverage, it's crucial to consider your net worth. Calculate your net worth by adding up the value of your assets, such as your home, vehicles, savings, and investments, and then subtracting any debts you owe. The goal is to have enough liability coverage to protect your assets in the event of an accident. Ideally, your total bodily injury liability limit should be higher than your net worth to ensure adequate protection.

Value of Your Vehicle:

If you're leasing or financing a vehicle, your lender may require you to carry comprehensive and collision coverage in addition to liability coverage. Comprehensive coverage protects your vehicle from events outside your control, such as theft, vandalism, or damage from weather. Collision coverage, on the other hand, pays for repairs or replacement of your vehicle if it's damaged in an accident with another vehicle or object. Even if you own your car outright, consider adding these coverages if your vehicle is valuable or if you can't afford repairs or replacement costs.

Optional Coverages:

In addition to the mandatory liability coverage, there are several optional coverages to consider:

- Uninsured/Underinsured Motorist Coverage: This protects you if you're hit by a driver with insufficient or no insurance. It's especially important if you live in a state with a high percentage of uninsured drivers.

- Personal Injury Protection (PIP): PIP covers medical expenses, lost wages, funeral expenses, and other costs resulting from an accident. It's required in some states and offers more comprehensive coverage than medical payments coverage (MedPay).

- Medical Payments Coverage (MedPay): MedPay covers medical expenses for you and your passengers after an accident. It's required in only a few states but can be useful if you or your passengers don't have health insurance or have high deductibles.

- Rideshare Insurance: If you drive for ridesharing companies, this coverage fills the gaps between your personal insurance and the company's insurance.

- Gap Insurance: If you lease or finance a vehicle, gap insurance covers the difference between the actual cash value of your car and what you owe on the loan or lease if your car is totaled.

Remember, while you must meet the minimum coverage requirements in your state, it's essential to assess your financial situation and choose coverages that provide adequate protection for your specific needs.

Drunk Driving: Auto Insurance Coverage?

You may want to see also

Frequently asked questions

Yes, an employer can ask for proof of auto insurance, especially if you drive your personal vehicle for work.

Employers want to ensure they are protected from liability or financial responsibility if you are in a crash during work hours. They also want to make sure you are adhering to the minimum coverage rules in your state.

Proof of insurance is typically a physical or digital document that verifies your insurance coverage is up-to-date and meets the state's minimum requirements. It includes your policy number, the names of the insured parties, vehicle information, coverage amounts and limits, and policy effective and expiration dates.

To ensure your policy is up-to-date, your employer may ask for proof of insurance on a semi-annual or bi-annual basis.