Life insurance can be a valuable asset in an estate plan, but understanding when it is includible in the estate is crucial for effective financial planning. This paragraph will explore the criteria that determine whether life insurance proceeds are considered part of the estate for tax and inheritance purposes, helping individuals and their advisors make informed decisions about their estate's composition and distribution.

What You'll Learn

- Policy Ownership: Who is the owner of the life insurance policy

- Beneficiary Designations: How are beneficiaries named on the policy

- Policy Value: What is the cash value of the policy

- Tax Implications: Are there tax consequences for the estate

- Policy Termination: What happens to the policy upon the insured's death

Policy Ownership: Who is the owner of the life insurance policy?

The ownership of a life insurance policy is a crucial aspect to consider when dealing with estate planning and administration. The owner of the policy, or the insured individual, has the right to control and make decisions regarding the policy during their lifetime. This includes the ability to name beneficiaries, change beneficiaries, and make premium payments. When it comes to the inclusion of life insurance in an estate, the ownership of the policy can significantly impact the process.

In many cases, the insured individual is the owner of the life insurance policy. This means that the policy is typically listed as an asset in their estate, and the proceeds from the policy will be distributed according to the terms of the policy and the wishes of the insured. For example, if the insured person names themselves as the primary beneficiary, the death benefit will be paid out to them or their estate. This ownership structure allows the insured to have control over the policy's benefits and ensures that the proceeds are accessible to their intended recipients.

However, there are alternative ownership structures to consider. Joint ownership, for instance, can be established, where the insured and another individual, such as a spouse or business partner, own the policy together. In this scenario, the proceeds from the policy may be split between the co-owners according to the terms of the policy. This arrangement can provide financial security for the co-owner and ensure that the policy's benefits are not solely dependent on the insured's survival.

Additionally, the insured can also choose to name a trust as the owner of the life insurance policy. By doing so, the policy proceeds become assets of the trust, and the trust's beneficiaries will receive the death benefit. This strategy can offer tax advantages and provide a more structured approach to distributing the insurance proceeds.

Understanding the ownership structure of a life insurance policy is essential for effective estate planning. It allows individuals to make informed decisions about beneficiary designations, premium payments, and the overall management of their insurance assets. By considering the implications of policy ownership, individuals can ensure that their life insurance proceeds are distributed according to their wishes and that their estate is properly managed.

Life Insurance with Atrial Fibrillation: What You Need to Know

You may want to see also

Beneficiary Designations: How are beneficiaries named on the policy?

When it comes to life insurance, the process of naming beneficiaries is a crucial aspect of estate planning. Beneficiary designations play a significant role in determining who receives the death benefit from the insurance policy upon the insured individual's passing. This is an essential consideration as it can impact the distribution of assets and the overall estate plan.

The method of naming beneficiaries varies depending on the type of life insurance policy. Typically, the insured person has the flexibility to choose and change beneficiaries at any time, often through a written request or online portal provided by the insurance company. This allows for a certain level of control over the distribution of the policy's proceeds. For instance, an individual might name their spouse as the primary beneficiary and their children as secondary beneficiaries, ensuring a specific order of priority.

In some cases, the policy may offer different options for beneficiary selection. For instance, a "joint-with-right-of-survivorship" (JWROS) clause can be included, where the insured and a designated beneficiary are listed as joint owners of the policy. This means that if the insured dies, the beneficiary automatically becomes the owner of the policy and receives the death benefit. This type of designation is often used for tax-efficient estate planning.

It's important to note that the rules and regulations regarding beneficiary designations can vary by jurisdiction and insurance provider. Some policies may have specific requirements or restrictions on who can be named as a beneficiary, especially in certain countries or regions. Therefore, it is advisable to consult the insurance company's guidelines or seek professional advice to ensure compliance with any legal or administrative considerations.

Additionally, regular reviews of beneficiary designations are recommended, especially when significant life events occur, such as marriages, births, or changes in relationships. These reviews help ensure that the beneficiary designations remain aligned with the individual's current wishes and circumstances, providing peace of mind and proper estate management.

Understanding Supplemental AD&D Life Insurance: A Comprehensive Guide

You may want to see also

Policy Value: What is the cash value of the policy?

The cash value of a life insurance policy is a crucial aspect to consider when determining its inclusion in an estate. This value represents the amount of money that can be accessed by the policyholder or their beneficiaries if the policy is surrendered or the loan is repaid. It is an essential component of the policy's overall worth and can significantly impact the estate planning process.

When an individual purchases a life insurance policy, a portion of their premium payments goes towards building this cash value. Over time, the policy accumulates a reserve, which can be used for various purposes. The cash value grows through a combination of interest earned on the investment and any additional contributions made by the policyholder. This feature is particularly beneficial as it provides a source of funds that can be utilized during the policyholder's lifetime or passed on as part of the estate.

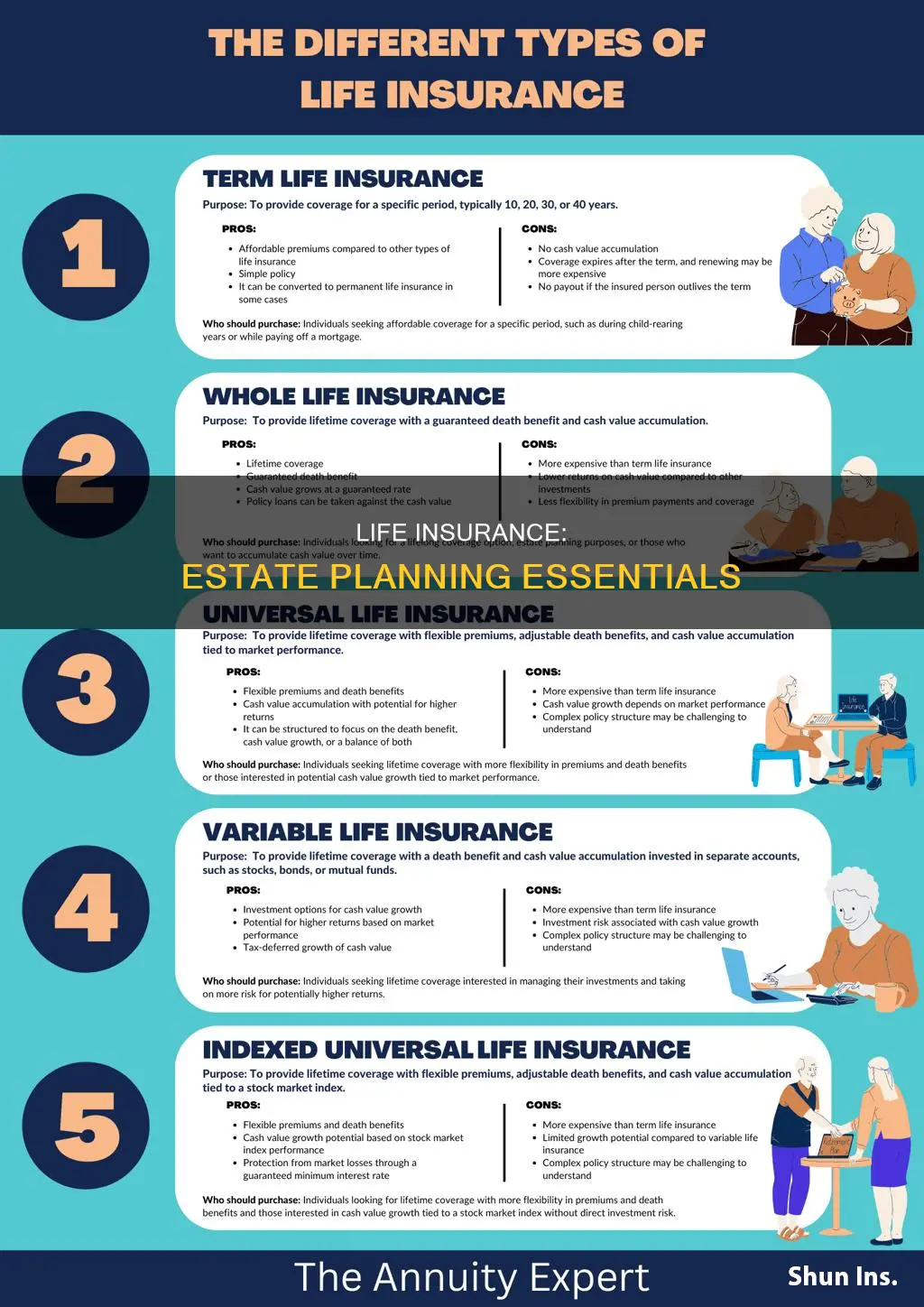

The calculation of the cash value can vary depending on the type of policy. For instance, in whole life insurance, the cash value grows steadily over time, ensuring a guaranteed death benefit. In contrast, term life insurance policies do not accumulate cash value, as they are designed to provide coverage for a specific period. Understanding the policy's terms and conditions is vital to determining the exact amount of cash value available.

In the context of estate planning, the cash value of a life insurance policy can be a valuable asset. It can be used to pay for final expenses, provide financial security to beneficiaries, or even be converted into a lump-sum payment. By including the policy in the estate, the cash value can be utilized to fulfill various financial goals and ensure a smooth transition of wealth.

It is important to note that the cash value of a life insurance policy is not always readily available as cash. The process of accessing this value may involve surrendering the policy, taking a loan against it, or allowing it to mature over time. Policyholders should carefully consider their options and seek professional advice to make informed decisions regarding the utilization of the policy's cash value.

Life Insurance for Canadians: What US Companies Offer

You may want to see also

Tax Implications: Are there tax consequences for the estate?

When it comes to life insurance and its inclusion in an estate, understanding the tax implications is crucial for effective estate planning. The tax consequences can vary depending on the type of life insurance policy and the specific circumstances of the estate. Here's an overview of the tax considerations:

Inclusion in Gross Estate: Generally, life insurance proceeds paid to the designated beneficiaries are not includible in the gross estate of the deceased. This means that the insurance payout is typically exempt from estate taxes. The Internal Revenue Code (IRC) provides a clear rule that life insurance benefits received by the insured's beneficiaries are not subject to inclusion in the estate. This exclusion is designed to prevent double taxation, ensuring that the insurance proceeds are not taxed twice—once as income to the beneficiary and again as part of the estate.

Estate Tax Treatment: The tax treatment of life insurance can vary based on the type of policy. For instance, a term life insurance policy, which provides coverage for a specific period, is generally not taxable. However, if the policy is a permanent life insurance policy with a cash value component, the situation becomes more complex. The cash value of the policy may be subject to estate taxes if it exceeds a certain threshold. This threshold is typically the policy's "basis," which is the amount the insured paid for the policy plus any deposits or contributions made by the insured.

Income Tax Implications for Beneficiaries: While the insurance proceeds are not includible in the estate, beneficiaries may still be subject to income tax on the payout. The proceeds are generally considered taxable income to the beneficiary in the year they are received. The tax rate applied to the beneficiary will depend on their overall income for that year. It is essential for beneficiaries to be aware of these tax obligations and plan accordingly to minimize any potential tax liability.

Planning Strategies: To navigate these tax implications effectively, estate planners can employ various strategies. One approach is to structure the estate plan to take advantage of the exclusion rules. This may involve naming beneficiaries who are in a lower tax bracket or utilizing trust structures to manage the distribution of the insurance proceeds. Additionally, considering the type of life insurance policy can be crucial. Term life insurance is often preferred for its simplicity and lack of tax consequences, while permanent policies with cash values require careful consideration to minimize potential tax issues.

In summary, the tax implications of life insurance in an estate are significant and should be carefully considered. While the proceeds are generally not includible in the gross estate, beneficiaries may still face income tax obligations. Estate planners can utilize various strategies to optimize the tax treatment of life insurance, ensuring that the wishes of the deceased are carried out while minimizing potential tax consequences for the estate and its beneficiaries.

Life Insurance Offering by BB&T: What You Need to Know

You may want to see also

Policy Termination: What happens to the policy upon the insured's death?

When an insured individual passes away, the status of their life insurance policy becomes a crucial consideration for the estate. The inclusion of life insurance in the estate's assets is a significant aspect of estate planning and tax considerations. Upon the insured's death, the life insurance policy typically enters a termination phase, and the proceeds of the policy are subject to specific regulations.

The primary outcome of the policy termination is the distribution of the death benefit, which is the amount insured under the policy, to the designated beneficiaries. These beneficiaries can be named individuals, such as family members or trusted associates, or even charitable organizations. The death benefit is often a substantial sum, and its distribution is a critical part of the insured's estate settlement process. Typically, the insurance company is responsible for paying out the death benefit, and they will follow the instructions provided by the insured in their policy documents.

The inclusion of life insurance in the estate is essential for several reasons. Firstly, it ensures that the insured's beneficiaries receive the intended financial support, which can be crucial for their well-being and financial stability. Secondly, it helps in the efficient distribution of the estate, allowing the beneficiaries to access the funds promptly without lengthy legal processes. Moreover, the tax implications of life insurance proceeds are favorable, often treated as nontaxable events, which can provide significant tax benefits to the beneficiaries.

However, there are some considerations to keep in mind. The insurance company may require proof of death and proper documentation before releasing the death benefit. This process ensures that the proceeds are paid to the rightful beneficiaries. Additionally, if the policy has any outstanding loans or premiums, these must be settled before the death benefit can be fully distributed.

In summary, upon the insured's death, the life insurance policy is terminated, and the death benefit is paid out to the designated beneficiaries. This process is a critical aspect of estate administration, ensuring the insured's wishes are honored and providing financial security to the beneficiaries. Understanding the mechanics of policy termination and its implications is essential for effective estate planning and management.

Life Insurance Agents: Essential or Unnecessary?

You may want to see also

Frequently asked questions

Life insurance proceeds are generally includible in an estate when the insured individual dies. The insurance payout is considered an asset of the estate and is subject to the estate tax laws of the jurisdiction. The timing of inclusion can vary based on the specific policy and the beneficiary designation.

Yes, there are exceptions. If the life insurance policy is owned by a trust or an entity other than the insured, it may not be includible in the estate. Additionally, if the policy has a rider or endorsement that specifically excludes the proceeds from the estate, it may not be taxed. It's important to review the policy documents and consult with a legal or financial advisor to understand the specific terms and their implications.

The inclusion of life insurance proceeds in the estate can impact the estate tax liability. The value of the policy is added to the overall estate value, and if the total exceeds the applicable exclusion amount, estate taxes may be due. However, there are often strategies, such as splitting the policy ownership or using a trust, that can help minimize the tax impact and ensure proper distribution according to the insured's wishes.