Whole life insurance is a type of insurance policy that remains in force for the entirety of the insured person's life, provided that the premiums are paid. Whole life insurance premiums are typically much higher than term insurance premiums, but because term insurance premiums increase with the age of the insured, the total value of all premiums paid under both types of policies is roughly equal if the policy continues to average life expectancy. Whole life insurance policies build up a cash value over the life of the policy, which can be accessed at any time through policy loans that are received income tax-free and paid back according to a predetermined schedule. This cash value can be used to purchase additional coverage, known as paid-up additional life insurance, which has its own death benefit and continues to build cash value.

When is whole life insurance paid up?

| Characteristics | Values |

|---|---|

| Definition of paid-up life insurance | A policy that is paid in full, remains in force, and does not have any premiums owed |

| Who is it for? | People who no longer need the same amount of coverage or are concerned about keeping up with premium payments |

| How does it work? | The policy is kept in force by deducting the premium from the cash value account. The death benefit also decreases. |

| How to convert to paid-up status? | Using dividends that the policy earns to purchase additional coverage and grow additional cash value |

| How to purchase paid-up additions? | Using dividends generated by a whole life policy |

| What are paid-up additions? | Increases in coverage that can be purchased using dividends generated by a whole life policy |

| What are the benefits of paid-up additions? | No increase in premium payments, larger death benefit, faster cash value growth, and dividend compounding |

What You'll Learn

- Whole life insurance policies are typically paid in full for the insured's entire lifetime

- The policy may be set up to be paid up at a certain age, e.g. 65 or 80

- Paid-up additional life insurance can be purchased with dividends from a whole life policy

- Paid-up additions are small, paid-up life insurance policies that build up cash value

- Reduced paid-up insurance allows the policyholder to buy out their coverage

Whole life insurance policies are typically paid in full for the insured's entire lifetime

Whole life insurance is a type of insurance policy that remains in force for the insured's entire lifetime, provided that the required premiums are paid. It is sometimes referred to as "straight life" or "ordinary life" insurance. Whole life insurance policies typically require the policyholder to pay premiums for the duration of the policy, but there are options to pay up the policy early.

One way to do this is through limited pay policies, which allow the policyholder to pay premiums for a set number of years, such as 20, or until they reach a certain age, such as 65 or 80. These policies typically cost more upfront, as the insurance company needs to build up sufficient cash value to fund the policy for the remainder of the insured's life. Another option for early payment is to make a single large premium payment, although this option may not be available from all insurers or on all policies.

Paid-up additional life insurance is another way to achieve paid-up status on a whole life insurance policy. This involves purchasing small chunks of additional coverage, known as paid-up additions (PUAs), using the dividends generated by the policy. These additions have their own death benefit and cash value and also earn dividends, which can be used to purchase further additions. This allows the policyholder to increase their coverage and the cash value of the policy over time without increasing their premium payments.

It is important to note that the ability to purchase paid-up additions may depend on the specific insurance company and policy. Additionally, while paid-up additions can provide significant benefits, they are typically very small on their own and may not be worth much individually. Policyholders should carefully review their policy and consult with a financial professional to understand their options and make informed decisions about their insurance coverage.

Life Insurance for Young Adults: What You Need to Know

You may want to see also

The policy may be set up to be paid up at a certain age, e.g. 65 or 80

Whole life insurance is a permanent life policy that provides coverage for your entire lifetime, meaning it will never expire. As long as you pay your premiums, the policy will pay out a death benefit to your beneficiaries after you pass away. Whole life insurance is designed to last for your entire life, regardless of how old you are when you pass away.

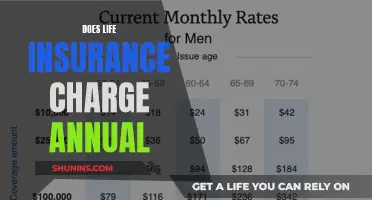

Whole life insurance premiums are based on several factors, including your age, gender, health history, tobacco usage, occupation, how much coverage you buy, state of residence, and the type of underwriting (exam or no-exam). The older you are when you purchase a policy, the more expensive the premiums will be, as the cost of life insurance is based on actuarial life tables that assign a likelihood of dying while the policy is in force.

The policy may be set up to be paid up at a certain age, such as 65 or 80. The age at which a whole life insurance policy is paid up can vary depending on the insurance provider and the specific terms of the policy. Typically, the maximum age for a whole life insurance policy can range from 95 to 120. It's important to note that the premiums may increase as the insured person ages, as more of the premium is needed to cover the higher risks associated with old age.

Purchasing a whole life insurance policy at a younger age can result in lower premiums and a buildup of cash value over a longer period. This can provide financial flexibility later in life. It's worth noting that the cash value component of a whole life insurance policy can be accessed by the policyholder during their lifetime, providing a living benefit.

Uncovering Your Brother's Life Insurance: A Step-by-Step Guide

You may want to see also

Paid-up additional life insurance can be purchased with dividends from a whole life policy

Whole life insurance is a type of permanent life insurance that offers lifelong coverage and a death benefit. It is a contract between the insured and the insurer, guaranteeing that the insurer will pay the death benefit to the policy's beneficiaries when the insured dies, as long as the required premiums are paid. Whole life insurance policies also build up tax-deferred cash value or savings over the life of the policy, which can be accessed by the policyholder during their lifetime.

Paid-up additional life insurance is an option available with some whole life insurance policies. It allows policyholders to purchase small chunks of additional whole life insurance, known as paid-up additions (PUAs), using the dividends earned from their base policy. These PUAs have their own death benefit and cash value and also earn dividends, which can compound over time, increasing the overall value of the policy. This option is particularly valuable for those who may have experienced a decline in health, making it difficult or costly to increase coverage through other means.

The ability to purchase PUAs is often included as a rider on the original policy, known as a PUA rider. These riders may have different names and structures depending on the insurance company, and they typically allow for flexibility in the amount contributed annually. It is important to note that policies with PUA riders may initially have lower cash values and death benefits, but the long-term compounding effect can lead to a significant increase in value over time.

When considering a whole life insurance policy with a PUA rider, it is essential to carefully review the plan's details. Dividends may be guaranteed or non-guaranteed, and policies with guaranteed dividends often have higher premiums to mitigate the added risk for the insurance company. Policyholders should also consider the insurance company's credit rating to assess the sustainability of dividend payments. Dividends are not guaranteed and are based on the financial performance of the insurance company, but they can provide potential income and flexibility in managing the policy.

In summary, paid-up additional life insurance is a valuable option for those with whole life insurance policies who want to increase their coverage and maximize their policy's value over time. By using dividends to purchase PUAs, policyholders can benefit from the compounding effect of these mini-policies, leading to a larger death benefit and cash value.

Life Insurance: Tax ID Number Eligibility

You may want to see also

Paid-up additions are small, paid-up life insurance policies that build up cash value

Whole life insurance is a type of insurance policy that remains in force for the entirety of the insured person's life, provided that the required premiums are paid. Whole life insurance policies build up tax-deferred cash value or savings over the life of the policy. This cash value grows over time according to the premiums paid in. Whole life insurance typically requires the policyholder to pay premiums for the duration of the policy. However, there are arrangements that allow the policy to be "paid up", meaning that no further payments are required. This can be achieved in as few as five years or with a single large premium payment upfront.

Paid-up additional insurance can be understood as small chunks of whole life insurance that are purchased with the dividends from a whole life policy. Each paid-up addition (PUA) represents a fully paid-up miniature life insurance policy with its own death benefit and cash value. They are like small packets of life insurance that are entirely paid for upfront, with no future premiums or other costs. The death benefit is paid out to the policyholder's family in the event of their death.

The cash value of paid-up additions accumulates over time, as they also earn dividends and interest from the insurance company, which are added to the cash value. This compounding effect can significantly increase the policy's financial benefits over the long term. The additional cash value provided by paid-up additions offers greater liquidity for the policyholder, who can access this cash through loans or withdrawals, subject to the terms of the policy.

Paid-up additions are typically offered as a rider to the original whole life insurance policy. Policyholders can choose to purchase paid-up additions with the dividends they receive from their insurance company. This allows them to increase their coverage and enhance the policy's cash value and death benefit without paying additional premiums or undergoing medical underwriting. By reinvesting dividends into paid-up additions, policyholders can grow their wealth and secure a larger legacy for their beneficiaries.

Who Gets Your Life Insurance Money: Contingent Beneficiaries Explained

You may want to see also

Reduced paid-up insurance allows the policyholder to buy out their coverage

Whole life insurance is a policy that remains in force for the insured's entire lifetime, provided that the required premiums are paid. Whole life insurance policies offer coverage for the entire life of the insured and have level premiums and a guaranteed death benefit. The cash value in these policies grows at a guaranteed rate, usually 4%, plus an annual dividend. This cash value can be accessed at any time through policy loans that are received tax-free.

Paid-up life insurance typically comes in two forms: paid-up status and paid-up additions. The former allows policyholders to keep their policy in force without paying premiums, while the latter involves using dividends from the policy to purchase additional coverage and grow its cash value. Paid-up additions are like small packets of life insurance that are entirely paid for and can be used to increase the overall value of the policy over time.

Reduced paid-up insurance (RPU) is a non-forfeiture option available in some whole life insurance policies. It allows the policyholder to buy out their coverage by using the policy's cash value to purchase a smaller amount of paid-up whole life insurance. This option is chosen when the policyholder no longer wants to pay premiums and is more concerned with preserving the existing cash value than maintaining the full amount of the death benefit. The amount of reduced paid-up coverage is determined by the policy's existing cash value and the insured's age at the time of conversion.

The main benefit of reduced paid-up insurance is that it allows policyholders to stop paying premiums while still maintaining a portion of their coverage for life. This option may be particularly attractive to those struggling to make annual premium payments, as it provides a way to keep the policy in force without incurring additional costs. Additionally, the cash value in a reduced paid-up policy continues to grow, whereas with extended-term insurance, the cash value eventually diminishes.

It is important to note that reduced paid-up insurance may not be the best option for everyone. For example, if the current whole life policy includes riders that the policyholder relies on for financial protection, these riders will be canceled upon conversion to a reduced paid-up policy. Therefore, it is recommended to consult a certified financial planner or licensed life insurance agent to determine if this option is suitable for one's specific needs and circumstances.

Get Life Insurance: Tips for Approval

You may want to see also

Frequently asked questions

"Paid-up" means that all of the premiums have been paid. The policyholder will never need to pay any more money towards the policy, and it will cover them for their entire life.

Paid-up life insurance allows you to keep a whole life insurance policy in force without paying any premiums, either temporarily or permanently. It is only an option if you have already built up a significant cash value in your policy. The policy is kept in force by deducting the premium from your cash value account.

Paid-up life insurance typically comes in two forms: paid-up status and paid-up additions. You can convert a whole life insurance policy to a paid-up status policy, which means that your family will still receive a portion of the original death benefit if you die, but you do not have to continue to pay the premiums. Paid-up additions are small packets of life insurance that are entirely paid for and purchased using the dividends from a whole life policy.