Whole life insurance can be a valuable financial tool, but understanding its tax implications is crucial. While it offers lifelong coverage, certain aspects of whole life insurance may be taxable, depending on the circumstances. This article aims to explore the scenarios where whole life insurance payments could be subject to taxation, helping policyholders make informed decisions and optimize their financial strategies.

| Characteristics | Values |

|---|---|

| Tax Treatment | Whole life insurance is generally not taxable. However, there are exceptions and specific conditions that may trigger taxation. |

| Taxable Event | 1. If the death benefit exceeds the policy's cash value, the excess amount may be taxable as income. 2. If the policy is surrendered or used for a loan, any withdrawals or interest may be taxable. 3. In some cases, the policy's growth in value (cash value) can be subject to taxation if it exceeds certain thresholds. |

| Exemptions | 1. The first $500 of death benefits per year per policyholder is often exempt from income tax. 2. Long-term care insurance benefits from whole life policies may be tax-free if used for qualified medical expenses. |

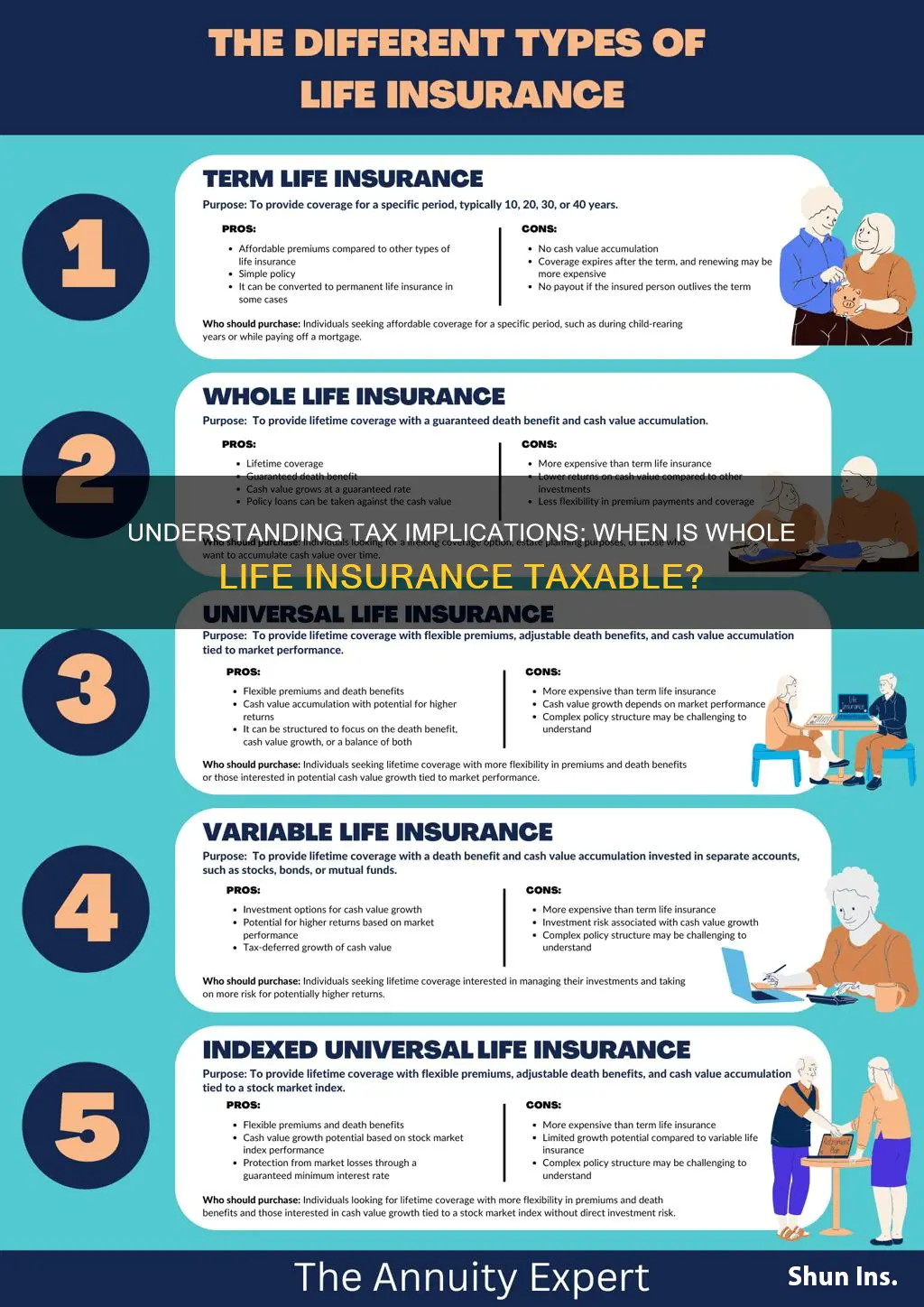

| Policy Types | Traditional whole life insurance, variable universal life, and fixed index universal life policies may have different tax implications. |

| State Variations | Tax laws can vary by state, so it's important to check local regulations. Some states may exempt the entire death benefit, while others may tax only the excess over a certain amount. |

| Policyholder's Residence | The tax treatment might differ based on the policyholder's state of residence. |

| Policy Age | The age of the policy can impact taxation. Older policies with higher cash values may have different rules. |

| Policy Loans | Taking a loan against the policy's cash value may result in taxable income if the loan amount exceeds the policy's cash value. |

| Surrender Charges | If the policy is surrendered early, there might be surrender charges, which could be taxable. |

| Policy Conversion | Converting a term life policy to a whole life policy may have tax implications, especially if the conversion results in a higher cash value. |

What You'll Learn

- Taxable Income: Whole life insurance proceeds may be taxable as ordinary income if they exceed the policy's cash value

- Exemption Limits: Proceeds under certain limits (e.g., $1,000) are often exempt from taxation

- Policy Loans: Loans taken against whole life insurance policies can be taxable as ordinary income

- Surrender Charges: Penalties for early policy surrender may be taxable as ordinary income

- State Variations: Tax treatment varies by state; some offer tax-free proceeds, while others may tax them

Taxable Income: Whole life insurance proceeds may be taxable as ordinary income if they exceed the policy's cash value

When it comes to whole life insurance, understanding the tax implications is crucial for policyholders. One important aspect to consider is whether the proceeds from a whole life insurance policy are taxable. The answer to this question lies in the relationship between the policy's cash value and the amount of the proceeds.

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. It offers a combination of death benefit protection and a cash value component that grows over time. The cash value is essentially the accumulation of the premiums paid into the policy, plus any interest earned. This cash value can be borrowed against or withdrawn, providing financial flexibility.

Now, here's the key point regarding taxation: If the proceeds from a whole life insurance policy exceed the policy's cash value, they may be subject to taxation as ordinary income. This means that the amount received as a payout could be considered taxable income, similar to wages or other forms of earned income. The tax treatment is based on the principle that the insurance proceeds are considered a form of compensation for the risk taken by the insurance company.

To illustrate, let's say an individual has a whole life insurance policy with a death benefit of $100,000 and a cash value of $50,000. If the insured person passes away, the beneficiary receives the $100,000 death benefit. If the proceeds ($100,000) exceed the cash value ($50,000), the $50,000 difference may be subject to ordinary income tax. It's important to note that the tax rules can vary depending on the jurisdiction and individual circumstances, so consulting with a tax professional is advisable.

In summary, whole life insurance proceeds can be taxable if they surpass the policy's cash value. This taxation is based on the ordinary income tax rate, and it's essential for policyholders to be aware of this potential tax liability when considering the financial implications of their insurance policies. Understanding these tax aspects can help individuals make informed decisions regarding their insurance and financial planning.

CalPERS Life Insurance: What Retirees Need to Know

You may want to see also

Exemption Limits: Proceeds under certain limits (e.g., $1,000) are often exempt from taxation

When it comes to whole life insurance, understanding the tax implications is crucial for policyholders. One important aspect to consider is the exemption limits set by tax authorities, which can vary depending on the jurisdiction. In many countries, the proceeds from whole life insurance policies are generally not taxable up to a certain threshold. For instance, if the death benefit or payout from a whole life insurance policy is below a specified amount, such as $1,000, it may be exempt from taxation. This means that if the insured individual passes away, and the beneficiary receives a payout of $1,000 or less, they may not have to pay any taxes on that amount.

The idea behind these exemption limits is to provide a basic level of financial security to the beneficiaries without subjecting them to unnecessary tax burdens. It ensures that the insurance proceeds received by the designated recipients, especially in cases of accidental or untimely deaths, are not taxed heavily. This can be particularly beneficial for families who rely on the insurance payout to cover immediate expenses or to provide for their loved ones.

However, it's essential to note that these exemption limits can vary significantly from one country to another. Some nations may have higher thresholds, while others might have lower limits. For instance, in certain countries, the tax-free threshold for whole life insurance proceeds could be $5,000 or even higher. It is advisable for individuals to consult their local tax laws or seek professional advice to understand the specific exemption limits applicable to their region.

Additionally, it's worth mentioning that there might be other factors that determine the taxability of whole life insurance proceeds. These factors could include the relationship between the insured and the beneficiary, the policy's cash value, and the overall policy structure. Therefore, a comprehensive understanding of the tax regulations and seeking appropriate guidance is essential to ensure compliance with the law.

In summary, knowing the exemption limits for whole life insurance proceeds is vital for policyholders and beneficiaries alike. These limits provide a tax-free threshold, often set at a specific amount like $1,000, ensuring that beneficiaries receive a certain level of financial support without facing excessive tax liabilities. Being aware of these limits and seeking relevant information can help individuals make informed decisions regarding their insurance policies and financial planning.

Colonial Penn Life Insurance: Understanding the Unit System

You may want to see also

Policy Loans: Loans taken against whole life insurance policies can be taxable as ordinary income

When it comes to whole life insurance, there are various scenarios where the policy can be subject to taxation. One such instance is when an individual takes out a loan against their whole life insurance policy. These policy loans can have tax implications and are treated as ordinary income, which means they are taxed at the same rate as your regular income.

Taking a loan against your whole life insurance policy is a common practice for policyholders who need immediate access to funds. The loan is typically secured by the cash value of the policy, allowing the policyholder to borrow against the accumulated savings. However, it's important to understand the tax consequences associated with these loans.

The tax treatment of policy loans is based on the principle of "inclusion." When you borrow from your whole life insurance policy, the loan amount is considered a taxable event. This means that the loan proceeds are included in your taxable income for the year in which the loan is taken. As a result, you will need to pay taxes on the amount borrowed, which can be a significant amount, especially if the loan is substantial.

The tax implications of policy loans can be complex and may vary depending on individual circumstances. It is advisable to consult with a tax professional or financial advisor to fully understand the potential tax consequences. They can provide guidance on how to structure the loan and any available tax benefits or deductions that may apply. Proper planning and understanding of the tax rules can help policyholders make informed decisions regarding policy loans.

In summary, policy loans against whole life insurance policies can result in taxable income, and individuals should be aware of the tax implications. Seeking professional advice is essential to navigate the complexities of tax laws and ensure compliance with the tax authorities. Understanding these tax considerations is crucial for policyholders to make sound financial decisions related to their insurance policies.

Life Insurance: Protecting Your Dollar's Worth

You may want to see also

Surrender Charges: Penalties for early policy surrender may be taxable as ordinary income

When it comes to whole life insurance, understanding the tax implications is crucial, especially regarding surrender charges. These charges can be a significant consideration for policyholders who may need to surrender their policy early. Here's a detailed explanation of how surrender charges can impact your taxes:

Surrender charges, also known as surrender fees or surrender penalties, are typically applied when a policyholder exits their whole life insurance policy before reaching a certain point in its term. This early surrender can occur due to various reasons, such as financial need, policy dissatisfaction, or the desire to access the cash value of the policy. The charges are designed to compensate the insurance company for the potential loss of future premiums and benefits. When a policy is surrendered, the insurance company may impose a fee, often a percentage of the total premiums paid, as a penalty.

The tax treatment of these surrender charges is essential to comprehend. In many cases, the penalties incurred from early policy surrender are considered taxable ordinary income. This means that the amount of the surrender charge that you receive from the insurance company will be subject to income tax. The IRS views these charges as a distribution of the policy's cash value, which is generally taxable at the ordinary income tax rate. It is important to note that the specific tax rules can vary depending on the jurisdiction and the insurance company's policies.

For instance, if you surrender your policy after paying premiums for several years but before the guaranteed period ends, the surrender charge might be a significant portion of the total premiums paid. When you receive this charge, you must report it as ordinary income on your tax return for the year it is received. This can result in a substantial tax liability, especially if the surrender charge is a large sum. It is advisable to consult with a tax professional to understand the potential tax consequences and explore alternative options if early surrender is necessary.

To avoid or minimize the tax impact, some insurance companies offer grace periods or surrender options with reduced penalties. These features can provide policyholders with more flexibility and potentially lower tax implications. Additionally, understanding the terms and conditions of your policy, including the surrender schedule and any associated fees, is crucial before making any decisions regarding early policy surrender.

In summary, surrender charges associated with early policy surrender can have tax consequences, often treated as ordinary income. Policyholders should be aware of these potential penalties and consider the tax implications when deciding to exit their whole life insurance policy. Seeking professional advice can help navigate these complexities and make informed choices regarding insurance and tax matters.

Effective Strategies for Advertising Life Insurance Policies

You may want to see also

State Variations: Tax treatment varies by state; some offer tax-free proceeds, while others may tax them

The tax treatment of whole life insurance proceeds varies significantly across different states in the United States, and understanding these variations is crucial for policyholders and financial planners. Some states provide tax-free treatment for the death benefits received from whole life insurance policies, while others may impose taxes on these proceeds. This difference in tax treatment can have a substantial impact on the overall financial planning and strategy of individuals and families.

In states where whole life insurance death benefits are tax-free, the proceeds received by the beneficiaries upon the insured individual's passing are not subject to income tax. This means that the full amount of the death benefit can be utilized for the intended purposes, such as covering final expenses, providing financial security to dependents, or funding education. For example, in states like New York, New Jersey, and California, the proceeds from whole life insurance are generally exempt from state income tax, ensuring that the intended beneficiaries receive the full value of the policy.

On the other hand, in states that do impose taxes on whole life insurance proceeds, the tax treatment can vary. Some states may exempt a portion of the death benefit from taxation, while others may tax the entire amount. For instance, in states like Florida and Texas, the death benefit from whole life insurance is typically exempt from state income tax, but it may still be subject to federal taxes. In contrast, states like Pennsylvania and Illinois may tax the entire death benefit, which could result in a reduced amount for the beneficiaries.

The variation in tax treatment by state highlights the importance of considering one's residence and the location of the insurance policy when evaluating the tax implications. Policyholders should be aware of the tax laws in their state of residence, as well as any state-specific tax treaties or agreements that may affect the tax treatment of whole life insurance proceeds. Consulting with a tax professional or financial advisor who is familiar with state-specific regulations can provide valuable guidance in navigating these complexities.

Understanding the tax implications of whole life insurance is essential for effective financial planning. Policyholders should carefully review the tax laws in their state and consider the potential tax consequences when choosing a policy. By being aware of these state variations, individuals can make informed decisions regarding their insurance coverage and ensure that the death benefits are utilized according to their intended purpose, providing financial security and peace of mind for their loved ones.

Interest-Sensitive Life Insurance: Understanding the Unique Features

You may want to see also

Frequently asked questions

No, whole life insurance death benefits are generally not taxable. The proceeds from a whole life insurance policy are typically paid out tax-free to the designated beneficiaries upon the insured individual's death.

Yes, the cash value of a whole life insurance policy can be taxable. When you take a loan against your policy or make withdrawals from the cash value, these amounts may be subject to income tax. It's important to understand the tax implications of any policy-related transactions.

Yes, there are a few exceptions. If the insured individual surrenders the policy for a cash payment or takes a loan that is not repaid, the surrender value or loan amount may be taxable as ordinary income. Additionally, if the policy is considered a modified endowment contract (MEC), any withdrawals or surrender could trigger tax consequences.

Proper planning can help minimize taxes. Consider consulting a financial advisor or tax professional to understand the best strategies for your situation. Options may include tax-efficient investing within the policy, regular contributions to the policy's cash value, or utilizing the policy's death benefit efficiently to avoid any potential tax issues.