Understanding the type of prudential life insurance you have is crucial for ensuring you and your loved ones are adequately protected. Prudential offers a range of life insurance products, each designed to meet different financial needs and goals. Whether you're looking to provide financial security for your family, plan for retirement, or protect against unforeseen circumstances, knowing the specifics of your policy is essential. This knowledge will help you make informed decisions about your insurance coverage and ensure that your financial plan is aligned with your objectives.

What You'll Learn

- Understanding Policy Types: Know the different types of prudential life insurance (term, whole life, universal life)

- Coverage Amount: Determine the death benefit amount you have

- Policy Duration: Understand the length of your policy's coverage

- Premiums: Learn how much you pay for your insurance

- Riders: Explore any additional benefits or riders included in your policy

Understanding Policy Types: Know the different types of prudential life insurance (term, whole life, universal life)

When it comes to life insurance, understanding the different policy types is crucial to ensure you have the right coverage for your needs. Prudential, a well-known insurance provider, offers various life insurance options, each with its own unique features and benefits. Here's a breakdown of the common types of Prudential life insurance policies:

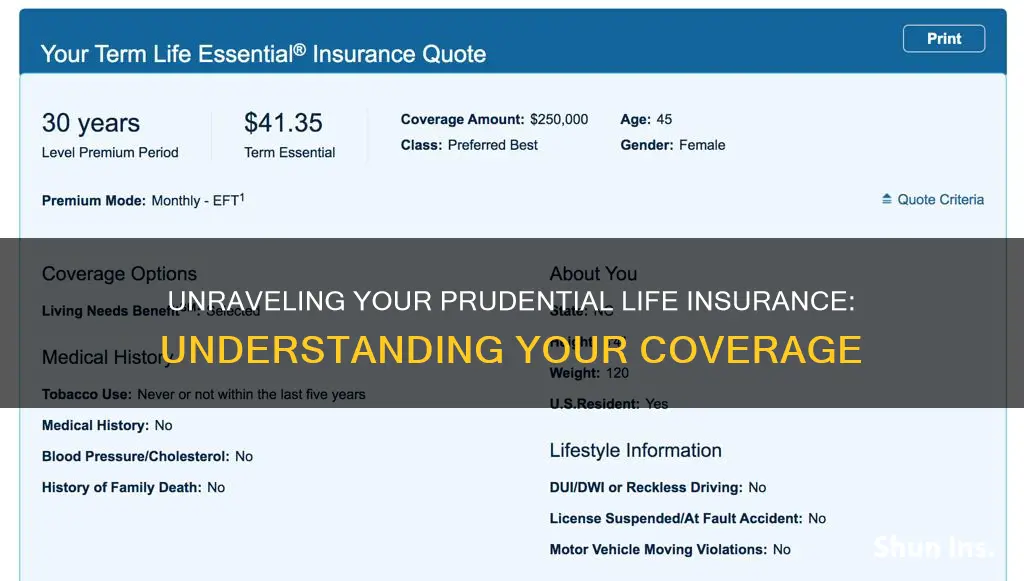

Term Life Insurance: This is a straightforward and cost-effective type of coverage. Term life insurance provides a death benefit for a specified period, known as the 'term.' It is typically less expensive than other types of life insurance because it does not accumulate cash value over time. The policyholder pays a premium for the chosen term duration, which can range from 10 to 30 years or even longer. During this period, if the insured individual passes away, the beneficiary receives the death benefit. Once the term ends, the policy may be renewed, but at a higher cost, or it can be converted into a permanent policy. Term life is ideal for those seeking temporary coverage, especially for individuals who want to provide financial security for their families during specific life stages, such as when raising children or paying off a mortgage.

Whole Life Insurance: In contrast to term life, whole life insurance offers permanent coverage for the entire lifetime of the insured individual. It provides a death benefit and also includes an investment component, known as cash value. This cash value grows over time, allowing the policyholder to build a savings component within the insurance policy. Premiums for whole life insurance are typically higher than term life due to the lifelong coverage and the accumulation of cash value. With whole life, the death benefit is guaranteed, and the policy's value can be borrowed against or withdrawn, providing financial flexibility. This type of policy is suitable for those seeking long-term financial security and the potential for tax-advantaged savings.

Universal Life Insurance: Universal life insurance offers flexibility and permanent coverage, similar to whole life. It provides a death benefit and includes an investment component, but with more flexibility in premium payments. Policyholders can adjust their premiums and death benefits over time, allowing for customization based on their financial situation. The cash value in universal life policies grows at a variable rate, which can be influenced by market performance. This type of insurance is ideal for those who want the security of permanent coverage and the ability to adapt their policy as their financial goals change. Universal life policies may also offer an additional feature called "dividend participation," where a portion of the policy's earnings can be allocated to increase the cash value.

Understanding the differences between these policy types is essential to make an informed decision. Term life is ideal for temporary needs, whole life provides lifelong coverage with savings, and universal life offers flexibility and potential investment growth. By evaluating your financial goals, risk tolerance, and long-term plans, you can determine which type of Prudential life insurance aligns best with your requirements.

Understanding Conversion Privilege in Life Insurance Policies

You may want to see also

Coverage Amount: Determine the death benefit amount you have

To determine the coverage amount of your Prudential life insurance policy, you need to understand the death benefit amount you have. This is a crucial aspect of your insurance policy, as it specifies the financial payout that your beneficiaries will receive in the event of your passing. Here's a step-by-step guide to help you figure this out:

Review Your Policy Documents: The first and most important step is to carefully examine your Prudential life insurance policy documents. These documents typically include a summary of your policy, a declaration page, and a policy schedule. Look for sections that mention the "Death Benefit," "Beneficiary Information," or "Payout Amount." The policy schedule, in particular, often provides detailed information about the coverage amount, including any adjustments or riders that may affect it.

Check for Policy Riders or Endorsements: Prudential policies may offer optional riders or endorsements that can modify the death benefit. These additional features can increase the coverage amount or provide other benefits like accelerated death benefits or guaranteed issue riders. Review these sections of your policy to understand if and how they impact your death benefit.

Contact Prudential Customer Support: If you're still unsure about the coverage amount, don't hesitate to reach out to Prudential's customer support team. They can provide you with accurate and up-to-date information regarding your policy. You can typically find contact details on your policy documents or on Prudential's official website. Be prepared to provide your policy number and other relevant details to ensure they can access your specific information.

Understand the Basis of Coverage: Prudential life insurance policies are typically based on the insured's age, health, and lifestyle factors. The coverage amount is often determined by these factors, and it may vary depending on the type of policy you have (e.g., term life, whole life). Understanding the basis of your coverage will help you assess if the current amount meets your needs or if adjustments are required.

Assess Your Needs and Circumstances: Consider your financial obligations, dependents, and future goals when evaluating the coverage amount. If you have a large family, mortgage, or significant financial responsibilities, you might want to ensure that your death benefit is adequate to cover these expenses. Prudential may offer tools or calculators to help you estimate the appropriate coverage amount based on your personal circumstances.

Life Insurance: 15-Year Guarantee Explained

You may want to see also

Policy Duration: Understand the length of your policy's coverage

When it comes to understanding the duration of your Prudential life insurance policy, it's crucial to grasp the concept of policy coverage and how it aligns with your financial goals and needs. The policy duration refers to the length of time your insurance coverage will remain in effect, providing financial protection for your loved ones. This aspect is essential as it determines how long your beneficiaries will receive the death benefit in the event of your passing.

Prudential offers various types of life insurance policies, each with its own coverage period. The most common types include term life insurance and permanent life insurance. Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years. During this term, the policy offers a death benefit if the insured individual passes away. Once the term ends, the policy may lapse unless you choose to renew or convert it. On the other hand, permanent life insurance, also known as whole life or universal life, offers coverage for the entire lifetime of the insured individual, providing long-term financial security.

To determine the appropriate policy duration, consider your financial obligations and goals. If you have specific short-term needs, such as covering mortgage payments or providing for your children's education, a term life insurance policy might be suitable. This type of policy offers a focused and cost-effective solution for a defined period. For instance, if you want to ensure your family's financial stability for the next 20 years, you can opt for a 20-year term policy.

On the other hand, if you seek long-term financial security and want to build a cash value that can be borrowed against or used for various financial needs, permanent life insurance could be a better choice. This type of policy provides coverage for life and accumulates cash value over time, which can be used for various purposes, such as funding retirement or paying for college.

It's important to review and assess your policy regularly, especially as your life circumstances change. Life events like marriage, the birth of a child, or purchasing a home may require adjustments to your insurance coverage. Prudential offers policy review services to help you evaluate your current coverage and make necessary changes to ensure it aligns with your evolving needs. Understanding the policy duration and exploring the various options available will enable you to make informed decisions about your Prudential life insurance, ensuring that your loved ones are protected according to your preferences.

Income Fluctuations: Life Insurance Impact and Adjustments

You may want to see also

Premiums: Learn how much you pay for your insurance

Understanding the cost of your life insurance is crucial for making informed financial decisions. The amount you pay for your Prudential life insurance policy, known as the premium, is determined by several factors, and knowing these can help you manage your finances effectively. Here's a breakdown of how to calculate and consider your insurance premiums:

- Age and Health: One of the most significant factors influencing your premium is your age and overall health. Younger individuals typically pay lower premiums because they are considered less risky to insure. As you age, premiums tend to increase due to the higher likelihood of health issues and potential claims. Additionally, your health status plays a vital role. If you have pre-existing medical conditions or engage in activities that increase the risk of injury or illness, your premiums may be higher. Insurers often require medical exams or health questionnaires to assess your risk profile accurately.

- Policy Type and Coverage: Prudential offers various life insurance policies, including term life, whole life, and universal life. Each type has different coverage periods and benefits, which directly impact the premium. Term life insurance provides coverage for a specified period, usually 10, 20, or 30 years, and generally has lower premiums compared to permanent life insurance. Whole life and universal life policies offer lifelong coverage and may have higher premiums, especially with additional features like cash value accumulation. The amount of coverage you choose also matters; higher coverage amounts result in higher premiums.

- Lifestyle and Occupational Hazards: Your lifestyle choices and occupation can influence the cost of your insurance. Smokers, for instance, often pay higher premiums due to the increased health risks associated with smoking. Similarly, individuals with dangerous or high-risk occupations may face higher insurance costs. Insurers consider these factors when calculating premiums to ensure they can adequately cover potential claims.

- Review and Adjustments: It's essential to periodically review your insurance policy and understand the premium breakdown. Prudential may offer tools or resources to help you estimate your premiums based on your personal information. Additionally, they might provide options to adjust your coverage or make payments, allowing you to manage your insurance costs according to your financial situation.

By considering these factors and staying informed about your insurance policy, you can make better decisions regarding your Prudential life insurance. Remember, understanding your premiums is just one aspect of managing your insurance effectively. Regularly reviewing and updating your policy can ensure you have the right level of coverage at a cost that suits your needs.

Life Insurance vs Final Expense: What's the Difference?

You may want to see also

Riders: Explore any additional benefits or riders included in your policy

When it comes to understanding the intricacies of your Prudential life insurance policy, it's essential to delve into the various riders and additional benefits that might be included. These riders are essentially add-ons to your base policy, providing extra coverage and customization options to suit your specific needs. Here's a breakdown of how to explore and understand these riders:

Review Your Policy Documents: Start by carefully examining the policy documents provided by Prudential. These documents often include a detailed section on riders and their respective benefits. Look for a table or summary that outlines the different rider options available and their corresponding costs. This section will help you identify the specific riders included in your policy.

Identify the Riders: Prudential offers a range of riders to enhance your life insurance coverage. Common riders include Accidental Death Benefit, Critical Illness Rider, Waiver of Premium, and Long-Term Care Rider. Each rider provides additional protection or financial benefits in specific circumstances. For instance, the Accidental Death Benefit ensures that your beneficiaries receive the full death benefit if your life is taken due to an accident.

Understand the Benefits: Take the time to comprehend the purpose and advantages of each rider. For example, the Critical Illness Rider provides financial assistance if you are diagnosed with a critical illness, helping with medical expenses and potential income loss. The Waiver of Premium rider ensures that your policy premiums are waived if you become disabled, preventing a lapse in coverage. Understanding these benefits will help you appreciate the value of each rider.

Assess Your Needs: Consider your personal and financial goals when evaluating the riders. Determine if the included riders align with your requirements. For instance, if you have a family that relies on your income, the Waiver of Premium rider could be crucial in ensuring your policy remains active during periods of illness or disability. Customizing your policy through riders allows you to create a comprehensive insurance plan tailored to your specific circumstances.

Consult with a Representative: If you're unsure about the riders or their implications, don't hesitate to contact a Prudential insurance representative. They can provide personalized guidance and explain how the riders interact with your base policy. Representatives can also assist in adjusting your policy to better meet your evolving needs over time.

By thoroughly exploring the riders and additional benefits, you can ensure that your Prudential life insurance policy is optimized to provide the coverage you need. It empowers you to make informed decisions and adapt your insurance plan as your life circumstances change.

Globe Life Insurance: Is It Worth the Hype?

You may want to see also

Frequently asked questions

You can typically find this information in your policy documents or by contacting Prudential's customer service. They will provide details about the specific type of insurance, such as term life, whole life, or universal life, and its associated features and benefits.

If you've lost your policy documents, don't worry. You can reach out to Prudential's customer service team, who will be able to assist you in locating your policy information. They might require some personal details to verify your identity.

Yes, Prudential offers various insurance options, and you can explore different plans to find the one that best suits your needs. You can contact their representatives to discuss your options and make any necessary changes to your policy.

Prudential's policies regarding fees and penalties for policy changes may vary. It's best to review your current policy or consult with their customer service to understand the specific terms and conditions related to any potential fees associated with modifying your insurance coverage.