Life insurance is a crucial financial tool that provides a safety net for individuals and their loved ones. While it is a long-term investment, the benefits of life insurance become most apparent during challenging life events. When faced with the loss of a primary breadwinner, life insurance can provide financial support to cover essential expenses, such as mortgage payments, funeral costs, and daily living expenses. Additionally, it can help ensure that beneficiaries can maintain their standard of living and achieve their financial goals. Understanding when life insurance is most beneficial can help individuals make informed decisions about their coverage and ensure that their loved ones are protected during difficult times.

What You'll Learn

- When You're Young: Life insurance is crucial for young families to ensure financial security?

- During Peak Earnings: Maximize the value of your policy when you're earning the most

- With Dependents: Protect your loved ones by covering their needs and future expenses

- After Major Life Events: Major life changes like marriage or a new home warrant a review

- In Case of Early Death: Life insurance provides financial support to dependents in the event of premature death

When You're Young: Life insurance is crucial for young families to ensure financial security

When you're young, life insurance might not be the first thing on your mind, but it could be one of the most important financial decisions you make. This is especially true for young families, as it provides a safety net and financial security during a time when your loved ones rely on you the most. Here's why life insurance is crucial for young families:

Protecting Your Family's Future: Young families often have a lot of financial responsibilities, including mortgage or rent payments, child care costs, education expenses, and other daily living expenses. In the event of your untimely death, these financial obligations can become overwhelming for your spouse or partner, who may now be left to manage them alone. Life insurance can provide a steady income to cover these expenses, ensuring that your family's standard of living is maintained and that your children's needs are met.

Peace of Mind: Knowing that your family is financially secure in your absence can provide immense peace of mind. It allows you to focus on enjoying your life and raising your children without constantly worrying about the financial implications of your death. This peace of mind is invaluable and can significantly reduce stress and anxiety.

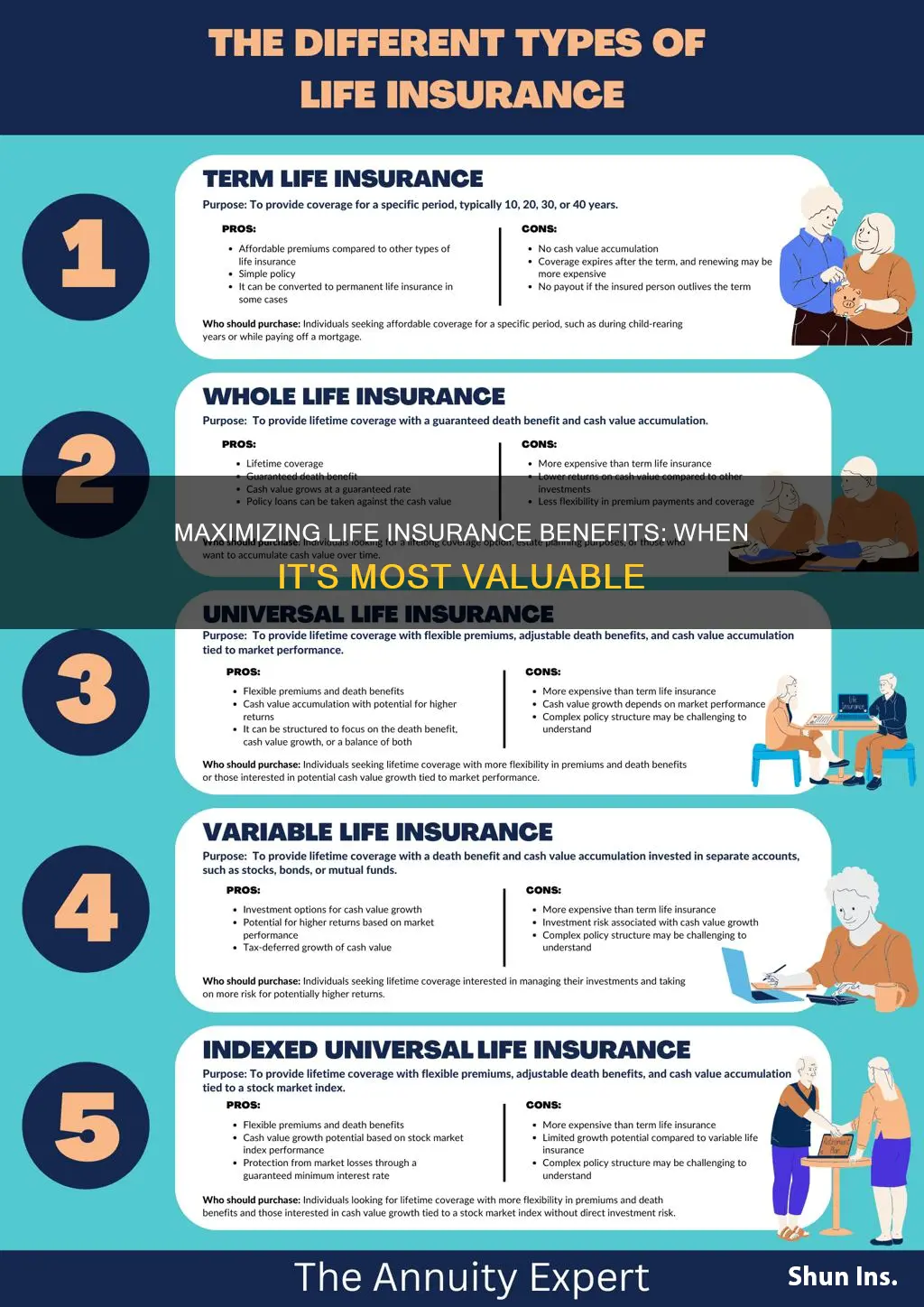

Building Wealth for the Future: Life insurance can also be a valuable tool for building wealth. Certain types of life insurance, such as whole life insurance, accumulate cash value over time. This cash value can be borrowed against or withdrawn, providing funds for future goals like your child's education or your retirement. Additionally, the death benefit from a life insurance policy can be used to pay for your final expenses, ensuring that your family doesn't have to bear the financial burden of your funeral and burial costs.

Long-Term Financial Security: As your family grows and your financial responsibilities evolve, life insurance can adapt to your changing needs. You can adjust the policy to increase the death benefit or change the type of coverage as your family's circumstances change. This flexibility ensures that your life insurance remains a relevant and beneficial part of your financial plan throughout your life.

In summary, life insurance is a vital consideration for young families as it provides financial security, peace of mind, and the ability to plan for the future. It ensures that your loved ones are protected and that your family's long-term goals remain on track, even in the face of unexpected tragedy.

Get Life Insurance for Your Dad: A Step-by-Step Guide

You may want to see also

During Peak Earnings: Maximize the value of your policy when you're earning the most

During the peak earning years, life insurance can be a powerful tool to secure your family's financial future and maximize the value of your policy. This is a critical time to ensure that your loved ones are protected in the event of your untimely passing. As your income rises, so does the importance of having a comprehensive life insurance plan. Here's how you can make the most of your policy during this lucrative phase of life:

Review and Increase Coverage: When you're earning at your highest potential, it's an ideal moment to review your existing life insurance policy. Assess your current coverage and determine if it aligns with your current financial obligations and future goals. Consider the following: Are your beneficiaries adequately protected? Do you have enough coverage to cover your family's living expenses, mortgage, or any other long-term financial commitments? If the answer is no, it's time to increase your policy limit. Higher earnings mean increased financial responsibilities, and a larger policy ensures that your family can maintain their standard of living even if you're no longer around.

Choose the Right Type of Policy: Different types of life insurance policies offer varying benefits. During peak earnings, term life insurance is often a popular choice. This type of policy provides a fixed amount of coverage for a specified term, typically 10, 20, or 30 years. The premiums are usually lower compared to permanent life insurance, making it more affordable when you have substantial income. As your earnings peak, you can opt for a longer term policy to cover the critical years when your family might need the financial support the most.

Consider Permanent Life Insurance: If you plan to maintain a high level of income for an extended period, permanent life insurance could be a strategic decision. This type of policy offers lifelong coverage and includes a cash value component that accumulates over time. While it comes with higher premiums, the long-term benefits can be significant. Permanent life insurance ensures that your family receives a death benefit, and the cash value can be borrowed against or withdrawn, providing financial flexibility during peak earning years and beyond.

Review and Adjust Regularly: Life circumstances change, and so should your insurance plan. Regularly review your policy, especially when there are significant life events like marriages, births, or major financial changes. Adjusting your coverage accordingly ensures that you're always prepared for the unexpected. As your earnings fluctuate, so might your insurance needs, making it essential to stay proactive in managing your policy.

In summary, maximizing the value of your life insurance during peak earning years involves a strategic approach. By increasing coverage, choosing the right policy type, and regularly reviewing your plan, you can provide financial security for your loved ones when it matters the most. This period of life is an opportunity to ensure that your family's future is protected, allowing them to focus on what matters most—enjoying their lives together.

Life Insurance Payouts: What to Expect When You Receive Them

You may want to see also

With Dependents: Protect your loved ones by covering their needs and future expenses

When you have dependents, ensuring their financial security becomes a top priority. Life insurance can be a powerful tool to safeguard your loved ones and provide them with the financial support they need during challenging times. Here's how life insurance can be most beneficial in this context:

Caring for Dependents: Dependents often rely on the primary caregiver for their daily needs, including food, shelter, education, and healthcare. If something happens to the primary breadwinner, the financial stability of the family can be severely impacted. Life insurance steps in to fill this gap by providing a financial safety net. The policy's death benefit can be used to cover the immediate expenses of the dependents, ensuring they have the resources to maintain their standard of living. This includes covering daily living costs, such as rent or mortgage payments, utilities, groceries, and other essential expenses.

Long-Term Financial Security: Beyond the immediate needs, life insurance can also address long-term financial goals for your dependents. For instance, if your children are still in school, the insurance payout can contribute to their education expenses, ensuring they have the means to complete their studies. Similarly, if your spouse or partner relies on your income for their livelihood, the policy can provide financial security to cover their living expenses and help them maintain their standard of living. Over time, the death benefit can also be used to build a nest egg for your dependents, allowing them to invest in their future, whether it's purchasing a home, starting a business, or pursuing further education.

Peace of Mind: Knowing that your dependents are financially protected can offer immense peace of mind. It allows you to focus on other aspects of your life without constantly worrying about the financial well-being of your loved ones. With the right life insurance coverage, you can rest assured that your family will have the financial resources to navigate life's challenges, even in your absence.

Customizing the Policy: When purchasing life insurance with dependents in mind, it's essential to tailor the policy to your specific needs. Consider the number and age of your dependents, their future expenses, and the length of time you want to ensure their financial security. Work with an insurance advisor to determine the appropriate death benefit and policy type (term life, whole life, etc.) that aligns with your goals and budget. Regularly reviewing and adjusting the policy as your dependents' needs evolve is also crucial to ensure ongoing protection.

In summary, life insurance with dependents in mind is a strategic decision that provides financial security and peace of mind. It ensures that your loved ones have the resources to cover their daily expenses and achieve their long-term goals, even when you're no longer there to provide directly. By carefully selecting and managing the policy, you can create a robust financial safety net for your family.

Group Life Insurance: Non-Federal Employees' Options Explored

You may want to see also

After Major Life Events: Major life changes like marriage or a new home warrant a review

When significant life events occur, it's a natural and opportune moment to reassess your life insurance coverage. Major life changes, such as getting married or purchasing a new home, can have a substantial impact on your financial situation and the level of protection you need. Here's why these events warrant a comprehensive review of your life insurance policy:

Marriage: The union of two individuals often leads to a significant increase in financial responsibilities. As a married couple, you may now be jointly liable for expenses, such as a mortgage, utilities, and shared living costs. Additionally, you might be considering starting a family, which further emphasizes the importance of life insurance. In the event of an unforeseen tragedy, your spouse and any dependent children would rely on the policy's payout to cover these essential costs. It's crucial to ensure that your life insurance policy reflects this new dynamic and provides adequate coverage to support your loved ones.

New Home Ownership: Buying a home is a substantial financial commitment and a major milestone in many people's lives. As a homeowner, you are now responsible for a mortgage, property taxes, insurance, and maintenance costs. If something were to happen to you, your family would need to manage these expenses, and a life insurance policy can provide the necessary financial support. The policy's death benefit can be used to pay off the mortgage, ensuring that your loved ones don't face financial strain during a difficult time. Moreover, the value of your home can also be considered an asset to be protected, and life insurance can help safeguard this valuable investment.

Life insurance is a critical tool to provide financial security and peace of mind during significant life transitions. By reviewing and adjusting your policy after major life events, you can ensure that you and your loved ones are adequately protected. This proactive approach allows you to adapt to changing circumstances and maintain the level of coverage that aligns with your current needs. Remember, life insurance is not just about protecting your assets; it's about safeguarding the people and commitments that matter most to you.

Divorced Parents: Joint Life Insurance Beneficiaries?

You may want to see also

In Case of Early Death: Life insurance provides financial support to dependents in the event of premature death

Life insurance is a crucial financial tool that offers a safety net for individuals and their loved ones, especially in the event of an untimely demise. When it comes to the question of when life insurance is most beneficial, the answer often lies in the unfortunate possibility of early death. This is because life insurance is designed to provide financial security and peace of mind during challenging times.

In the event of a premature death, life insurance becomes a lifeline for the policyholder's dependents, ensuring their financial well-being. The primary purpose of life insurance is to offer financial support to those who depend on the insured individual. This support can be particularly crucial when the primary breadwinner passes away, leaving behind a family or dependents who rely on their income. The insurance payout can help cover various expenses, such as mortgage payments, children's education fees, daily living costs, and even outstanding debts. By providing a financial cushion, life insurance ensures that the dependents can maintain their standard of living and have the necessary resources to manage their affairs without the added stress of financial burdens.

The benefit of life insurance in such circumstances is twofold. Firstly, it provides immediate financial relief, allowing the dependents to cover essential expenses and make important decisions regarding their future. This financial support can prevent the family from falling into financial hardship or being forced to make difficult choices due to a lack of resources. Secondly, life insurance ensures that the dependents have the means to plan for the future, including long-term financial goals and the overall well-being of the family. It provides a sense of security, knowing that the loved ones will be taken care of, even in the absence of the primary provider.

Moreover, life insurance can be a powerful tool for risk management. It allows individuals to plan for the future and protect their loved ones from the financial impact of their untimely death. By carefully selecting the appropriate coverage and beneficiaries, policyholders can ensure that their dependents receive the necessary financial support when they need it most. This proactive approach to financial planning can provide immense relief and peace of mind, knowing that one's family is protected against the unforeseen.

In summary, life insurance is most beneficial when it provides financial support to dependents in the event of early death. It offers a safety net, ensuring that the family can maintain their lifestyle and financial stability during a difficult period. With proper planning and the right insurance policy, individuals can safeguard their loved ones and provide them with the financial security they need to navigate life's challenges.

Life Insurance Benefits: Taxable in Massachusetts?

You may want to see also

Frequently asked questions

Life insurance is a valuable consideration at various life stages, but it is particularly beneficial when you have a growing family, financial responsibilities, or significant assets. It becomes essential when you want to ensure your loved ones are financially protected in the event of your passing. This coverage can provide peace of mind, knowing that your family's financial well-being is secure, especially during times of emotional distress.

Life insurance offers long-term benefits by providing a financial safety net for your beneficiaries. The death benefit amount is paid out upon your passing, which can be used to cover various expenses, such as mortgage payments, children's education, or everyday living costs. Over time, this financial support can help your family maintain their standard of living, cover debts, and achieve their financial goals, even after you're gone.

Absolutely! Life insurance can still be advantageous even in retirement. It can help cover final expenses, such as funeral costs or outstanding debts, ensuring a peaceful transition for your loved ones. Additionally, if you have a surviving spouse, life insurance can provide them with the financial means to maintain their lifestyle, cover daily expenses, and potentially plan for their future, even in their later years.