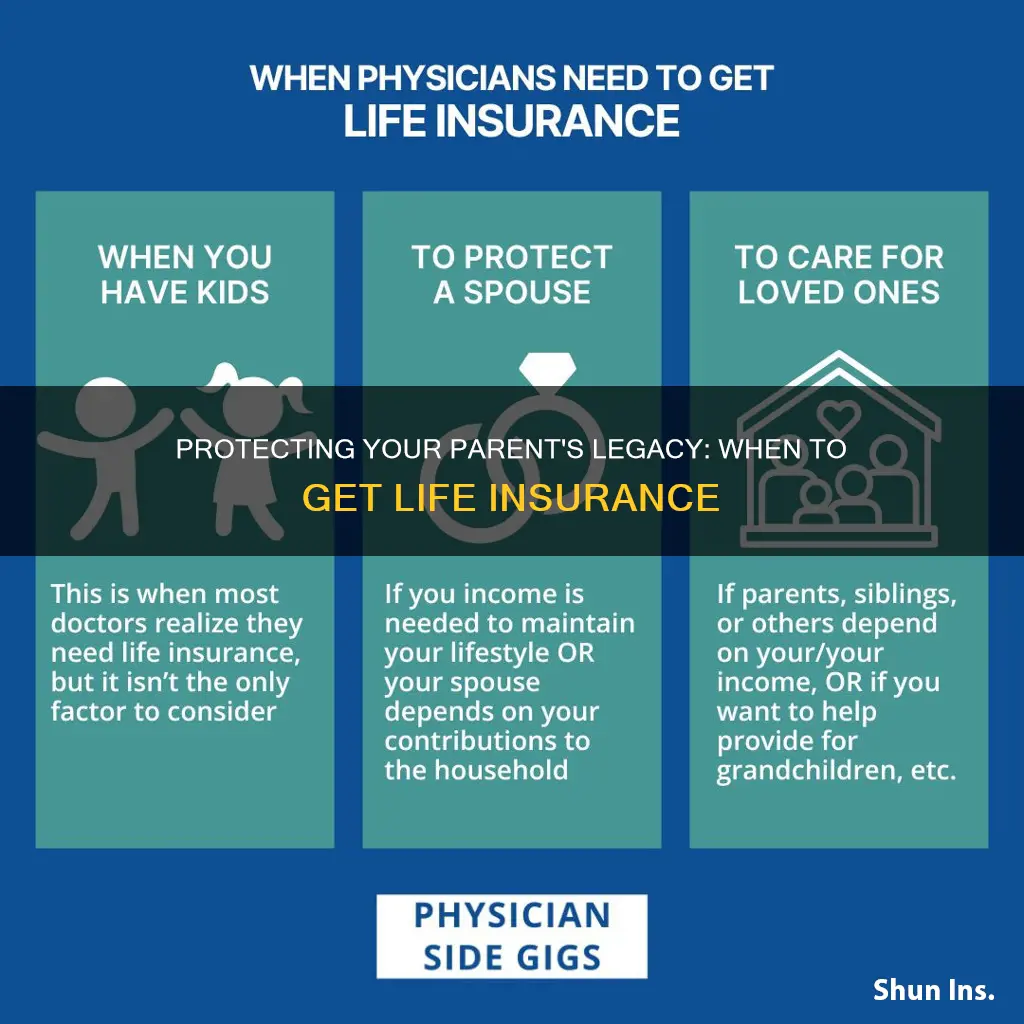

When considering life insurance for a parent, timing is crucial. It's important to assess your parent's current financial situation and long-term goals. If your parent has dependents or significant financial obligations, such as a mortgage or children's education costs, life insurance can provide financial security and peace of mind. Additionally, if your parent has health issues or is approaching a certain age, it may be more challenging to secure coverage or obtain favorable rates. Understanding your parent's unique circumstances and seeking professional advice can help determine the optimal time to purchase life insurance, ensuring that your loved ones are protected in the event of an unforeseen tragedy.

What You'll Learn

- Age and Health: Consider life insurance for parents when they're young and healthy, as premiums are lower

- Financial Dependents: If parents have dependents, life insurance provides financial security for their care

- Debt and Assets: Life insurance can cover debts and leave assets for beneficiaries, ensuring financial stability

- Long-Term Care: Parents with chronic illnesses or disabilities may need long-term care coverage

- Legacy Planning: Life insurance can be part of a parent's estate plan to leave a legacy for heirs

Age and Health: Consider life insurance for parents when they're young and healthy, as premiums are lower

When it comes to planning for your parents' future, considering life insurance is a thoughtful and practical step, especially when they are young and in good health. This is a crucial aspect of financial planning that can provide peace of mind and security for your family. Here's why this is an ideal time to think about life insurance for your parents:

Lower Premiums: One of the most significant advantages of getting life insurance for your parents when they are young and healthy is the cost. Insurance companies typically offer lower premiums to individuals in this age group and health category. Young and healthy individuals are considered less risky to insure, and as a result, the financial burden of regular payments is significantly reduced. This can be a substantial savings over time, allowing your parents to potentially secure a more comprehensive coverage plan.

Long-Term Benefits: Life insurance provides a safety net for your family, ensuring financial stability in the event of your parent's untimely passing. By purchasing a policy when they are young, you can lock in lower rates for the long term. As your parents age, their health may change, and insurance premiums can increase. By starting early, you can secure a policy that will remain affordable and provide the necessary coverage throughout their lives.

Peace of Mind: Encouraging your parents to consider life insurance at a young age can be a thoughtful gesture. It demonstrates your commitment to their well-being and future security. Knowing that they have a financial safety net in place can alleviate stress and provide peace of mind for both you and them. This is especially important if they have dependents or financial responsibilities that would be impacted by their passing.

Additionally, when your parents are young and healthy, they can choose from a variety of coverage options, including term life insurance, which provides coverage for a specific period, or permanent life insurance, which offers lifelong coverage with an investment component. They can also select the appropriate amount of coverage based on their needs and family circumstances.

In summary, getting life insurance for your parents when they are young and healthy is a strategic move. It ensures lower premiums, long-term financial security, and peace of mind for your family. It is a responsible step towards safeguarding your parents' future and the well-being of your loved ones.

Life Insurance Payouts: Taxable or Tax-Exempt?

You may want to see also

Financial Dependents: If parents have dependents, life insurance provides financial security for their care

When considering life insurance for a parent, it's essential to recognize the role they play in the lives of their financial dependents. If your parents have children or other family members who rely on their financial support, life insurance can be a crucial tool to ensure their well-being. Here's a detailed breakdown of why this is the case:

Financial Dependents: The primary reason to consider life insurance for a parent is to provide financial security for their dependents. Parents often take on the role of primary caregivers and financial providers for their children. This responsibility can be significant, and any unexpected event that leads to their passing could leave the family in a vulnerable position. Life insurance can step in to fill this gap. For instance, if a parent's income is essential for covering daily expenses, mortgage or rent payments, education costs, or other regular outgoings, a life insurance policy can ensure that these financial obligations are met even in their absence. This financial security allows the dependents to maintain their standard of living and access the necessary resources for their well-being.

Long-Term Care: As parents age, they may require long-term care, which can be financially demanding. Life insurance can help cover these costs, ensuring that the dependents are not burdened with unexpected expenses. This is especially important if the parent's health deteriorates, and they need specialized care or assistance.

Education and Future Goals: For parents with children, life insurance can contribute to their children's education and future goals. It can provide the means to pay for college tuition, extracurricular activities, or other educational expenses, ensuring that the children's aspirations are supported even if the parent is no longer around.

Peace of Mind: Perhaps the most significant benefit is the peace of mind that life insurance provides. Knowing that your family's financial future is protected can reduce stress and anxiety, allowing you and your parents to focus on the present and enjoy their company.

In summary, life insurance for a parent is a thoughtful consideration, especially if they have financial dependents. It ensures that the dependents' needs are met, their future goals are supported, and their overall well-being is maintained, even in the face of an unexpected loss. It is a way to honor the parent's role in the family and provide a safety net for the ones they love.

Adjustable Life Insurance: My Rip-Off Story

You may want to see also

Debt and Assets: Life insurance can cover debts and leave assets for beneficiaries, ensuring financial stability

Life insurance can be a crucial tool to ensure financial stability and peace of mind for your parents, especially when it comes to managing debts and assets. Here's how it can help:

Protecting Against Debt: Life insurance provides a safety net when it comes to financial obligations. If your parent has outstanding debts, such as a mortgage, car loans, or personal loans, life insurance can help cover these liabilities. When a parent passes away, the death benefit from the insurance policy can be used to settle these debts, preventing the burden from falling on their loved ones. This is particularly important if your parent has a substantial amount of debt, as it can provide a much-needed financial cushion for the family.

Leaving a Legacy: Life insurance allows you to plan for the future and ensure your parent's wishes are respected. By naming beneficiaries, you can specify who will receive the death benefit. This enables you to leave a financial legacy for your parent's loved ones, covering expenses like funeral costs, outstanding medical bills, or even providing a lump sum for their retirement or future education. The insurance proceeds can be a significant source of financial support for the beneficiaries, helping them maintain their standard of living and achieve their goals.

Asset Management: Life insurance can also be a strategic way to manage and protect assets. For instance, if your parent owns a business, life insurance can provide funds to buy out the interests of other owners or to cover any outstanding business debts. This ensures the business's continuity and prevents potential financial strain on the family. Additionally, life insurance can be used to pay for estate taxes, allowing the remaining assets to be distributed according to the parent's wishes.

When considering life insurance for your parent, it's essential to evaluate their current financial situation, including debts and assets. This will help determine the appropriate coverage amount to ensure that their financial affairs are adequately protected. Consulting with a financial advisor or insurance professional can provide valuable guidance in tailoring a life insurance plan to your parent's specific needs, ensuring a secure and stable future for the entire family.

Wealthy Wisdom: Unveiling the Elite's Life Insurance Choices

You may want to see also

Long-Term Care: Parents with chronic illnesses or disabilities may need long-term care coverage

When considering long-term care for your parents, especially those with chronic illnesses or disabilities, it's crucial to understand the potential financial burden that may arise. Long-term care insurance is a specialized type of coverage designed to assist individuals who require ongoing assistance with daily activities due to age, illness, or injury. This type of insurance can provide a safety net for your parents, ensuring they receive the necessary support and care when they need it most.

Chronic illnesses and disabilities can significantly impact a person's ability to perform everyday tasks, such as bathing, dressing, eating, and even managing their medications. As these conditions progress, the need for long-term care becomes more apparent. This care can be provided at home, in a nursing facility, or in a variety of other settings, depending on your parents' specific needs and preferences. The costs associated with long-term care can be substantial, and without proper insurance coverage, it may lead to financial strain for your family.

Long-term care insurance typically covers a range of services, including skilled nursing care, assisted living, and even in-home care. It can also provide coverage for personal care, which includes help with activities of daily living (ADLs) and instrumental activities of daily living (IADLs). These services are often required for individuals with chronic conditions, such as Alzheimer's disease, Parkinson's, or multiple sclerosis, as well as for those recovering from surgeries or accidents.

Obtaining long-term care insurance for your parents is a proactive approach to financial planning. It allows you to secure their future well-being and peace of mind. When considering this type of insurance, it's essential to evaluate your parents' current and future needs, as well as their overall health and medical history. This will help determine the appropriate level of coverage and ensure that the policy meets their specific requirements.

Additionally, it's worth exploring the various options available in the market, as different long-term care insurance policies offer varying benefits and coverage levels. Some policies may provide tax advantages, while others might include inflation protection, ensuring that the coverage remains relevant over time. Consulting with a financial advisor or insurance specialist can provide valuable guidance in choosing the right policy for your parents' long-term care needs.

Life Insurance Exam: What to Expect

You may want to see also

Legacy Planning: Life insurance can be part of a parent's estate plan to leave a legacy for heirs

Life insurance can be a powerful tool for parents to ensure their legacy and provide financial security for their loved ones. When considering life insurance as part of your estate planning, it's essential to understand its role in legacy creation. Here's a detailed guide on how life insurance can be a valuable asset in this context:

Leaving a Financial Legacy: One of the primary benefits of life insurance in an estate plan is the ability to leave a substantial financial legacy. Parents can choose the policy amount that aligns with their goals, ensuring a significant sum is available for their heirs. This financial legacy can be a one-time payment or a series of regular payments, depending on the policy type and the parent's preferences. By doing so, you provide your children or beneficiaries with a financial cushion, enabling them to pursue their dreams, cover educational expenses, or even start their own businesses.

Long-Term Financial Security: Life insurance can also contribute to the long-term financial security of your family. In the event of your passing, the death benefit from the policy can be used to cover various expenses, such as funeral costs, outstanding debts, or even daily living expenses for a period. This ensures that your loved ones are not burdened with financial responsibilities during a challenging time. Moreover, the proceeds can be invested or managed according to your wishes, allowing you to leave a growing asset for future generations.

Flexibility in Estate Planning: Estate planning is a complex process, and life insurance offers flexibility in tailoring your legacy. You can decide on the policy's term, ensuring coverage during the years when your family may need it the most. For instance, you might opt for a 20-year term to cover potential mortgage payments or children's education. Additionally, you can choose between different policy types, such as term life, whole life, or universal life, each offering unique benefits and long-term financial advantages.

Peace of Mind: Perhaps the most significant aspect of incorporating life insurance into your legacy planning is the peace of mind it provides. Knowing that your family is financially protected in your absence can alleviate stress and allow you to focus on other aspects of your life. It ensures that your loved ones have the resources to maintain their standard of living and achieve their financial goals, even if you're no longer around.

In summary, life insurance is a versatile tool for parents to create a lasting legacy and provide for their family's future. By carefully selecting the right policy and integrating it into your estate plan, you can leave a substantial financial gift and offer long-term security. It is a thoughtful way to ensure your family's well-being and empower your heirs to build a successful future.

Life Insurance Beneficiaries: Earned Income or Not?

You may want to see also

Frequently asked questions

It's a thoughtful decision to consider life insurance for a parent at any stage of life, but it's particularly important when there are dependent children or financial obligations involved. Life insurance can provide financial security for your family in the event of your parent's untimely passing, ensuring that their loved ones are taken care of.

There are several factors to consider. If your parent has financial dependents, such as a spouse, children, or other family members who rely on their income, life insurance can be crucial. Additionally, if your parent has significant financial obligations, such as a mortgage, business debts, or other large expenses, life insurance can help cover these costs and provide financial relief to the beneficiaries.

The best type of life insurance for a parent depends on their individual circumstances. Term life insurance is often a popular choice as it provides coverage for a specific period, typically 10, 20, or 30 years, and offers a fixed premium. This type of policy is ideal for covering short-term financial needs. On the other hand, permanent life insurance, such as whole life or universal life, offers lifelong coverage and includes a savings component, making it a more comprehensive option for long-term financial planning.