Auto insurance is financial protection in the event of a car accident. It covers medical bills, property damage, and expenses that you could be held financially responsible for. However, there are instances when auto insurance may not cover a major accident. For example, if you exceed your policy limits, engage in intentional damage, or have excluded drivers operating your vehicle, your insurance company may not cover the costs of the accident. It is important to carefully review your auto insurance policy to understand what is covered and what is excluded to ensure you have the protection you need.

| Characteristics | Values |

|---|---|

| When you don't have auto insurance | You can be fined, your license may be suspended, and your vehicle could be impounded. |

| When you have auto insurance but not health insurance | You can use your auto insurance to cover medical expenses related to car accident injuries until you reach your policy limit. |

| When you have both auto insurance and health insurance | Your auto insurance will cover your medical expenses until you reach your policy limit, after which your health insurance will cover the remaining expenses. |

What You'll Learn

- When the accident occurs outside the geographical coverage of the insurance policy?

- When the accident involves intentional damage?

- When the accident involves a driver excluded from the policy?

- When the accident involves electrical wear and tear?

- When the accident involves a vehicle with a loan that exceeds the value of the car?

When the accident occurs outside the geographical coverage of the insurance policy

When it comes to auto insurance, it's important to understand the geographical limitations of your policy to ensure you have the right coverage. Here are some detailed insights on what to expect when an accident occurs outside the geographical coverage of your insurance policy:

Understanding Geographical Coverage

Geographical coverage is a crucial aspect of auto insurance policies, and it defines the areas where your insurance is valid and applicable. This coverage typically includes the country or region where the policy was purchased and may extend to neighbouring countries or specific states or provinces. It is essential to review your policy documents carefully to identify the geographical scope of your insurance coverage.

Accidents Outside Geographical Coverage

If you are involved in a major accident outside the geographical coverage area specified in your insurance policy, your insurance company may not provide coverage for the incident. This means that any damages, injuries, or losses incurred in the accident will not be covered by your insurance provider. It is important to note that insurance policies often have specific exclusions and limitations regarding geographical coverage, and these vary from policy to policy.

Policy Exclusions and Limitations

In the event of an accident outside your geographical coverage, your insurance policy may have certain exclusions and limitations. For example, your policy might exclude coverage for accidents that occur in specific countries or regions. Additionally, there might be limitations on the types of damages or injuries covered if the accident occurs outside the specified geographical area. These limitations could include a maximum coverage amount for repairs, medical expenses, or liability claims.

Steps to Take After an Accident

If you find yourself in a major accident outside your geographical coverage, there are several important steps you should take:

- Notify Your Insurance Company: Contact your insurance provider as soon as possible, regardless of your location. Explain the situation and provide them with all the relevant details of the accident, including the location. Ask about the specific geographical coverage of your policy and whether there are any exceptions or extensions that might apply to your situation.

- Review Your Policy Documents: Carefully review your insurance policy to understand the exact geographical coverage and any exclusions or limitations. Look for any clauses or provisions that might offer coverage for accidents outside the specified area.

- Explore Alternative Coverage: If your insurance policy does not cover the accident due to geographical limitations, there may be other options. For example, if you have travel insurance or a premium credit card, they might offer some level of coverage for rental cars or international travel.

- Consider Legal Requirements: Depending on the location of the accident, there may be specific legal requirements for insurance coverage. Some countries or states may mandate a minimum level of insurance for drivers, and failing to meet these requirements can result in legal consequences.

- Seek Legal Advice: Consult with a legal professional, especially if the accident occurred in a different country. They can advise you on the local laws, your rights, and any potential recourse for obtaining compensation for damages or injuries.

Preventative Measures

To avoid being caught off guard by geographical coverage limitations, there are several preventative measures you can take:

- Review Your Policy Regularly: Don't wait until an accident occurs to understand your coverage. Review your policy documents periodically, paying close attention to the geographical coverage and any exclusions or limitations.

- Consider Extended Coverage: If you frequently travel outside your insured area, consider extending your geographical coverage or purchasing additional insurance that provides coverage in those specific regions.

- Inform Your Insurance Provider of Travel Plans: If you plan to drive across borders or take an extended trip, inform your insurance company beforehand. They can advise you on the necessary coverage adjustments or provide temporary extensions to ensure you're adequately insured during your travels.

In conclusion, understanding the geographical coverage of your auto insurance policy is crucial to ensuring adequate protection. By being aware of the limitations and taking the necessary preventative measures, you can avoid unpleasant surprises in the event of a major accident outside your insured area. Remember to always review your policy documents carefully and seek alternative coverage options if needed.

Jupiter Auto Insurance: Is It Worth the Hype?

You may want to see also

When the accident involves intentional damage

Auto insurance typically covers accidents, but there are certain situations where your insurance company might deny your claim. One such scenario is when the accident involves intentional damage.

Intentional damage refers to situations where you deliberately cause harm to your vehicle or someone else's property. In these cases, your auto insurance policy may not provide coverage, and you could be held fully responsible for the damages. It is important to understand that filing for intentional damages could even be considered insurance fraud.

For example, let's say you intentionally rammed into another vehicle out of anger or frustration. In this case, your insurance company would likely deny your claim, leaving you financially liable for the repairs to both your vehicle and the other driver's car. Not only will you have to bear the cost of repairs, but you may also face legal consequences for your actions.

Similarly, if someone vandalises your car, this could be considered intentional damage. While comprehensive insurance typically covers vandalism, there are situations where the insurance company may deny your claim. For instance, if you have a history of making frequent claims for vandalism, the insurance company might become suspicious and may refuse to cover the damage. In such cases, they may suspect that you are committing insurance fraud or that you are not taking adequate measures to protect your vehicle.

It is important to remember that insurance policies are designed to protect against accidental damage, not intentional harm. So, if you intentionally damage your vehicle or someone else's property, you are going against the very purpose of insurance, and your claim will most likely be rejected.

Understanding SR-22 Auto Insurance Requirements

You may want to see also

When the accident involves a driver excluded from the policy

An excluded driver is someone who is specifically mentioned in an auto insurance policy as not being allowed to drive a particular vehicle. This could be due to their driving record, age, or other factors that make the insurance company consider them a higher risk. When someone is labelled as an excluded driver, it means the insurance policy will not provide coverage if that person drives the insured vehicle and gets into an accident. The policyholder usually agrees to this exclusion to help manage the risk and keep insurance costs reasonable.

If an excluded driver takes the wheel and gets into an accident, the insurance company may not cover the damages, leaving the owner of the vehicle or the excluded driver responsible for the costs. This is why it is crucial for policyholders to understand and follow these rules to avoid unexpected troubles and ensure that everyone driving their car is covered by the insurance.

Excluding vs Removing Drivers from Car Insurance

Excluding a driver means specifically stating in the policy that a certain person is not covered if they drive the insured vehicle. This is often done when the excluded person is considered a higher risk, perhaps due to a history of accidents or other factors. Removing a driver, on the other hand, means taking them off the insurance policy entirely, usually because they no longer live in the same household or don't drive the insured vehicle anymore.

Consequences of an Excluded Driver Accident

When an excluded driver has an accident, it can lead to the following consequences:

- No insurance coverage: The insurance company may not pay for the damages because the excluded driver is not covered in the policy.

- Financial responsibility: The responsibility for covering the costs of the accident, including repairs and medical bills, falls on either the vehicle owner or the excluded driver.

- Out-of-pocket expenses: The policyholder may need to pay for the accident-related expenses out of their own pocket since the insurance won't step in to help.

- Impact on insurance record: The accident involving an excluded driver could affect the policyholder's insurance record, possibly leading to increased premiums in the future.

Grange Auto Insurance: Legit or a Scam?

You may want to see also

When the accident involves electrical wear and tear

When it comes to electrical wear and tear in an accident, car insurance coverage can be uncertain. It is important to note that common electrical faults in cars are generally not covered by car insurance. If your bulbs burn out or an electric motor on your sunroof malfunctions, you will likely have to pay for the bulbs, motor, and labour out of pocket.

However, if an event causes damage to your electrical system, your insurance may pay for the repairs. For example, if an accident causes damage under the hood that affects electrical components, your collision insurance will cover the repairs as long as you are at fault for the claim. If you are not at fault, but the other party is uninsured, you can file an uninsured motorist claim and won't have to pay a deductible.

Additionally, comprehensive insurance may cover electrical problems resulting from flooding, fires, falling objects, or damage caused by rodents and other live animals. In these cases, it is important to understand your policy to know what is and is not covered.

While car insurance might not cover electrical wear and tear, you may have protection through other means. If your car is still under the manufacturer's warranty, you have purchased mechanical breakdown coverage, or you buy a full-coverage car warranty through a dealer or credit union, you may be covered for electrical repairs.

Calculating Auto Insurance: A Quick Guide to the 10% Rule

You may want to see also

When the accident involves a vehicle with a loan that exceeds the value of the car

If you have a loan on your car, you will usually need to insure it. If you don't, the loan company may buy insurance and charge you for it, which is likely to be more expensive.

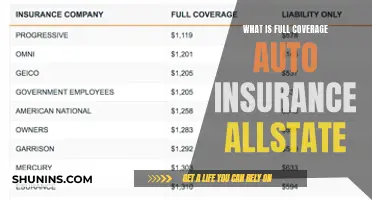

Full-coverage insurance is often required by lenders, and this generally includes comprehensive and collision coverage in addition to the state-minimum insurance. Comprehensive insurance covers damage to your vehicle due to theft, vandalism, natural disasters, or other non-collision events. Collision insurance covers damage to your vehicle caused by physical contact with another vehicle or object, regardless of who is at fault.

If you don't have full coverage on a financed car, you may be in violation of your loan contract, and the lender could repossess your car. If you don't purchase the required insurance, the lender may get force-placed insurance, which is much more expensive.

If your car is in an accident and is deemed a total loss, a standard auto insurance policy will only reimburse you for the car's current market value. You are responsible for any remaining loan or lease balance. This is where gap insurance is useful. If you have gap insurance, it will cover the difference between the car's value and the remaining loan amount.

If you don't have gap insurance, you will have to pay off the remaining loan balance yourself. This is known as an upside-down car loan or negative equity, and it often occurs with a small down payment or a long loan length. To avoid this situation, you can put down a larger down payment or choose a shorter loan length.

In summary, if your car has a loan that exceeds its value and is in a major accident, your insurance company will likely only cover the car's current market value. You will be responsible for the remaining loan balance unless you have gap insurance, which covers the difference.

Finding Affordable Auto Insurance in Texas: Tips and Tricks

You may want to see also

Frequently asked questions

If you don't have health insurance, don't delay getting necessary medical treatment after a car accident. Laws in your state may require healthcare providers to work with you on a payment plan, and you may be entitled to receive care at a reduced rate.

If you don't have auto insurance, you will be required to cover all the costs of an accident out of your own pocket. In most states, you are legally required to have a minimum amount of auto insurance to drive.

If you are at least 51% at fault, your premium will likely increase when you renew your policy. This increase is called a surcharge.

If you cannot afford your premiums, you may be eligible for a low-cost automobile insurance program, depending on your state and income level.