If you're considering cash value life insurance, you might be wondering where to find the best options. Cash value life insurance is a type of permanent life insurance that offers both death benefit coverage and a savings component. It's an attractive choice for those seeking long-term financial security and investment opportunities. In this paragraph, we'll explore the various places where you can find and compare cash value life insurance policies, including independent insurance brokers, direct from insurance companies, and online platforms that connect you with multiple providers. Understanding your options is key to making an informed decision about your financial future.

What You'll Learn

- Online Platforms: Compare rates and buy policies from reputable online insurance marketplaces

- Independent Agents: Find agents who specialize in cash value life insurance for personalized advice

- Financial Advisors: Consult advisors for tailored recommendations based on your financial goals and needs

- Direct Insurer Websites: Visit the websites of major insurers offering cash value policies

- Local Brokers: Engage local brokers for local expertise and access to niche insurers

Online Platforms: Compare rates and buy policies from reputable online insurance marketplaces

When considering cash value life insurance, online platforms can be a convenient and efficient way to compare rates and purchase policies from reputable insurance companies. These platforms act as intermediaries, allowing you to explore various options and make informed decisions without the need for extensive research or multiple company interactions. Here's a guide on how to navigate this process:

Research and Choose Reputable Online Marketplaces: Start by identifying well-known and trusted online insurance marketplaces. These platforms often feature a wide range of insurance providers, making it easier to compare offerings. Look for websites that have been in operation for a while, have positive user reviews, and offer a secure and user-friendly interface. Some popular options include Insure.com, PolicyGenius, and Quotacy.

Compare Rates and Features: Once you've selected a few reputable online marketplaces, you can begin comparing rates and policy details. These platforms typically provide a side-by-side comparison of different insurance providers' offers. You can input your personal and financial information to receive customized quotes. Pay attention to the coverage amount, death benefit, premium costs, and any additional fees associated with the policy. Also, consider the cash value accumulation rate, surrender charges, and the overall policy structure.

Read Policy Details and Reviews: Before making a purchase, thoroughly review the policy documents provided by the online marketplace. Understand the terms, conditions, and exclusions to ensure you are making an informed decision. Look for platforms that offer transparent information and allow you to ask questions or seek clarification. Additionally, read customer reviews and testimonials to gain insights into the experiences of other policyholders.

Proceed with Purchase and Review Options: When you've found a policy that meets your requirements, proceed with the purchase through the online platform. These marketplaces often provide a seamless process for completing the application and making payments. You may have the option to pay upfront or set up regular premium payments. After purchasing, regularly review your policy to ensure it aligns with your needs and consider the potential for policy adjustments or conversions in the future.

Online insurance marketplaces offer a convenient and comprehensive approach to finding cash value life insurance. By comparing rates, reading policy details, and utilizing the platform's resources, you can make a well-informed decision. Remember to choose reputable platforms and carefully review the terms to ensure you are getting the best value for your money.

Understanding Tax on Life Insurance Cash Surrender Value

You may want to see also

Independent Agents: Find agents who specialize in cash value life insurance for personalized advice

When it comes to finding the right cash value life insurance policy, engaging an independent agent can be a game-changer. These agents are not tied to a specific insurance company, allowing them to offer a wide range of options and provide unbiased advice tailored to your needs. Here's why considering independent agents is a smart move:

Specialized Knowledge: Independent agents often specialize in cash value life insurance, which means they have in-depth knowledge of various policies and their unique features. They understand the intricacies of these policies, including how cash value accumulates over time, loan options, and surrender charges. This expertise ensures you receive accurate information and guidance throughout the decision-making process.

Personalized Service: One of the key advantages of working with independent agents is the personalized attention you receive. They take the time to understand your financial goals, risk tolerance, and long-term plans. By assessing your individual circumstances, they can recommend policies that align perfectly with your needs. This tailored approach ensures you get a cash value life insurance policy that suits your specific requirements, providing both financial security and flexibility.

Access to Multiple Carriers: Independent agents have access to multiple insurance carriers, not just one. This broad network allows them to compare policies from various providers, ensuring you get the best value for your money. They can present you with a range of options, including different policy types, coverage amounts, and premium structures. This comprehensive view empowers you to make an informed decision based on your unique circumstances.

Unbiased Recommendations: Since independent agents are not bound to a single company, they can offer unbiased advice. They are free to recommend the policy that best fits your needs, without any pressure to purchase from a specific insurer. This impartiality ensures you receive recommendations based solely on your best interests, helping you make a well-informed choice.

To find the right independent agent, start by researching those who specialize in cash value life insurance in your area or online. Look for agents with excellent reviews and a strong reputation for providing personalized service. You can also ask for referrals from friends or family members who have had positive experiences with independent agents. Once you've identified potential candidates, schedule consultations to discuss your requirements and assess their expertise and approach.

Specialty Life Insurance: Legit or a Scam?

You may want to see also

Financial Advisors: Consult advisors for tailored recommendations based on your financial goals and needs

When considering cash value life insurance, it's essential to seek professional guidance from financial advisors who can provide tailored recommendations based on your unique financial goals and needs. These advisors are experts in financial planning and can help you navigate the complex world of insurance products. Here's why consulting a financial advisor is a wise step:

Personalized Advice: Financial advisors will take the time to understand your financial situation, goals, and risk tolerance. They will analyze your current assets, liabilities, and income to determine the most suitable cash value life insurance policy. This personalized approach ensures that the insurance plan aligns with your specific needs, whether it's for long-term savings, estate planning, or providing financial security for your loved ones.

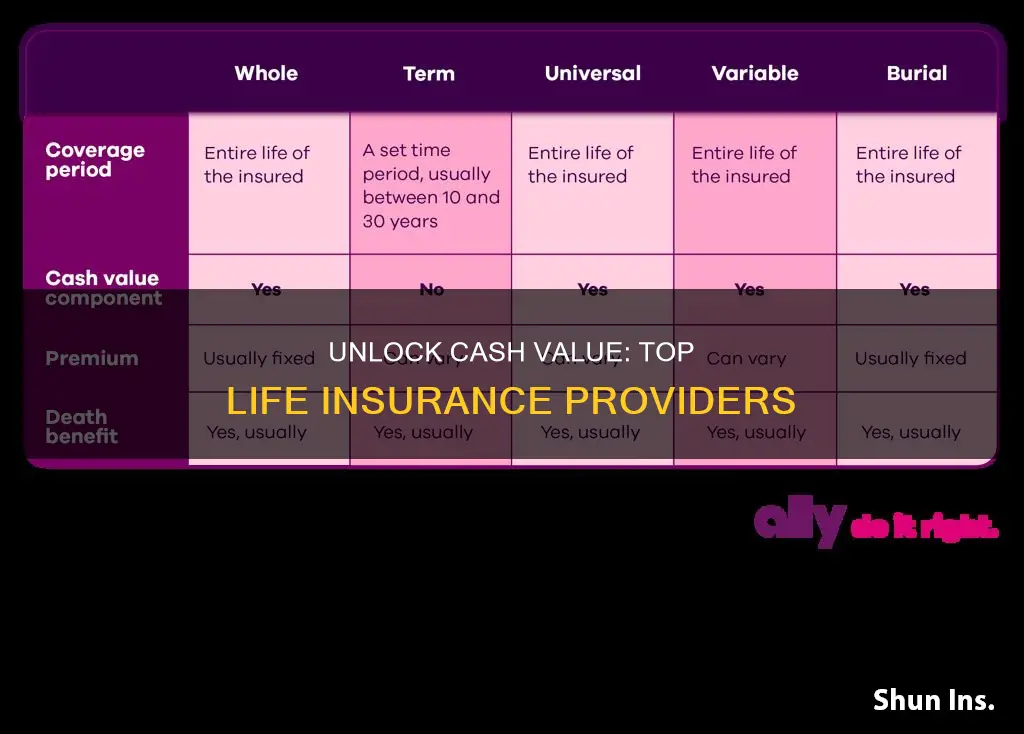

Expert Knowledge: These advisors possess extensive knowledge about various insurance products, including cash value life insurance. They can explain the different types of policies, such as whole life, universal life, and variable life insurance, and their respective benefits and drawbacks. By understanding the technical aspects, you can make informed decisions and choose the policy that best fits your requirements.

Risk Management: Life insurance is a critical component of a comprehensive financial plan. Financial advisors can help you assess the risks associated with different life events, such as premature death, disability, or critical illness. They can recommend appropriate coverage amounts and strategies to ensure your financial security and that of your dependents. Through risk management, advisors can help you prepare for unforeseen circumstances.

Long-Term Financial Planning: Cash value life insurance offers a dual benefit of insurance coverage and a savings component. Financial advisors can assist in optimizing this feature by providing strategies for long-term wealth accumulation. They can guide you on how to utilize the cash value to build equity, borrow funds (when allowed by the policy), or make additional contributions to enhance your savings. This ensures that your insurance policy becomes a valuable tool for achieving your financial objectives.

Regular Review and Adjustments: Life circumstances change over time, and so should your insurance needs. Financial advisors will schedule regular reviews of your insurance policies to ensure they remain appropriate. They can also help you adjust your coverage as your financial goals evolve, ensuring that your insurance strategy remains aligned with your changing life situation. This ongoing support is crucial for maintaining an effective financial plan.

Consulting a financial advisor for cash value life insurance is an investment in your financial well-being. Their expertise and personalized approach can help you make informed decisions, manage risks, and build a robust financial plan. By seeking their guidance, you can ensure that your insurance policy becomes a powerful tool to secure your future and the future of your loved ones.

Unveiling Walgreens' Life Insurance: A Comprehensive Guide

You may want to see also

Direct Insurer Websites: Visit the websites of major insurers offering cash value policies

When searching for cash value life insurance, one of the most direct and efficient methods is to explore the websites of major insurance companies. Many well-known insurers offer cash value policies, and their websites provide a wealth of information to help you make an informed decision. Here's a guide on how to navigate this process:

Research and Compare: Start by researching reputable insurers known for their cash value life insurance products. Some of the top companies include MetLife, Prudential, and New York Life. Visit their official websites, as these are the primary sources of information for their policies. You'll find detailed explanations of how cash value insurance works, including the investment options available to policyholders. Compare the features, benefits, and potential returns of different policies to understand what suits your needs.

Explore Policy Details: Insurance company websites often provide comprehensive policy documents, such as illustrations and prospectuses. These documents outline the policy's cash value accumulation, investment options, and potential surrender charges. Review these carefully to grasp the long-term benefits and any associated fees. For instance, you can see how your policy's cash value might grow over time and the potential for loan features, which can be valuable in emergencies.

Contact Customer Support: If you have specific questions or need further clarification, don't hesitate to reach out to the insurer's customer support team. Most websites provide contact information, including phone numbers and email addresses. Inquire about policy details, investment strategies, and any available resources to help you understand the policy better. A knowledgeable representative can provide personalized guidance, ensuring you make a well-informed choice.

Apply Online: Many insurers allow you to apply for cash value life insurance directly through their websites. This streamlined process typically involves filling out an application form, providing personal and financial information, and uploading necessary documents. Ensure you have all the required details ready to complete the application efficiently. Once submitted, the insurer will review your application, and if approved, you can proceed with the necessary steps to finalize the policy.

By visiting the websites of major insurers, you gain direct access to their cash value life insurance offerings, allowing you to compare policies, understand the benefits, and make a confident decision. This approach empowers you to take control of your insurance choices and potentially secure a valuable financial asset.

Life Insurance Options for Rheumatoid Arthritis Patients

You may want to see also

Local Brokers: Engage local brokers for local expertise and access to niche insurers

When considering cash value life insurance, engaging with local brokers can be a strategic move. These professionals often have a deep understanding of the local market and can provide tailored solutions that might not be readily available through national insurers. Here's why local brokers can be your advantage:

Local Expertise: Local brokers are embedded in their communities and understand the unique needs and preferences of the local population. They can offer insights into the specific insurers that cater to the region's demographics. For instance, they might know which insurers provide better rates for older individuals or those with specific health conditions. This local knowledge can be invaluable when navigating the complex world of insurance.

Access to Niche Insurers: Local brokers often have relationships with a range of insurance companies, including some that might not be widely known or accessible. These niche insurers can offer specialized products that cater to specific needs. For example, they might provide policies with unique riders or benefits that are not available through larger, more mainstream insurers. By working with local brokers, you gain access to a broader selection of options, increasing the chances of finding a policy that suits your individual circumstances.

Personalized Service: Local brokers typically provide a more personalized service compared to larger insurance companies. They take the time to understand your specific financial goals, health status, and family situation. This personalized approach allows them to recommend policies that align perfectly with your needs. They can also provide ongoing support and guidance, ensuring that your insurance policy remains relevant and beneficial as your life circumstances change.

Community Connections: Local brokers are often part of the community and can leverage their connections to offer competitive rates and additional benefits. They may have negotiated special deals or partnerships with local businesses, which can result in lower premiums or added value for their clients. These connections can be particularly useful if you have a specific insurance need that requires a tailored solution.

Convenience and Support: Engaging with local brokers means you have a dedicated point of contact for all your insurance needs. They can guide you through the process, answer questions, and provide support when making important decisions. This level of convenience and personalized attention can make the insurance buying process less daunting and more efficient.

In summary, local brokers can be a valuable resource when seeking cash value life insurance. Their local expertise, access to niche insurers, personalized service, community connections, and convenience make them a reliable partner in finding the right insurance policy for your specific needs.

Life Insurance Payout: How Long Before Dependents Benefit?

You may want to see also

Frequently asked questions

Cash value life insurance is typically offered by independent insurance companies, mutual or stock insurance companies, and some banks and credit unions. You can also explore options through insurance brokers or financial advisors who specialize in life insurance products. It's important to research and compare different providers to find the best fit for your needs and budget.

Qualification for cash value life insurance depends on various factors, including your age, health, and financial situation. Insurance companies often have specific underwriting criteria. Generally, they will assess your health through medical exams or health questionnaires to determine your risk profile. It's advisable to consult with insurance professionals who can guide you through the process and help you understand the requirements based on your individual circumstances.

Yes, many insurance companies now offer the option to purchase cash value life insurance policies online. This process typically involves completing an online application, providing personal and financial information, and choosing your preferred coverage options. However, it's recommended to review the policy details thoroughly and consider consulting a financial advisor or insurance agent for personalized advice, especially for more complex or substantial coverage amounts.

Working with a financial advisor who specializes in life insurance can provide several advantages. They can offer personalized recommendations based on your financial goals, risk tolerance, and long-term plans. Financial advisors can also help you navigate the various policy options, explain the features and benefits of cash value life insurance, and ensure that you make informed decisions. Additionally, they can assist with policy reviews and adjustments over time to align with your changing circumstances.