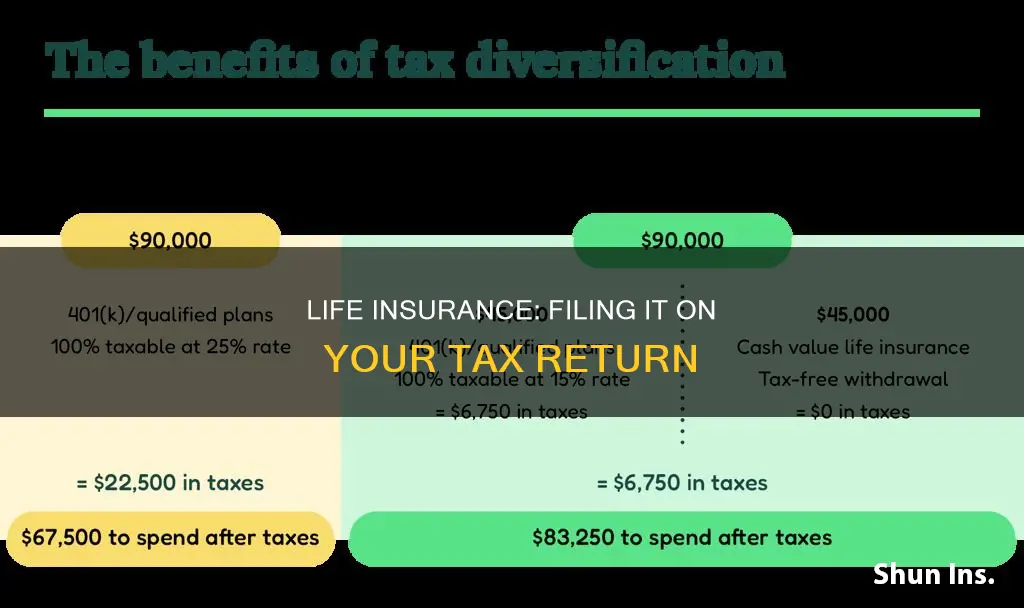

When filing your tax return, it's important to understand the tax implications of your life insurance policies. While life insurance itself is not taxable, there are certain aspects of your policy that may be reportable on your tax return. For instance, if you have a cash value component in your policy, any interest earned on that cash value may be taxable. Additionally, if you have taken out a loan against your policy or made any premium payments with after-tax dollars, these amounts may also be reportable. Understanding these nuances can help you navigate the tax process more effectively and ensure you're taking advantage of any potential deductions or credits you may be entitled to.

What You'll Learn

- Life Insurance Proceeds: Report taxable life insurance proceeds as income

- Premiums: Deductions for life insurance premiums may be available

- Excess Premiums: Excess premium payments over $100,000 are not deductible

- Taxable Benefits: Understand the tax implications of life insurance benefits

- State Variations: Tax treatment varies by state; consult local guidelines

Life Insurance Proceeds: Report taxable life insurance proceeds as income

When it comes to filing life insurance proceeds on your tax return, it's important to understand the tax implications and how to properly report these amounts. Life insurance can provide financial security for your loved ones, but it also has tax consequences that you need to be aware of. Here's a detailed guide on how to handle life insurance proceeds:

Understanding Taxable Proceeds: Life insurance proceeds received as a result of a life insurance policy can be taxable income. This is because the insurance company pays out the policy amount as a benefit, which is generally considered taxable income for the recipient. The key is to recognize that the proceeds are not just a gift or a one-time payment but rather a form of income that may be subject to taxation.

Reporting Requirements: When filing your tax return, you must report the taxable life insurance proceeds. This is typically done on the tax form relevant to your jurisdiction. For example, in the United States, you would report it on Form 1040, Schedule 1, or Form 1040-NR, depending on your tax status. The proceeds should be included in the 'Other Income' section of your tax return. It's essential to provide accurate details about the life insurance policy and the amount received.

Exclusions and Deductions: There are certain exclusions and deductions that may apply to life insurance proceeds. For instance, if the policy was owned by an individual for a specific period and was not paid for with after-tax dollars, the proceeds might be excluded from taxation. Additionally, if the policy was a term life insurance contract, the proceeds could be deductible. However, these exclusions and deductions vary based on individual circumstances, so it's crucial to consult tax regulations or seek professional advice.

Calculating Taxable Amount: To determine the taxable amount, you need to consider the policy's terms and the recipient's relationship to the insured. The tax authorities often require a detailed breakdown of the policy, including the premium payments, ownership period, and the nature of the policy (e.g., term or permanent). By providing this information, you can calculate the taxable proceeds accurately and ensure compliance with tax laws.

Seeking Professional Guidance: Tax regulations regarding life insurance can be complex, and they may vary depending on your country or region. It is highly recommended to consult a tax professional or accountant who specializes in insurance and tax matters. They can provide personalized advice, ensuring that you report the life insurance proceeds correctly and take advantage of any applicable exclusions or deductions.

Stonebridge Life Insurance: Is the Company Still Operational?

You may want to see also

Premiums: Deductions for life insurance premiums may be available

When it comes to filing life insurance on your tax return, understanding the deductions for premiums can be a significant advantage for policyholders. Life insurance premiums can be a substantial expense, and if you meet certain criteria, you may be able to claim a deduction, reducing your taxable income and, consequently, your tax liability. This is particularly beneficial for those with high-income earners or those who have recently purchased a large life insurance policy.

The Internal Revenue Service (IRS) allows individuals to deduct the cost of life insurance premiums if they meet specific conditions. Firstly, the insurance must be a term life policy, meaning it has a specific term or period during which it is in force. Secondly, the policy must be owned by the insured person, and the beneficiary must be the insured's spouse, child, or another dependent. It's important to note that the deduction is limited to the amount paid for the insurance during the tax year.

To claim the deduction, you'll need to provide detailed information on your tax return. This includes the name of the insurance company, the policy number, and the amount of premiums paid during the year. You'll also need to ensure that the policy meets the IRS's criteria for being considered a valid life insurance contract. It's recommended to keep all relevant documentation, such as insurance policies, receipts, and any correspondence with the insurance provider, to support your claim.

The deduction for life insurance premiums can be a valuable tax benefit, especially for those with substantial insurance coverage. It's essential to review the IRS guidelines and consult a tax professional to ensure you are claiming the correct amount and meeting all the necessary requirements. By taking advantage of this deduction, you can effectively reduce your taxable income and potentially lower your tax burden.

In summary, filing life insurance premiums on your tax return can be advantageous, but it requires careful consideration and adherence to IRS regulations. Understanding the criteria and keeping proper documentation will enable you to maximize this deduction and potentially save on taxes. Remember, proper tax planning can lead to significant financial benefits, so it's worth exploring all available options.

Reliance Nippon Life Insurance: Check Your Policy Status Easily

You may want to see also

Excess Premiums: Excess premium payments over $100,000 are not deductible

When it comes to filing your life insurance premiums on your tax return, it's important to understand the rules and limitations set by the tax authorities. One specific rule that can impact your deductions is the limitation on excess premium payments.

Excess premium payments refer to the amount by which your life insurance premiums exceed the maximum amount allowed for deduction. For tax purposes, the general rule is that you can deduct the amount of your life insurance premiums that you paid during the tax year. However, there is a cap on this deduction. If your total life insurance premiums for the year exceed $100,000, only a portion of that amount is deductible.

The key point to note is that excess premium payments over $100,000 are not deductible at all. This means that if your total premiums for the year are, for example, $150,000, you can only deduct $100,000. Any amount above $100,000 will not be considered a deductible expense. This rule applies to both individual and group life insurance policies.

To calculate the deductible amount, you need to determine the excess premium. Subtract the $100,000 limit from your total premiums paid. For instance, if your total premiums were $120,000, the excess premium would be $20,000 ($120,000 - $100,000). This excess amount is not deductible, and you should not include it in your tax return as an expense.

It's essential to keep detailed records of your life insurance premiums and any other relevant financial information to ensure accurate tax reporting. Understanding these rules will help you navigate the tax implications of your life insurance policies and ensure compliance with the tax regulations.

Life Insurance: Securing Your Future with Fixed Returns

You may want to see also

Taxable Benefits: Understand the tax implications of life insurance benefits

When it comes to life insurance, understanding the tax implications of the benefits you receive is crucial for effective financial planning. Life insurance policies can provide a significant financial safety net for your loved ones, but the tax treatment of these benefits can vary depending on the type of policy and the circumstances. Here's a detailed breakdown of how to navigate the taxable benefits of life insurance:

Understanding Taxable Benefits:

Life insurance benefits are generally not taxable income for the insured individual. However, there are exceptions and specific scenarios where these benefits may be subject to taxation. The key factor is whether the policy is owned by the insured or by a third party, such as an employer or an individual. When a third party owns the policy, the tax implications can be more complex.

Tax Treatment of Death Benefits:

In the event of the insured's death, the death benefit or payout from the life insurance policy is typically paid out tax-free to the designated beneficiaries. This is a significant advantage of life insurance, as it provides financial support to your family without being subject to income tax. The beneficiary can use this money for various purposes, such as covering funeral expenses, paying off debts, or funding education.

Tax Implications for the Insured:

If you are the insured individual and the policy is owned by you, the premiums you pay are generally tax-deductible as a medical expense. However, this is subject to certain limitations and rules set by the tax authorities. It's essential to keep detailed records of your premium payments and consult a tax professional to ensure compliance with the tax laws in your jurisdiction.

Employer-Provided Life Insurance:

Many employers offer group life insurance policies as a benefit to their employees. In such cases, the premiums are often deducted from the employee's wages, and the policy is owned by the employer. The tax treatment of the death benefit in this scenario is generally favorable, as it is typically exempt from income tax for the beneficiary. However, there might be specific rules and limitations, so it's advisable to review the policy details and consult with a tax advisor.

Non-Qualified vs. Qualified Policies:

It's important to distinguish between non-qualified and qualified life insurance policies. Non-qualified policies, also known as "universal life" or "whole life" policies, offer more flexibility and potential investment components. The tax treatment of benefits from these policies can vary, and they may be subject to income tax in certain circumstances. On the other hand, qualified policies, such as term life insurance, often have more straightforward tax implications, and the death benefit is generally tax-free.

In summary, life insurance benefits can provide valuable financial security, and understanding the tax implications is essential for effective planning. While death benefits from most life insurance policies are generally tax-free, there are exceptions and specific rules to consider. Consulting with a tax professional or financial advisor can help you navigate these complexities and ensure that you maximize the tax benefits of your life insurance policy while adhering to the relevant tax laws.

Flat Extra: Life Insurance's Hidden Cost Explained

You may want to see also

State Variations: Tax treatment varies by state; consult local guidelines

When it comes to filing life insurance on your tax return, it's important to understand that the rules and regulations can vary significantly from state to state. Each state has its own tax laws and guidelines, which can impact how you report and claim life insurance benefits. Therefore, it is crucial to consult the specific guidelines provided by your state's tax authority to ensure compliance and avoid any potential penalties.

In some states, life insurance proceeds may be taxable and need to be reported on your tax return. For instance, if you receive a lump sum payment from a life insurance policy, it might be considered taxable income and should be included in your overall earnings for the tax year. However, the tax treatment can vary depending on the type of policy and the reason for the payout. Term life insurance, for example, may not be taxable if it is used to cover specific expenses like mortgage payments or education costs.

On the other hand, some states may exempt life insurance proceeds from taxation. This means that the benefits received from a life insurance policy might be tax-free, provided they meet certain criteria. These criteria often include the policyholder's relationship to the deceased, the purpose of the insurance, and the amount of the payout. It is essential to research and understand the specific rules applicable to your state to determine if and how to report life insurance benefits.

Additionally, the state's tax department may provide instructions or forms to help you navigate the process. These resources can guide you through the necessary steps to report life insurance proceeds accurately. They might also offer clarification on what types of policies are eligible for tax exemptions or deductions. It is advisable to regularly check for updates on state tax websites or consult with a tax professional to stay informed about any changes in regulations.

Remember, the tax treatment of life insurance can vary widely, so it is crucial to be well-informed and seek guidance when needed. By understanding the specific rules in your state, you can ensure that you file your tax return correctly and take full advantage of any available deductions or exemptions related to life insurance.

Did My Mom Have Life Insurance? How to Check

You may want to see also

Frequently asked questions

Yes, you should report life insurance proceeds on your tax return if you received a payout from a life insurance policy. This is considered taxable income and must be included in your total income for the year.

You typically report life insurance proceeds on the appropriate tax form, which is usually Form 1040 or 1040-SR, depending on your filing status. You'll need to provide details about the insurance policy, the amount received, and any applicable deductions or exclusions.

Yes, there are some exceptions. For example, if you are the primary beneficiary of a life insurance policy owned by your spouse, and you are not expected to benefit financially from the policy, you may not need to report it. Additionally, certain types of life insurance policies, like those used for estate planning or with specific tax-qualified status, may have different reporting requirements.

Failing to report life insurance proceeds can result in penalties and interest charges. It's important to accurately report all income, including life insurance payouts, to ensure compliance with tax laws and avoid potential legal issues.