Life insurance is a financial tool that provides a safety net for individuals and their families, offering various benefits and features. One of the key advantages of certain life insurance policies is the option to secure a fixed rate of return on the policy's cash value. This feature ensures that policyholders can build a substantial cash value over time, which can be borrowed against or withdrawn tax-free. With a fixed rate of return, individuals can have peace of mind knowing that their investment is growing predictably, providing financial security and a reliable source of funds for future needs. This aspect of life insurance is particularly attractive to those seeking a stable and consistent return on their investment while also ensuring the coverage of a loved one's financial obligations.

What You'll Learn

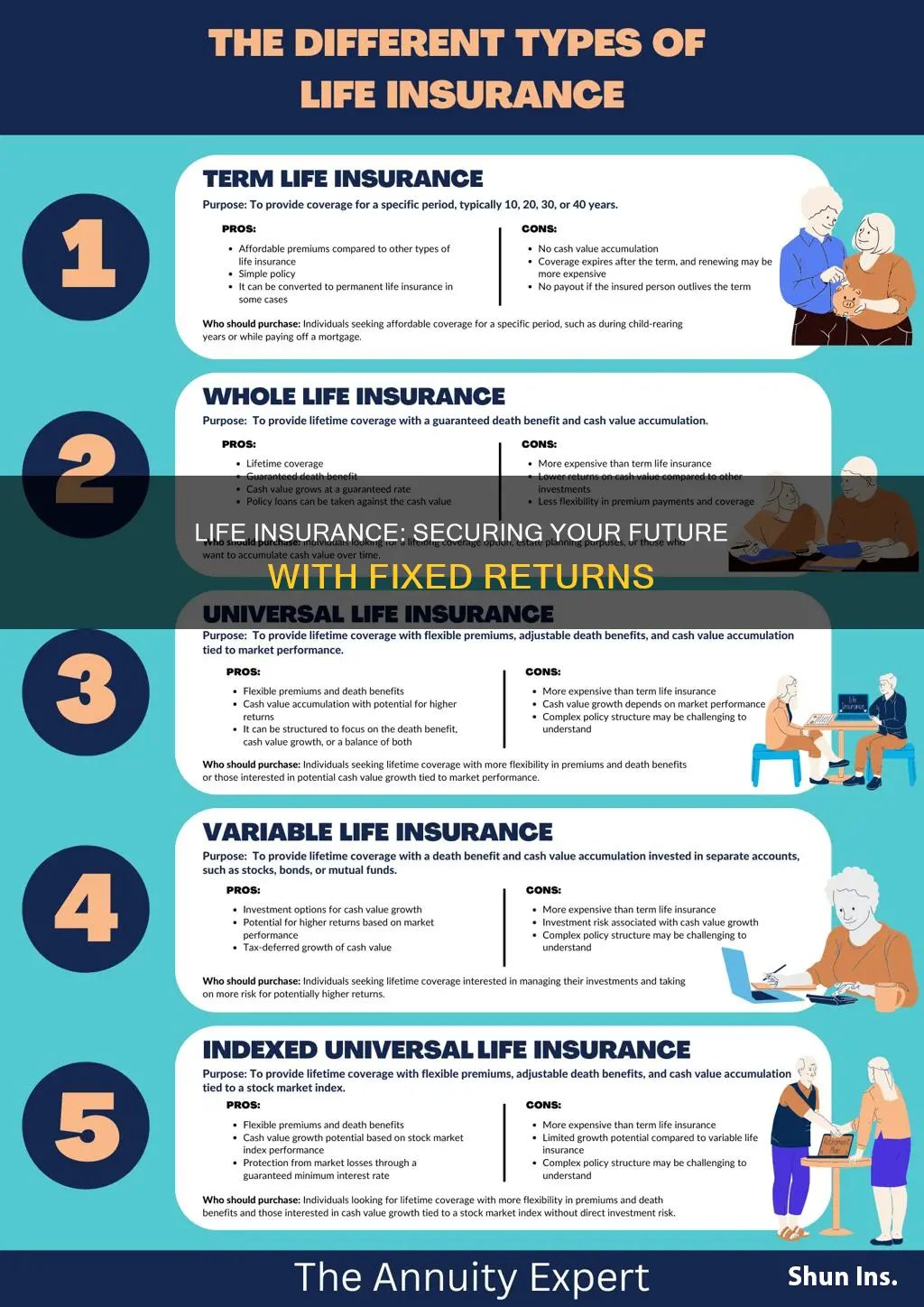

- Term Life Insurance: Offers fixed returns over a set period, providing coverage for a specific duration

- Whole Life Insurance: Provides a guaranteed return on investment, ensuring a fixed death benefit and cash value

- Fixed Universal Life: Combines permanent life insurance with a fixed investment component, offering consistent returns

- Fixed Index Universal Life: Ties returns to market indexes, offering potential for higher returns with guaranteed minimums

- Annuities: Provide a fixed income stream and guaranteed returns, often with tax advantages

Term Life Insurance: Offers fixed returns over a set period, providing coverage for a specific duration

Term life insurance is a type of life insurance that provides coverage for a specific period, offering a fixed rate of return or benefit during that time. Unlike permanent life insurance, which provides coverage for the entire life of the insured, term life insurance is designed to meet the needs of individuals for a particular duration, such as 10, 20, or 30 years. This type of insurance is often more affordable and straightforward, making it an attractive option for those seeking temporary coverage.

The primary advantage of term life insurance is its predictability and simplicity. With this policy, the insured individual pays a fixed premium for a set period, and in return, the insurance company promises to pay a predetermined death benefit to the policyholder's beneficiaries if the insured person passes away during the term. This fixed rate of return ensures that the policyholder knows exactly what they will receive if the worst happens, providing financial security for their loved ones. For example, if someone purchases a 20-year term life insurance policy with a $200,000 death benefit, the insurance company guarantees that amount will be paid out if the insured dies within those 20 years.

One of the key benefits of term life insurance is its cost-effectiveness. Since the coverage is limited to a specific period, the premiums are generally lower compared to permanent life insurance. This makes it an excellent choice for individuals who want to provide financial protection for their families during a particular life stage, such as when they have young children or a mortgage. By choosing a term that aligns with their specific needs, they can ensure their loved ones are financially secure without paying for coverage they don't need.

Additionally, term life insurance offers flexibility. Policyholders can select the term length that best suits their circumstances. For instance, a young professional might opt for a 10-year term to cover any potential financial gaps during their early career, while a family with a mortgage might prefer a 20-year term to ensure their home loan is fully protected. This flexibility allows individuals to tailor their insurance to their unique situations.

In summary, term life insurance provides a fixed rate of return over a set period, offering coverage for a specific duration. It is a cost-effective and straightforward solution for those seeking temporary financial protection. With its predictable benefits and customizable terms, term life insurance ensures individuals can provide for their loved ones during critical life stages without the long-term commitments of permanent insurance policies.

Life Insurance: Am I Entitled to Benefits?

You may want to see also

Whole Life Insurance: Provides a guaranteed return on investment, ensuring a fixed death benefit and cash value

Whole life insurance is a type of permanent life insurance that offers a unique and attractive feature: a guaranteed return on investment. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers long-term financial security and a range of benefits that can be tailored to individual needs. One of the key advantages is its ability to provide a fixed death benefit, ensuring that the beneficiary receives a predetermined amount upon the insured's passing. This feature is particularly valuable as it guarantees financial support for loved ones, covering essential expenses such as mortgage payments, education costs, or daily living expenses.

The guaranteed return aspect of whole life insurance is a significant draw for investors. It operates similarly to a savings account, with a portion of the premium paid going into an investment account. This investment component grows over time, providing a tax-deferred savings opportunity. The cash value accumulation in whole life insurance is a powerful tool, allowing policyholders to build a substantial fund that can be borrowed against or withdrawn, providing financial flexibility. This feature is especially beneficial for those seeking to secure their financial future and build a nest egg for retirement or other long-term goals.

The fixed rate of return on investment in whole life insurance is a critical factor in its appeal. It ensures that the policyholder's money grows at a consistent rate, providing a sense of security and predictability. This is in contrast to other investment vehicles, where returns can vary widely. With whole life insurance, the guaranteed return is typically higher than the average interest rate on savings accounts or certificates of deposit, making it an attractive option for those seeking to maximize their savings while also providing essential coverage.

Over time, the cash value in a whole life insurance policy can become substantial, allowing policyholders to access funds for various purposes. This feature is particularly useful for those who want to build wealth while also having a safety net in place. Additionally, the guaranteed death benefit ensures that the policy remains in force for the entire life of the insured, providing long-term financial protection. This level of security and flexibility is a key differentiator, making whole life insurance an attractive choice for individuals seeking a comprehensive financial strategy.

In summary, whole life insurance offers a compelling solution for those seeking a guaranteed return on their investment while also providing a fixed death benefit and cash value. Its ability to offer both financial security and investment growth makes it an excellent tool for long-term financial planning. By understanding the features and benefits of whole life insurance, individuals can make informed decisions to protect their loved ones and build a more secure financial future.

Race and Life Insurance: Does It Affect Premiums?

You may want to see also

Fixed Universal Life: Combines permanent life insurance with a fixed investment component, offering consistent returns

Fixed Universal Life is a type of life insurance policy that offers a unique blend of permanent life coverage and a fixed investment component. This innovative product is designed to provide individuals with a sense of financial security and the potential for consistent returns over time. Here's a detailed breakdown of how it works and its benefits:

In the world of life insurance, permanent life insurance policies, such as whole life or universal life, offer lifelong coverage with a cash value component. The cash value grows over time, providing a source of funds that can be borrowed against or withdrawn. However, the returns on these policies are often variable, dependent on market performance. Fixed Universal Life takes this concept a step further by incorporating a fixed investment component, ensuring a consistent return rate.

When you purchase a Fixed Universal Life policy, a portion of your premium is allocated to a fixed investment account. This investment is typically guaranteed by the insurance company, offering a predetermined rate of return that remains constant over the policy's term. This fixed rate of return is a significant advantage, especially in volatile markets where other investment options may fluctuate. Policyholders can enjoy the peace of mind that comes with knowing their investment will grow at a steady pace.

The beauty of Fixed Universal Life lies in its ability to provide both insurance and investment benefits. The permanent life insurance aspect ensures that you and your beneficiaries are protected financially, even if the investment component underperforms. Additionally, the fixed rate of return can be particularly attractive to those seeking a more predictable financial strategy. Over time, the cash value of the policy can accumulate, providing a substantial sum that can be used for various financial goals, such as retirement planning or funding education.

One of the key advantages of this policy is its flexibility. Policyholders can typically adjust their premium payments and policy values to align with their changing financial circumstances. This adaptability is crucial for individuals who want to optimize their insurance and investment strategies as their lives evolve. Moreover, the fixed nature of the investment component makes it an attractive option for risk-averse investors who prefer a more conservative approach to growing their wealth.

In summary, Fixed Universal Life offers a compelling solution for those seeking a combination of permanent life insurance and a fixed investment strategy. With its consistent returns and the security of lifelong coverage, this policy provides a comprehensive approach to financial planning. Understanding the features and benefits of Fixed Universal Life can help individuals make informed decisions about their insurance and investment needs, ensuring a more secure and prosperous future.

Understanding Vantage Term Life Insurance: A Comprehensive Guide

You may want to see also

Fixed Index Universal Life: Ties returns to market indexes, offering potential for higher returns with guaranteed minimums

Fixed Index Universal Life (FIUL) is a type of life insurance policy that combines the features of both fixed and variable life insurance, offering a unique way to secure financial protection while also providing the potential for higher returns. This policy is designed to tie its returns to the performance of a specific market index, typically the S&P 500, which is a widely recognized and diverse stock market index. By doing so, FIUL provides policyholders with a way to potentially benefit from market growth while also offering guaranteed minimums, ensuring a level of security.

In a FIUL policy, the death benefit, which is the amount paid to the policyholder's beneficiaries upon their passing, is guaranteed and typically fixed. This means that regardless of market fluctuations, the policy will provide a predetermined amount to the insured's family. However, the policy also includes an investment component that is linked to the performance of the chosen market index. This investment portion allows the policy to grow over time, potentially offering higher returns compared to traditional fixed-rate life insurance.

The way FIUL works is that a portion of the policy's premium is invested in a separate account, which is managed by the insurance company. This investment account is designed to mirror the performance of the market index. When the market index performs well, the investment account grows, and this growth is reflected in the policy's cash value. The cash value is the sum of the policy's investments and any interest or earnings generated. This growth can provide policyholders with a higher return on their premiums, especially during periods of market growth.

One of the key advantages of FIUL is the guaranteed minimums. While the policy is tied to market performance, it also ensures that the policyholder will not lose any of their initial investment. The insurance company guarantees a minimum interest rate, which means that even if the market index underperforms, the policyholder will still earn a minimum rate of return on their cash value. This feature provides a level of security and stability, especially for those seeking long-term financial protection.

For those considering FIUL, it is important to understand the potential risks and benefits. While the policy offers the potential for higher returns, it is also subject to market volatility. During periods of market decline, the policy's performance may be impacted, and the cash value could decrease. However, the guaranteed minimums provide a safety net, ensuring that the policyholder's initial investment is protected. Additionally, FIUL policies often have higher minimum premium requirements and may have certain restrictions on policy loans or withdrawals, which are important considerations for potential buyers.

Investments to Secure Your Future: Alternatives to Life Insurance

You may want to see also

Annuities: Provide a fixed income stream and guaranteed returns, often with tax advantages

Annuities are a financial product that offers a unique and attractive option for those seeking a stable and secure income stream, especially in retirement planning. They provide a fixed income over a specified period, ensuring a regular and predictable cash flow for individuals who want to rely on a guaranteed return on their investments. This is particularly appealing to those who prioritize financial security and want to avoid the risks associated with market volatility.

When considering an annuity, investors typically purchase it from an insurance company, which then becomes their annuity provider. The insurance company promises to pay the investor a series of fixed payments at regular intervals, such as monthly, quarterly, or annually. These payments can start immediately, providing an immediate income stream, or they can be deferred for a future date, allowing the investor to build up a larger lump sum. The beauty of this arrangement is the guarantee of these payments, ensuring a steady income for the annuitant, the person who owns the annuity.

One of the key advantages of annuities is the potential for tax advantages. In many jurisdictions, annuity payments are often tax-deferred, meaning the income generated within the annuity is not taxed until it is withdrawn. This can be particularly beneficial for retirement savings, as it allows investors to grow their money over time without incurring significant tax liabilities. Additionally, some annuities offer tax-free growth, where the investment gains are not taxed, further enhancing the overall return on investment.

Guaranteed returns are another significant feature of annuities. The insurance company backing the annuity provides a fixed rate of return, often higher than what is typically available in traditional savings accounts or bonds. This guarantee provides a sense of security, knowing that your investment will grow at a predetermined rate, and you will receive a specific amount back over time. This aspect is especially valuable for risk-averse investors who prefer a more conservative approach to growing their wealth.

In summary, annuities offer a compelling solution for individuals seeking a fixed income stream and guaranteed returns. With the potential for tax advantages and the security of a predetermined rate of return, they provide a stable and reliable way to manage finances, especially during retirement. Understanding the features and benefits of annuities can help investors make informed decisions about their long-term financial planning and ensure a more secure future.

Top Life Insurance Companies: Finding the Best Fit for You

You may want to see also

Frequently asked questions

A fixed-rate return life insurance policy is a type of investment-linked life insurance where the policyholder receives a guaranteed interest rate on their investment over a specified period. This rate is typically higher than traditional savings accounts, offering policyholders a way to grow their money while also having life insurance coverage.

With this policy, a portion of your premium is invested in a separate account, often an investment fund or a portfolio of securities. The insurance company guarantees a fixed annual rate of return on these investments, which is added to your policy's cash value. This cash value can be borrowed against or withdrawn, providing financial flexibility.

While fixed-rate return policies offer stability, there are still risks. The guaranteed rate may be lower than market rates, and there's a chance that the investment performance could be less than the guaranteed rate. Additionally, some policies may have restrictions on withdrawals or borrowing, and policyholders should carefully review the terms and conditions.

Policyholders can benefit from long-term savings, tax advantages, and potential wealth accumulation. The guaranteed rate of return can provide a sense of security, knowing that your investment will grow at a predictable pace. It also offers a way to build a financial safety net while providing life coverage.

Yes, but there may be penalties or fees associated with early withdrawals. Some policies allow for partial withdrawals, while others might require you to surrender the policy, which could result in significant losses. It's essential to understand the policy's terms and any associated charges before making any withdrawals.