Vantage Term Life Insurance is a type of life insurance that provides coverage for a specific period, known as the term. It offers a straightforward and cost-effective way to secure financial protection for your loved ones during a defined period, typically 10, 15, 20, or 30 years. This insurance policy guarantees a death benefit if the insured individual passes away during the term, ensuring financial security for beneficiaries. Vantage Term Life Insurance is known for its simplicity, with no investment or savings components, making it a pure insurance product. It is a popular choice for individuals seeking affordable coverage to protect their family's financial well-being without the complexities of permanent life insurance.

What You'll Learn

- Definition: Vantage term life insurance is a temporary coverage option with a set duration

- Benefits: It offers affordable premiums and fixed coverage for a specific period

- Term Length: Vantage plans typically last 10, 15, or 20 years

- Cost: Premiums are lower than permanent policies but do not accumulate cash value

- Conversion Option: Vantage policies often allow conversion to permanent insurance later

Definition: Vantage term life insurance is a temporary coverage option with a set duration

Vantage term life insurance is a specific type of life insurance policy designed to provide coverage for a defined period. This type of insurance is often considered a more affordable and flexible alternative to permanent life insurance, as it offers a temporary solution for a predetermined duration. The term "term" in this context refers to the length of time for which the policy is in effect, providing coverage during a specific period.

When you purchase a vantage term life insurance policy, you agree to pay a premium for a set number of years or a specified term. This term can vary, typically ranging from 10 to 30 years, depending on the insurance company and the individual's needs. During this term, the policy provides a death benefit if the insured individual passes away. The primary advantage of this type of insurance is its simplicity and predictability.

The key feature of vantage term life insurance is its temporary nature. Unlike permanent life insurance, which offers coverage for the entire lifetime of the insured, term life insurance is designed to meet specific needs during a particular period. For example, it can be used to cover expenses related to raising children, paying off a mortgage, or funding a child's education. Once the term ends, the policy expires, and further coverage may need to be obtained if desired.

This type of insurance is particularly attractive to those who want a straightforward and cost-effective solution for a defined period. It allows individuals to secure financial protection without the long-term commitment associated with permanent life insurance. During the term, the policyholder can enjoy the peace of mind that their loved ones will be financially protected if something happens.

In summary, vantage term life insurance is a temporary coverage option that provides a set duration of protection. It is a flexible and affordable choice for individuals who need insurance for a specific period, allowing them to manage risks and provide financial security during that time. Understanding the term and its duration is essential for anyone considering this type of insurance to ensure it aligns with their specific needs and goals.

Life Insurance: Money Laundering's Unlikely Friend

You may want to see also

Benefits: It offers affordable premiums and fixed coverage for a specific period

Vantage term life insurance is a type of life insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. One of its key benefits is the affordability it offers to policyholders. This type of insurance is designed to provide a safety net for individuals and families during a defined period, ensuring financial security for loved ones in the event of an untimely demise.

The affordability of vantage term life insurance is a result of its structured nature. Since the coverage period is fixed, the insurance company can offer competitive rates. This is because the risk associated with insuring an individual for a specific period is more predictable compared to permanent life insurance, where coverage lasts for the entire life of the insured. By offering a defined term, the insurance provider can calculate the premiums more accurately, making it an attractive option for those seeking cost-effective life insurance.

In addition to affordable premiums, vantage term life insurance provides fixed coverage. This means that the amount of death benefit remains the same throughout the policy term. Policyholders can rest assured that their loved ones will receive a predetermined sum in the event of the insured's passing. This fixed coverage provides a clear understanding of the financial protection offered, making it easier for individuals to plan and budget accordingly.

The fixed nature of the coverage also allows for easier comparison and selection of policies. When shopping for term life insurance, individuals can compare different providers and policies based on the fixed coverage amount. This transparency empowers policyholders to make informed decisions, ensuring they receive the appropriate level of protection for their specific needs.

Furthermore, the affordability and fixed coverage of vantage term life insurance make it an excellent choice for those who want a straightforward and cost-effective solution. It is particularly beneficial for individuals who have specific financial goals or obligations during a particular period, such as paying off a mortgage, funding a child's education, or providing for a family's short-term needs. By offering affordable premiums and fixed coverage, this type of insurance provides a sense of security and peace of mind, allowing individuals to focus on their present and future without the added worry of life's uncertainties.

Life Insurance Physicals: Are They Necessary?

You may want to see also

Term Length: Vantage plans typically last 10, 15, or 20 years

Term life insurance, including Vantage plans, is a type of coverage that provides financial protection for a specified period. The term length is a critical aspect of these policies, as it determines the duration of the coverage and the associated benefits. Vantage term life insurance plans are designed to offer a straightforward and cost-effective solution for individuals seeking temporary coverage for a defined period.

When considering Vantage plans, the term length is typically one of three options: 10, 15, or 20 years. These durations are carefully selected to cater to various financial needs and goals. For instance, a 10-year term is suitable for those who require coverage for a specific project or a defined period, such as a mortgage or a business venture. It provides a temporary safety net without the long-term commitment. Similarly, a 15-year term can be ideal for individuals who want coverage until their children become financially independent or a significant financial goal is achieved.

The 20-year term, on the other hand, offers a longer period of coverage, providing a more extended safety net for those who want to ensure their family's financial security for an extended duration. This term length is often chosen by individuals who want to build a substantial financial cushion or cover long-term commitments like education expenses. It's important to note that the term length of a Vantage plan is a customizable feature, allowing policyholders to choose the option that best aligns with their unique circumstances and financial objectives.

Understanding the term length is crucial when evaluating Vantage term life insurance. It ensures that the coverage is tailored to the specific needs of the individual, providing a sense of security during the chosen period. Whether it's a short-term project or a long-term financial goal, the term length of Vantage plans offers flexibility and adaptability to meet diverse insurance requirements.

In summary, Vantage term life insurance plans offer a range of term lengths to cater to various financial situations. The 10, 15, and 20-year options provide individuals with the flexibility to choose a coverage period that suits their needs, ensuring they have the necessary protection during the specified time frame. This approach allows for a more personalized and effective insurance solution.

Understanding Adult Life Insurance Eligibility Criteria

You may want to see also

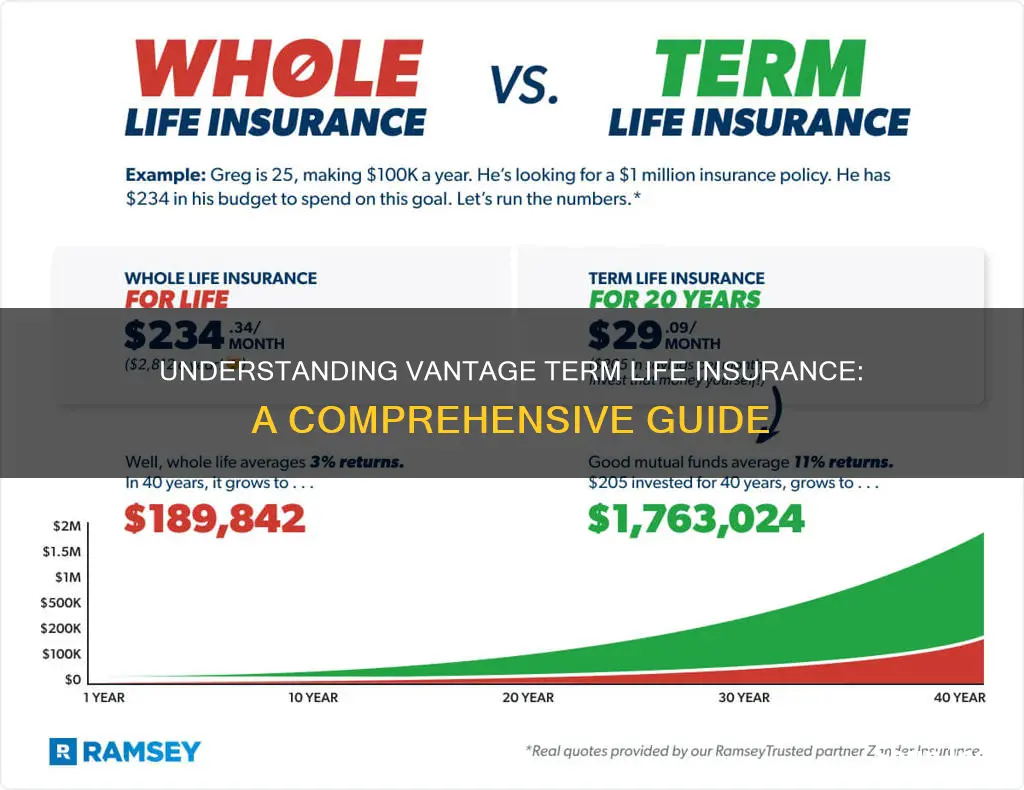

Cost: Premiums are lower than permanent policies but do not accumulate cash value

Vantage term life insurance is a type of life insurance that offers a straightforward and cost-effective solution for individuals seeking coverage for a specific period. Unlike permanent life insurance, which provides lifelong coverage and includes an investment component, vantage term life insurance is designed with a clear focus on affordability and defined coverage terms.

One of the key advantages of vantage term life insurance is its lower cost compared to permanent policies. This cost-effectiveness is primarily due to the temporary nature of the coverage. With term life insurance, you pay premiums for a specified period, often ranging from 10 to 30 years, after which the policy expires. This shorter coverage period results in lower overall costs since the insurance company doesn't have to account for long-term commitments and associated expenses. As a result, individuals can secure substantial coverage without the higher premiums typically associated with permanent life insurance.

However, it's important to note that, unlike permanent policies, vantage term life insurance does not accumulate cash value. Cash value is the investment component of permanent life insurance, which grows over time and can be borrowed against or withdrawn. In term life insurance, the primary function is to provide financial protection during a specific period. Once the term ends, the policy expires, and any unused premiums are not returned or invested. This lack of cash accumulation means that term life insurance is not suitable for those seeking long-term savings or investment opportunities.

The lower premiums of vantage term life insurance make it an attractive option for individuals who want comprehensive coverage without the higher costs associated with permanent policies. It is particularly beneficial for those who require insurance for a defined period, such as covering mortgage payments, providing financial security for children's education, or ensuring financial stability during a specific life stage. By choosing term life insurance, individuals can obtain the necessary protection at a more affordable price, allowing them to allocate their financial resources to other aspects of their lives.

In summary, vantage term life insurance offers a cost-efficient solution for temporary coverage needs. Its lower premiums make it accessible to a broader range of individuals, providing them with the financial protection they require without the long-term commitments and associated costs of permanent life insurance. Understanding the differences in cost and coverage between term and permanent policies is essential for making informed decisions about life insurance.

Irrevocable Life Insurance Trust: What You Need to Know

You may want to see also

Conversion Option: Vantage policies often allow conversion to permanent insurance later

The conversion option is a powerful feature of Vantage term life insurance policies, offering policyholders a unique flexibility in managing their insurance coverage. This option allows individuals to transform their term life insurance into a permanent, or whole life, policy at a later date, providing long-term financial security.

When you purchase a Vantage term life insurance, you typically select a specific term duration, such as 10, 15, or 20 years. During this term, the policy provides a death benefit if the insured individual passes away. The conversion option is a clause that allows you to convert this term life insurance into a permanent policy without the need for a new medical examination or application process.

Here's how it works: After the initial term period, you have the right to convert your Vantage term policy to a permanent one. This conversion process is often straightforward and can be done by simply notifying your insurance provider and paying any additional premiums required for the permanent coverage. By doing so, you ensure that your loved ones are protected for the long term, even if your health or financial situation changes over time.

The conversion option is particularly advantageous for those who initially prefer the simplicity and affordability of term life insurance but later desire the peace of mind that comes with permanent coverage. It provides a seamless transition, allowing you to build equity in the policy and potentially receive a cash value accumulation over time. This feature is especially beneficial for individuals who want to ensure their family's financial stability without the long-term commitment of a whole life policy from the start.

In summary, the conversion option in Vantage term life insurance empowers policyholders to adapt their coverage as their needs evolve. It offers a practical solution for those seeking a flexible approach to life insurance, providing both short-term protection and the potential for long-term financial benefits. Understanding this feature can help individuals make informed decisions about their insurance needs and ensure they have the right coverage at every stage of life.

Life Insurance Exam: California's Question Quota

You may want to see also

Frequently asked questions

Vantage Term Life Insurance is a type of life insurance policy that provides coverage for a specific period, known as the "term." It is a straightforward and affordable way to protect your loved ones financially during a defined period, such as 10, 15, or 20 years. This policy offers a death benefit if the insured person passes away during the term, and it typically has no cash value accumulation.

This insurance policy is designed to be simple and easy to understand. You pay a premium for a specified term, and in return, you receive a death benefit if the insured individual dies during that period. The policy's coverage ends at the end of the term, and there are no ongoing investments or savings components. It is a pure insurance product, focusing solely on providing financial protection for a defined period.

Vantage Term Life Insurance offers several advantages:

- Affordability: It is generally more affordable than permanent life insurance because it provides coverage for a limited term.

- Flexibility: You can choose the term length that best suits your needs, ensuring coverage during the years when your family's financial needs are most significant.

- No Lapse in Coverage: The policy remains in force as long as the premiums are paid, providing continuous protection.

- Simplicity: With no investment or savings components, the policy is easy to understand and manage.

Vantage Term Life Insurance is suitable for individuals who want to provide financial security for their families during a specific period. It is often chosen by those who have financial responsibilities, such as mortgage payments, children's education expenses, or other long-term commitments. Young and healthy individuals typically qualify for lower premiums, making it an excellent option for those starting their families or businesses.