When it comes to appealing a life insurance claim, understanding the process and knowing where to file can be crucial. This guide will provide an overview of the typical steps involved in filing an appeal and the locations where you can submit your case. Whether you're an individual seeking to dispute a claim decision or a representative acting on behalf of a policyholder, this information will help you navigate the appeals process effectively.

What You'll Learn

- Geographic Location: Determine the appropriate state or federal agency based on your location

- Policy Type: Understand the specific insurance policy to identify the governing jurisdiction

- Denial Reason: Research the reason for denial to find the relevant appeal process

- Deadline: Adhere to strict timelines for filing to avoid rejection

- Documentation: Gather all necessary records and evidence to support your appeal

Geographic Location: Determine the appropriate state or federal agency based on your location

When it comes to appealing a life insurance claim, understanding the specific geographic location is crucial as it determines the appropriate agency to file your appeal. The process can vary significantly depending on whether you are in a specific state or if your case falls under federal jurisdiction. Here's a breakdown to guide you through this process:

State-Level Appeals:

In most cases, life insurance claims and their subsequent appeals are handled at the state level. Each state has its own insurance department or commission that regulates and oversees insurance companies, including life insurance providers. If you believe that your claim has been unfairly denied or that there are discrepancies in the settlement amount, you should start by contacting your state's insurance department. These departments often provide resources and guidance on how to file an appeal, ensuring that your rights as a policyholder are protected. They can also assist in understanding the specific requirements and deadlines for your state. For example, if you are a resident of New York, you would reach out to the New York State Department of Financial Services, which has a dedicated division for insurance complaints and appeals.

Federal Jurisdiction:

There are certain scenarios where your appeal might fall under federal jurisdiction, especially if the insurance company is a federal entity or if the policy was issued by a federal program. For instance, if you are a member of the military or a federal employee, your life insurance policy may be administered by the federal government. In such cases, you would need to file your appeal with the appropriate federal agency. The Social Security Administration, for example, handles appeals related to life insurance policies issued through the Social Security program. Understanding whether your case is state or federal in nature is essential to ensure you direct your appeal to the right authority.

Online Resources and Direct Contact:

Many state insurance departments provide online resources and forms to facilitate the appeal process. These resources can guide you through the necessary steps and requirements. If you are unable to find specific information online, it is advisable to contact the department directly. They can provide detailed instructions on how to file an appeal, including any supporting documents or evidence you need to submit. Direct contact also allows you to clarify any doubts and ensure that your appeal is filed correctly and promptly.

Remember, the key to a successful appeal is timely action and proper documentation. Once you have identified the appropriate agency, ensure that you adhere to their specific guidelines and deadlines to increase the chances of a favorable outcome.

Life Insurance for Marathon Runners: What's Covered?

You may want to see also

Policy Type: Understand the specific insurance policy to identify the governing jurisdiction

When it comes to appealing a life insurance claim, understanding the type of policy you hold is crucial as it determines the governing jurisdiction for your appeal. Different types of life insurance policies may have varying terms and conditions, and this can significantly impact the process of filing an appeal. Here's a breakdown of how to approach this:

Term Life Insurance: This is a straightforward policy where the insurance company agrees to pay a predetermined amount upon the insured individual's death. If you have a term life insurance policy, the appeal process typically follows a standard procedure. The policy usually specifies the primary governing law, which could be the state where the insurance company is headquartered or the state where the insured individual resides. In such cases, you would file the appeal with the relevant state insurance department or the company's designated appeals board.

Whole Life Insurance: Unlike term life, whole life insurance provides coverage for the entire lifetime of the insured. The policy has a cash value component and may offer additional benefits. When appealing a whole life insurance claim, you should carefully review the policy documents to identify the governing jurisdiction. This information is often found in the policy's fine print, where it specifies the state or country whose laws govern the contract. Filing an appeal might require contacting the insurance company's legal department or the appropriate regulatory body in the identified jurisdiction.

Universal Life Insurance: This type of policy offers flexibility in premium payments and death benefits. Understanding the governing jurisdiction for universal life insurance is essential. The policy terms may indicate a specific state or country, or it could default to the insurance company's headquarters' jurisdiction. In such cases, you should consult the policy documents or seek legal advice to determine the correct filing location for your appeal.

Variable Universal Life Insurance: This policy combines investment and insurance features, allowing for variable death benefits. The appeal process for this policy type may require a more intricate approach. You should examine the policy's governing law clause, which might be complex and require legal interpretation. Consulting with a legal professional who specializes in insurance law can help you navigate the appeal process effectively.

In summary, identifying the specific type of life insurance policy is the first step in determining the appropriate governing jurisdiction for your appeal. Each policy type may have unique considerations, and understanding these nuances is essential to ensure a smooth and successful appeal process. Always refer to the policy documents and, if necessary, seek professional guidance to make informed decisions.

ZYN and Life Insurance: What You Need to Know

You may want to see also

Denial Reason: Research the reason for denial to find the relevant appeal process

When a life insurance claim is denied, it's crucial to understand the specific reason for the rejection to navigate the appeal process effectively. The first step is to carefully review the denial letter or communication from the insurance company. This document will provide valuable insights into the insurer's decision and the grounds for rejection. Look for any specific references to policy terms, conditions, or exclusions that were not met. For instance, if the policy has a waiting period before coverage begins, and the claim was filed too soon, this could be the reason for the denial. Understanding these details is essential as it guides your next steps in the appeal process.

The next step is to research the reason for the denial in more detail. This might involve looking into the specific policy provisions related to the claim. For example, if the denial is due to a pre-existing condition, you should research the policy's definition of such conditions and any waiting periods or exclusions. If the insurer has denied a claim based on a lack of evidence, you'll need to gather and present the necessary documentation to support your case. This could include medical records, lab results, or any other relevant proof.

Identifying the precise reason for the denial is crucial as it determines the appropriate course of action. For instance, if the issue is a misunderstanding of the policy terms, you might need to provide additional clarification or seek a review by a professional mediator. In cases where the denial is due to a dispute over the cause of death, you may need to provide more detailed evidence to support your claim. Understanding the specific reason will help you tailor your appeal strategy and increase the chances of a successful outcome.

Once you have a clear understanding of the denial reason, you can start to gather evidence and arguments to support your appeal. This might involve collecting additional medical records, seeking expert opinions, or providing more detailed explanations of the circumstances surrounding the claim. It's important to be thorough and organized in your research and presentation of evidence.

Remember, the appeal process often requires a well-structured and compelling argument. You may need to provide additional documentation, clarify any misunderstandings, or address any gaps in the initial claim. By thoroughly researching the denial reason, you can ensure that your appeal is tailored to the specific grounds for rejection, increasing the likelihood of a favorable decision.

Understanding Adult Life Insurance Eligibility Criteria

You may want to see also

Deadline: Adhere to strict timelines for filing to avoid rejection

When it comes to appealing a life insurance claim, understanding the importance of deadlines is crucial. Insurance companies often have strict timelines for filing appeals, and failing to meet these deadlines can result in the rejection of your claim. It is essential to be aware of the specific requirements and procedures to ensure a successful appeal process.

The first step is to carefully review the policy documents you received upon purchasing the life insurance. These documents should outline the terms and conditions, including any provisions related to appeals and the associated deadlines. Pay close attention to the 'Appeals and Disputes' section, as it will provide vital information about the process and the time limits for filing. Take note of the exact dates and any specific instructions regarding the submission method.

Once you have identified the deadline, it is imperative to act promptly. Insurance companies typically provide a limited window for filing an appeal, often ranging from 30 to 60 days from the date of the initial decision. Missing this window can lead to automatic rejection, so it's crucial to start the process as soon as possible. Gather all the necessary documentation, including any supporting evidence, medical records, or expert opinions that strengthen your case. Ensure that your appeal letter is well-structured, clearly stating your reasons for disagreement and providing relevant facts.

When submitting your appeal, follow the instructions provided in the policy. This may involve sending your documents via a designated online portal, email, or postal mail. Keep a record of your submission, including the date and any tracking information, especially if you opt for online or email submission. In some cases, you might be required to submit your appeal in person, so be aware of the specific location and any necessary appointments.

Remember, the key to a successful appeal is adhering to the given deadlines. Insurance companies have strict procedures to follow, and missing a deadline can be a significant factor in the rejection of your appeal. Therefore, it is essential to stay organized, keep track of important dates, and ensure that your appeal is filed well before the specified timeframe.

Understanding Life Insurance Solicitation Rules: Purpose and Impact

You may want to see also

Documentation: Gather all necessary records and evidence to support your appeal

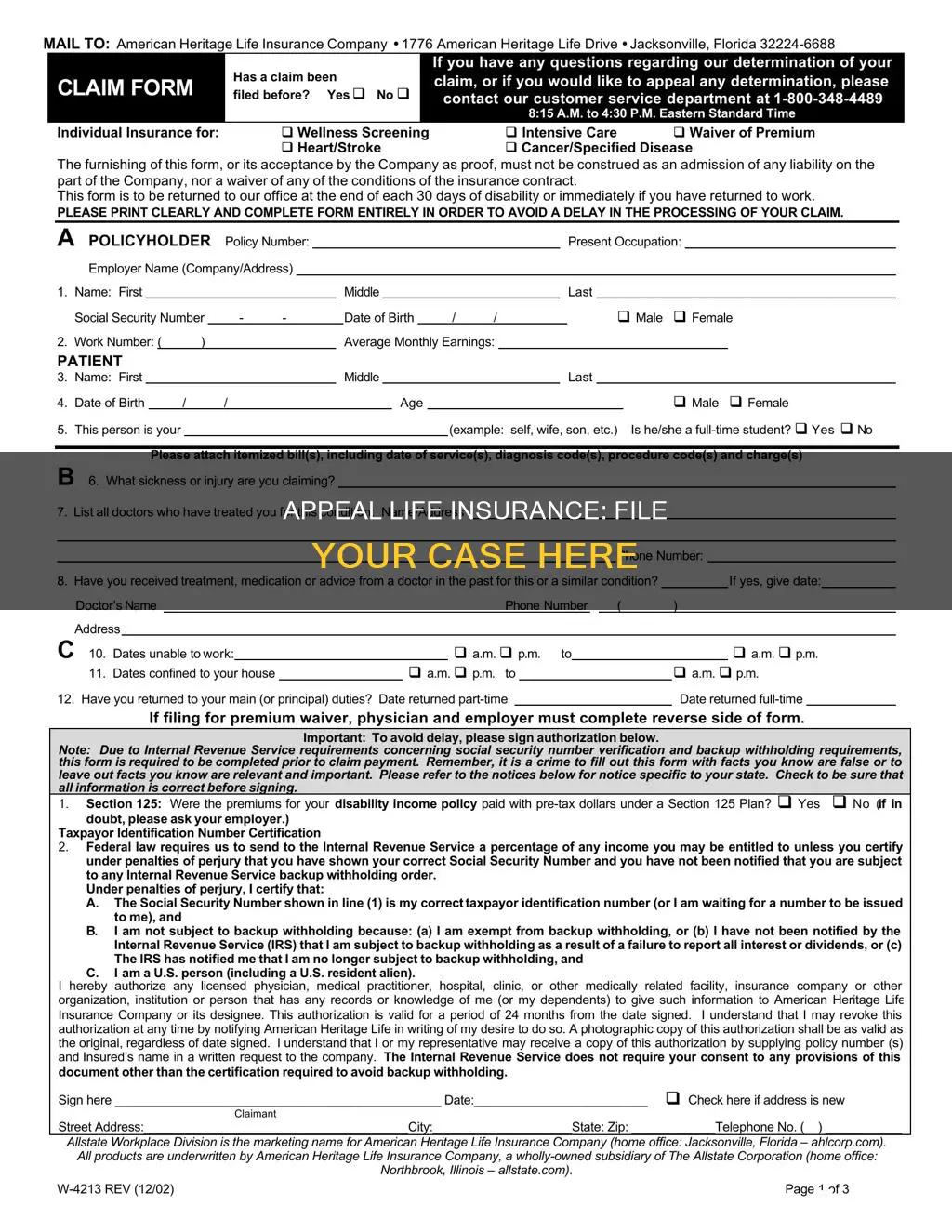

When preparing to appeal a life insurance claim, gathering comprehensive documentation is crucial. This process involves collecting all relevant records and evidence that can support your case and strengthen your appeal. Here's a step-by-step guide on how to approach this critical aspect of the appeal process:

- Medical Records and Reports: Obtain detailed medical records related to the insured individual's health, especially if the claim denial was based on health-related grounds. Include hospital discharge summaries, medical test results, diagnoses, and any correspondence between the insured and their healthcare providers. These documents provide a comprehensive medical history and can help demonstrate the validity of the claim.

- Policy Documents: Review the original life insurance policy carefully. Ensure you have a copy of the policy agreement, including all terms, conditions, and exclusions. Pay close attention to any clauses related to claim denials, appeal processes, and the specific reasons for rejection. Understanding the policy's language is essential to identifying the correct course of action.

- Claim Submission Materials: Re-examine the documents you initially submitted with the claim. This may include death certificates, funeral expense receipts, beneficiary letters, and any other supporting documentation. Verify that all required forms were filled out accurately and that all necessary information was provided. Incomplete or missing information can be a common reason for claim rejections, so double-checking these details is vital.

- Additional Evidence: Depending on the nature of the appeal, you might need to gather additional evidence. For instance, if the claim was denied due to fraud or misrepresentation, you may require witness statements, emails, or any other communication that contradicts the insurer's claims. In cases of accidental deaths, accident reports or witness testimonies could be valuable. Ensure that all evidence is relevant, timely, and properly documented.

- Organize and Compile: Create a comprehensive file or folder system to organize all the collected documents. Arrange them in a logical order, categorizing them by type and date. This organized approach will make it easier to present your case and provide a clear timeline of events to the appeal review committee.

Remember, the goal of this documentation process is to provide a clear and compelling narrative that supports your appeal. Ensure that all information is accurate, up-to-date, and presented in a professional manner. By thoroughly gathering and organizing these records, you increase the chances of a successful appeal and potentially recover the benefits you are entitled to.

Life Insurance for Celiac: What You Need to Know

You may want to see also

Frequently asked questions

If you are dissatisfied with the life insurance company's decision regarding your claim, you can file an appeal with the same company. Typically, there is a designated department or team within the insurance provider that handles appeals. You can reach out to their customer service or claims department to inquire about the specific process and any required documentation. They will guide you through the steps and provide instructions on how to submit your appeal.

The time limit for filing an appeal can vary depending on the insurance company's policies and the jurisdiction. It's essential to review the decision letter or policy documents to understand the time frame within which you must file an appeal. Generally, you have a limited period, often 30 to 60 days, from the date of the initial decision to initiate the appeal process. Missing this deadline may result in the rejection of your appeal.

You have the right to represent yourself in the appeal process, but it is generally recommended to have legal assistance, especially if the claim involves complex issues or significant amounts of money. A lawyer specializing in insurance law can help you navigate the process, ensure your rights are protected, and present your case effectively. They can also help gather and organize the necessary evidence and documentation to support your appeal. However, if you prefer to handle it yourself, you can still file the appeal and provide the required information, but having legal guidance can increase your chances of a successful outcome.