When it comes to finding the best life insurance rates, it's important to shop around and consider various factors. Life insurance rates depend on individual circumstances such as age, health, and medical history. Younger and healthier individuals tend to pay lower premiums. It's also worth noting that certain hobbies and activities, such as skydiving or rock climbing, can increase premiums. Additionally, the type of policy, term length, and coverage amount will impact the cost. Term life insurance is the most common, offering coverage for a set number of years, while permanent life insurance provides lifelong coverage. When choosing an insurer, it's advisable to consider their financial strength, customer satisfaction, and coverage options. Comparing quotes from multiple insurers and seeking advice from financial advisors or agents can help individuals find the best life insurance rates suited to their needs.

What You'll Learn

Cheapest life insurance companies

When shopping for life insurance, it's important to consider a range of factors besides just the price. These include an insurer's financial ratings, policy offerings, application process, and customer satisfaction. Nevertheless, here is a list of some of the cheapest life insurance companies and their offerings.

Protective

Protective offers a range of term life insurance options, including a rare 40-year term policy, which is significantly longer than the 20-30 years offered by most other insurers. Protective's policies are also convertible from term to permanent. The company has a high financial strength rating from AM Best, indicating long-term stability.

Ladder Life

Ladder Life offers term life insurance of up to $8 million in coverage, with policies up to $3 million not requiring a medical exam. The company partners with Allianz Life Insurance Company and Fidelity Security Life Insurance Company, both of which have high AM Best financial strength ratings. Ladder Life insurance applicants must be between 20 and 60 years old.

Pacific Life

Pacific Life is the second-cheapest company according to U.S. News 360 Reviews, although specific details on their offerings are not readily available.

State Farm

State Farm is the third-cheapest company on the U.S. News 360 Reviews list. They offer policies that require a medical exam, which helps the company assess risk and can lead to lower premiums.

Progressive Life Insurance

Progressive Life Insurance offers term life policies that don't require a medical exam, making it a good option for those looking for no-exam coverage.

It's worth noting that life insurance rates depend heavily on individual factors such as age, gender, health, and medical conditions. To find the best rates, it's recommended to shop around, get quotes from multiple insurers, and consider purchasing a policy when you're young and healthy.

Life Insurance and COVID-19: What You Need to Know

You may want to see also

How age and health affect rates

Age and health are two of the most significant factors that influence life insurance rates. Age is a primary factor that can greatly inflate quotes over time. As applicants get older, policy costs increase due to the heightened chance of a death benefit claim. The probability of death rises steadily as we age, and insurers charge higher premiums to account for this greater risk. This is why younger individuals generally qualify for lower rates.

However, age is not the only factor that affects life insurance rates. Health status, medical history, and lifestyle choices also play a role in determining rates. Individuals who are younger but have serious health issues may pay higher premiums than older, healthier applicants. Some common health conditions that can affect life insurance rates include high blood pressure, obesity, high cholesterol, cancer, and mental health conditions. Additionally, risky activities such as skydiving and rock climbing can also increase premiums.

It is important to note that life insurance rates are personalized and depend on various factors beyond age and health, including coverage needs, the type of policy (term or permanent), gender, tobacco use, family history, lifestyle, and occupation. When determining rates, insurers assess multiple personal rating factors and consider the mortality risk of the individual.

To find the best life insurance rates, it is recommended to shop around and get quotes from multiple insurers. This allows individuals to compare rates and choose the most suitable policy for their needs. Obtaining quotes from two or three highly-rated companies and consulting with independent agents can help in finding the most favorable options.

Additionally, individuals can consider taking steps to improve their health and lower their risk classification, such as quitting smoking, changing occupations, or losing weight. These actions can potentially result in lower premiums. However, it is important to remember that switching insurance providers to get a lower rate may not always be successful, as the individual will be older than when they obtained their existing policy, which could result in higher rates.

The Healthcare System: A Doctor and Insurance Haven?

You may want to see also

How to get a good rate

Life insurance rates vary from person to person and depend on several factors, including age, health, and lifestyle choices. Here are some tips on how to get a good rate:

Start Early

Life insurance generally becomes more expensive as you age, so purchasing a policy when you're young can help you secure lower rates.

Maintain Good Health

Improving your health can positively impact your insurance rates. For example, quitting smoking or engaging in safer activities instead of risky hobbies like skydiving can indicate a healthier and safer lifestyle to insurers.

Shop Around and Compare Quotes

Don't settle for the first insurance company you find. Shop around and get quotes from multiple insurers to find the best rate for your needs. Compare their financial ratings, policy offerings, application process, pricing, and customer satisfaction.

Choose the Right Type of Policy

Term life insurance is sufficient for most people as it covers you for a set number of years, typically when you have the most financial obligations. Permanent life insurance, on the other hand, lasts a lifetime and is more expensive.

Work with a Financial Advisor or Agent

Engaging with an experienced financial advisor or life insurance agent can be beneficial. They have the expertise to guide you toward insurance companies most likely to offer you a good rate based on your circumstances.

Consider Company Reputation and Financial Strength

Choose an insurance company with a good reputation for customer service and financial stability. Check their financial strength ratings, such as AM Best ratings, to ensure they are likely to remain solvent and pay out benefits when needed.

How to Get Life Insurance for Your Spouse

You may want to see also

Customer satisfaction and financial strength

Customer Satisfaction

Life insurance is a significant financial decision, and it's essential to choose a company that will be easy to work with and treat you courteously. To evaluate customer satisfaction, you can visit the National Association of Insurance Commissioners (NAIC) website to review the number of complaints filed against a company within a particular state. Additionally, customer reviews and satisfaction surveys, such as those conducted by J.D. Power, can provide valuable insights into the experiences of policyholders.

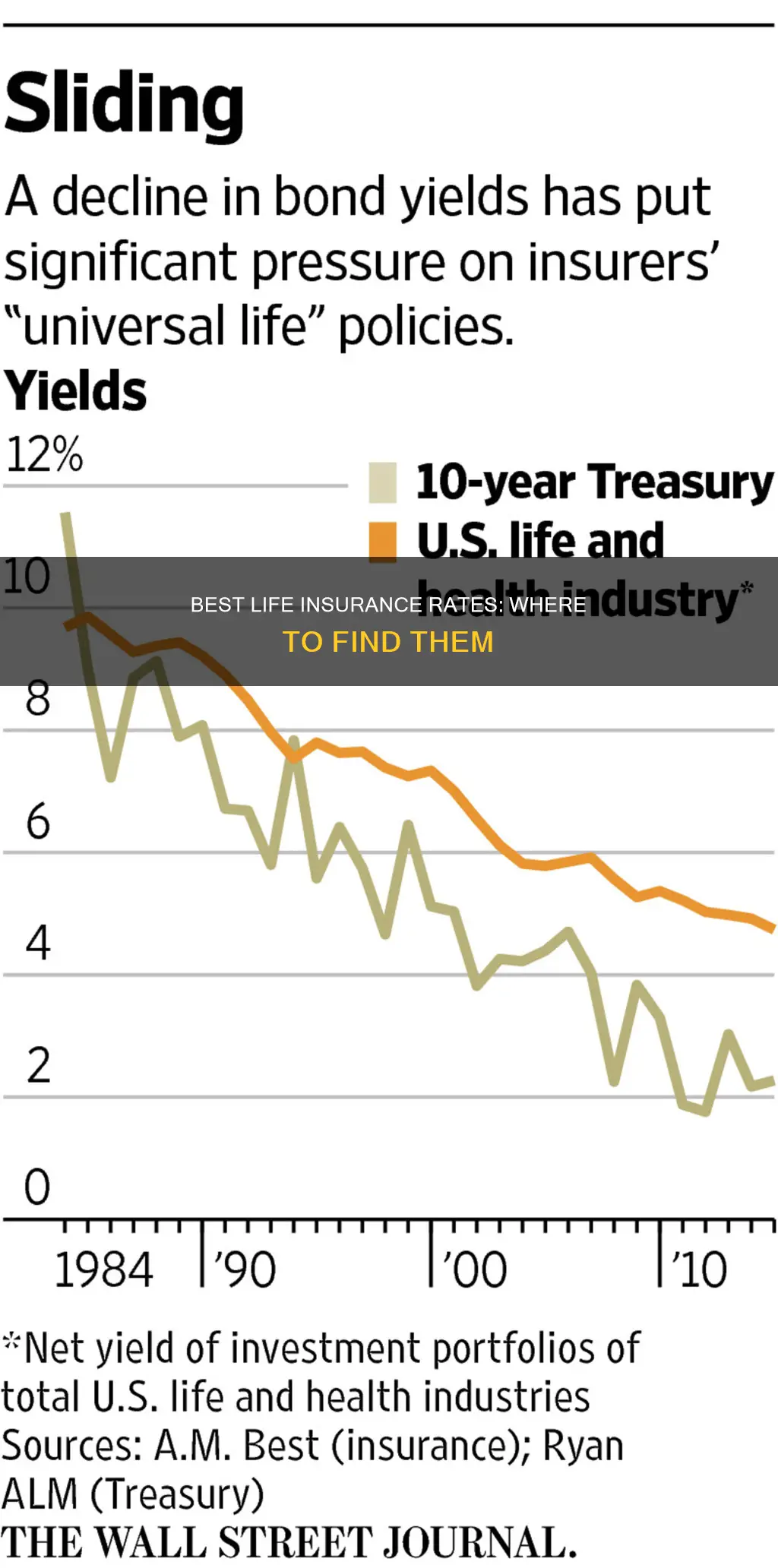

Financial Strength

The financial strength of a life insurance company is critical, as it indicates their ability to pay future claims and remain solvent when it comes time to pay the death benefit to beneficiaries. Credit ratings from agencies like AM Best can help assess a company's financial stability and long-term solvency. A company with a high financial strength rating, such as an A++ rating from AM Best, indicates a strong position to honour claims and insurance obligations well into the future.

When considering customer satisfaction and financial strength, several life insurance companies stand out:

- State Farm: State Farm has consistently received high customer satisfaction scores from J.D. Power and has been recognised by Bankrate for its top-notch customer service and accessibility tools. They have an A++ financial strength rating from AM Best, indicating strong financial stability.

- Northwestern Mutual: This company has a high JD Power customer satisfaction rating of 790/1,000 and an A++ financial strength rating from AM Best. They offer a range of products, including term, whole, and universal life insurance.

- Mutual of Omaha: Mutual of Omaha consistently earns high marks for customer satisfaction in J.D. Power surveys and has a strong A+ financial strength rating from AM Best. They are known for their generous two-year graded death benefit period, which includes a 10% interest benefit.

- Lincoln Financial Group: Lincoln Financial has a strong J.D. Power life insurance satisfaction score above the industry average. They offer flexible term lengths and a generous conversion policy, allowing policyholders to convert term coverage to permanent policies. They also have strong financial ratings.

- Penn Mutual: According to Forbes Advisor board member Barry D. Flagg, Penn Mutual is "one of the highest-rated insurers for financial strength and claims-paying ability." They offer competitive internal policy costs and reliable quotes and policy illustrations.

Understanding Conversion Privilege in Life Insurance Policies

You may want to see also

Whole life insurance companies

When looking for the best life insurance rates, it is important to consider an insurance company's history, reputation for customer service, financial stability, and coverage options. Whole life insurance is a type of permanent life insurance that remains in force for the rest of your life as long as you keep paying your premiums. It is more expensive than term life insurance but allows you to leave a financial legacy for your loved ones. It also grows tax-deferred and can build cash value and earn dividends.

Guardian

Guardian has a diverse range of whole life products, including life insurance for people living with HIV. With Guardian, you can choose a policy with level premiums or a “limited payment” policy that allows you to pay off your policy in 10, 15, or 20 years. They also offer a range of riders, such as a disability waiver of premium rider and a long-term care rider. Guardian has paid dividends to its permanent policyholders every year since 1868.

MassMutual

MassMutual offers several whole life insurance options, including a survivorship policy and universal and variable life insurance products. Their survivorship policy is ideal for couples interested in estate planning, as it covers both partners and pays out after the second person dies. MassMutual has paid dividends to its policyholders annually since 1869 and is set to distribute a record $2.5 billion in 2025.

Northwestern Mutual

Northwestern Mutual offers five term, whole life, and universal life policies. They have been paying dividends to eligible policyholders annually since 1872 and announced an $8.2 billion dividend dispersal for 2025, the industry's largest payout. Their whole life riders include a long-term care benefit, a waiver of premium, and an additional purchase benefit.

State Farm

State Farm offers a range of term, whole, and universal life insurance products, including survivorship and no-medical exam plans. They have a traditional whole life policy with premiums paid until age 100 and a limited-pay policy with contributions for 10, 15, or 20 years. State Farm was ranked No. 1 for customer satisfaction in J.D. Power's 2024 individual life insurance survey.

Protective

Protective offers remarkably affordable term life insurance options, including a rare 40-year term policy. They provide a comprehensive range of life insurance products, from temporary coverage with term life to lifelong protection with whole and universal life policies.

It is important to shop around and get quotes from multiple insurers to find the best whole life insurance policy for your needs. Consider factors such as financial strength, customer satisfaction, coverage options, riders, dividends, and the amount of coverage you can buy.

Bill Collectors and Life Insurance: What Are Their Rights?

You may want to see also