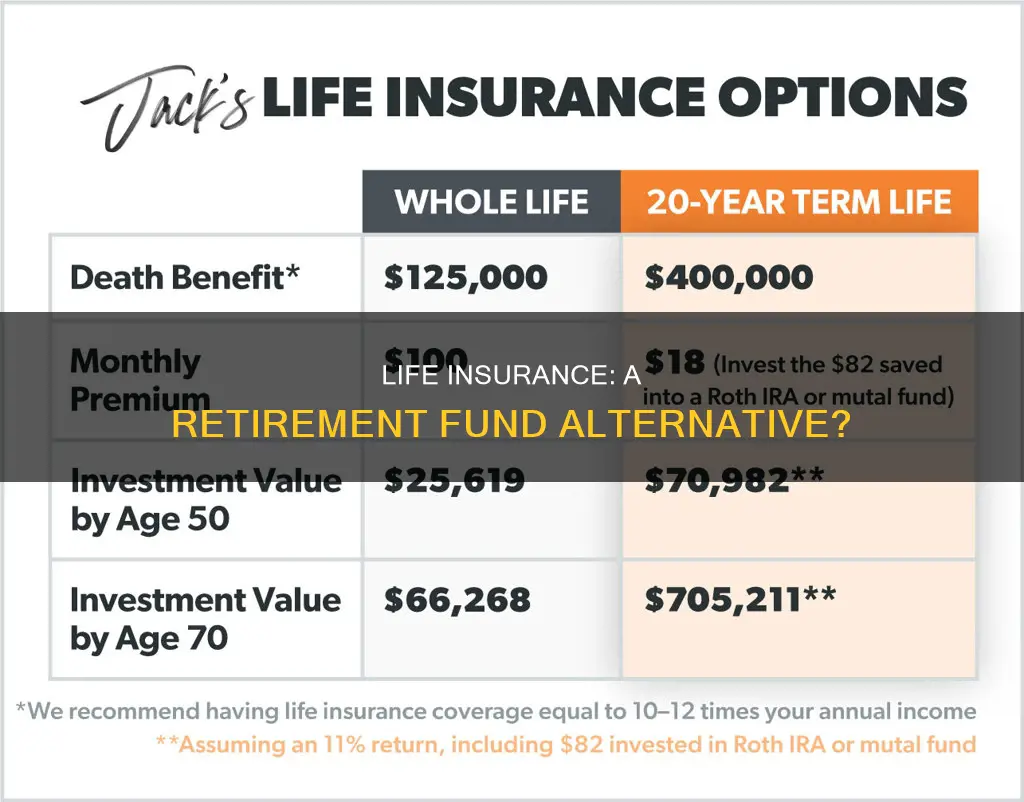

Life insurance can be a valuable financial safety net for your loved ones when you pass away. However, did you know that certain types of life insurance policies can also provide benefits while you are still alive? Permanent life insurance policies, such as whole life and universal life, offer the advantage of building cash value over time. This cash value can be utilised as a source of income during retirement, providing a supplementary retirement plan.

While permanent life insurance policies are generally more expensive than term life insurance, they offer unique benefits such as lifelong coverage, guaranteed cash value growth, and stable premiums. The cash value can be accessed through withdrawals, loans, or by surrendering the policy. However, it's important to carefully consider the potential consequences, as accessing the cash value may reduce the death benefit and affect your beneficiaries. Additionally, there may be tax implications and surrender fees associated with withdrawing or borrowing against the cash value.

Before making any decisions, it's recommended to consult a financial advisor to understand the potential risks and rewards of utilising your life insurance policy for retirement purposes.

| Characteristics | Values |

|---|---|

| Types of life insurance that build cash value | Whole life, universal life, indexed universal life, variable universal life |

| How to access cash value | Withdrawals, loans, surrendering the policy, selling the policy, using cash value to pay premiums |

| Tax implications | No taxes on withdrawals up to the amount of premiums paid; taxes on withdrawals that exceed the amount of premiums paid; no taxes on loans unless the policy is a modified endowment contract |

| Impact on death benefit | Withdrawals and loans reduce the death benefit; surrendering the policy cancels the death benefit |

| Pros of cash withdrawals | No interest paid on withdrawals |

| Cons of cash withdrawals | Reduces policy cash value and death benefit; may be taxable if withdrawal exceeds amount of premiums paid |

| Pros of borrowing cash | No loan application or credit check; no need to repay the loan; can earn interest on the outstanding loan amount |

| Cons of borrowing cash | Interest charged on the loan; reduces death benefit if not repaid; may cause the policy to lapse if the loan amount plus interest exceeds the total cash value |

| Pros of surrendering the policy | If the policy has a surrender or cash value above the surrender charge, this provides money |

| Cons of surrendering the policy | Surrender charges may wipe out any cash value; taxes may be owed; no death benefit for heirs |

| Pros of selling the policy | Get more cash than by surrendering the policy |

| Cons of selling the policy | Must meet age or health requirements to qualify; cash offer will be much less than the death benefit |

What You'll Learn

Borrowing from your life insurance policy

Life insurance policy loans allow you to borrow money from the insurance company, using your policy's death benefit and cash value as collateral. There is no approval process or credit check required, and you can use the money for anything you want. The interest rates on these loans are typically lower than those for personal loans or credit cards, ranging from 5% to 8%.

Repaying the Loan

While there is no strict repayment schedule, it is important to pay back the loan in a timely manner to avoid accruing interest. If the loan is not repaid before the insured person's death, the loan amount plus any interest owed will be deducted from the death benefit paid to the beneficiaries.

Pros and Cons

The amount you can borrow depends on the insurer, but it is typically up to 90% of the policy's cash value. It is important to note that you will need to have sufficient cash value built up in your policy before you can borrow against it, which can take several years.

In conclusion, borrowing from your life insurance policy can be a useful financial tool, but it is important to carefully consider the pros and cons before making a decision. Be sure to consult a financial advisor or estate planning attorney to understand the potential tax implications and impacts on your beneficiaries.

Imputed Income: Calculating Your Life Insurance Need

You may want to see also

Withdrawing from your life insurance policy

Withdrawals

Generally, you can make limited withdrawals from your life insurance policy. The amount available will depend on the type of policy you have and the company issuing it. Withdrawals are not taxable up to your policy basis if your policy is not a Modified Endowment Contract (MEC). Withdrawing more than your basis may be subject to taxation. Withdrawals can also cause a reduction in your death benefit and may increase your premium payments, making the policy more expensive.

Loans

Most cash-value policies allow you to borrow money from the issuer, using your cash-accumulation account as collateral. There are usually no financial or underwriting requirements for these loans. The loan might be subject to interest at fixed or variable rates. You are not obligated to repay the loan, but any outstanding balance will be deducted from the death benefit paid to your beneficiaries. Loans from non-MEC policies are not taxable, but loans from MEC policies may be subject to taxation and early withdrawal penalties.

Surrendering the Policy

If you surrender your policy, you can cancel it and receive the cash surrender value, which is the accumulated cash value minus any fees. Surrendering the policy will result in the loss of life insurance coverage, so your beneficiaries will not receive a death benefit. Surrendering a policy may also incur taxes on any gains and outstanding loan balances. Additionally, there may be surrender fees, especially if the policy is surrendered within the first few years of ownership.

Selling the Policy

You can also sell your life insurance policy to a third party for a lump sum, often through a life settlement or viatical settlement. The buyer will then be responsible for premium payments and will receive the death benefit when you pass away. Selling your policy can get you more cash than simply surrendering it, but there may be fees and taxes involved. Additionally, you will need to meet certain requirements, such as age and health conditions, to qualify for a life settlement.

Deaf People's Access to Life Insurance Options

You may want to see also

Surrendering your life insurance policy

There are several reasons why you might want to surrender your life insurance policy:

- Cost: If you can no longer afford your premiums, you could surrender your policy to get the surrender value in cash and avoid monthly payments.

- Cash needs: Surrendering a life insurance policy will give you access to a lump sum of cash. However, there may be ways to access cash value without giving up coverage, such as a policy loan.

- Better coverage: You may find better coverage from a new policy and want to surrender your existing one.

- Better price: You might find a life insurance policy with a better price.

- No longer needed: If no one relies on you financially, you may not need life insurance coverage anymore.

When you surrender your life insurance policy, you will likely need to pay surrender fees and taxes on any gains earned on the cash value of the policy. The exact timing for surrendering your life insurance policy depends on your personal preference and financial situation. However, most policies require you to pay surrender fees when surrendering a policy. These fees are usually higher for newer policies and don't apply after 10 to 15 years.

To surrender your policy, you will need to contact your insurance company or agent, and you may have to sign paperwork. The insurance company will then calculate your final payout, which is generally your cash value balance minus any surrender fees or outstanding loans on your policy.

Term Life Insurance: Understanding the Policy and its Penalties

You may want to see also

Selling your life insurance policy

The process of obtaining a life settlement involves selling a life insurance policy to a third-party buyer for a cash payout that is more than the policy's cash surrender value but less than the total face value of the policy. The third-party buyer will then pay the policy premiums and when you die, they will receive the death benefit.

The steps for selling a life insurance policy for cash are as follows:

- Find an experienced life settlement provider.

- Meet the qualifying factors, such as owning a policy with a death benefit of $100,000 or more, and being over the age of 60.

- Take a detailed health questionnaire.

- Provide authorization to the provider to access medical records and contact the insurance company.

- Share your policy details with the life settlement provider.

- Wait for the underwriting process to be completed.

- Complete the closing process, which is the actual transfer of ownership of the policy and all the accompanying documentation.

It's important to note that there are some potential downsides to selling your life insurance policy. For example, you may have to pay taxes on the proceeds, your beneficiaries will no longer receive the death benefit, and there may be fees or commissions involved. Additionally, if you currently receive Medicaid or other types of financial assistance, you may lose eligibility by selling your policy.

Before selling your life insurance policy, it's recommended that you speak with a financial advisor or tax expert to fully understand the potential consequences.

Who Can Be Your Life Insurance Nominee?

You may want to see also

Using cash value to pay premiums

If you have a permanent life insurance policy, you can use the cash value that has built up in your policy to pay premiums. This is a good option if you are retired and need to reduce your monthly expenses but want to keep your policy in place. However, you should be aware that any amount taken from your cash value account and not repaid before your death will reduce the death benefit paid to your beneficiary.

Variable and universal life insurance policies are often favoured because they allow you to use the policy's cash value to pay premiums. This strategy will only work for a short period if you start while the cash value is small or if interest rates are low. In addition, you have to carefully monitor the cash value to make sure it doesn't drop too far, or you may lose your coverage. But if you have a fairly large cash value with consistent returns, you can keep coverage in place for years at little to no additional cost.

For example, if your annual premium is $5,000 and you have $100,000 in cash value, you would just need the policy's cash value to net 2.5% interest annually to cut your premium payments in half while maintaining the full cash value.

Whole life insurance policies typically don't let you pay premiums using the policy's cash value, except if you convert to a paid-up policy. Not all insurers offer this option, but with a paid-up life insurance policy, the cash value is large enough that you can stop paying premiums out of pocket. Instead, you can use the cash value to pay premiums. The downside to paid-up whole life insurance policies is that each premium payment is deducted from the policy's death benefit. In addition, less cash value is available for other purposes, such as a policy loan.

If you are considering using your cash value to pay premiums, it is important to consult a financial advisor to understand all the potential consequences.

Haven Life Insurance: Exclusions and Their Implications

You may want to see also