Life insurance is a common benefit offered by employers to full-time and salaried employees. While group term life insurance (GTL) policies that offer coverage of $50,000 or below are considered tax-free by the IRS, policies that exceed this amount are taxed differently. This additional amount is known as imputed income, and it's important to understand how it's calculated to ensure employees aren't underpaying their taxes.

| Characteristics | Values |

|---|---|

| What is imputed income? | Generally, imputed income includes the benefits an employee receives that are not part of their salary and wages. But these benefits are still taxed as part of an employee’s income. |

| How does imputed income work in life insurance? | The IRS treats employer-subsidized life insurance as a tax-free benefit if the policy coverage is $50,000 or below. Amounts over that cutoff are considered imputed income and are taxed. |

| How to calculate imputed income | Subtract $50,000 from the total amount of insurance coverage, divide that number by 1000, multiply the total by the Table I amount (based on the employee's age), then multiply the total from the previous step by the number of months the employee was covered. |

What You'll Learn

Calculating imputed income for basic and voluntary life insurance plans

To calculate imputed income for basic and voluntary life insurance plans, you need to refer to the Internal Revenue Service (IRS) table, which breaks down the monthly taxable income cost per $1,000 of excess coverage. This is for coverage above and beyond the $50,000 death payout of term life insurance.

Basic Life Insurance Plan

A basic life insurance plan is paid for entirely by the employer. To calculate the imputed income, you need to:

- Subtract $50,000 from the total amount of insurance coverage (the total benefit amount).

- Divide that number by 1,000.

- Multiply the total by the Table I amount, based on the employee's age.

- Multiply the total from Step 3 by the number of months the employee was covered.

- Subtract the amount the employee has paid for coverage after tax.

For example, consider a 54-year-old employee with $75,000 of life insurance coverage through a company-sponsored group life insurance plan. First, we can ignore the initial $50,000, leaving us with $25,000 of taxable coverage. Next, per the IRS rules, we can divide that $25,000 by $1,000. Using the IRS table, we see that $0.23 per $1,000 is the tax rate owed by our 54-year-old employee. The result is 25 multiplied by $0.23, giving a monthly imputed income of $5.75.

Voluntary Life Insurance Plan

A voluntary life insurance plan is paid partially by the employee. The calculation is almost the same as for a basic plan, with the difference being that the amount the employee pays for premiums is added to the yearly imputed income.

For example, an employee pays $150 per year for a voluntary life insurance policy with a death benefit of $250,000. The employee is 47 years old. Using the IRS table, this employee would fall into the 45- to 49-year-old range and incur a cost of 15 cents per $1,000 in coverage.

Excess coverage = $250,000 - $50,000 = $200,000

Monthly imputed income = ($200,000 / $1,000) x .15 = $30

Yearly imputed income = $30 x 12 = $360 - $150 (what the employee pays in premiums) = $210

Life Insurance: Rising Costs and What to Expect

You may want to see also

What is imputed income?

Imputed income is a term used to describe the benefits an employee receives that are not part of their salary or wages but are still taxed as part of their income. These benefits are often referred to as 'fringe benefits' and can include items such as a company car, gym membership, or group-term life insurance. While these benefits are not typically cash-related, they are still considered part of an employee's taxable income and must be included on their W-2 form.

The calculation of imputed income is required only for group term life insurance plans that are subject to the Internal Revenue Code, Section 79. In the case of group-term life insurance, the Internal Revenue Service (IRS) considers premiums for a policy of more than $50,000 to be a fringe benefit, creating a taxable income for the employee. This is because the IRS treats group-term life insurance provided by an employer as a tax-free benefit only if the policy's death benefit is less than $50,000. Therefore, if an employee is provided with over $50,000 in life insurance coverage, the excess value of the life insurance policy is referred to as imputed income and is subject to income taxes.

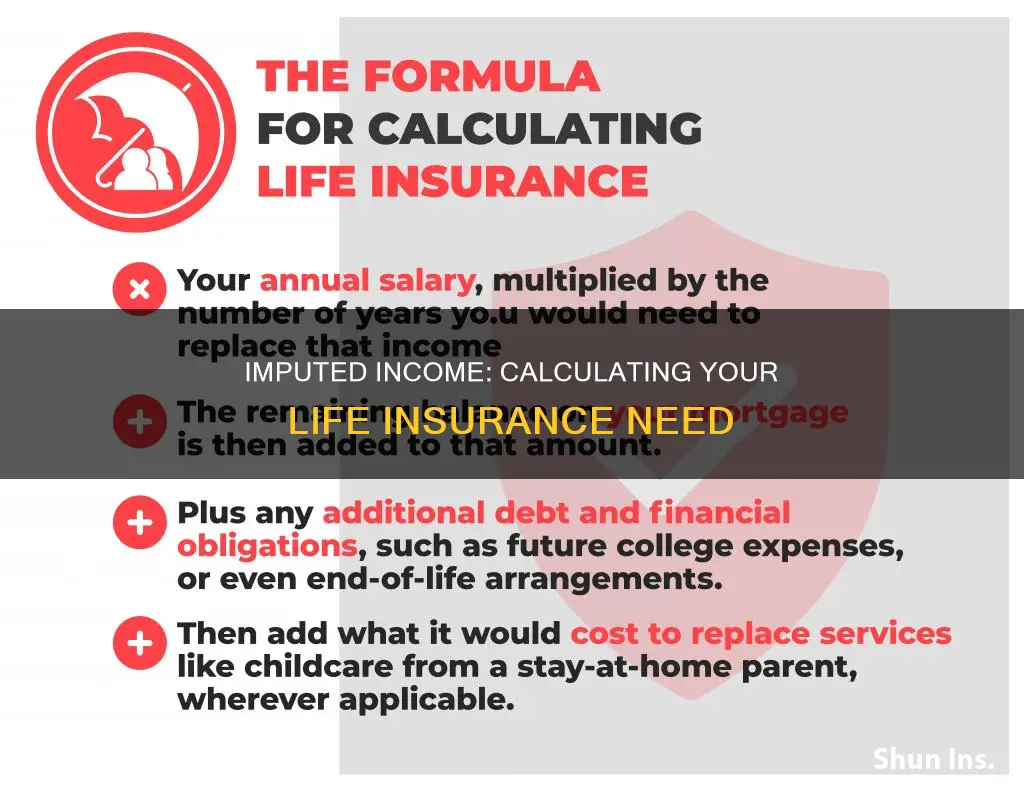

The amount of imputed income can be calculated by subtracting $50,000 from the total amount of insurance coverage, dividing that number by 1000, and then multiplying it by the Table I amount based on the employee's age. This total is then multiplied by the number of months the employee was covered, and finally, the amount the employee has paid for coverage after tax is subtracted. It is important to note that this calculation may vary depending on whether the employee has a basic or voluntary life insurance policy. In a basic policy, the employer pays the entire cost, whereas in a voluntary policy, the employee pays a portion of the cost.

As an example, consider an employee with a basic life insurance policy with a death benefit of $150,000, paid entirely by their employer. If the employee is 47 years old, they would fall into the 45-49 age range on the IRS table and incur a cost of 15 cents per $1,000 in coverage. The excess coverage would be $100,000 ($150,000 - $50,000), resulting in a monthly imputed income of $15 ($100,000 / $1,000 x .15). The yearly imputed income would be $180 ($15 x 12), which the employer would include in the employee's W-2 form at the end of the year.

Irish Life Health Insurance: Overseas Coverage Explained

You may want to see also

How does imputed income work in life insurance?

Imputed income is the value of the income tax the Internal Revenue Service (IRS) puts on group-term life insurance coverage that exceeds $50,000. In other words, when the value of the premiums paid for by employers becomes too great, it must be treated as ordinary income for tax purposes.

The IRS considers group-term life insurance provided by an employer to be a tax-free benefit as long as the policy's death benefit is less than $50,000. Therefore, there are no tax consequences if your group-term policy does not exceed $50,000 in coverage.

However, there are tax implications if an employee is provided over $50,000 in life insurance coverage and pays less in premiums than the IRS has deemed the policy to be worth. In this situation, the value of the life insurance policy in excess of what an employee pays in premiums is referred to as imputed income, which is subject to income taxes.

For example, if you have a group life insurance policy with a death benefit of $150,000 that is paid entirely by your employer, the employee is taxed on the amount exceeding $50,000. Using the IRS table, this employee would fall into the 45- to 49-year-old range and incur a cost of 15 cents per $1,000 in coverage. The monthly imputed income would be $15, and the yearly imputed income would be $180. The employer would then include $180 in the employee’s W-2 form at the end of the year.

To calculate the reportable imputed income amount, you will need the total amount of insurance coverage for each month, the employee's age at the end of the calendar year, the amount the employee pays per month for insurance after taxes, and the number of months for which the coverage has been in effect.

Life Insurance Rates: The Impact of Age on Premiums

You may want to see also

What are the tax implications of imputed income?

Imputed income is the value of the income tax the Internal Revenue Service (IRS) puts on group-term life insurance coverage in excess of $50,000. In other words, when the value of the premiums paid for by employers becomes too great, it must be treated as ordinary income for tax purposes. The IRS considers group-term life insurance provided by an employer to be a tax-free benefit as long as the policy's death benefit is less than $50,000. Therefore, there are no tax consequences if your group-term policy does not exceed $50,000 in coverage.

However, there are tax implications if an employee is provided over $50,000 in life insurance coverage and pays less in premiums than the IRS has deemed the policy to be worth. In this situation, the value of the life insurance policy in excess of what an employee pays in premiums is referred to as imputed income and is subject to income taxes. This is calculated by the employer using an IRS imputed income table and then reported on the employee's W-2 tax form.

Imputed income is important to recognize as it is a fringe benefit. These are benefits, such as services, goods, or experiences, provided by an employer that are in addition to an employee's regular income. In the case of group-term life insurance, the IRS states that life insurance premiums for a policy of more than $50,000 are a fringe benefit and create a taxable income for the employee. As an employer, it is important to note that this information must be included in your employees' W-2 tax forms. If it is not reported, you will be undervaluing the amount of tax your employees must pay.

Imputed income is the value of non-cash compensation employees receive from their employer. This form of income is outside of their regular wages or salary. Many fringe benefits and perks are taxable imputed income. Other employee benefits, such as health insurance and health reimbursement arrangements (HRAs), aren't subject to income taxes. If you offer certain fringe benefits to your employees, you must treat the imputed earnings as regular taxable income and report the amount on your staff's Form W-2s for tax purposes.

Imputed income is income attributed to any taxable non-cash benefit or income an employee receives that isn't part of their normal taxable wages. These extras at work can be a great perk, but there are imputed income tax implications to be aware of. You and your employer will pay FICA tax, which covers Social Security and Medicare contributions, on most items of imputed income. Taxable imputed income is grouped together with your normal taxable income, but only if the benefit qualifies. As such, qualifying benefits are taxed at your normal federal income tax rates.

Globe Life Insurance: Accidental Overdoses Coverage?

You may want to see also

How to calculate imputed income for dependent term life insurance

To calculate imputed income for dependent term life insurance, you must first understand the context of the situation. Imputed income is the value of the income tax the Internal Revenue Service (IRS) puts on group-term life insurance coverage that exceeds $50,000. This is considered a fringe benefit, which is a benefit provided by an employer that is in addition to an employee's regular income. In the case of group-term life insurance, the IRS states that premiums for a policy of more than $50,000 are a fringe benefit and create a taxable income for the employee. This taxable income must be included in the employee's W-2 form at the end of the year.

The calculation of imputed income depends on whether the life insurance is a basic plan or a voluntary life insurance plan. In a basic plan, the employer pays the entire cost of the term life insurance. In a voluntary plan, the employee pays for part of the term life insurance policy.

- Identify the total amount of insurance coverage: Determine the total amount of insurance coverage provided by the employer for the dependent term life insurance.

- Subtract $50,000 from the total amount: As the first $50,000 of group-term life insurance coverage is typically excluded from taxation, subtract this amount from the total coverage to find the excess coverage amount.

- Divide the excess coverage amount by 1000: Convert the excess coverage amount to a value per $1000 of coverage.

- Multiply by the applicable Table I rate: The IRS provides a Table I of rates based on the employee's age. Use the rate that corresponds to the employee's age to calculate the taxable income cost per $1000 of excess coverage.

- Multiply by the number of months of coverage: Determine how many months the employee was covered under the dependent term life insurance plan and multiply the previous value by the number of months.

- Subtract any after-tax contributions by the employee: If the employee has made any contributions towards the coverage on an after-tax basis, subtract these contributions from the total.

- Report the imputed income on the employee's W-2 form: Include the calculated imputed income amount in the employee's taxable income reported on their W-2 form.

It is important to note that the calculation may vary slightly depending on the specifics of the insurance plan and the circumstances. Additionally, different states may have their own regulations and guidelines regarding imputed income and group-term life insurance. It is always recommended to consult with a tax professional or an insurance specialist to ensure accurate calculations and compliance with applicable laws.

Group Life Insurance: Cash Surrender Value Explained

You may want to see also

Frequently asked questions

Imputed income is the value of the income tax the Internal Revenue Service (IRS) puts on group-term life insurance coverage in excess of $50,000.

The IRS treats group-term life insurance provided by an employer as a tax-free benefit as long as the policy's death benefit is less than $50,000. However, if the employee is provided over $50,000 in life insurance coverage, the excess value is referred to as imputed income and is subject to income taxes.

To calculate imputed income for life insurance, subtract $50,000 from the total amount of insurance coverage, then divide that number by 1,000 and multiply it by the Table I amount based on the employee's age. Next, multiply this total by the number of months the employee was covered and subtract any amount the employee has paid for coverage after tax.

Yes, imputed income is considered taxable income and is subject to Social Security and Medicare taxes.

Imputed income is included in your gross wages and may appear as a separate line item on your paystub. It will also be included in your W-2 tax form at the end of the year.