When considering supplemental life insurance, it's important to explore various options to ensure you find the best fit for your needs. Many insurance companies offer supplemental life insurance policies, often as an add-on to an existing policy or as a standalone product. These policies can be obtained directly from the insurance company or through independent agents. Additionally, some employers may provide supplemental life insurance as a benefit to their employees. It's also worth considering independent insurance brokers or financial advisors who can help you compare different providers and policies to find the most suitable coverage for your situation.

What You'll Learn

- Online Platforms: Compare rates and buy coverage directly from insurance company websites

- Financial Advisors: Seek advice from professionals for personalized recommendations

- Employer-Sponsored Plans: Check if your employer offers group life insurance

- Independent Brokers: Work with independent brokers for access to multiple insurers

- Term Life Extensions: Consider extending term life insurance for additional coverage

Online Platforms: Compare rates and buy coverage directly from insurance company websites

When considering supplemental life insurance, online platforms offer a convenient and efficient way to compare rates and purchase coverage directly from insurance company websites. This approach provides several advantages, including transparency, accessibility, and the ability to make informed decisions from the comfort of your home. Here's a guide on how to navigate this process effectively:

Research and Compare Rates: Begin by researching various insurance companies that offer supplemental life insurance. Many reputable insurers provide their rates and coverage options online. Visit the websites of several companies to gather information. Look for comprehensive rate quotes that include different coverage amounts, policy terms, and any additional benefits or riders you may want to add. Compare the premiums, coverage limits, and overall value offered by each insurer. Online comparison tools can simplify this process, allowing you to input your preferences and receive tailored quotes.

Direct Purchase from Insurance Company Websites: Once you've identified the insurance companies with the most competitive rates and suitable coverage options, you can proceed to purchase the policy directly from their websites. Here's how:

- Navigate to the chosen insurer's website and locate the supplemental life insurance section or product page.

- Carefully review the policy details, including coverage amounts, term lengths, premium payments, and any exclusions or limitations.

- Provide the required personal and financial information to obtain a quote tailored to your needs. This may include your age, health status, income, and desired coverage amount.

- Complete the application process, which typically involves filling out forms and providing necessary documentation. You might need to upload proof of identity and income or undergo a medical questionnaire.

- Review the policy summary and ensure you understand the terms and conditions.

- Proceed to make the initial premium payment, often through secure online payment methods.

- Download or save the policy documents for your records.

Online platforms and direct purchases from insurance company websites streamline the process, allowing you to make decisions promptly. You can also take advantage of additional resources provided by the insurers, such as educational materials, customer support, and policy management tools. Remember to carefully review the fine print and seek clarification on any doubts before finalizing your purchase. This approach ensures you receive a personalized quote and a policy that aligns with your specific supplemental life insurance requirements.

Life Insurance and Section 8: Understanding the Connection

You may want to see also

Financial Advisors: Seek advice from professionals for personalized recommendations

When considering supplemental life insurance, seeking professional advice from a financial advisor is a crucial step to ensure you make an informed decision. These advisors are experts in financial planning and can provide valuable insights tailored to your unique circumstances. Here's why consulting a financial advisor is essential:

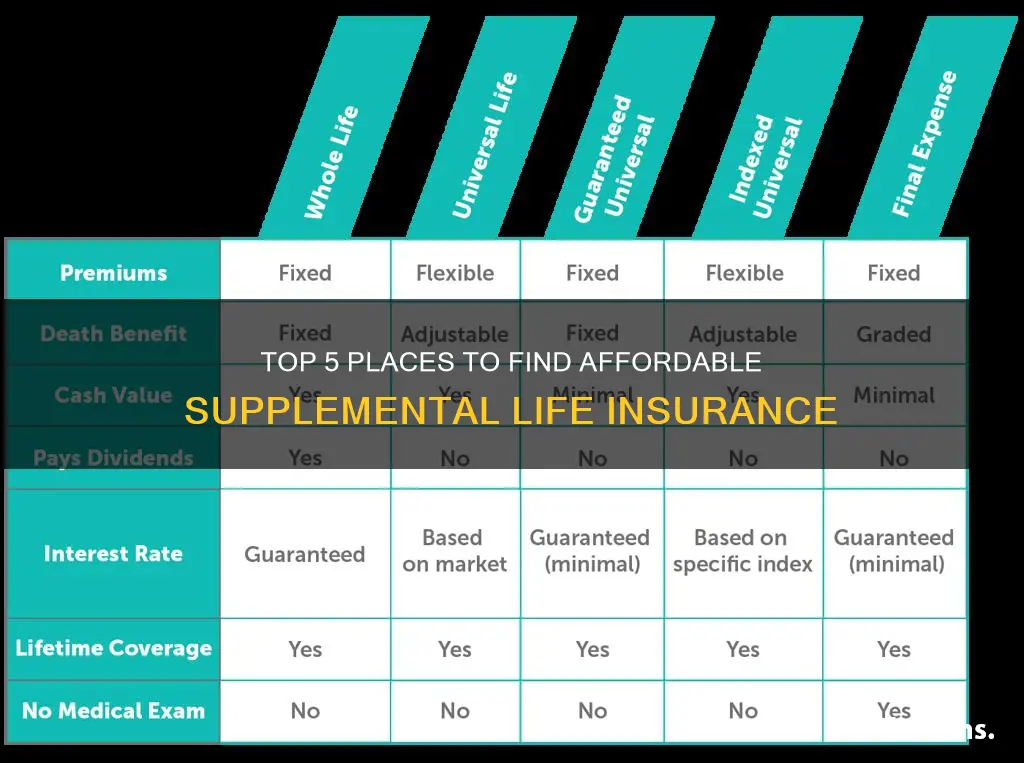

Financial advisors have a comprehensive understanding of various insurance products, including supplemental life insurance. They can explain the different types of coverage available, such as term life, whole life, or universal life insurance, and how they fit into your overall financial strategy. By assessing your current financial situation, risk tolerance, and long-term goals, they can recommend the most suitable options. For instance, they might suggest term life insurance for temporary coverage or whole life for long-term financial security.

One of the key benefits of consulting a professional is their ability to provide personalized recommendations. They will consider your age, health, occupation, and financial obligations to determine the appropriate amount of coverage. This personalized approach ensures that the supplemental life insurance you choose aligns with your specific needs. For example, a financial advisor might recommend a higher coverage amount if you have a large family or significant financial responsibilities.

Moreover, financial advisors can help you navigate the often complex world of insurance providers. They have relationships with various insurance companies and can guide you through the application process, ensuring you understand the terms, conditions, and exclusions. This expertise can save you time and potential headaches, as they can identify the best providers and policies that match your requirements.

In addition to providing advice, financial advisors can also assist with policy comparisons, helping you understand the benefits and drawbacks of different plans. They can negotiate on your behalf and secure discounts or additional benefits that might not be readily available to the general public. This level of advocacy ensures you get the most value for your supplemental life insurance investment.

Lastly, a financial advisor can help you integrate supplemental life insurance into your broader financial plan. They can advise on how it fits with other financial instruments, such as retirement plans, investments, and estate planning. By taking a holistic approach, they ensure that your supplemental life insurance complements your overall financial strategy, providing both short-term protection and long-term financial security.

Adjustable Life Insurance: What's the Real Deal?

You may want to see also

Employer-Sponsored Plans: Check if your employer offers group life insurance

If you're looking for supplemental life insurance, one of the most accessible options is to explore employer-sponsored plans. Many companies offer group life insurance as a benefit to their employees, which can provide an additional layer of financial security for you and your loved ones. This type of coverage is often more affordable compared to individual policies because the employer shares the cost, and it's typically easier to qualify since you're already an employee.

Checking with your employer is the first step to finding out if you're eligible for this benefit. Most human resources departments can provide information about the group life insurance plan, including the coverage amount, premiums, and any specific terms and conditions. This is a great starting point as it often requires minimal effort on your part, and you can take advantage of the group rate, which is usually more cost-effective.

Group life insurance policies typically cover a certain percentage of your salary or a set amount, whichever is greater. This means that if you were to pass away, your beneficiaries would receive a lump sum payment to help cover expenses and provide financial support. It's important to understand the coverage limits and any exclusions to ensure you have adequate protection.

When reviewing the plan, pay attention to the duration of the coverage. Some employer-sponsored plans may offer term life insurance, which is valid for a specific period, often 10, 20, or 30 years. After the term ends, you might need to convert the policy or find another source of coverage. Additionally, consider the flexibility of the plan. Some employers may allow you to increase or decrease the coverage amount, ensuring you can adjust it as your financial needs change.

If your employer doesn't offer group life insurance, don't worry; you still have options. You can explore individual supplemental life insurance policies, which provide additional coverage beyond what's typically included in a standard life insurance policy. These policies can be tailored to your specific needs and often have more flexible terms. However, it's essential to compare different providers and policies to find the best fit for your requirements and budget.

Coworker Life Insurance: A Smart Financial Safety Net

You may want to see also

Independent Brokers: Work with independent brokers for access to multiple insurers

When considering supplemental life insurance, engaging with independent brokers can be a strategic move. These professionals act as intermediaries between you and various insurance companies, offering a unique advantage: access to multiple insurers. This access is key, as it allows you to compare policies, coverage options, and premiums from different providers, ensuring you find the best fit for your needs and budget.

Independent brokers are not tied to a single insurance company, which means they can provide an unbiased and comprehensive view of the market. They have relationships with a wide range of insurers, each with its own strengths and specializations. This network enables them to offer a diverse selection of policies, ensuring you can find a plan that aligns with your specific requirements. For instance, if you're looking for a policy with a higher death benefit or one that includes additional riders, an independent broker can help you locate the right insurer.

The role of an independent broker is to guide you through the complex world of insurance, simplifying the process of choosing a supplemental life insurance policy. They will assess your unique circumstances, such as your age, health, and financial situation, to recommend the most suitable options. This personalized approach ensures that you don't end up with a policy that doesn't meet your expectations or needs. Moreover, brokers can provide valuable insights into the fine print of policies, helping you understand the terms and conditions to make an informed decision.

Working with independent brokers also offers the benefit of personalized service. These professionals take the time to understand your individual needs and preferences, providing tailored advice and recommendations. They can answer your questions, address your concerns, and help you navigate the often complex world of insurance. This level of service can be particularly valuable when making a significant financial decision like purchasing supplemental life insurance.

In summary, independent brokers are a valuable resource when seeking supplemental life insurance. Their access to multiple insurers, unbiased advice, and personalized service can help you make an informed decision. By working with an independent broker, you can ensure that you find a supplemental life insurance policy that provides the coverage and benefits you need, all while fitting within your financial plan. This approach can ultimately lead to a more satisfying and secure insurance experience.

Understanding Universal Index Life Insurance: A Comprehensive Guide

You may want to see also

Term Life Extensions: Consider extending term life insurance for additional coverage

Term life insurance is a popular and cost-effective way to secure financial protection for your loved ones. When you purchase a term policy, you're essentially locking in coverage for a specified period, often 10, 20, or 30 years. This type of insurance provides a death benefit to your beneficiaries if you pass away during the term. However, as life progresses, your needs may change, and you might find yourself in a situation where you want to extend your coverage. This is where term life extensions come into play, offering a flexible and valuable solution.

Term life extensions allow you to increase your insurance coverage without the need for a new medical examination or a lengthy application process. When your initial term policy comes to an end, you can opt to extend it, ensuring that your loved ones remain protected. This is particularly beneficial if your financial responsibilities have evolved, such as starting a family, purchasing a home, or taking on additional debt. By extending your term life insurance, you can provide a safety net that adapts to your changing circumstances.

The process of extending your term life insurance is straightforward. You'll typically receive a notice from your insurance provider before the end of your current policy, allowing you to review your options. This notice will outline the terms and conditions for extending the policy, including any potential changes in premiums. It's essential to carefully review this information and consider your current financial situation and future goals. If you decide to extend, you can usually do so without any medical questions, making it a convenient way to maintain continuous coverage.

One of the significant advantages of term life extensions is the potential cost savings. When you extend your policy, you're essentially locking in the current rates, which may be lower than what you would pay for a new policy. This is especially true if you've maintained a healthy lifestyle and have no significant changes in your medical history. By taking advantage of this extension, you can ensure that your coverage remains affordable and tailored to your current needs.

In summary, term life extensions are a valuable tool for those seeking to adapt their life insurance coverage as their life circumstances change. It provides a seamless way to increase protection without the complexities of a new application process. By extending your term life insurance, you can provide long-term financial security for your loved ones and ensure that your coverage remains relevant and affordable throughout your life's journey. Remember, it's always a good idea to review your insurance needs periodically and explore the options available to you.

Life Insurance While Hospitalized: Is It Possible?

You may want to see also

Frequently asked questions

Supplemental life insurance is an additional policy that provides extra coverage beyond the basic life insurance policy. It is designed to complement your existing life insurance and offer additional financial protection for your loved ones.

You can obtain supplemental life insurance by contacting your current life insurance provider or seeking out independent insurance brokers. They can guide you through the process, help you choose the right coverage, and assist with the application and underwriting procedures.

Supplemental life insurance policies may have specific eligibility criteria, such as age, health status, and existing insurance coverage. Underwriters will assess your individual circumstances to determine if you qualify for the additional coverage.

This type of insurance offers several advantages, including increased financial security for your family, the ability to customize coverage to your needs, and potentially lower rates compared to a standalone policy. It can provide an extra layer of protection during challenging times.

The cost of supplemental life insurance varies depending on factors such as age, health, coverage amount, and the insurance company's rates. It is typically a relatively affordable way to enhance your life insurance coverage and can be tailored to fit your budget.