Auto insurance is a necessity for all drivers, and with so many options available, it can be challenging to choose the right provider. In New Jersey and California, there are numerous insurance carriers to choose from, each offering various coverage options, discounts, and benefits. When selecting an auto insurance carrier, it is essential to consider factors such as financial stability, customer satisfaction, and the specific needs of the individual. By researching and comparing different carriers, individuals can find the best fit for their requirements and budget.

| Characteristics | Values |

|---|---|

| Best auto insurance in New Jersey | Travelers, Geico, State Farm, Progressive, and NJM Insurance |

| Cheapest auto insurance in New Jersey | Geico |

| Best auto insurance in California | Not found |

What You'll Learn

Auto Insurance Carriers in New Jersey

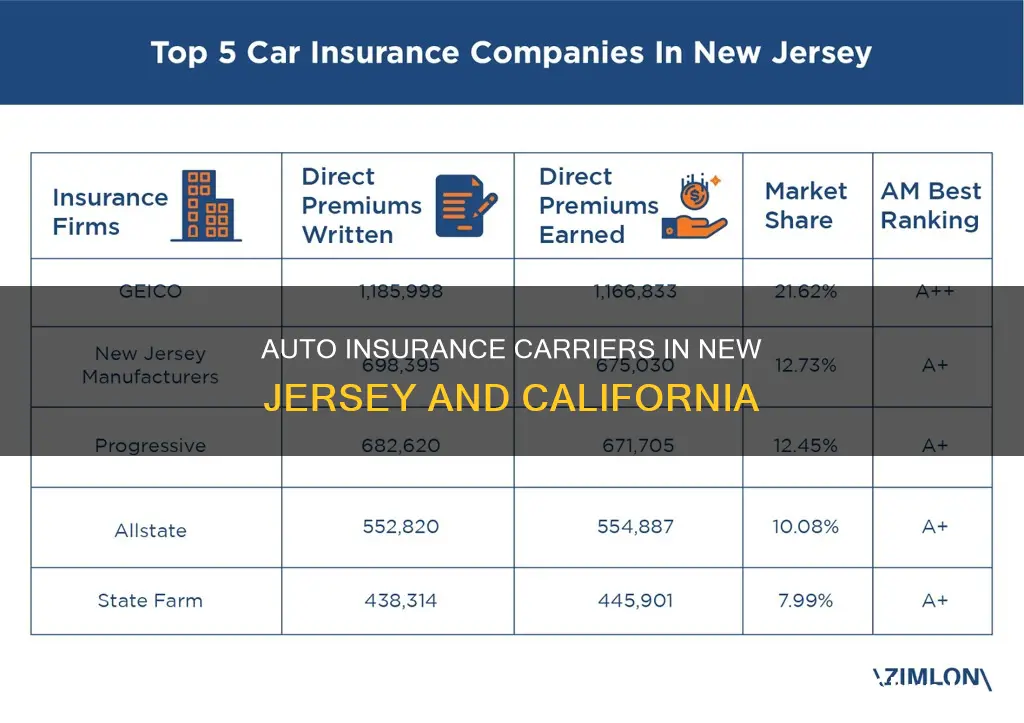

There are a plethora of auto insurance carriers in New Jersey, with the top five being Travelers, Geico, State Farm, Progressive, and NJM Insurance. These companies offer great rates on both minimum and full-coverage policies and have strong financial backing and solid reputations for providing excellent service to New Jersey drivers.

Geico is the largest car insurance company in New Jersey, selling roughly a quarter of all auto policies in the state. It is known for its low prices, with an average rate of $91 a month for full coverage. Geico also offers a host of car insurance discounts that drivers may qualify for.

Progressive is the second-largest car insurance company in New Jersey, selling 14% of all auto insurance policies in the state. It offers cheap rates, a low number of customer complaints, and some of the best rates in the state for people with a DUI.

New Jersey Manufacturers (NJM) is the third most popular auto insurance company in New Jersey, selling 12% of all auto policies in the state. NJM stands out for its below-average full-coverage rates and very low levels of complaints. It is also a mutual company, so customers can earn profits in the form of dividends.

State Farm has a strong network of agents across New Jersey and ranked second for overall customer satisfaction in a recent J.D. Power survey. It offers 14 discounts for New Jersey drivers, ranging from age-based to vehicle-safety discounts.

Travelers is one of the biggest insurers in the country and has a strong financial standing. It offers unique coverage packages, such as its Premier Responsible Driver Plan, which provides accident forgiveness and disappearing deductibles for accident-free drivers.

Other auto insurance carriers in New Jersey include:

- Allstate

- Encompass Insurance Company of NJ

- Esurance Insurance Company of New Jersey

- American Family Insurance Group

- American International Group

- Amica Mutual Insurance Company

- Berkley Insurance Company

- Foremost Insurance Company Grand Rapids, Michigan

- California Casualty & Fire Insurance Company

- Cincinnati Insurance Company

- Electric Insurance Company

- Liberty Mutual Group

- Metromile Insurance Company

- National General Group

- New Jersey Skylands Insurance Association

- United Services Auto Association (USAA)

- Hanover Insurance Company

- Hartford Insurance Company of the Midwest

- Safeco Insurance Company of America

- Mercury Insurance Group

- Pacific Specialty Insurance Company

- Teachers Auto Insurance Company of New Jersey

- High Point Property and Casualty Insurance Company

- Palisades Safety & Insurance Association

- Twin Lights Insurance Company

- Privilege Underwriters Reciprocal Exchange (PURE)

- Drive New Jersey Insurance Company

- Selective Auto Insurance Company of New Jersey

- St. Paul Protective Insurance Company

- Fidelity & Guaranty Insurance Underwriters, Inc.

- Ironshore Indemnity Inc.

- Spinnaker Insurance Company

- American Bankers Insurance Company of Florida

- American Modern Property and Casualty Insurance Company

- XL Specialty Insurance Company

- CSAA General Insurance Company

- Encompass Insurance Company of NJ

- Essentia Insurance Company

- Foremost Insurance Company Grand Rapids, Michigan Farmers P&C Insurance Company

- GEICO Secure Insurance Company

- New Hampshire Insurance Company

- Philadelphia Indemnity Insurance Co.

- Sentry Select Insurance Company

- Dairyland Insurance Company

- United Farm Family Insurance Company

AAA Akron Auto Insurance: What You Need to Know

You may want to see also

Auto Insurance Carriers in California

Auto insurance is a necessity for all drivers in California. The Golden State is known for its busy roads and highways, and with so many people behind the wheel, the risk of accidents and collisions is always present. When shopping for auto insurance in California, it's important to consider various factors such as the company's reputation, coverage options, customer service, and of course, the cost of premiums.

When it comes to auto insurance carriers in California, there are several established companies that come to mind. One notable mention is the California State Auto Group, also known as CSAA General Insurance Company. They are a trusted name in the industry and have a strong presence in the state. CSAA offers a range of coverage options, including liability, collision, and comprehensive insurance. Their website, www.AAA4insurance.com, provides a convenient platform for customers to access information and manage their policies.

Another prominent auto insurance carrier in California is the California Casualty & Fire Insurance Company. This company caters specifically to educators, firefighters, nurses, state police, and members of United MileagePlus. While they are not accepting any new business at the moment, their commitment to serving those in these essential professions is commendable.

In addition, national insurance providers such as Geico, Progressive, and State Farm also have a strong presence in California. These companies offer competitive rates and have a wide range of coverage options available to California drivers. Their large scale and financial stability can provide peace of mind to their customers.

When choosing an auto insurance carrier in California, it is always advisable to shop around and compare quotes from multiple providers. By doing so, drivers can find the best coverage options at the most affordable prices. Additionally, it is essential to consider the level of customer service and claims handling that each company provides. In the event of an accident or incident, having a responsive and reliable insurance carrier can make all the difference in getting back on the road quickly and efficiently.

Overall, California drivers have a variety of auto insurance carriers to choose from. By considering factors such as coverage, cost, and customer service, they can make an informed decision that best suits their individual needs and provides them with the protection they need while navigating the state's busy roads.

AAA Auto Insurance: Affordable Coverage, Why?

You may want to see also

Geico: Best for Affordability

GEICO is the largest car insurance company in New Jersey, selling roughly a quarter of all auto policies in the state. It is also available in California, as evidenced by its California Notice of Collection.

GEICO is known for its highly competitive rates, with an average price of just $49 per month for a liability-only policy in New Jersey, which is about half the state average. The company has been in the insurance business for 85 years and has a 97% customer satisfaction rating.

GEICO offers a range of discounts, including for good students with a B+ average, federal employees, and safe drivers. You can also save money by combining property insurance with your car insurance policy.

The GEICO Mobile app is the number one insurance mobile app, allowing you to get a quote, update your policy, request a tow, and change your address. The app also provides easy access to your insurance ID cards and billing information.

GEICO has a strong network of local agents in New Jersey, and you can also interact with the company through its useful website. GEICO receives significantly fewer customer complaints compared to the average company of its size, according to the National Association of Insurance Commissioners (NAIC).

However, GEICO scored below average on J.D. Power's recent auto claims satisfaction survey and overall customer satisfaction survey.

Auto Insurance Arbitration: Your Right to Know

You may want to see also

NJM: Best for Customer Satisfaction

NJM, formerly known as New Jersey Manufacturers, is a highly regarded auto insurance provider that boasts high customer satisfaction and low levels of complaints. It has been recognised by J.D. Power for its exceptional auto claims experience for six consecutive years. NJM is also distinguished by its low average rates, with its full coverage and minimum coverage plans costing significantly less than the national average.

NJM offers a wide range of discounts, including those for good students, vehicle safety equipment, bundling home and auto insurance policies, and electronic payment. The company also provides incentives for purchasing a more comprehensive policy, such as offering a discount for buying both comprehensive and collision coverage.

NJM's customer service is not available 24/7, and it does not have a mobile app for policy management. However, it does have an online policy portal that allows customers to access their policies, view claims details, and upload documents at their convenience.

NJM is a regional insurer, currently operating in only five states: Connecticut, Maryland, New Jersey, Ohio, and Pennsylvania. Despite its limited service area, NJM has been recognised for its financial stability and superior service to policyholders. In 2023, it was recognised as a Ward's 50 Top Property and Casualty Insurance Company for the second consecutive year, highlighting its financial integrity and commitment to serving its customers.

Overall, NJM is a strong choice for auto insurance, particularly for those who value low rates, robust coverage options, and high levels of customer satisfaction.

Understanding Short Rate Auto Insurance Cancellation Scenarios

You may want to see also

State Farm: Best for Ease of Use

State Farm is a popular auto insurance carrier in both New Jersey and California. It is one of the largest auto insurance companies in New Jersey, with a strong network of agents across the state. State Farm is known for its ease of use, offering a seamless digital experience for filing claims, as well as dedicated agents who are ready to provide personalized service and assistance.

State Farm's Personal Price Plan® allows customers to create an affordable, customized insurance plan that fits their unique needs and budget. The company offers various coverage options, including comprehensive, collision, liability, medical payments, and uninsured or underinsured motor vehicle insurance. State Farm also provides insurance for a range of vehicles, such as delivery vans, speed boats, motorcycles, antique cars, and more.

One of the standout features of State Farm is the number of discounts available to customers. By bundling different types of insurance policies, such as homeowners, renters, condo, or life insurance with auto insurance, customers can save a significant amount. State Farm also offers savings of up to 30% with its Drive Safe & Save® program, and young, safe drivers can save up to 20% with the Steer Clear® program.

State Farm's mobile app further enhances the ease of use, allowing customers to file and manage claims, get roadside assistance, access ID cards, and more. The app brings the convenience of having a neighborhood agent right on your device, no matter where you are.

State Farm's long legacy of protection, dating back to 1922, coupled with its focus on innovation and customer satisfaction, makes it a reliable choice for auto insurance in both New Jersey and California.

Full Coverage Auto Insurance: Engine Damage Protection

You may want to see also