GEICO, the Government Employees Insurance Company, is an American auto insurance company that provides a range of insurance options, including auto, motorcycle, ATV, RV, boat, snowmobile, travel, pet, event, homeowner, renter, and jewelry insurance. GEICO has a large customer base, insuring over 24 million motor vehicles owned by more than 15 million policyholders as of 2017. The company offers various discounts and has a high customer satisfaction rating, making it a popular choice for many drivers. In this topic, we will explore the different auto insurance companies affiliated with GEICO and how they work together to provide insurance products to customers.

What You'll Learn

GEICO's insurance products

GEICO, the Government Employees Insurance Company, offers a wide range of insurance products to cater to the diverse needs of its customers. The company primarily focuses on auto insurance but has expanded its offerings over the years to include various other types of insurance.

Auto Insurance

GEICO is well-known for its auto insurance policies, which are available in all 50 U.S. states and the District of Columbia. The company offers personalized coverage options, allowing customers to customize their insurance plans according to their specific needs. GEICO also provides several discount opportunities, such as savings for good students, federal employees, or safe drivers.

Motorcycle, ATV, RV, and Boat Insurance

In addition to auto insurance, GEICO provides coverage for motorcycles, ATVs, RVs, and boats. These policies are ideal for those who enjoy outdoor recreational activities and want to ensure their vehicles are protected.

Snowmobile, Travel, and Pet Insurance

Recognizing the diverse interests of its customers, GEICO offers snowmobile insurance for those who enjoy winter sports. Additionally, the company provides travel insurance for individuals who want peace of mind while exploring new places. GEICO also caters to pet owners with its pet insurance policies, ensuring that their furry friends are covered in case of unexpected veterinary expenses.

Event, Homeowner, Renter, and Jewelry Insurance

GEICO also offers event insurance for special occasions, providing financial protection in case of unforeseen incidents. The company understands the importance of safeguarding one's home and belongings, offering both homeowner and renter insurance policies. Additionally, GEICO's jewelry insurance provides specialized coverage for valuable items, giving customers added peace of mind.

Business Insurance

GEICO hasn't forgotten about business owners, offering a range of business insurance options. These include commercial auto insurance, general liability insurance, professional liability insurance, and workers' compensation insurance. By providing these policies, GEICO helps businesses mitigate risks and protect their operations.

Additional Insurance Options

Recognizing that everyone has unique needs, GEICO offers a variety of additional insurance products. These include life insurance, umbrella insurance, overseas insurance, and even bicycle insurance. GEICO's comprehensive range of insurance products demonstrates its commitment to providing tailored protection for its customers' diverse lifestyles and interests.

Vehicle Removal: Insurance Coverage?

You may want to see also

GEICO's customer service

GEICO offers a variety of ways to contact their customer service team. Their website offers a live chat feature where customers can talk to a licensed agent about their auto policy service questions. GEICO's live chat agents can help customers make payments online, adjust their payment plans, understand their bill, and look for discounts. Customers can also use the live chat to add or remove a vehicle or driver, update their coverages, and get their ID card. GEICO takes measures to ensure that their customers' private information stays private. All information placed in the chat is encrypted and protected for the customer's safety. Customers can also download their chat conversation for their records.

GEICO also offers a mobile app that allows customers to track and manage their claims, report a claim, report glass-only damage, or request emergency road service. The app also provides customers with their digital ID cards and allows them to pay and manage their bills. Customers can also use the app to add a vehicle to their policy.

In addition to the live chat and mobile app, customers can contact GEICO's customer service team by phone or email. The website provides a contact page with information on how to reach the company. GEICO also has a network of local agents, called GEICO Field Representatives, who are available in person or over the phone to answer questions.

GEICO is known for its commitment to customer service and satisfaction. The company has a customer satisfaction rating of 97%. They offer personalized service, providing answers to questions about car insurance and more. GEICO also provides convenient claims and repairs, allowing customers to report an auto claim anytime online, through the mobile app, or over the phone. Their Auto Repair Xpress® program offers fast and convenient repairs with guaranteed work for as long as the customer owns the vehicle. GEICO also offers 24/7 roadside assistance as an add-on to their car insurance policies.

Auto Insurance Shopping: Annual Customer Acquisition Challenge

You may want to see also

GEICO's insurance rates

GEICO offers a range of insurance products, including auto insurance, which is its primary business. The company provides insurance for private passenger automobiles in all 50 US states and the District of Columbia. In addition to auto insurance, GEICO offers motorcycle, ATV, RV, boat, snowmobile, travel, pet, event, homeowner, renter, and jewelry insurance.

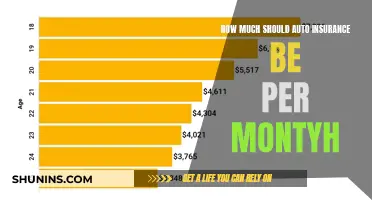

GEICO's auto insurance rates are competitive, and the company has a history of providing affordable rates and personalized service. New customers report average annual savings of over $700, and the company has a 97% customer satisfaction rating. GEICO's rates are influenced by various factors, including the driver's age, gender, and driving history, as well as the vehicle's year, make, model, and safety features.

GEICO offers several ways to save money on auto insurance, including discounts for good students with a B+ grade average, federal employees, and safe drivers. Additionally, customers can save money by combining property insurance with their auto insurance policy and taking advantage of standard safety features in newer cars, such as airbags and anti-lock brakes.

GEICO also provides a range of optional coverages, such as emergency roadside assistance, rental reimbursement, and mechanical breakdown insurance. The company's website and mobile app make it easy for customers to compare rates, customize their coverage, and file claims.

Auto-Owners Insurance: Comprehensive Condo Coverage in Michigan?

You may want to see also

GEICO's insurance discounts

GEICO, the Government Employees Insurance Company, offers a range of insurance discounts and premium reductions to its customers. The company provides auto insurance, as well as insurance for motorcycles, ATVs, RVs, boats, snowmobiles, travel, pets, events, homeowners, renters, and jewellery.

GEICO has various discounts available for car insurance, including:

- Good Driver Discounts: Customers with a clean driving record who have been accident-free for 5 years can save up to 22% on most coverages.

- Multi-Car Discounts: Insuring more than one car with GEICO can result in a discount of up to 25% on car insurance coverages.

- Vehicle Equipment Discounts: Vehicles equipped with certain safety features, such as airbags, anti-lock brakes, and daytime running lights, may be eligible for discounts of up to 23%, 5%, and 3%, respectively, on specific coverages.

- New Vehicle Discount: For vehicles 3 model years old or newer, customers can receive up to a 15% discount on select coverages.

- Seat Belt Use Discount: Customers who always wear seat belts can receive a discount on the medical payments or personal injury protection portion of their premium.

- Defensive Driving Discount: Completing a defensive driving course can lead to savings on insurance premiums.

- Driver's Education Discount: Young drivers who have completed a driver's education course may earn a discount on most coverages.

- Good Student Discount: Full-time students with good academic records can receive up to a 15% discount on certain coverages.

- Federal Employee Discount (Eagle Discount): Active or retired federal employees can receive up to a 12% discount on their total auto insurance premium.

- Military Discounts: GEICO offers discounts of up to 15% on specific car insurance coverages for active-duty military, retired military, and members of the National Guard or Reserves. Additionally, they provide an Emergency Deployment Discount of up to 25% for those deployed to imminent danger zones.

- Membership and Employee Discounts: GEICO has partnered with over 800 groups, including Alumni Associations, Fraternities, and Professional Organizations, to offer discounts or premium reductions to their members or employees.

GEICO also provides opportunities to save on insurance premiums by combining property insurance with car insurance policies. Furthermore, they offer discounts for students, those over 50 years old, and various other programs.

Understanding Auto Liability Insurance: Your Guide to Coverage and Claims

You may want to see also

GEICO's insurance claims

If a customer's car is safe to drive after an accident, GEICO schedules a time for them to bring it in, usually within 24 hours. If the car is not safe to drive, the company sends an auto damage adjuster to the vehicle's location. Customers can choose any repair shop for their repairs, but GEICO also offers its Auto Repair Xpress® program for fast, hassle-free repairs with a written lifetime guarantee.

The inspection, which typically takes around 30 minutes, involves a shop representative evaluating the damage to the car and writing up an estimate. If customers have rental reimbursement coverage, GEICO helps set them up with a rental car during the repair process.

GEICO usually sends payment to the customer as soon as possible after the accident investigation is complete. Payment can be made digitally or by mail and covers the cost of repairs, minus any deductible amount.

If someone involved in the accident claims that the GEICO customer was at fault and suffered bodily injury or property damage, GEICO investigates and evaluates these claims. Settlements in this situation may take longer, as the company needs to determine who was at fault.

In the rare event that a claim results in a lawsuit, GEICO arranges for an experienced attorney to defend and advise the customer.

Marital Status and Auto Insurance: Exploring the Connection

You may want to see also

Frequently asked questions

GEICO has affiliated automobile insurance with the Maryland Automobile Insurance Fund International Insurance Group, Inc (Mexican Auto), Chubb Seguros Mexico S.A., and GEICO Marine Insurance Company (formerly Seaworthy).

GEICO has non-affiliated automobile insurance with International Insurance Group (IIG).

In addition to auto insurance, GEICO provides motorcycle, ATV, RV, boat, snowmobile, travel, pet, event, homeowner, renter, and jewelry insurance options.