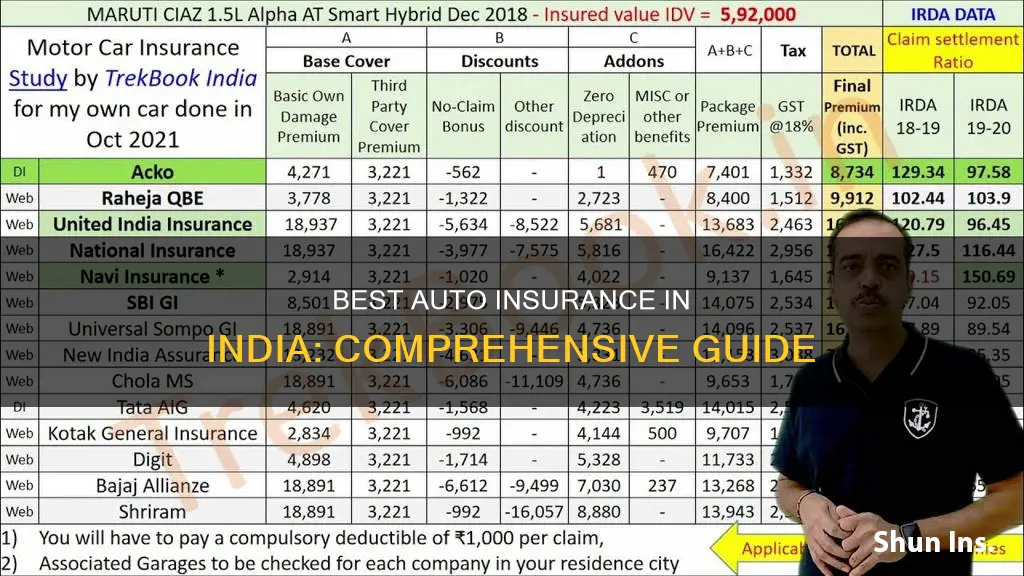

There are several car insurance companies in India, and the best one for you will depend on your specific needs and requirements. Here are some of the top car insurance companies in India, in no particular order:

- Bajaj Allianz Car Insurance

- ICICI Lombard Car Insurance

- Tata AIG Car Insurance

- HDFC ERGO Car Insurance

- New India Assurance Car Insurance

- National Car Insurance

- Royal Sundaram Car Insurance

- Future Generali Car Insurance

- Cholamandalam MS Car Insurance

- Liberty Car Insurance

- IFFCO Tokio Car Insurance

- United India Car Insurance

- Universal Sompo Car Insurance

- Oriental Car Insurance

- Shriram Car Insurance

- Raheja QBE Car Insurance

- Reliance Car Insurance

- Magma HDI Car Insurance

- SBI General Insurance

- Kotak Mahindra Car Insurance

- ACKO Car Insurance

- Edelweiss Car Insurance

| Characteristics | Values |

|---|---|

| Number of Companies | 20+ |

| Company Names | Bajaj Allianz, Tata AIG, HDFC Ergo, ICICI Lombard, Future Generali, National, New India Assurance, Royal Sundaram, United India, Liberty, Cholamandalam, IFFCO Tokio, Universal Sompo, Magma HDI, Raheja QBE, Shriram, SBI General, Reliance, ACKO, Zuno, Go Digit, Bharti AXA, Oriental, Kotak Mahindra |

| Best Type of Insurance | Comprehensive Car Insurance |

| Add-ons | Zero Depreciation, No Claim Bonus, Consumables Cover, Daily Cash Allowance, Critical Replacement Cover, Consumables Plus Cover, Return to Invoice, Key Replacement, Loss of Personal Belongings, Paid Driver Cover, Tyre Damage Cover, Rim Damage Cover, Voluntary Deductible |

What You'll Learn

Comprehensive Car Insurance

- Manmade acts like vandalism, strikes or riots

- Theft, burglary or housebreaking

- Damages caused by a bird or an animal or rat bite causing electrical damage

- Accidental damages when the insured car was in transit via roadways, railways, airways, etc

- Fire, self-ignition or explosion of the insured vehicle

- Damages caused by natural disasters like floods, hailstorms, tornadoes, hurricanes, earthquakes, etc

- Third-party liabilities (death, injury, and property damage)

- Wear and tear and ageing of the motor vehicle

- Depreciation borne by the car

- Mechanical or electrical breakdown

- Damages caused to tubes and tyres

- Damages caused when driving the car without a valid driving license

- Damages caused due to driving under the influence of intoxicants such as alcohol

- Any loss or damage due to mutiny, war, or a nuclear attack

Add-Ons Under Comprehensive Car Insurance

You can enhance the coverage of your standard comprehensive car insurance by purchasing additional covers, including:

- Zero Depreciation Cover

- Roadside Assistance Cover

- Engine Protect Cover

Best Auto Insurance Companies in Rhode Island

You may want to see also

Third-Party Car Insurance

Third-party insurance provides coverage for any third-party-related liabilities caused by an accident involving your car. It offers monetary compensation in the case of third-party death, bodily injuries or property damage caused by the insured car.

The Motor Vehicles Act of India, 1988, states that it is legally mandatory for all vehicle owners in India to have at least a third-party insurance cover to be able to use their vehicles on public roads. If you are caught driving without a valid third-party car policy in India, you may have to pay hefty fines or face imprisonment.

The compensation offered in the case of third-party death is unlimited, while for property damage, it's limited to Rs 7.5 lakh.

- Bajaj Allianz Car Insurance

- Tata AIG Car Insurance

- ICICI Lombard Car Insurance

- HDFC Ergo Car Insurance

- New India Assurance Car Insurance

- Royal Sundaram Car Insurance

- Future Generali Car Insurance

- United India Car Insurance

- National Car Insurance

- Liberty Car Insurance

- Universal Sompo Car Insurance

- SBI General Car Insurance

- Digit Car Insurance

Understanding Auto Insurance Claims and Reimbursement

You may want to see also

Standalone Own-Damage Car Insurance

The premium for standalone own-damage insurance is higher than that of third-party insurance but lower than comprehensive insurance. The premium is calculated based on factors such as the Insured Declared Value (IDV) of the vehicle, the age of the car, and the number of claims made.

When choosing a standalone own-damage car insurance policy, it is essential to consider the insurance company's claim settlement ratio, the network of cashless garages, the availability of add-ons, and customer support services.

Some of the leading insurance providers in India offering standalone own-damage car insurance include HDFC ERGO, New India Assurance, and ICICI Lombard, among others. These companies offer a wide range of benefits, including cashless garages, overnight vehicle repairs, and 24/7 roadside assistance.

Bundling Auto and Motorcycle Insurance: Is It Worth It?

You may want to see also

Add-ons and Customisation

- Zero Depreciation Cover: This add-on provides coverage for the depreciation of car parts over time, which is typically not included in standard policies.

- No Claim Bonus (NCB) Protection: The NCB is a discount on the premium offered by insurance companies for every claim-free year. With this add-on, you can retain your NCB even if you make a claim during the policy period.

- Roadside Assistance Cover: This add-on provides assistance in case of a breakdown or accident, including services such as towing, minor repairs, and spare key arrangements.

- Personal Accident Cover: This type of cover provides compensation for the owner-driver in case of death or disability due to an accident. Some policies also offer coverage for passengers.

- Engine Protection Cover: This add-on provides coverage for losses or damages caused to the engine due to issues such as water ingression or oil spill.

- Daily Allowance Cover: If your car is being repaired and you need alternative transport, this add-on provides a daily allowance to cover those expenses.

- Consumables Cover: This covers the cost of consumable items such as engine oil, nuts and bolts, lubricants, etc., which are usually not included in standard policies.

- Accessories Cover: This add-on provides coverage for car accessories such as stereo systems, fans, air-conditioners, etc.

- Return to Invoice Cover: In case of total loss, constructive loss, or theft of the car, this add-on provides the car owner with an amount equivalent to the invoice value, including the cost of registering a new vehicle and road tax.

- Key Replacement Cover: Covers the cost of replacing lost or stolen car keys.

- Loss of Personal Belongings Cover: Provides coverage for any damage or loss of personal items kept in the car.

- Paid Driver Cover: Provides coverage for injuries caused to an employed driver in an accident.

- Tyre Damage Cover: Provides assistance in case of a flat tyre, including the cost of repair or replacement.

- Rim Damage Cover: Covers any warping or damage to the rim of the wheel.

When choosing a car insurance policy in India, it is important to consider the availability of add-ons that meet your specific needs. Different insurance companies offer different add-ons, so it is essential to compare and select the one that best suits your requirements.

Exposing Bad Doctors: How Auto Insurance Companies Flag Them

You may want to see also

Customer Service and Support

When it comes to customer service and support, there are several factors to consider when choosing the best auto insurance in India. Here are some key aspects to look for:

- 24/7 Customer Support: Look for an insurance company that offers round-the-clock customer support. This ensures that you can reach out for assistance at any time, especially in case of emergencies. Some companies provide a dedicated helpline number, while others offer support through their website or mobile app.

- Responsive and Helpful Service: The quality of customer service is crucial. Choose a company with a responsive and helpful customer care team that can guide you through the insurance process, address your queries, and assist you during claim settlements.

- Easy Claim Settlement Process: Opt for an insurance company with a smooth and efficient claim settlement process. This includes prompt inspection, minimal paperwork, and timely approval of claims. Some companies also offer cashless claim settlements at network garages, making the process more convenient for customers.

- Wide Network of Garages: A vast network of garages, including cashless garages, ensures that you have convenient access to repair facilities in case of an accident. A larger network increases the likelihood of finding a preferred garage in your city or neighbourhood.

- Quick Response Time: Choose an insurance company known for its quick response time, especially during emergencies. This includes prompt inspection and timely repairs or claim settlements.

- Add-on Covers: Consider the availability of add-on covers that can enhance your insurance policy. These add-ons provide additional benefits, such as roadside assistance, engine protection, personal accident cover, and more.

- Customer Reviews: Before finalising your decision, check customer reviews and testimonials to gain insights into other customers' experiences with the insurance company. Look for a company with a good reputation and a high level of customer satisfaction.

Remember to compare different insurance companies based on these criteria and choose the one that best meets your needs and expectations in terms of customer service and support.

Employment Status: How Does It Affect Auto Insurance Rates?

You may want to see also

Frequently asked questions

The best type of car insurance in India is Comprehensive Car Insurance. This is because it provides both third-party and own damage coverage.

An insurance policy that provides comprehensive coverage at a low premium is considered the best. You can choose any insurance company that provides such a plan.

It is recommended to get a Comprehensive Car Insurance Plan for your car as it provides third-party and own damage coverage.

Yes, ACKO car insurance is reliable. It is an IRDAI-licenced insurance company that provides online insurance coverage for cars and bikes. The company offers hassle-free buying, renewing and claim experiences, which are completely online.

It is important to buy the law-mandated third-party insurance for your car. However, for better coverage, you can opt for Comprehensive car insurance, which provides third-party and own damage coverage.