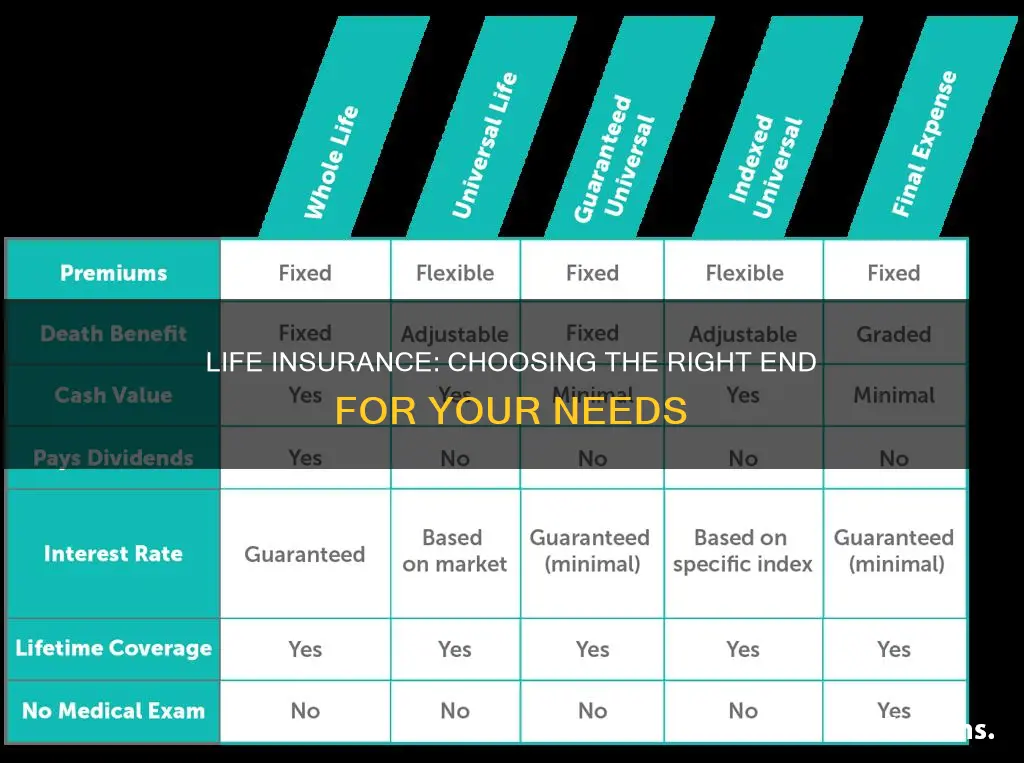

When it comes to choosing the right end-of-life insurance, it's important to understand the various options available and their benefits. This guide will explore the different types of end-of-life insurance, including term life, whole life, and universal life policies, to help you make an informed decision. Each type of policy has its own advantages and considerations, such as coverage duration, flexibility, and potential investment opportunities. By evaluating your financial goals, risk tolerance, and long-term needs, you can select the end-of-life insurance that best suits your individual circumstances and provides the necessary financial security for you and your loved ones.

What You'll Learn

- Term Life Insurance: Temporary coverage, affordable, provides financial security for beneficiaries

- Whole Life Insurance: Permanent coverage, builds cash value, offers guaranteed death benefit

- Universal Life Insurance: Flexible premiums, adjustable death benefit, potential for higher returns

- Variable Universal Life Insurance: Offers investment options, potential for higher returns, adjustable coverage

- Final Expense Insurance: Covers funeral costs, burial expenses, tailored for specific needs

Term Life Insurance: Temporary coverage, affordable, provides financial security for beneficiaries

Term life insurance is a type of coverage that offers a straightforward and effective solution for individuals seeking temporary financial protection. It provides a safety net for beneficiaries during a specified period, typically ranging from 10 to 30 years. This type of insurance is particularly appealing due to its affordability and the peace of mind it offers.

The beauty of term life insurance lies in its simplicity. It is designed to cover a specific period, often aligning with significant financial commitments or responsibilities. For instance, it can be tailored to protect your loved ones during the years when you are actively paying off a mortgage, providing a financial cushion if something happens to you. This temporary nature ensures that the policy remains cost-effective, making it accessible to a wide range of individuals.

One of the key advantages is the fixed premium structure. The cost remains consistent throughout the term, allowing policyholders to budget effectively. This predictability is a significant factor in making term life insurance an attractive option for those seeking long-term financial planning. Additionally, the coverage amount is predetermined, ensuring that the beneficiaries receive the intended financial support.

When considering term life insurance, it's essential to evaluate your specific needs. The duration of the policy should align with your financial obligations and the time frame during which you want to ensure your family's financial security. For example, if you have young children and a mortgage, a 20-year term might be suitable, providing coverage until your children become financially independent and your mortgage is paid off.

In summary, term life insurance offers a practical and affordable approach to financial security. Its temporary nature allows individuals to manage costs effectively while providing a safety net for beneficiaries. By understanding the duration and coverage options, you can make an informed decision, ensuring that your loved ones are protected during the most critical periods of your life. This type of insurance is a valuable tool in the realm of personal finance, offering peace of mind and financial stability.

Insuring a Life Estate House: What You Need to Know

You may want to see also

Whole Life Insurance: Permanent coverage, builds cash value, offers guaranteed death benefit

Whole life insurance is a type of permanent life insurance that provides long-term coverage and offers several advantages that make it an attractive option for many individuals. One of its key features is the guarantee of coverage for the entire lifetime of the insured individual, hence the term "permanent." This means that as long as the premiums are paid, the policyholder will have coverage, ensuring financial security for their loved ones in the event of their passing.

In addition to providing permanent coverage, whole life insurance also builds cash value over time. This is a significant benefit as it allows the policyholder to accumulate a savings component within their insurance policy. The cash value grows tax-deferred, and it can be borrowed against or withdrawn, providing financial flexibility. This feature is particularly useful for those who want to build a substantial savings account while also having the security of life insurance.

The guaranteed death benefit is another critical aspect of whole life insurance. This means that the insurance company promises to pay out a specific amount upon the insured's death, regardless of when it occurs. This guarantee provides peace of mind, knowing that your beneficiaries will receive a predetermined sum, which can be used to cover various expenses, such as funeral costs, mortgage payments, or education fees. The guaranteed death benefit is especially valuable for those who want to ensure their family's financial stability in the long term.

Furthermore, whole life insurance offers a fixed interest rate, which is typically higher than other investment vehicles. This feature allows the policyholder to earn a return on their premiums, further enhancing the cash value accumulation. The combination of permanent coverage, cash value growth, and a guaranteed death benefit makes whole life insurance a comprehensive and reliable choice for end-of-life planning.

When considering end-of-life insurance options, whole life insurance stands out for its ability to provide long-term financial security and peace of mind. It is a valuable tool for individuals who want to ensure their loved ones are protected and their financial goals are met, even in the event of their passing. With its permanent coverage, cash value accumulation, and guaranteed death benefit, whole life insurance offers a robust solution for those seeking a reliable and comprehensive insurance product.

Sanitation Workers' Life Insurance: Are AZ CTY Employees Covered?

You may want to see also

Universal Life Insurance: Flexible premiums, adjustable death benefit, potential for higher returns

Universal life insurance offers a unique and flexible approach to end-of-life coverage, providing policyholders with a range of benefits that can adapt to their changing needs and financial goals. One of its key advantages is the ability to customize premiums, allowing individuals to tailor their payments to their financial situation at any given time. This flexibility is particularly appealing to those who may experience fluctuations in income or prefer a more personalized insurance strategy.

The death benefit of universal life insurance is adjustable, meaning it can be increased or decreased based on the policyholder's preferences and financial circumstances. This feature ensures that the insurance coverage can be aligned with the policyholder's evolving needs, whether it's to provide a more substantial financial safety net during their working years or to adjust as their financial situation improves. For instance, a policyholder might opt for a higher death benefit during their peak earning years to secure their family's financial future, and then reduce it later in life as their financial obligations and goals change.

A significant advantage of universal life insurance is the potential for higher returns on investment. Unlike traditional term life insurance, where premiums are fixed and the focus is solely on providing a death benefit, universal life insurance incorporates an investment component. Policyholders can allocate a portion of their premiums into an investment account, which can grow over time, offering the potential for higher returns compared to traditional savings accounts or fixed-income investments. This investment aspect provides an opportunity for policyholders to potentially build wealth while also ensuring a death benefit.

The flexibility of universal life insurance extends to the policyholder's ability to make loan payments against the cash value of their policy. This feature can be particularly useful in times of financial need, allowing policyholders to access funds without having to surrender their policy or take out a separate loan. Additionally, the investment growth in the policy's cash value can be used to pay for the policy's premiums, ensuring that the coverage remains in force even if the policyholder encounters temporary financial challenges.

In summary, universal life insurance stands out for its adaptability, offering policyholders the freedom to adjust premiums and death benefits according to their life stages and financial objectives. The potential for higher returns on investment and the ability to access cash value loans provide additional financial benefits. This type of insurance is an attractive option for those seeking a comprehensive and personalized end-of-life insurance solution that can evolve with their changing needs.

Life Insurance Trust Agreements: What You Need to Know

You may want to see also

Variable Universal Life Insurance: Offers investment options, potential for higher returns, adjustable coverage

Variable Universal Life Insurance (VUL) is a type of permanent life insurance that offers a unique blend of insurance protection and investment opportunities. It is designed to provide long-term financial security while also allowing policyholders to potentially grow their money through various investment options. Here's a detailed look at why VUL can be a good choice for end-of-life insurance:

Investment Flexibility: One of the key advantages of VUL is the investment component. Unlike traditional term life insurance, which primarily focuses on providing a death benefit, VUL allows policyholders to allocate a portion of their premium payments into various investment accounts. These investment options can include stocks, bonds, mutual funds, and even money market accounts. This flexibility enables individuals to tailor their investment strategy according to their risk tolerance and financial goals. Over time, the performance of these investments can significantly impact the cash value of the policy, which is the portion of the policy's value that can be borrowed against or withdrawn.

Potential for Higher Returns: The investment aspect of VUL offers the potential for higher returns compared to more conservative investment vehicles. Policyholders can choose from a range of investment options, some of which may be more aggressive and carry higher risks but also offer the possibility of greater growth. This feature is particularly attractive to those who want to make the most of their insurance premiums and potentially build a substantial cash value over time. The performance of the investments can directly influence the overall value of the policy, providing a financial safety net for the insured's beneficiaries.

Adjustable Coverage: VUL policies also offer the benefit of adjustable coverage. This means that the death benefit, which is the amount paid out upon the insured's passing, can be adjusted throughout the life of the policy. Policyholders can increase or decrease the coverage amount based on their changing needs and financial circumstances. For example, if an individual's family size increases or their financial obligations grow, they can adjust the coverage to ensure adequate protection. Conversely, if their financial situation improves, they can reduce the coverage to avoid paying more than necessary. This adjustability provides a level of customization that is not typically found in traditional life insurance policies.

Long-Term Financial Planning: Variable Universal Life Insurance is well-suited for long-term financial planning. It allows individuals to build a substantial cash value over time, which can be used for various purposes. This includes funding college education, starting a business, or providing financial security for retirement. The investment options within the policy can help grow the cash value, ensuring that it keeps pace with or potentially exceeds the rate of inflation. Additionally, the adjustable coverage feature ensures that the policy remains relevant and appropriate as an individual's life circumstances evolve.

In summary, Variable Universal Life Insurance provides a comprehensive approach to end-of-life insurance by combining insurance protection with investment opportunities. It offers policyholders the flexibility to choose their investment strategy, the potential for higher returns, and the ability to adjust coverage as needed. This type of insurance can be a valuable tool for long-term financial planning, providing both security and growth potential for individuals and their beneficiaries.

Transamerica Life Insurance: THC Testing and You

You may want to see also

Final Expense Insurance: Covers funeral costs, burial expenses, tailored for specific needs

When considering end-of-life insurance, it's essential to explore options that provide comprehensive coverage and peace of mind. One such option is Final Expense Insurance, a specialized policy designed to cover the costs associated with funeral arrangements and burial expenses. This type of insurance is tailored to meet the unique needs of individuals and their families during a challenging time.

Final Expense Insurance is specifically crafted to provide financial assistance when it matters most. It ensures that the burden of funeral and burial costs does not fall solely on the loved ones left behind. The policy typically covers expenses such as funeral services, casket or urn, burial or cremation, and any other related costs. By having this coverage in place, individuals can rest assured that their final wishes will be honored without causing financial strain on their families.

One of the key advantages of Final Expense Insurance is its customization. Policies can be tailored to suit individual preferences and specific requirements. For instance, some policies may offer options for additional coverage, such as coverage for the purchase of a grave marker, memorial services, or even the cost of a headstone. This flexibility allows individuals to create a personalized plan that aligns with their unique wishes and financial situation.

Furthermore, this type of insurance can be particularly beneficial for those with pre-existing health conditions or older individuals who may face higher insurance premiums. Final Expense Insurance often provides coverage regardless of health status, making it accessible to a broader range of people. It offers a safety net, ensuring that individuals can plan for their final expenses without the worry of unexpected financial burdens.

In summary, Final Expense Insurance is a valuable consideration for anyone seeking to secure their future and provide financial protection for their loved ones. It offers a tailored approach to covering funeral and burial costs, ensuring that one's final wishes are respected. With its customizable nature and accessibility, this insurance option empowers individuals to make informed decisions about their end-of-life planning, providing both financial security and peace of mind.

Terminating Irrevocable Life Insurance Trusts: Is It Possible?

You may want to see also

Frequently asked questions

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It is a cost-effective way to secure financial protection during a particular time frame. Permanent life insurance, on the other hand, offers lifelong coverage and includes a savings component. This type of insurance is more expensive but provides long-term financial security and potential cash value accumulation.

Determining the appropriate coverage amount involves considering various factors. Start by assessing your financial obligations, such as mortgage payments, children's education costs, and any other long-term financial commitments. Also, evaluate your income and ensure that the policy's death benefit is sufficient to cover these expenses. It's essential to strike a balance between adequate coverage and affordable premiums.

Yes, life insurance can offer tax benefits. In many countries, the death benefit received from a life insurance policy is generally tax-free. Additionally, the premiums paid for certain types of permanent life insurance policies may be tax-deductible, providing a potential tax advantage. However, it's advisable to consult with a tax professional to understand the specific tax implications in your jurisdiction.

Yes, most life insurance policies offer flexibility in terms of adjustments. You can typically increase or decrease the coverage amount, change the policy term, or convert it to a different type of insurance. It's recommended to review your policy regularly, especially when significant life events occur, to ensure that your coverage remains appropriate. Adjustments may be subject to certain conditions and fees, so it's best to consult with your insurance provider for personalized guidance.